Vincor: Project Twist Report.docx

advertisement

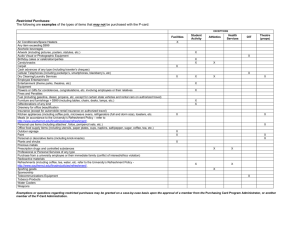

Vincor: Project Twist Report Feb 13, 2014 Karen Stanley, Olivia Pratile, Alexandra Carlow, Caitlin Tizzard, Lorena Reyes Table of Contents Company History Case Background Key Issues and Decisions Market Characteristics Competitive Landscape Analyses SWOT Analysis PEST Analysis Porter’s Five Forces Challenges Case Synopsis Alternative Recommendations Final Recommendation Epilogue Company History Vincor’s history can be traced back to 1874 with the establishment of the Niagara Falls Wine Company, founded by Thomas Bright and Francis Shirriff. Over the years, a number of Ontariobased wineries were established, eventually amalgamating into three large companies. In 1993, these companies; Cartier, Inniskillin and T. J. Bright, merged together to form Vincor. As of 2004, Vincor was the world’s eighth largest producer and distributor of wine and wine-related products. Case Background Vincor: Project Twist details the decisions that Vincor’s marketing team had to make in order to create a new alcoholic beverage to bring to the market. This task was challenging due the fact that “what’s trendy today may not be trendy two years from now,” as stated by Vincor’s marketing manager Kelly Kretz. Key Issues and Decisions The key issue in this case was coming up with a concept for a new alcoholic beverage product. Decisions to be made in regard to the product included: product characteristics, positioning, target market, branding, packaging and distribution strategy, pricing, and promotional strategy. Vincor was already a well-established player in the wine industry, holding 16% of the refreshment market in 2004 with their VEX and Growers Cider brands. Creating a successful new cooler could help Vincor gain an even larger share of the $230 million refreshment industry; however, reaching success in such a highly competitive market was a significant hurdle to cross. Market Characteristics The refreshment category has been traditionally split by cooler type: spirit, cider or wine, though the term “cooler” is often used to refer to all three beverages. Over 6.8 million nine-litre cases of coolers sold in 2004, making the refreshment industry an attractive one. According to Vincor’s survey, 56% of adult Canadians consumed at least one type of cooler. Generally, the target market for coolers is university aged adults, who have exploratory tastes and are open to trying new things. Vincor’s survey indicated that over a third of cooler drinkers were less than 34 years old, with 57% being female, 43% male. In terms of purchasing behaviour, 93% of respondents claimed flavour as the most important driver for purchase, followed by “looking for something familiar” (59%), “looking for something new and different (44%), and the brand (37%). A unique characteristic of the refreshment category was its seasonal nature, centered around the Canadian summer. As a result, just a few weeks’ delay of a spring launch could equate to significant bottom line sales losses. Companies generally start preparing for new products 10-12 months in advance: conducting research in the spring or summer, pitching the retail trade in the fall, and finalizing production and distribution in the winter to have the products on shelves by the start of April. Unfortunately, the refreshment category is a competitive one. New products have a short lifespan, rarely lasting beyond three years. There is constant innovation by companies creating both new flavours and new products: 30% of coolers on the shelf each year are either new products or line extensions. Additionally, as of 2004, the refreshment category was down 6% from the previous year. Competitive Landscape The refreshment industry was dominated by a few market leaders, with competition also coming from a large number of new products entering the market. Vincor’s main competitors were Smirnoff Ice, Bacardi Breezer and Mike’s Hard Lemonade. Smirnoff Ice is a vodka-based drink, and held 26% of the market share in 2004. It is known as the market leader, and is seen as edgy, cool, and appealing to both males and females. It also has the benefit of having a brand name attached to it. Bacardi Breezer is a fruity, rum-based drink, and held 17% of the market share. It is a more female-oriented beverage, and associated with a tropical lifestyle. Mike’s Hard Lemonade was launched in 1996, and is considered to have been the first cooler on the market. It held 9% of the market share, and has a strong masculine appeal. Vincor was already a player in the market as well, with their VEX line of products and Growers Cider. VEX, with 7% market share, was seen as being good value, but was still establishing its brand identity. Growers held 9% of the market share, and was associated with BC, nature and fruit. Vincor also had Canada Cooler, the number one wine cooler in Canada with 60% of the wine cooler market share, but only 2% of total cooler share, as well as TABU, a carbonated lowalcohol beverage with an insignificant market share. Neither product was a significant source of revenue nor held much growth potential. SWOT Analysis Strengths First and foremost, Vincor had prior experience in the refreshment market. Since they produced VEX, Growers and Canada Coolers, they were already established in the refreshment industry. Vincor was also a leading Canadian wine brand which would assist in getting meetings with the various liquor boards in each province. They had an experienced sales team that knew exactly what it would take to get the product into the liquor stores across Canada and what types of promotions had worked in the past. Weaknesses Despite their successful refreshment brands, Vincor was seen primarily as a wine company which meant that getting people behind a new refreshment product could prove to be difficult. The launch of a new product could be very risky because they were missing the in-house capabilities for some of the options for labelling, bottling and fermentation. This meant that they would likely have to outsource and risk losing control of the product. Lastly, there was no brand name liquor to back the cooler (ex. Bacardi, Smirnoff). People lend more legitimacy to a new product if it is backed by a product the consumer already knows. Opportunities Studies conducted by the firm said that even with relatively high levels of brand loyalty, consumers were still very interested in trying new products. This was especially true with young drinkers who didn’t want to drink what their older siblings drank. With this drive to try new products, there was a huge opportunity to achieve high volume sales through innovation. The absence of a gin- or tequila-based refresher on the market revealed another opportunity for Vincor. If Vincor were to go this route, they would be embracing the “Law of the Category”: if you can’t be the first, create a new category in which you can be first. This goes the same with the creation of a premium 6-pack. At the time, there were no 6-pack premium refreshments in the market. Vincor could differentiate itself based on their packaging. Lastly, there may have been the opportunity to increase distribution through bars and restaurants. In 2004, bars and restaurants only made up 10% of Vincor’s business. However, restaurants are where a lot of trial and awareness is made possible. There was a lot of potential to grow the business through these outlets. Threats The refreshment market is highly competitive and dominated by a few huge category leaders. It is difficult to fight for market share against industry leaders. In addition, the refreshment category was shrinking 6% annually which made the market very volatile. Regardless of the shrinking sales, companies came out with many new products annually. Thirty-percent of the category was made up of either completely new products or line extensions of existing products. This meant competition was constantly changing and innovating. Even if the new product was successful, there was the risk that it may compete too closely with one of Vincor’s other products, such as VEX. If there was not enough differentiation, the sales of the new product could cannibalize the sales of their already successful product lines. The Canadian liquor distribution laws make it difficult to completely penetrate the market. Each province only has one or two major buyers, for example, the LCBO. If Vincor was unsuccessful in making the sale to these key buyers, they would have no way to get the finished product to the consumer. Also, getting shut out of a key province such as Ontario could mean failure. Lastly, the refreshment market is known for its short product life span. Successful products might have a three year shelf life, and many fail within the first year. This was a huge threat. Even with a successful launch, Vincor would need to constantly work on the brand and the product itself to remain relevant in a transient market. PEST Analysis Political As mentioned before, the liquor market is largely government regulated. There are a variety of different regulations in each province and it is important for the sales reps in each area to have a complete understanding of the market in their territory. This includes knowledge of any laws regarding alcohol distribution, as well as any regulations about packaging, language laws, and advertising. Economic In 2005, the market was fairly stable. Inflation was rising steadily and people’s disposable income levels were increasing. Therefore, the Canadian population would be able to afford nonessential items such as alcoholic refreshments. Social The cooler market is a market dominated by females. Often coolers are seen as ‘girly’ which has pushed males away from drinking them. However, coolers are becoming increasingly socially acceptable for males. In 2002, males made up 30% of the consumers of refreshers, whereas women made up the other 70%. However, the research conducted in 2005 showed that sales to men were up to 43% with women making up the other 57%. Technological In 2005, social media was about to take off and websites and blogs were already prevalent. Vincor would need to take the rise of the internet into account in their 5 year plan. However, it was not a huge issue at the time. It was also important for Vincor to take advantage of any innovative technological advancement in the manufacturing process. If they were going to add new infrastructure to support the creation of a new type of beverage, they should search for new products that may set them apart from the competition. This could also mean a more ecologically friendly manufacturing process. Porter’s Five Forces Competition in the Industry HIGH There is a very high level of competition in the refresher industry. The category shrank 6% from 2003 to 2004 resulting in companies fighting over market share in a declining market. With huge players such as Bacardi and Smirnoff in the mix, there was even less market share for the smaller companies to compete for. There were also many new companies entering the refreshment market each year which meant there were constantly new products to compete with. The refresher customer is very exploratory and the cost of switching to a new brand is very low with little to no risk to the consumer. Since the product is low involvement, it is very easy to impulsively try a new flavour or brand. And since it is fairly inexpensive (compared to a higher involvement good such as a car) if the consumer does not like it, it is not a huge hit to their pocketbooks. Threat of New Entrants into Industry MEDIUM Even with the difficulties posed by Canadian liquor laws, it was still a relatively easy to enter the market, especially for already established companies. This comes in the form of both new products and line extensions. However, with the difficult process of getting new products to the consumer through the provincial liquor distributors, it is difficult for smaller companies to get their products in stores. Power of Suppliers LOW At the time, much of the fermentation and processing was done in-house which meant that Vincor’s suppliers had little power over the finished product and pricing. However, with some of the ideas explored in new product development, Vincor may relinquish some of their power to outsiders through outsourcing. Power of Buyers HIGH As mentioned before, there are only really one or two major buyers in each province since liquor distribution is government run. Liquor stores keep very few SKU’s (Stock Keeping Units) on the shelves since there is limited space in their stores. If products do not perform, they are taken off the shelves in favour of another better performing product. With little to no alternative to these provincially run stores, failure to get into one of the provinces outlets would be disastrous and would likely mean the end of a product. Threat of Substitute Products HIGH In addition to the many different coolers out there, there is the chance that many formulations could be easily replicated at home. For example, Smirnoff offers a Vodka Cranberry Lime cooler, which can be easily made at home with the ability to customize the strength of the drink and serving size. The consumer can also use their favourite brand of vodka and cranberry juice rather than relying on what the manufacturer uses. There is also little differentiation between products. Even though companies may categorize each beverage differently, they are all considered “coolers” by consumers. This means that a vodka-based cooler and a rum-based cooler may be purchased interchangeably. Vincor must take into account anything that can be considered a refresher beverage when discussing substitute products. Challenges One of the biggest challenges Vincor faced in this case was the high level of competition in the refreshment market. Up to 80% of new products failed to last beyond the first year. Exhibit 6 mentions the fact that “the refreshment category as a whole is overdeveloped in all regions except Quebec.” The nature of the university-aged target market was also a factor in the large amount of innovation in the market, as trends and tastes constantly change and demand for new products is high. There were certain limitations of Vincor’s actual in-house production capabilities as well. Current in-house capabilities were based off of production of the products already under Vincor’s umbrella, and did not allow for certain packaging options or beverage options that Kertz was considering. The nature of coolers in the minds of the consumers was also a challenge. Focus groups identified a number of drawbacks to drinking coolers, such as their high sugar content, toostrong taste and poor aftertaste, and feelings of fullness and bloating. Overcoming these perceptions when marketing the new product would be important. Finally, distribution of the product was a potential barrier. Given the regulation of alcohol sales in Canada, Vincor had to appeal to each separate buyer in each province to ensure their product had a place on the shelf. Getting the product onto each liquor boards store shelves was only part of the battle, as agency stores in smaller towns also had to be convinced to pull products from the central buyer to ensure complete distribution to consumers. The development of storemandated limited time offers and strong marketing programs would be critical in order to secure the best placement in stores. Case Synopsis In order to create a new beverage that would appeal to consumers and distributors, and surpass the one year trial period, Vincor had to differentiate the new product from the competition in flavour and packaging. It was imperative that the flavour introduced something new to the market while adhering to consumers’ preferred tastes. Similarly, all elements of packaging had to be creative and attract the attention of consumers while remaining financially on-track.: Beverage Concept REAL FRUIT JUICE Real fruit juice was the preferred flavour by respondents in Vincor’s qualitative research study. Some of the advantages of introducing a real fruit juice-based cooler were its healthier nature, lower added sugar content, and lack of carbonation. Survey respondents still showed concern over other artificial ingredients in the beverage, potential to be filling, how easily be made at home instead. A real fruit juice cooler did not exist in the market in 2004; however, Yuha had launched a similar product the year before and failed. There was hope that with better positioning, promotion and packaging, Vincor’s potential new beverage could succeed. GIN Gin-based drinks were also non-existent in the market in 2004. A gin based spirit would attract those who preferred a less sugary drink. Another advantage of having a gin based drink was that it could easily blend with any flavour to create a unique and sophisticated product offering. The disadvantages of gin were that it would alienate vodka and rum drinkers, and didn’t have a brand name alcohol attached to it. SPRING WATER This concept tested well in the survey. On a health note, a spring water-based spirit promised less dehydration, less sweetness and fewer in calories. A major concern for Vincor was flavouring if it proved too flavourless for consumers. TEQUILA Like gin, tequila would also be a unique offering in the market. A Vincor tequila-based beverage would include putting a gummy worm in the bottle. This was found to be a disadvantage as consumers could be turned off by the worm in the bottle. Survey results showed non-tequila drinkers were concerned about the overpowering taste of tequila. ENERGY COOLERS This beverage concept was a contender because Red Bull and vodka turned out to be a popular choice in the qualitative study conducted. It promised the convenience of having a pre-mixed drink, as well as a fruit flavour taste. The obvious advantage was increased energy, and many would find it appealing that energy drinks use guarana berry as a natural source of energy. Some drawbacks for this concept were the high sugar and caffeine content, as well as the negative impressions of energy-based alcoholic beverages for health purposes. Packaging CARRIER The carrier design would directly impact the production costs of the new product. The decision was to be made between a 4-pack versus a 6-pack, and an open versus a closed box carrier. The combination of these features would either connote the new product as a premium or value product. See Table 1 for details. LABEL As with most products, labels and logos are essential to attract and catch the attention of consumers, especially when introducing a new product into the market. Vincor wanted to introduce a premium product with an “edgy” look to generate interest and curiosity for its product. A paper label was the easiest and least expensive option but also the least upscale. Ceramic labels are graphics and text etched directly onto the bottle using a laser. Vincor would be the first cooler to use ceramic labelling, but did not have in-house facilities to do so. Pressure sensitive labelling would offer maximum flexibility for creative design making it the best option for creating the desired “edgy” look, but at a high cost and again requiring outsourcing. Vincor’s last option was no label on the bottles. Having no label would be unique, edgy and inexpensive to execute. However, there was the concern that no label would create a lack of interest in consumers to try the new product. See Table 2 for more details. BOTTLE The two options for bottles were plastic or glass. As with most packaging options discussed so far, there are costs to be considered for each, as well as differences in perceived quality. Along with this, the size and shape of the bottle are also important considerations for design and creative purposes. Plastic bottles are usually associated with bottled water products, soft drinks, and sports drinks, but would be less expensive and more durable. Glass would be the conventional choice for the cooler category, offering a longer shelf life than plastic bottles. Vincor considered introducing a square-shaped bottle for the new product as a differentiator, but doing so would require a new mold. In terms of size, Vincor was considering the standard bottle size (341 millilitres), which would be comparable to other coolers on the market. See Table 3 for more details. Pricing and Discounting A well-planned pricing and discounting strategy could create enough interest in a new product to maintain the necessary profit margins, and Vincor had four main pricing options. The Grey Goose Approach would use price to connote “premium”, but could potentially turn off customers without a well-known brand name attached. Line pricing the new beverage would price the new product at slightly below the market leader, establishing it as a competitor for the market leader in terms of price and quality. Pricing below the $9 value strategy had the possibility of generating higher sales volume but could affect the perceived quality of the product. It would also create competition for VEX. Finally, discounting in-stores through LTOs (limited time offers) would ensure good placement in provincial liquor stores, grab the attention of consumers would and hopefully increase sales through promotion. See Table 4 for more details. Promotional Strategy In a period in time when social media was not a major aspect of the marketing mix, Vincor’s new cooler beverage could be heavily marketed via experiential marketing initiatives that thoroughly engage consumers to try the new product in different ways. In-street and event sampling is a great method for consumer trial, while providing key information about the company and product itself. This would lead to word-of-mouth recommendations, meaning quicker product recognition among the market. As mentioned above, LTOs would also support these initiatives as consumers would be put in front of the new product right away and at a discounted price. Experiential marketing should be supported through traditional forms of marketing such as commercials and ads that give the brand and product an image and character. Target Market Vincor was hoping to bring a new, unique product to the market that would appeal to both men and women. It would be positioned as a premium beverage with an ‘edge’. The demographic targeted would change depending on the final product chosen. However, based on previous quantitative and qualitative research, mainly a younger demographic drinks coolers, and therefore Vincor: Project Twist’s target market would also likely be younger adults and university-aged individuals. . Alternative Recommendations Recommendation #1 Our first recommendation is a spring water-based cooler. Featuring a premium yet value conscious product, we opted for a square, plastic bottle priced under the ten-dollar mark and sold in a four pack. We preferred the spring water based beverage because it received favorable results from consumers. When asked how likely they were to try a new product, 77 percent of the total survey population stated that they would be either very likely or likely to try spring water coolers. As one of the most preferred beverage options, spring water also had the highest incidence of regular drinking at 21%. This is important since the key issue in launching a new beverage product is having it surpass the first year trial mark. Taking into account the consumer information presented in the case synopsis we would have to ensure that the beverage would have an appealing taste. We chose the bottle, shape, price and packaging based on the aspects that would reach a broader audience. The plastic bottle presents an athletic, on the go, smart beverage that appeals to both genders. We opted for a square bottle that revitalizes the premium appeal that may have been lost with the plastic bottle selection. The four-pack again resonates with a premium product, but pricing the beverages under ten dollars assists in providing an affordable option. These choices help develop a product that is significantly different from others on the market and one that will draw in a broader audience. Recommendation #2 Our second recommendation is a real fruit juice based cooler. Since Vincor was interested in launching a premium product our second recommendation will encompass the premium aspects previewed in the case synopsis. The real fruit juice beverage would feature a round, glass bottle, sold in a four pack and priced above the ten-dollar mark. Real fruit juice was chosen because research demonstrated that it was the number one beverage concept of choice, with 85 percent of respondents stating they are very likely or likely to try real fruit juice coolers. Furthermore, it had the highest anticipated occasional drinking, with 78 percent of respondents stating they would drink the products again. Similar to spring water, these factors are integral to a new product launch because recommending the top beverages consumers favored could lead to a better anticipated sales run within the first year. With the first recommendation we were looking to generate a product that could appeal to a broader audience, by mixing the premium with the affordable. With our second recommendation we look to focus on a strictly premium product that Vincor aspires to launch. The glass bottle accords to a premium beverage, because it cost more, has a longer shelf life and is more acceptable within restaurants and bars. Going along with the premium theme, the beverage would be in a four-pack and be in a higher financial bracket. A real fruit juice cooler presented in this manner could really hone in on the older generations who have the financial backing to try new products and continually purchase ones that are more expensive. Although our competitors feature many of these packaging attributes, there was no other real fruit juice product on the market and with growing health concerns there is a high probability that such a product would succeed its first year. Recommendation #3 Our third recommendation is to focus on current product lines and creating new line extensions. Under the Vincor umbrella there are three main products that fall within the refreshment category; VEX, Growers and Canada Cooler. Growers is the #1 cider in Canada, Canada Cooler is the #1 wine cooler and VEX is the #3 spirit cooler in Canada. These brands carry with them a well-established and profitable consumer group which is loyal to the brand name. Vincor should take advantage of the market opportunities they already have by unveiling a new product under one of these already established names. As demonstrated within the case study, companies need to be innovative and continually find new beverage ideas for the market. It is possible for Vincor to be innovative and develop a category to be first in, like spring water based or real fruit juice based coolers, but it could have more of an impact if a new beverage was launched under one of their existing brand names. This will be further expanded upon in our final recommendation. Final Recommendation It is our recommendation that Vincor reconsider launching a new premium cooler beverage in the refreshment market and instead develops innovative ideas under their existing product lines. In this manner, we urge the company to expand on their well-known products and take advantage of the market opportunities presented from them. For example, create new flavors, like a water based vodka beverage but with the VEX name, or create new beverage flavors for Growers. Having well established names like these could better market the product to consumers and lead to further recommendations like expansion into other provinces. We came to this conclusion based on several red flags that were evident throughout the case study. Firstly, although this could be a very profitable market, it is extremely competitive and over 80 percent of new product offerings fail within the first year. Secondly, getting distribution rights within the province is quite complicated. Since only 6% of refreshment sales are from restaurants and bars, the LCBO is an essential distribution center. If distribution is approved, then we recommend continually investing in limited time offers to get the flow of traffic moving in the products first year. Lastly, Vincor was not meeting its numbers this year and the general appeal in the refreshment category was slowly declining. Launching a new product, with a new name, would be a very big financial risk. With $40 million on the line, our recommendation to Kretz and the Vincor executive team is to rethink launching a premium beverage product or to do so under one of their existing well-established brand names. Epilogue In the summer of 2006, Vincor launched their premium spring water based vodka cooler called Hydra. Hydra was presented in a round, glass bottle and featured creative print media advertisements. One such ad showcased a ninja in a tank, kicking the water, with the tagline “water with a kick.” Steve Bolliger was Vincor’s Senior Vice president of marketing and spoke adamantly about the product. They decided to launch Hydra because water was a big trend at that time and they felt they had an opportunity to stay current. Bolliger states, “sometimes when you are number one you tend to look backwards instead of forwards.” Although Hydra showed strong signs success in the first few months it was clear the product would not succeed beyond its first year and in 2007 the product was dropped from the market. Bibliography Bell , Robert. "Vincor Canada: A Constellation Company." . Vincor International Inc, n.d. Web. 10 Feb 2014. <http://www.winesofcanada.com/vincor_history.html>. CALJ. (n.d.). About Us. Retrieved from Canadian Association of Liquor Jurisdictions : http://www.calj.org/AboutUs.aspx Bourdeau, Annette. “Vincor Steve Bolliger thrives on launches.” Strategy, Web. 01 Oct 2006. <http://strategyonline.ca/2006/10/01/who-20061001/> Appendices Table 1. Carrier Type Pros Cons 4-pack Differentiation from vex (6-pack) Premium aspect Most competitors are in 4-packs 6-pack Has to be priced above the $10 mark to achieve desired margins Faster and inexpensive to produce (Vincor already has 6-pack production facilities) First premium product in the market to be in a 6-pack Open box Consumer can see product Easy to pull out beverage Has an easy to carry handle Less surface space for creative packaging Closed box Larger surface area for creative packaging, design and copy Not as easy to carry Table 2. Label type Cost per label Pros Cons Paper 1¢ Easiest and less expensive option (already being within existing Vincor products) Less upscale Doesn’t achieve “edgy,” eyecatching, differentiation packaging Ceramic 3-4¢ First cooler to produce it Premium aspect More expensive Higher costs (not recyclable) Pressure sensitive 6¢ Maximum flexibility for creative design Best option for an “edgy” look Most expensive option Higher costs (not recyclable) Unique Inexpensive Lack of interest to try product No label - Table 3. Bottle Pros Cons Plastic Value product Less expensive More durable Differentiation Not a long shelf life (4 months) Glass Longer shelf life (up to 1 year) Premium aspect Conventional choice Square shape Differentiation Brings “edginess” More expensive (need to purchase new mold) Size (341 ml) Easiest size to use Same as competitors (no differentiation) Table 4. Strategy Grey goose approach Pricing 4-pack= $11.95 Perception Premium pricing Exceeds $10 psychological threshold Difficult to launch product at this price mark without an existing brand name Value add Compares with market leader Same as other products on the market, people will go with the name they know Puts product too close to VEX Confuses consumers on product positioning 6-pack= $14.95 Line pricing approach Potential product= $9.45 Pros/cons Market leader (Smirnoff Ice)= $9.65 Pricing below $9 value Potential product= $8.95 Value product Store discounts (LTOs) Deep discount= $1.50-$2.00 (per pack) Addresses premium or value product Deep discount Can lead to unmet profit margins Smaller discount Protects profit margins Smaller discount= $0.50-$1.00 (per pack)