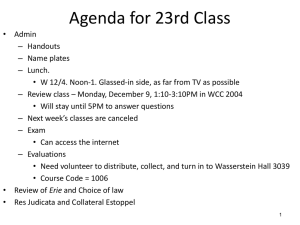

Banking Documentation and Contractual Estoppel

advertisement