Dispute in BQ Rate 23-5

advertisement

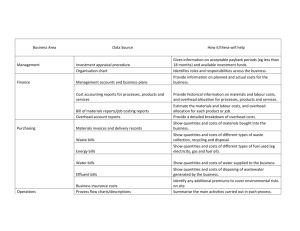

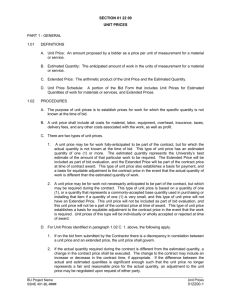

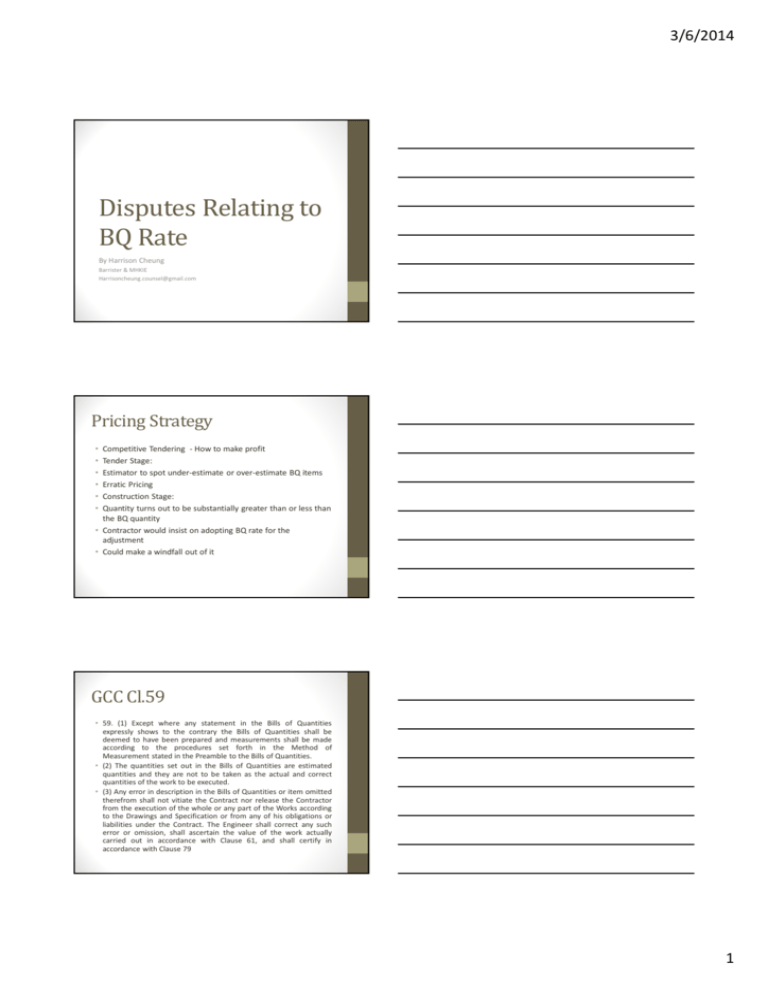

3/6/2014 Disputes Relating to BQ Rate By Harrison Cheung Barrister & MHKIE Harrisoncheung.counsel@gmail.com Pricing Strategy Competitive Tendering - How to make profit Tender Stage: Estimator to spot under-estimate or over-estimate BQ items Erratic Pricing Construction Stage: Quantity turns out to be substantially greater than or less than the BQ quantity • Contractor would insist on adopting BQ rate for the adjustment • Could make a windfall out of it • • • • • • GCC Cl.59 • 59. (1) Except where any statement in the Bills of Quantities expressly shows to the contrary the Bills of Quantities shall be deemed to have been prepared and measurements shall be made according to the procedures set forth in the Method of Measurement stated in the Preamble to the Bills of Quantities. • (2) The quantities set out in the Bills of Quantities are estimated quantities and they are not to be taken as the actual and correct quantities of the work to be executed. • (3) Any error in description in the Bills of Quantities or item omitted therefrom shall not vitiate the Contract nor release the Contractor from the execution of the whole or any part of the Works according to the Drawings and Specification or from any of his obligations or liabilities under the Contract. The Engineer shall correct any such error or omission, shall ascertain the value of the work actually carried out in accordance with Clause 61, and shall certify in accordance with Clause 79 1 3/6/2014 GCC Cl.59 • Provided that there shall be no rectification of any error, omission or wrong estimate in any description, quantity or rate inserted by the Contractor in the Bills of Quantities. • (4) (a) For the purpose of calculating the Final Contract Sum the Engineer shall ascertain and determine by measurement the quantity of work executed in accordance with the Contract. Subject to (b) of this sub-clause such work shall be valued at the rates set out in the Bills of Quantities or if there are no appropriate rates in the Bills of Quantities then at other rates determined in accordance with the Contract. • (b) Should the actual quantity of work executed in respect of any item be substantially greater or less than that stated in the Bills of Quantities (other than an item included in the daywork schedule if any) and if in the opinion of the Engineer such increase or decrease of itself shall render the rate for such item unreasonable or inapplicable, the Engineer shall determine an appropriate increase or decrease of the rate for the item using the Bills of Quantities rate as the basis for such determination and shall notify the Contractor accordingly. HCCT 94/1997 • • • • • • • • • • • Secretary For Justice v Sun Fook Kong (Civil) Limited Unreported, 24th November 1997 Facts: Contract with DSD to construct a sewage disposal scheme Excavation in rock BQ Quantity appeared in various bill numbers: 70 m3 - $ 5,000 20 m3 - $ 8,000 100 m3 - $ 5,000 1 m3 - $ 3,000 (appeared in 4 bill numbers) Actual Quantity: 7,048 m3 HCCT 94/1997 • Engineer invoked Cl. 59(4) and re-fixed the rate • Result: A difference of HK$ 31,000,000 • Dispute brought to Arbitration 2 3/6/2014 Issues for arbitrator • (1) Has the actual quantity of work executed in respect of any of the 7 BQ items in question been substantially greater than that stated in the bills of quantities? • (2) If so, for any such item, in the factual circumstances of this case, did the Engineer a reasonably and correctly conclude that such increase in quantities, of itself, has rendered the rate for any such item, unreasonable or inapplicable? • (3) In determining an appropriate increase or decrease in any such rates, should the a Engineer take account of how and to what extent the rate for such item has been rendered unreasonable or inapplicable? • (4) In general, how should the Engineer determined an appropriate increase or decrease of the rate for any such item, using the BQ rate as the basis for such determination? Arbitrator’s Decision • Substantially increase of Quantity? Yes • S.59(4)-increase of itself: applies to a change in quantity which itself changes the method of working or the economics of a working method • Fact finding: No change in method from that contemplated at tender stage • Ruling: Not a case for re-fixing the rate Govt’ challenges at Appeal Government not satisfied with the Arbitrator’s Decision Went to court for leave to appeal Challenges: 1) Too narrow interpretation of Cl.59(4)(b) Court: there may be some other basis to render the rate unreasonable, but not the present case • 2) Arbitrator did not consider economies of scale & effects of overhead costs • Court: Did not agree arbitrator did exclude. Main contractor used sub-contractor. Evidence showed that main contractor did not pay less • • • • • 3 3/6/2014 Govt’ challenges at Appeal • Could not be correct to alter a contractor’s profit percentage on a re-rate • 3) Arbitrator was wrong to rule the “one cubic metre items” were not genuine estimates and was there for obtaining a rate only . Therefore, it would not be fair to subject them to a rerate. • Court: Did not agree with the Arbitrator. Literally interpretation leads to “substantially increase”. However, since the difference in these 4 items only amounted to $ 140,000. Exercised discretion not to grant leave Maeda Corp v HKSAR • • • • • • • • • • • [2014] 1 HKLRD 1 Judgment redacted – not knowing the full story Actual Quantity >>>>> Estimated Quantity Contractor made a windfall Engineer re-fixed the rate Dispute referred to arbitration Arbitrator’s Decision: Increase in quantity rendered BQ rate unreasonable & inapplicable Contractor appealed to CFI for leave to appeal Refused Contractor appealed to CA , refused CFA, Refused again Maeda Corp – Arbitrator’s Decision • Factual Finding: Contractor built up the rate by transfer some money from another BQ item • Arbitrator’s approach of s.59(4)(b): • three-stage process. • 1) establishing any increase or decrease in quantities • 2)the formation by the Engineer of his opinion as to whether the change in quantity has caused the rate for the relevant item to become ‘unreasonable or inapplicable’, and • 3)f the Engineer decides that the rate is unreasonably high or unreasonably low when applied to the changed quantity, to fix a new rate using the Bill rate as the basis for deriving the new rate.” 4 3/6/2014 Maeda Corp – Arbitrator’s Decision • Parties agreed “substantially increase in quantity” • 2nd Stage: • “In order to understand the effect that a significant alteration in the quantity of work has on the rate, it is necessary to understand firstly, whether the rate is a composite rate, in the sense that it covers a number of individual activities, or one which involves a single activity. If the rate is a composite rate, then it may well be necessary to understand how the Contractor priced that rate in order to identify which elements of cost are fixed and which are variable in order to understand the effect of the increased or decreased quantity on the applicability or reasonableness of the rate. It is clear from the description of ( ) in ( ) that it covers not only ( ), but also ( ).” Maeda Corp – Arbitrator’s Decision • “In the case of an activity with a large element of fixed cost, the marginal cost of executing a greater quantity of work may be relatively low. To apply such a rate to a significant increase or decrease in quantity of work will be unreasonable since it will either over-reimburse the Contractor in the case of an increase in quantity or under-reimburse the Contractor in the case of a decrease in quantity. If, on the other hand, there is no reason to suppose from the nature of the work undertaken, particularly where it involves a single activity, that any increase or decrease in quantities will of itself make any difference to the Contractor’s incremental cost in executing increased or decreased quantities of work, then there may well be no reason to make any further enquiry as to the buildup of the rate.” Maeda Corp – Arbitrator’s Decision • Since the Arbitrator found this item did comprise composite activities, the Engineer was therefore required to look at the contractor’s build up to assess a reasonable rate. • Contractor refused to provide • Engineer therefore re-fixed the rate based on his own assessment • Arbitrator agreed with the Engineer 5 3/6/2014 Maeda’s Challenges • 1) the arbitrator was fundamentally wrong, as a matter of law, in having regard to the build-up of the rate inserted in Item ( ) in order to determine if it was unreasonable or inapplicable by reason of the increased quantity of work. Maeda relied on Wates Construction (Wates Construction (South) Ltd v Bredero Fleet Ltd (1993) 63 BLR 133 • Held: • Nothing in the contract prohibits the use of tender build up • Wates distinguished. Wates was a case on the admissibility of extrinsic evidence for the interpretation of a contract term. • Now it is concerned with admissibility of build-up of a rate for examination of reasonabeness Maeda’s Challenges 2) the build-up rate was confidential commercial data Held: That was the contractor’s choice If refused to disclose, the consequence would then be for the Engineer to carry out his own re-rating without making reference to the contractor’s tender build-up • If Maeda wished to challenge Engineer’s assessment, it had to submit contemporary records including details of tender buildup • • • • Maeda’s Challenges • 3)the rate itself was not relevant in deciding the question of reasonableness. The rate was simply the price for the work activity and so, it was submitted, the arbitrator should instead have asked whether, as a matter of objective assessment, there was any increase in the work activities and it was only if there was such an increase in the work activity that the question of re-rating under the clause arose. • the arbitrator was entitled only to look at the final rate and then make an assessment of how the changed work required that rate to be altered, so that how the rate was originally built up was irrelevant 6 3/6/2014 Maeda’s Challenges • Held: • Court simply agreed with the Arbitrator’s reasoning about the composite rate approach. If the build-up is relevant in determining whether a rate is reasonable, it ought to be disclosed. • Sun Fook Kong case was distinguished. • Nothing in the wording of Cl. 59(4)(b) indicating the increase must involve a change in the work activities • The wordings of Cl. 59 (4)(B) should be construed widely instead of narrowly Maeda’s Challenges • 4) the arbitrator had wrongly distinguished the case of Henry Boot Construction Ltd v Alstom Combined Cycles Ltd [1999] BLR 123 (and on appeal [2000] CLC 1147) which was authority for the requirement to use the stipulated contract rates when measuring the value of work done • Doctrine from Henry Boot: BQ rate is sacrosanct or immutable even if it contains error • Arbitrator ought to have followed this doctrine and adopted the rate, even if contains error, in his assessment whether the rate was reasonable Maeda’s Challenges • Held: • Distinguished Henry Boot • 1) there was a known error which was sought to be applied to VO in that case. The rate was subject to Cl.59(3) which says: “Provided that there shall be no rectification of any errors, omissions or wrong estimates in the descriptions, rates and prices inserted by the contractor in the Bill of Quantities.” The rate was therefore not open to challenge on the basis of error. • 2) the case involved valuation of VO, so the relevant wording of Cl.61 was at issue, not Cl.59 7 3/6/2014 Maeda’s Challenges • 5) If the Engineer is allowed to look at the build-up, he ought to distinguish the fixed component to 2 parts, i.e one related to the work activity and one unrelated. • By doing so, the part unrelated to the work activity ought not be disturbed as it is tantamount to a profit element • Held: • reject this distinction as being artificial and not based on any logical rationale. Equity/Policy Concern? • Court also held: • “the unusual facts of the case and the very significant additional amount that would inure to the appellant, in effect as a windfall, by the application of the original rate to the changed quantity of work (as reflected in the figures I have set out in the introduction above) demonstrate why, simply as a matter of fairness, GCC 59(4)(b) ought to be applied in the way the arbitrator did.” BQ Error Case • If a tenderer spots some mistakes in BQ during the tender stage, most of the tenderers may keep quiet and hopefully one would be able to get some benefits out of it • A case concerning “design and build” item which contains an error in description of the quantity of the area • Hung Wan Construction Co Ltd v Hong Kong Housing Authority, HCCT 21/2010, unreported, 29th July 2010 8 3/6/2014 Hung Wan v HKHA Description Quantit Uni Rat y t e $ Metal Main Roof ........ Design, supply and installation of metal main roof including..... to meet all requirements as stated in Specification section STE, section APQ – Appendix “Q”, other relevant Specification sections and Drawing Nos. KL32/7/CC/A/L0-07......KL32/7/CC/S/ 902.... (detail omitted) A General; (Type MF/1) (approximate area on plan 2,048 m²) Ite $14,900,0 m 00 25 Hung Wan v HKHA Hong Kong Government’s General Conditions of Contract Building Works (1993 edition) (GCC) GCC 59(4)(a) provides: “Variations ordered in accordance with Clause 60, work shown on the Drawings or described in the Specification but not measured in the Bills of Quantities or the rectification of any error in firm quantities shall be valued in accordance with Clause 61. Provisional quantities shall, subject to (b) of this sub-clause, be valued at the rates stated in the Bills of Quantities.” 26 Hung Wan v HKHA GCC 5(2)(a) provides: “errors in firm quantities or work shown on the Drawings or described in the Specification but not measured in the Bills Quantities shall be dealt with in accordance with clause 59;” Clause 59(3) provides: “The quantities in the Bills of Quantities are firm except where described as provisional. Only provisional quantities, variations ordered in accordance with Clause 60, work required by the Architect to be carried out which is shown on the Drawings or described in the Specification but not measured in the Bills of Quantities and errors discovered in firm quantities shall be measured. Provided that there shall be no rectification of any error, omission or wrong estimate in any description, quantity or rate inserted by the Contractor in the Bills of Quantities.” 27 9 3/6/2014 Hung Wan v HKHA BQ Area: Approx. 2048m2 Actual area: 4300 m2 Contractor argued there was a BQ error which ought to be rectified and be paid on a pro-rata basis Prior to the substantive hearing, HKHA sought interlocutory application for discovery of the contractor’s tender correspondences with its sub-contractor s Arbitrator held: Pre-contractual negotiations including those between Hung Wan and its sub-contractors were not admissible as they were irrelevant. Subjective mind of Hung Wan at the time of the tender stage was not important. Contract ought to be interpreted objectively. 28 Hung Wan v HKHA Substantive Hearing: Held: The real issue for consideration by the arbitrator was a question of “description”, and not a question of “quantity”. When the estimator came to prepare the tender he would know that he had to design and build and price for the entirety of the metal main roof works because the expression “Item” in the “Unit” column of BQ 9.6/75A plainly referred to the roof itself, and there was no need to look for any quantity. No issue of an error in quantity arose. 29 The End of Pricing Strategy? Since mid 2014, Development Bureau had rolled out a new tender assessment method: Price Proposal Assessment Method (PPA) Instead of 60% price 40% Performance tender assessment Now PPA proposes 50% price 10% Rate reasonableness 40% Performance assessment method Effect: Erratic Pricing may have less chance of being awarded the tender 30 10 3/6/2014 The End of Pricing Strategy? • • • • • • • New Engineering Contract NEC3 is getting more and more widely used Option B and D are the ones using BQ But BQ in NEC3 is now far less important than the Govt’ GCC Cl. 60.4: A difference between final total quantity of work done and the quantity stated for an item in BQ is a compensation event if: Difference does not result from a change to Works Information Difference causes Defined Cost per unit of quantity to change and The rate in BQ for the item multiplied by the final total quantity of work done is >0.5% of the total of the Prices at the Contract Data 31 The End of Pricing Strategy? • • • • • If the Defined Cost per unit of quantity is reduced, the affected rate is reduced Option B Defined Cost: is the cost of the components in the Shorter Schedule of Cost Components (i.e. labour, plant, equipment, materials, insurance, design etc..) Option D Defined Cost: amount of payments due to subcontractors …… and the cost of components in the Schedule of Cost Components for other works less Disallowed Cost 63.13 Assessing compensation events, If the Project Manager and the Contractor agree, rates and lump sums may be used to assess a compensation event instead of Defined Cost Effect: If rates not reasonable, PM will never agree 32 Q&A END 11