COSO Framework

advertisement

plantemoran.com

{COSO Framework}

A higher return on experience.

Changes to

COSO framework =

more versatile and

cost effective approach.

2

I. Changes to the COSO Framework

Maintaining a sound control environment is a critical component

of mitigating risks inherent in a continuously changing economic,

technological, and regulatory environment. Organizations are

expected to provide swift, effective, and socially responsible

measures to safeguard against these risks.

Enter the Committee of Sponsoring Organizations of the

Treadway Commission (COSO), who published Internal

Control — Integrated Framework in 1992 to provide a common

definition of and efficient method to analyze and evaluate

internal controls. COSO’s Internal Control — Integrated

Framework (COSO’s Framework) became the best-practice

standard for 20 years. The final version of the updated

COSO framework was released to the public on June 6, 2013.

While the changes to the framework will not result in substantial changes for organizations with a control environment

deemed to be effective, the updates to the framework will

result in a more versatile and cost-effective approach to the

design and evaluation of organizational internal control systems.

Additionally, this should not impact the attestation process

under SOX 404. Here is a brief overview of COSO and its key

changes based on the recently issued exposure draft from

September 2012; although the changes are not final, we do

not anticipate a significant change from the exposure draft.

Why Did the Framework Change?

The original Internal Control — Integrated Framework stood

unchanged for 20 years. The Committee of Sponsoring

Organizations elected to update the framework to reflect the

dynamic changes in the business environment by incorporating

discussions on the technological advances in business processes

and communication, as well as an ever-increasing regulatory

atmosphere that impacts an organizational control environment. The updated framework has been modified to maintain

relevance with current and future business environments and

will apply to public companies, privately held companies,

not-for-profit agencies, and governmental entities.

This does not, however, change other COSO Frameworks,

such as 2004’s Enterprise Risk Management — Integrated

Framework, but will be used alongside the forthcoming update

to the Guidance on Internal Control over External Financial

Reporting (ICEFR) to update the guidance set forth for Smaller

Public Companies.

What Are the Key Changes to

the Framework?

The Framework is expected to provide users a number of

benefits, highlighted by the following:

•

Increased ease of use through revised codification structure

•

Enhanced corporate governance

The Original Framework

•

Improved breadth & scope of risk assessment

COSO was founded on four critical underlying concepts:

•

Expansion of guidance for objectives beyond periodic

financial reporting

•

Consideration of fraud prevention

•

Ability to adapt controls to changing business environments

•

Consideration of extended business models

•

Internal control is a process toward the achievement of

organizational objectives.

•

The internal control process is driven by people at all

levels of the organization.

•

Internal control is a means to achieve objectives within

one or more separate but overlapping categories.

•

Internal control can provide only reasonable assurance

to the achievement of organizational objectives.

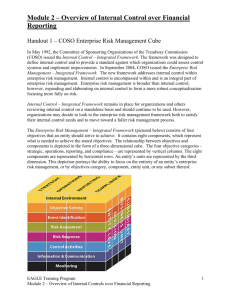

The framework further details five framework components as

summarized by the updated COSO Cube for internal controls,

shown below:

•

Control environment

•

Risk assessment

•

Control activities

•

Information & communication

•

Monitoring activities

The original five Internal Control Integrated Framework components remain, but 17 principles from the original framework

are now explicitly listed among those five components. As

a result, the framework adopts a principles-and-attributes

approach, which provides more detailed guidance for

designing and assessing the effectiveness of internal controls.

This change is critical because the framework more clearly

communicates the fundamental concepts associated with the

components of internal control.

1

The 2012 Framework and SOX

The COSO Framework is expected to remain consistent with

SEC suitability criteria and to remain an accepted framework

for use by management and independent auditors in

meeting SOX requirements. While use of the updated

Framework will not result in substantial changes that have been

effectively leveraging COSO’s 1992 framework to meet SOX

compliance requirements, the updates to the framework will

result in a more versatile and cost-effective approach to the

design and evaluation of organizational internal control

systems. Because the updated framework represents an

evolution of, but remains consistent with, the original, it

should not impose a higher level of control and should not

impact the attestation process under SOX 404.

Organizational objectives are set by management and

represent the activities necessary to achieve that which is set

forth in the organization’s vision and mission. The Framework

categorizes entity objectives into the three basic categories:

operations, reporting, and compliance.

•

Operations objectives relate to the effectiveness and

efficiency of the entity’s operations, including operational

& financial performance goals, as well as safeguarding

assets against loss.

•

Reporting objectives relate to internal & external financial

and non-financial reporting. These objectives may concern

reliability, timeliness, transparency, or other terms as set

forth by entity policy or external regulators.

•

Compliance objectives relate to the legal & regulatory

environment within which the entity must operate. The

purpose of the internal control system is to ensure that

the organizational objectives are met. This is done

through the use of internal control components.

II. COSO Framework Structure

A direct relationship exists between organizational objectives,

control components (that which is required to meet organizational objectives), and entity structure. This relationship is

visually depicted in the form of the COSO cube:

•

The three categories of objectives are represented

by the columns.

•

The five components are represented by the rows.

•

The entity structure is represented by the third

dimension of the cube.

The COSO Framework maintains that internal control is a

highly integrated system in which the components actively

impact one another. These component activities, considered

to be relevant and suitable for all organizations, often overlap

and evolve with changes to the organization’s internal and

external environment. The components are as follows.

•

Control environment: The internal organizational

environment driven by the management operating

philosophy, risk appetite, integrity, & ethical values.

•Risk

assessment: Risks are identified & the likely impact

on the organization is assessed.

•

Control activities: Policies & procedures are implemented

to ensure organizational objectives and risk-mitigation

activities are effectively executed.

•Information

and communication: Relevant information

is communicated in an acceptable format & timely fashion

to enable the organization to meet its objectives.

•

Monitoring: The internal control process is continually

monitored. Modifications are made to improve internal

control activities as a result of the monitoring process.

Each component applies to all three categories of objectives.

Control Environment, for example, has a strong and direct

effect on the operations, reporting, and compliance objectives

through the overall attitude, awareness, and actions of

management. Entities require each of the five components

to maintain effective internal control over business activities.

2

However, the entity’s internal control system must be tailored based upon organization-specific factors such as size, risk appetite,

entity-level objectives, and operational needs, as well as environmental factors related to the industry, competitive, and

regulatory environment.

As previously discussed, the Framework is comprised of five components of internal control and an additional 17 principles

representing the fundamental concepts associated with those components. Below is a summary of each of the five components

and each related principle:

Component

Principle

Control Environment

1. The organization demonstrates a commitment to integrity & ethical values.

2. The board of directors demonstrates independence of management & exercises oversight

for the development & performance of internal control.

3. Management establishes, with board oversight, structures, reporting lines, & appropriate

authorities & responsibilities in the pursuit of objectives.

4. The organization demonstrates a commitment to attract, develop, & retain competent

individuals in alignment with objectives.

5. The organization holds individuals accountable for their internal control responsibilities

in the pursuit of objectives.

Risk Assessment

6. The organization specifies objectives with sufficient clarity to enable the identification &

assessment of risks relating to objectives.

7. The organization identifies risks to the achievement of its objectives across the entity &

analyzes risks as a basis for determining how the risks should be managed.

8. The organization considers the potential for fraud in assessing risks to the achievement

of objectives.

9. The organization identifies & assesses changes that could significantly impact the system

of internal control.

Control Activities

10. The organization selects & develops control activities that contribute to the mitigation of

risks to the achievement of objectives to acceptable levels.

11. The organization selects & develops general control activities over technology to support

the achievement of objectives.

12. The organization deploys control activities as manifested in policies that establish what

is expected & in relevant procedures to effect the policies.

Information & Communication

13. The organization obtains or generates & uses relevant, quality information to support

the functioning of the other components of internal control.

14. The organization internally communicates information, including objectives &

responsibilities for internal control, necessary to support the functioning of other

components of internal control.

15. The organization communicates with external parties regarding matters affecting the

functioning of other components of internal control.

Monitoring Activities

16. The organization selects, develops, & performs ongoing &/or separate evaluations to

ascertain whether the components of internal control are present & functioning.

17. The organization evaluates & communicates internal control deficiencies in a timely manner

to those parties responsible for taking corrective action, including senior management &

the board of directors, as appropriate.

3

Limitations of Internal Control and

the Framework

By design, the Framework is intended to ensure that internal

controls provide reasonable assurance of the achievement of

organizational objectives. However, the Framework specifically

notes that limitations do exist and may result from the:

•

Suitability of objectives established as a precondition

to internal control

•

Reality that human judgment in decision making

can be faulty

•

Breakdowns that can occur because of human failures

such as errors

•

Ability of management to override internal control

•

Ability of management, other personnel, and/or third

parties to circumvent controls through collusion

These limitations preclude the board and management from

having absolute assurance of the achievement of the entity’s

objectives through effective internal control.

Moreover, no matter how well internal controls are designed,

the system cannot overcome the certain limitations associated

with organizations that do not understand the purpose of

internal control or the proper procedures to remediate ineffective internal controls. Internal control cannot overcome the

limitations associated with management and employees that

do not value or support the process of internal control and

demonstrate this attitude through circumvention of policies

and procedures. Finally, internal control cannot overcome

the limitations associated with collusion by management or

employees to commit fraud.

III. Evaluate Existing System of

Internal Control

The process and methods for evaluating an organization’s

system of internal controls has not fundamentally changed

since the inception of the original COSO framework and will

continue to be familiar to those with experience in Internal

Audit and the evaluation of internal controls. The updated

framework has, however, provided more defined tools to aid

in the evaluation of a system of internal controls.

4

The updated framework provides better guidance on

performing a ‘top-down/risk-based’ approach to internal

control assessment and provides sample tools; however,

many organizations may have similarly designed tools for

internal control evaluation.

Similarly, the updated guidance suggests that the five

components and 17 principles of the framework are present

and functioning. This is prevalent in many organizations that

have adopted (or been required to adopt) Sarbanes-Oxley.

More specifically, the entity level controls assessment already

provides a path to assess the five components of the framework (control environment, risk assessment, control activities,

information and communication, and monitoring).

The updated framework’s approach and templates suggest that

organizations should prepare a variety of documentation, first,

at the principle level, noting controls and deficiencies and then

rolling this information upwards into the five components

The updated framework has provided templates that it

suggests organizations use for this assessment; however, the

crux of the discussion revolves around the following:

•

Is the component present as described by the 17 principles?

Is it functional? If so, how is this conclusion supported?

•

If a deficiency exists, identification of the deficiency that

specifically speaks to this component, describe the issue

•

If a deficiency exists, are there other compensating

controls that can be tested?

The sum of these documents allows organizations and

auditors to quickly assess the organization’s internal control

structure by using the points of focus under each of the

17 principles as guidance to ensure that internal controls

are operating effectively.

COSO has furnished sample documentation to document

these items. However, management has the ability to modify

its existing templates to ensure that it captures the principles

and components.

Therefore, as assurance auditors move forward, it will be useful

to consider the points of focus and summarize the way in which

information is reported back to the assurance auditors to place

greater reliance on the framework. This should be achieved

through minimal effort by modifying existing reporting tools

and templates to incorporate the information.

In assessing an organization’s framework, the information

should be presented to address the following:

1. What controls are tied to the principles (principles are

already tied to specific components)?

2. Beneath each principle, identify which control addresses

the points of focus.

3. If there are controls present to address the principle,

is it operating effectively?

4. If not, what controls failed, which compensating controls

are in operation & at what level is the deficiency (material

weakness, significant deficiency, or control deficiency)?

Role of Information Technology

Since the framework was rolled out in 1992, the most drastic

change in the operating environment of organizations is

information technology. The framework did not have much

structure around the IT environment. Internal audit departments,

management, and audit committees recognized these changes

and did a good job of ensuring that IT became a part of the

overall internal control structure of an organization. The

updated framework specifically supports IT within the framework through its points of focus in each of the principles.

IV. Design System of

Internal Control

The Framework asserts that the foundation of the internal

control system is the organizational operating, reporting,

and compliance objectives. Objectives may be set for the

entity as a whole, or relate to specific processes and activities.

Common entity-level objectives shared by most organizations

are maintaining a platform of ongoing success, complying

with laws and regulations, providing a working environment

that is safe and productive, and reporting relevant and timely

information to stakeholders. Management must identify

organization specific objectives within each of the three

categories and the processes that must be in place in order

to meet them. Moreover, management must identify the risks

that may prevent those objectives from being met and design

a system of internal control to mitigate those risks. The

updated COSO Framework can be used as a tool to assist in

the design of a new system of internal control. Management

may apply a systematic approach to apply the increased detail

in the codification of the framework to lay the foundation of

their organizations internal control system.

Management may view the framework as a template from

which to model the system. Each Framework component,

control environment, risk assessment, control activities, information and communication, and monitoring activities, may

serve as functional areas for which control activities must be

focused. In order to create and maintain an effective control

environment, management must ensure that each control

component is present and operating in an effective manner.

Doing so will help to ensure that the presence of risks that

act as an impediment to managements goals are properly

addressed and mitigated.

Management may elect to view the Framework components

as a top-down approach to control environment design. At the

highest level is the control environment, often thought of as

the embodiment of the “tone at the top,” management and

the board’s attitude toward the concept of internal control.

This component ensures and demonstrates that management

and the board value internal control, and have set organizational goals to ensure that a high moral and ethical standard

is upheld by both executive management and employees,

and is reflected within their behavior. The risk assessment

component provides guidance to ensure that management

engages in activities to identify, evaluate, and mitigate risks,

including those arising specifically from fraud. The control

activities framework component requires management to

implement actions that contribute to the mitigation of risks as

designed and documented in relevant policies and procedures.

The information and communication framework component

ensures that management effectively communicates the

expectations related to the control activities via relevant quality

information distributed through proven and reliable channels.

The monitoring activities framework component ensures that

the organization takes the appropriate actions to monitor the

design and effectiveness of control activities and takes the

appropriate corrective actions, when needed.

5

Selection of Controls

Integrated within each of the five Framework components are

17 principles designed to represent the fundamental concepts

to support the components. Management may adopt the

approach to specifically address each of the 17 principles by

designing and implementing an internal control activity to

ensure that the principle is met. For example, management

may wish to address the control environment framework component. In order to ensure the control environment component

is effectively operating, management should ensure that each

of the control environment principles listed below are present

and functioning via specific control activities.

Control Environment

•

The organization demonstrates a commitment to integrity

& ethical values.

•

The board of directors demonstrates independence of

management & exercises oversight for the development

& performance of internal control.

•

Management establishes, with board oversight, structures,

reporting lines, & appropriate authorities & responsibilities

in the pursuit of objectives.

•

The organization demonstrates a commitment to attract,

develop, & retain competent individuals in alignment

with objectives.

•

The organization holds individuals accountable for their

internal control responsibilities in the pursuit of objectives.

Each principle serves as an objective to be met to ensure that

the Framework component is effective. For example, management may demonstrate commitment to integrity and ethical

values by establishing an organizational code of conduct,

which executives and staff must read and acknowledge via

electronic signature on an annual basis. The board of directors

may demonstrate independence of management and exercise

oversight for the development and performance of internal

control via the formation of an internal audit committee of the

board of directors which regularly reviews the findings, recommendations, and results of the internal audit function.

When using the Framework to design a system of internal

control, management should consider the business processes

in place as there may be instances where internal control is

operating, albeit undocumented. Through direct observation,

management may note the design and operation of control

activities occurring through the normal course of business.

6

These instances should be evaluated for effectiveness of

design and operation, documented, and integrated into the

organization’s system of internal control. Controls over the

release of cash serve as examples of this type of activity.

Organizations often establish threshold amounts for which

cash disbursements may be issued without increasing levels

of approval. This organizational level of authority policy may

dictate the number of executive approvals that must be

obtained to issue cash disbursement of a certain amount.

The preventive control used in this simplified example is

assumed to be in place and firmly integrated into the

normal course of business for the organization. Outside of

documenting and communicating the activity, no further

control procedures may be necessary to mitigate the risks

associated with this portion of the business operation.

However, should management identify any areas for which a

Framework component is not present and operating, specific

controls will need to be designed to ensure the risks associated

with the relevant processes are mitigated. Revisiting the

example of the disbursement portion of the cash control

cycle, management may discover that there are unexplained

discrepancies between the general ledger cash account and

that which is reported on the bank statement. Further investigation may discover that monthly bank reconciliations are not

performed. Management must then design and implement a

monthly bank reconciliation control to ensure that the bank

account activity is monitored, valid cash transactions are

recorded in the ledger, invalid cash transactions are identified,

the ledger correctly reflects the organization’s cash position,

and that the reconciliation is performed and reviewed on a

timely basis.

Management and the board of directors must select controls

to ensure that risks that may prevent the organization from

meeting the operating, reporting, and compliance objectives

are sufficiently mitigated. In cases where the organization

must report to regulators, shareholders, creditors, or other

third parties on the design and operating effectiveness of its

overall system of internal control, management must design

and implement controls to meet the specific criteria set forth

by those who require the assertion that all components of

internal control are in place and functioning. The requirements

imposed by the third parties often determine the nature

and extent of the documentation to support the design and

operation of the internal control system.

Cost — Benefit Analysis

When using the COSO Framework to design a system of

internal control, management must evaluate the benefit

and costs of design, implementation, and operation of the

selection of controls.

Properly utilized, internal control provides management

and the board of directors with a system to efficiently and

effectively achieve goals and objectives aimed at increasing

shareholder wealth. In order to monitor the status of these

goals and objectives, management and the board must ensure

there are controls in place to ensure the delivery of operational

and administrative information to support critical decision

making related to operations, capital investment, and financing.

Further, an effective system of internal control will ensure

that there are mechanisms for timely and efficient processing

of transactions and metrics to evaluate operational data

as well as the presence of a conduit for the timely communication of reliable financial and non-financial reporting to

external stakeholders

For many organizations, certain goals and objectives are

compulsory and involve meeting regulatory requirements.

These compliance objectives may be met consistently and

efficiently through the effective use of an internal control

system, and will avoid potential costs such as fines and fees

levied due to non-compliance. The Framework provides

management with guidance to ensure that compliance

objectives are addressed and met in a satisfactory manner.

When evaluating the implementation of a system of internal

controls, it is imperative that an organization evaluate the costs

associated with the project. These costs include the easily

measurable direct and indirect costs associated with

implementing and maintaining an internal control system.

Examples may include hiring and/or training additional staff,

purchasing or upgrading an enterprise resource planning (ERP)

system, or physically securing inventory and assets. In addition,

it is also important to evaluate the opportunity costs associated

with use or redirection of resources. For instance, recruiting

and retaining staff with a higher level of competency will

require higher compensation costs. The resources used to

this end cannot be invested elsewhere in the organization.

In order to determine the full cost of implementing a system of

internal control under the updated Framework, management

must assess the efforts required to select, document, and

perform control activities. Selection of control activities

involves a thorough examination of the critical business

processes and the determination of the risk areas for which

key controls must be placed.

Once selected, the design of the process and key controls must

be captured and communicated via documentation, often in

the form of flowcharts and narratives. In order to establish and

clarify roles and responsibilities, control documentation must

be evaluated by the key process owners for acceptance and

understanding. This process helps management set standards

and communicate expectations for operational and control

performance, as well as establish the means to identify the

evidence necessary to evaluate the system of internal control.

Process owners must ensure that the control activities are

present within their processes and are operating effectively

as determined by the criteria established by management.

Often, this involves an incremental increase in the efforts

needed to effectively plan and execute the business process. However, this may be mitigated by the added leverage

provided by technology that increases the efficiency of data

collection, processing, and analysis to assist in management

decision making.

Management and the board of directors must identify and

allocate the resources necessary to monitor the system of

internal control, evaluate its effectiveness, and update the

system with any required changes or improvements found as

a result of the assessment. This may be achieved through the

development of the internal control function as a component

of the organization, or through the use of an independent

service provider. In both cases, the internal audit function must

work with management while maintaining independence in

both appearance and practice. For internal audit functions that

operate as a part of the organization, independence can be

achieved by reporting functionally to the board of directors

while reporting administratively to management.

Determining the breadth and depth of the scope of the

internal control system is a matter of judgment, and should

be done with cost-effectiveness in mind. Moreover, the

complexity of the cost-benefit analysis is intensified by the

interrelationship of controls within the ongoing business

operations. Management faces challenges in isolating costs

and benefits within a mix of controls that has been selected

to fit the needs of the organization. However, cost alone is

7

not an acceptable reason to avoid implementing a sufficient

system of internal controls. The cost and benefits considerations support management’s ability to develop and maintain

a system of internal control that balances the allocation and

deployment of resources to the areas of greatest risk, need,

or other factors relevant to the objectives set by management.

As a result, management must rely upon the COSO Framework’s integrated approach to ensure the efficient application

of internal controls by eliminating redundancies and needlessly

onerous processes. Effective internal control should meet the

needs of the organization without hindering the efficiency of

operations and management.

V. Conclusion

The 2013 COSO Framework emphasizes that the establishment

and maintenance of a sound control environment is solely the

responsibility of management. In order to help ease navigation

of this undertaking, the updated framework serves as a critical

tool that can assist management with the actions necessary

to maintain a sound control environment and effectively

manage risk. The explicit listing of the 17 principles increases

the framework’s ease of use and provides clarity for management to apply the Framework in the design, implementation,

operation, and evaluation of the effectiveness of the system

of internal control.

Use of COSO’s updated internal control framework will benefit

organizations seeking to build or improve upon their internal

control system. The Framework provides enhanced guidance

that makes it easier for management and the board of directors

to evaluate processes, identify, design, and implement controls

to ensure an effective control environment. Organizations

may leverage the Framework to better identify and mitigate

risks within a rapidly changing business environment as the

enhanced focus on principles may reveal areas not appropriately addressed. The Framework will help senior management

consider the importance of addressing the areas of control that

should better support the organizational objectives.

For more information contact:

Doug Farmer

Matthew Bohdan

Partner

312.602.3691

doug.farmer@plantemoran.com

CPA, CIA

2248.223.3619

matthew.bohdan@plantemoran.com

Jack Kristan

MBA, CPA, CIA

248.223.3605

jack.kristan@plantemoran.com

8

Changes to

COSO framework =

guidance for

risk response.

9

plantemoran.com