Gaming Information for Charitable Groups A Resource Manual

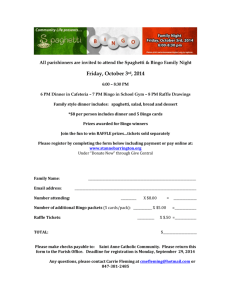

advertisement