annual report - Aalberts Industries

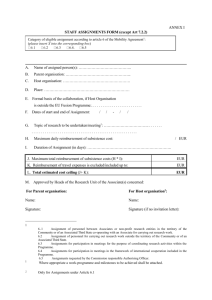

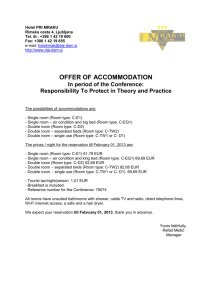

advertisement