ThesisxOleksandraxLeginevych

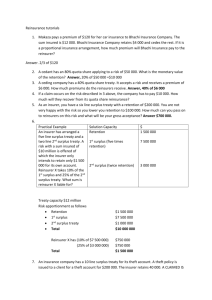

advertisement