Human Services 2013-14 PBS - Department of Human Services

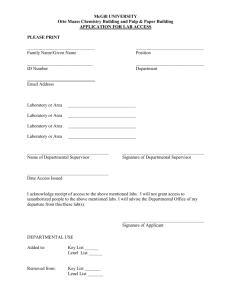

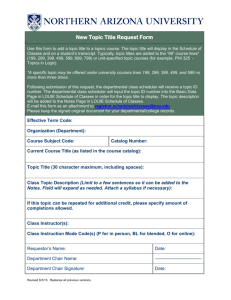

advertisement