to the internship Report United Bank Limited

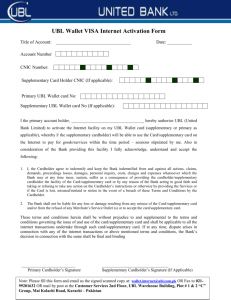

advertisement

INTERNSHIP CONCLUSIVE REPORT INTERNEE NAME: UMAIR JAVED INTERNSHIP PERIOD: Six WEEKS BRANCH (ES): COMMERCIAL CENTRE. S.TOWN RAWALPINDI 1 Contents of Report Acknowledgment UBL, where you come first Consumer Banking UBL Address UBL BusinessLine UBL CashLine UBL Credit Cards UBL Drive UBL Money Commercial Banking Agriculture Products Small Business Schemes Investment and Saving Accounts UBL Basic Banking Account UBL Business Partner (Current Account) PLS UniSaver PLS UniSaver Plus UBL Rupee Transaction Account (PLS Saving) UBL UniFlex eTransaction (Current Account) UBL Profit COD Complementary Services Insurance Certificate UBL Wallet VISA UBL Orion UBL Net banking Humrah UBL e-statement My Learnings Account Opening Clearing of cheques Remittances Demand Drafts Pay Orders Uni Remote Security Deposit Receipts 2 3 4 4 4 4 4 5 5 6 6 7 7 7 7 7 7 8 8 10 10 10 11 11 11 12 19 24 24 24 25 Acknowledgment By the Grace of Almighty, the most Merciful, the most Beneficial, I'm today submitting my internship report, at the end of my first pragmatic experience and I'm glad to have it with UBL, where you come first, only if you're the customer. Thirst of learning is inside you, and whatever the environment, if you're willing to learn, you do. At UBL, I had a new, challenging, yet a perfect environment to learn. My parents' prayers and their teachings were always with me and hereby I will like to take this opportunity to show my gratitude to all those who made my internship an adventurous outwit. . . Here I am, from more professional and rather corporate environment of UBL C.C. Satellite town branch. I never knew what it all going to be. As I enter the branch, it took me a minute to realize that the person sitting in the half fortified walls is the manager. Maybe I was expecting him in a glass sheeted room. At a glance, I grasped the interesting personality of the manager and today at the end of my internship; he’s one of the persons I’ll always remember. Sir whatever I learnt from you is always going to be respected, no matter whatever business field I choose. Those tips are always in my memory bag. Despite of the most hectic schedule, Maa'm Saiqa helped me so much. I'm really grateful to you maa'm for clarifying my concepts and making me learn from your experience. Whatever I learnt from you will definitely help me in my upcoming study and the professional life ahead. Thank you so much for being so co-operative and so helpful every time. I hope maa'm I have been up to your expectations. In the end, I'll like to thank all my other colleagues, Mr. Ghaffar, Mr. Mirza, Mr. Latif, Maa'm Beenish and all my other fellow internees, here and in cantt branch, for their unconditional support and help in making me learn in a good environment. Umair Javed 3 Consumer Banking You as an individual can gain and benefit the most through UBL Consumer Banking. In UBL you get friendly, efficient and attentive personalized banking services - a unique banking relationship experienced by each UBL client. You can utilize the following services. UBL Address Owning a house of your very own is a cherished dream. A lot of planning and hard work is involved in making this dream come true. That is why, at UBL we aim to make your decision easier, by offering you the right ingredients that can help you realize your dream with absolute convenience. UBL Address empowers you to become the proud owner of a home by offering a variety of product and pricing options that are flexible yet affordable. So choose the best product option and pricing to suit your needs. All product options are amortized and range over a tenor of 3-20 years. Buying a home Why rent when you can buy? Buying a home of your choice has never been so easy. With a maximum financing limit of 80% you can easily buy a house or apartment that best fits your requirements. So go ahead and start the search for your dream home because with easy and affordable installments you need not think of renting a house when you have hot UBL Address. UBL Business Line UBL Businesslin a complete solution to all your Business Financing needs. With UBL Business Financing facility, you can now take your business to greater and newer heights, and achieve the level of success that you truly deserve. UBL Businessline is a running Finance facility that not only provides funds for growth but also enables you to capitalize on profitable opportunities. With UBL Businessline, now you will surely say. “Ab Hui Kamiyaabi Meri Manzill”. Now, UBL Businessline credit line is here to solve all your cash flow problems. You can utilize up to Rs.10 million with the help of which you now focus on your business expansion and growth. 4 UBL Cash line UBL Cashline is a flexible loan that provides you cash up to Rs.500,000 without any security requirements. It empowers you to take control of your finance. UBL Cashline is aimed to make your life easier…ZINDAGEE ASAAN. Whether you are a salaried individual or a businessman, UBL Cash line takes care of your cash requirements. UBL Credit Card Welcome to the world of UBL Credit Cards the most exciting and vibrant credit card brand in Pakistan. We offer you a range of innovative and exciting cards that is not only powered by the security of chip but also enable you to personalize it any way you want… UBL Drive Accelerate your life; Drive the way that suits you! UBL Drive is a unique auto financing product which offers you features, option and flexibility unmatched by any other bank, because at UBL, You come firs t. New Car Financing UBL Drive allows you to drive away in your own car by making a down payment of just 15% and to top that with low monthly installments. Used Car Financing With UBL Drive you can buy favorite used car (up to 5 years old) at the most affordable rates. Cash Your Car UBL Drive is not a car loan; it’s financing facility that gives you Cash on your car, you can get up to 75% of your car value. UBL Money UBL money, the personal installment loan from UBL provides you with power, Control convenience and the flexibility to manage your financial requirements and realize on your dreams. It’s about buying new furniture or marriage expenses, financing the education of your child or enjoying vacations abroad! UBL Money caters your needs handsomely. You can borrow any sum between 50,000 to 500,000 (PKR) and payoff up till 5 years. We know what you need at what time. Just give us the opportunity and let us serve you best. 5 Other Services: • • • • UBL Net Banking UBL e-statement Hamrah UBL Wallet UBL Net Banking: UBL Net Banking is an internet banking portal offering a simple, convenient and secure method of accessing bank accounts on the internet. Its never being so easy to access and manage your finances in a secure real-time, online environment UBL e-statement: UBL is pleased to announce the launch of the UBL e-statement facility which it easier for you to get your statement of accounts and automated transactional debit/credit alerts right into you inbox. Hamrah: UBL has always been adding the forefront in identifying and meeting the financial needs of its valued customers. UBL was a pioneers an introducing Rupee Travelers Cheque facility in Pakistan, as early as 1971. In continuation of the same tradition, UBL in the shape of, “HAMRAH” Rupee Travellers Cheque enhances this facility for the convenience of its valued customers by offering denomination up to Rupees 10,000. UBL has a 24 hours customer’s help-line, providing its customers with round the clock tele-verification of HAMRAH Rupee Travellers Cheques. UBL Wallet: UBL Wallet VISA as your debit card, you can shop all you want, eat all you can or fill up car tank without carrying any cash. Commercial Banking To stand tall among the world’s leading banks, UBL has developed a YOU attitude to understand its customers well. When you talk, we speak for you. For small and middle size investors, UBL has so much to offer, so much to deliver. You live the way you want; we will always be shadowing you. Walk in to any nearest branch of UBL, enter the world class bank and let us serve you with what you need. 6 Small Business Scheme Under the Small Business Scheme, UBL is providing loans on easy terms to those who wish to set up their own small-scale business. This scheme is aimed at spreading prosperity in the country by reducing unemployment. As more and more people start their own industrial units, the country will move steadily towards economic self-reliance. 7 Investment and Saving Accounts: At UBL, we offer you the most beneficial and secured financial investment and saving options. You can choose from the following list of accounts anything that serve your needs best. UBL Basic Banking Account Exempted from Minimum Balance charges, UBL BBA holders can carry out two deposits and two withdrawals each month as per the bank policy. Through 24hrs ATM services, they can carry out transactions as and when desired, staying in the daily withdrawal limit. UBL Business Partner (Current Account) For our regular customers, we offer the ultimate option, UBL Business Partner (Current Account). With unlimited deposits and withdrawals, we offer you convenience of UBL netbanking, UBL Wallet, UBL Orion and other exciting consumer products. Customers are liable to maintain minimum balance of Rs. 10000 to avoid the minimum balance charges until and unless they are exempted from it. Remember! We are not just a business; we are your caretakers; we know what you need. PLS UniSaver Let your savings earn you bucks. PLS UniSaver offers you semi annually profit disbursement with profit being calculated upon average monthly balance. PLS UniSaver Plus Big amounts earn you big; but with PLS UniSaver Plus, we make it bigger for you. With deposits starting from Rs. 25 million, we offer 5.00% but more you put in, more profit rate will we offer. Avg Balance per month Profit Rate* Rs. 25 million 5.00% Rs. 25 million to Rs. 100 million 5.10% Rs. 100 million to Rs. 250 million 5.20% Rs. 250 million to Rs. 500 million 5.30% Above Rs. 500 million 5.50% * Profit rates are for the month of July only 8 UBL Rupee Transaction Account (PLS Saving) Have your money box at UBL! Put in your savings and let us earn you 5% p.a. over your daily savings. UBL UniFlex Have couple of thousands spare? Come invest in our UBL UniFlex Accounts, we will make you earn handsome. Amount Profit Rate 1000-50000 7.0% 50001-100000 7.25% 100001-200000 7.5% With UBL UniFlex, we serve you with fix profit rates at maturity. E-Transaction (Current Account) In the era of glooming computerization, even Chicago, Tokyo, Sydney, all are seconds away from you. Internet has turned distance into time, and we have turned your account into a shear pleasure. Now sitting at home, or at office or anywhere in the world, we offer you a wide spectrum of world-class electronic services and banking products each time you log in. Use your account like a regular account plus use the premium Internet & Mobile banking services for Instant Fund Transfers, Instant Shopping, Instant Bill payments, Instant Mobile top ups, Alerts, Statements and much more. You love surfing, come surf with UBL. UBL Profit COD Make fix investment with us, choose your profit option, and we will serve you the best rates in Pakistan. What if you earn at 16.25% p.a. Stop imagining, come invest in our Certificates of Deposit! At maturity, we offer you the following rates: 9 Deposit Tiers & Products Jul 1 – Jul 31, 2008 3 months 8.25% 6 months 8.50% 1 year 9.50% 2 years 11.50% 3 years 12.75% 4 years 13.25% 5 years 13.75% 6 years 14.25% 7 years 14.75% 8 years 15.25% 9 years 15.75% 10 years 16.25% 10 Complementary Services Insurance Certificate UBL not only cares about you, we care about those too who are dependent upon you. So UBL now offers enhanced Free Accidental and Disability Insurance Certificate coverage to all existing and new account holders. Closing Balance at month end (PKR) Insurance Limit (PKR)* 1 – 10,000 100,000 10,001 – 100,000 250,000 100,001 – 500,000 500,000 500,001 – and above 1,000,000 * Terms and conditions apply UBL Wallet VISA Imagine you are shopping in a big mall and you are ever so watchful about your cash in your wallet. Every time you shop, you're in a mess! Let UBL Wallet Visa ease your shopping. Shop around and pay your expenses directly from your account through UBL Wallet. Not only can this, individuals and sole proprietors, through more than 925 ATM machines, debit their accounts as many times as they want. You can choose according to your need. We offer Card Type Annual fee (Rs.) Daily Limits (Rs.) Primary Supplementary ATM Debit Card Funds Transfer Funds Transfer (From UBL to UBL) (From UBL to other Withdrawal Spend banks) Gold 500 250 40,000 100,000 250,000 250,000 Silver 300 150 20,000 50,000 250,000 250,000 Moreover, the convenience and excitement of Internet Shopping is also available at UBL Wallet VISA ATM/ Debit Card. So surf around and feel free to shop. We are here to help you pay miles away. UBL Orion ‘Buy W100! (Message tone) Dear customer your voucher # is 1456894525796324 Thank you for using Orion’ 11 Your finger tips might have not been that powerful before. Just type in commands and at your ease, buy mobile cards and pay your utility bills. With UBL Orion Mobile Wallet, running around for mobile cards and queuing to pay your utility Bills is no longer a part of your life. Live your life at your finger tips. UBL Net banking UBL is very much determinant to make banking as you will. How about being in office, or on your way, at home or at anywhere in the world but still connected to your account! Through UBL NetBanking, Access your accounts any time, pay anyone you want, pay your bills, buy vouchers you need and get account alerts, all integrated with one of the best security systems in the world. Humrah Humrah is your secured cash, something that’s safe anywhere and accepted everywhere. Offered in the denominations of 10,000 and 5,000, "Hamrah" Rupee Traveller Cheques are the ideal and safest way of carrying cash when travelling anywhere in Pakistan. Let it be business; property; trade or personal needs; we make you have the most convenient option. Moreover, Humrah RTC's are now accepted at more than 2000 places such as hotels, shops, real estate agents, jewelers, car dealers, etc and of course at all our UBL branches. UBL e-statement: During your busy hours, you don’t have to bother about visiting us to get your account statement. Neither there’s a risk of anyone else knowing your account details. Subscribe today, free of cost to UBL e-statement facility and let us share details with you daily, weekly, monthly, quarter or semi-annually. Get debit/credit alerts and know as soon as you get money or pay off. 12 My learnings Standing on the forth floor of UBL Islamabad head office, I heard the good news of me having a six week opportunity to interact with a world class bank. All these six weeks were full of events, full of learning and most importantly full of professional working. Here 'professional' regards in all from clerical to managerial work. In these six weeks period, the best thing to me was the authority and dependency of customers upon me, when they come with a hope that I'm there to guide them through. Knowing all is not learning, the real learning is to convey right. I tried to learn real, see real UBL, and tried to comprehend the difference between what we look from outside and what is going on inside. UBL is full of experienced and professional traditional bankers. As it perfectly suit the environment we are operating in, You attitude has helped UBL in capturing masses. In the private sector, no doubt its a fast growing bank, but here's something that's still unrealistic to the policy makers. The line of unsatisfied customers is increasing, not because we are not serving well, it's because customers are not understanding the YOU attitude right. Every customer wants to make sure his work is done at the first convenience, but they are not concerned about the responsibility with which every employee is working. We need to put in some guidelines for our customers, as they walk in. This will not only save their time but will also motivate staff members to work more promptly, because if customer and employee engage into some unhealthy quarrel, the whole environment will be disturbed. Back to my real learnings. In my six week internship, I worked in customer service department, as well as in clearing department. Because of some work load, I was unable to learn much about other cash and accounting department. Here is my count down learning of six weeks. Account Opening: Penning down information and keying it into the system does seem a simple and tedious job but it is not. My initial five days at customer service department was the liveliest experience of my internship. Though physically I was there just to assist the account opening officer, but it turned out to be much more for me. That is when I first actually imitated as a presenter of UBL to customers, when to many people, I'm their hope. UBL offers a variety of options for anyone; to everyone. You are an investor, regular businessman, middle man, salaried person or a house wife; UBL serve you in every way it can through its commendable and reliable services, because at UBL, YOU come first. Working at Customer Service Department, I did counter with different types of customer and opened their accounts under the supervision of the officer. When you have the sole responsibility to open the accounts, it's always very important to understand the needs of your customer. Understanding the psyche of customer is very important. Until 13 and unless you're completely satisfied that the customer has genuine reason and need to open the account, don't do so. Account Opening Form: In all the documentation within the bank, clearness and tidiness are the major features. Over writing and cutting should always be avoided as it may lead to any misinterpretation. Account Opening Form is the most important documentation when a customer walks in for commercial banking and wants to develop a relationship with us. In AOF, all the necessary information should be completely scrutinized before the customer walks back. Now let’s look at some of the salient requirements of AOF and their importance. Currency and Type of Account It offers you all the eight different types of accounts mentioned before. First understand why the customer is here and what type of account suits him a lot. Scale down all the options suiting his investment or requirement and help him choose what is best for him. Outline all the salient features of that particular account to him and make him tick the best box. Mark the currency box if the customer wishes to deposit in currency, in case, other than PKR. Nature of Account Understand and choose the desired nature of account. Individual Account (Single/Joint) determines if the account is personal or joint. Once again understand your customer here. Illiterate and gullible customers should better opt for joint account for their own security. Particulars of Account First of all the title of account is entered by which it will be called off. Following is the Key/Secret Word of six characters which is mostly preferred to be mother’s name because it’s simple unforgettable. Key word is used to verify the customer on phone or while other subsequent inquiries. Next comes the mailing address; where the bank should mail anything it has to. Next is the permanent address of the customer which should be copied from the CNIC of the customer. E-mail address is mandatory for Net banking and e-statement facility whereas Mobile number for mobile banking. Lastly it’s your choice to hold your statements for collection or mail it to you. *Here make sure mandatory fields are entered and any valid contact number must be provided. 14 Personal Information Following portion summarizes social with standing of a person. Applicant’s name, Father’s or husband’s name, gender, marital status, Date of birth, nationality, country of residence and identification source and its number should be enter. Make sure the source of identification is not expired. Enter NTN if available. Know the occupation of the applicant and check the respected box. In case there is more than one account applicant, fill in all the above mentioned information for other applicant as well. *It’s a good practice to ask for the original identification source of the customer and pen down the number and expiry date directly from it. Next of Kin In case if the account holder is somehow not contacted, this portion provides information of the person who should be contacted instead. Person’s name, relationship, address and Telephone number should be provided. Business Account determines that the party has its own entity under which the account will be supervised. Match the respected category and check the box. Particulars of Account Here the information about the business is filled in. Title of account, company/business name, and nature of business, office/mailing address, head office /registered address, office email and NTN are mandatory information required for business account. CNIC is required in case of sole proprietor ship and information of few persons are required who can be contacted in case of companies. Here we need to know that who will be operating the company accounts. Additional Information Existing relationship with UBL In case if the customer already has some relationship with UBL, it should be mentioned here. This is just in case to formally know and cross check the customer’s provided information. Existing relationship with other banks This is to know what relationship the customer has with other banks, if any. UBL Wallet ATM/Debit Card Here first define your customer what ATM card is, what are its features and what is the difference between its different options. Enter the name of the customer in ‘Name on card’ field. Then is the option of supplementary ATM card. 15 A customer can issue up to 9 supplementary cards. If supplementary card is required, a UBL Wallet VISA card requisition form is filled in which details about supplementary card holders is penned. Zakat Deduction (only on PLS A/C) PLS account holders can directly pay Zakat from their accounts, if they are willing to. Other UBL Products Account holders can opt for UBL Netbanking, UBL Orion, Credit card, Personal loan, Car Financing, Mortgage and Business Finance. Operating Instructions This identifies the signing authority of the account. It can be operated singly, either or survivor, jointly, mandate or by any other in special cases. Statement of Accounts This specifies how early the account statement is required. It can be daily, weekly, monthly, quarterly or semi annually. Customers can choose Mail or e Statement or both. Special Instructions Special instructions, if any, are registered here. It usually certifies further the operating instructions of the account. Account referred by Detail of person referring the customer is entered here. Terms and Conditions These terms and conditions outline the policy of bank about its accounts’ regulations. Abidance by state bank laws and bank’s policy is compulsory and customer’s signature at the end of the statement is his abidance by the law Indemnity and Undertaking Here the customer agree by the bank policies and agree to its terms. Applicant sign the undertaking and officially agrees to be a part of UBL. *As an account opening officer, you must enclose all the signatures and should verify them. Every cutting on the AOF should be verified by customer's signature, and officer should verify the customer's signature. 16 For Bank Use Only Special Category of Account If the account is of minor, UBL staff, Illiterate, Blind or Registered Alien, it should be checked respectively. Passport size Photographs are required in this case and customer can only make the transaction personally. Make sure signatures are not too simple or shaky. If so, again passport size photographs may be required and transactions can only be made personally for customer's own security. Service Charges This is the minimum balance penalty which is applicable to all except students, mustahiqueen of zakat and government employees' salary or pension purpose accounts Know You Customer Here's an assessment that the account opening officer do in order to understand some aspects of the new customer relationship. Individual Account The customer is marked as walk in, marketed or a referral; he/she is a public figure or not. Moreover what will be the customer's sources of funds. What would be the usual mode of transaction and what would be the intentions of account with UBL. Who will be the ultimate beneficiary and what is the approximate value of transaction per month. Business Account The customer is marked as a walk in, marketed or referred customer. Name of parent and other companies are entered. Geographical area of activity is mentioned. How the business earn is mentioned to know the business type. Then similarly mode of transaction, ultimate beneficiary, initial deposit and approximate maximum value of transaction per month is recorded. *Finally after fulfilling all the necessary requirements, the officer here by recommend to open the account of the customer. Documentation to be obtained Individuals Photocopy of CNIC/Alien Registration No./ passport Photocopy of service card/employment card/student card Sole Proprietorship As above and NTN/Sales Tax Registration Certificate 17 Application to open account on sole proprietorship letter head Rubber stamp of sole proprietorship to be affixed on AOF and SSC. Partnership Photocopy of CNIC of all partners Application to open account on partnership letter head signed by all partners Attested copy of Partnership deed Copy of Registration certificate with Registrar of Firms Authority letter in favor of person responsible to operate the account. Rubber stamp of partnership to be affixed on AOF and SSC. Joint Stock Companies Certified copies of: Resolution of BoDs for opening of account and certifying the person responsible to operate it Memorandum and Article of Association Certificate of Incorporation and Commencement of business CNIC of all the directors NTN/Sales Tax Registration Certificate Rubber stamp of Company to be affixed on all documentation Clubs, Societies and Associations Certified copies of: Certificate of registration By-Laws/Rules and Regulations Resolution of governing body to open an account, certifying the person responsible to operate it. NTN/Sales Tax Registration Certificate Rubber stamp of Company to be affixed on all documentation Agent Accounts Certified copy of 'Power of Attorney' Photocopy of CNIC Trust Accounts Photocopy of Certificate of Registration Photocopy of CNIC of all trusties Certified copy of instrument of trust Executors and Administrators Photocopy of CNIC of Executor/Administrator 18 Certified copy of Letter of Administration or Probate Specimen Signature Card (SSC) Whenever a customer visit us to make a transaction, we cannot all the time verify his signature by AOF. For this purpose SSC is signed and then scanned into the system. So whenever the signature requires verification, it can be done through systems next to employees. SSC comprises of Branch code, A/C No., date, customer's name, special instructions and two signatures. Cheque Book Requisition Form At the opening of account, this form is filled, identifying the account number, number of leaves and whether to hold cheque book for collection or to mail it. Letter of thanks A letter of thanks is dispatched to the mailing address of the new account holder and its copy is attached to the AOF. Actually this letter of thanks is for the confirmation of this fact that customer actually lives at the mentioned address. 19 Clearing of cheques: Outward Clearing My experience at C.C S.Town branch started from the clearing department. Right in the morning cheques collected from the drop box simply flood over my table. According to all I learnt through listening, viewing and questioning is summarized below. Documentation of Consumer Cheques: All the cheques collected are first categorized into o o o o Credit Cards Auto Loans Personal Loans Cash Line Having categorized, firstly loan number of each cheque is verified. For the verification of the prescribed loan number, following ledgers are credited Credit Cards Personal Loans Auto Loans Cash Line G3540223 G3540627 G3540601 G5610014 (Head Office) Verified cheques are then validated before being documented into the drop box collection sheet for our daily drop box collections record. To anticipate the approval of cheques, we need to validate some important specifications of all the cheques. They are: • • • • • • Date: Cheque should not be post dated or out of date. Figures: Amount in words and figures should match. Signature: Drawers signature must be clear. Intercity: Cheques must not be of other cities. Intercity clearing cheques for consumer departments are not entertained Payee’s Name: Payee’s name should be written, and endorsement should be as per the beneficiary of the cheque. There should be no over writing in every thing penned. All the filtered cheques are then entered into the collection sheet in which following information is entered. 20 • • • • • • Cheque No. Name of bank Name of Customer Loan No. Amount Document No. All the documented consumer cheques are then posted into the system. Posting of the Consumer Cheques For clearing, we opt for second option in Banking category, and after entering the posting date, clearing date and transfer delivery date, we opt for single entry option. Now all the cheques are credited in the clearing schedule in their prescribed ledgers. Credit Cards Personal Loans Auto Loans Cash Line G3540223 G3540627 G3540601 G3590991 (Miscellaneous) Credit Cards Cheques: G3540223 During the posting, following fields are keyed in Debit/Credit Account Number Bank Branch Credit Card Number Cheque Number Amount Personal Loans Cheques: G3540627 During the posting, following fields are keyed in Debit/Credit Account Number Bank Branch Transaction Type (Loan Repayment) Personal Loan Number 21 Cheque Number Amount Auto Loans Cheques: G3540601 During the posting, following fields are keyed in Debit/Credit Account Number Bank Branch Transaction Type (Loan Repayment) Auto Loan Number Cheque Number Amount Cash Line Cheques: G3590991 (Miscellaneous) During the posting, following fields are keyed in Debit/Credit Account Number Bank Branch Cheque Number Amount Cash Line Cheques are posted into Miscellaneous Sundry account when they are forwarded for clearing and, on clearance; they are transferred to head office (G5610014; Tr # 60) where all those cheques are credited to their respective accounts. Customer Accounts: During the posting, following fields are keyed in Debit/Credit Account Number Bank Branch Cheque Number Amount 22 After entering the details into the system, we can accept, modify and reject it. As soon as entry is accepted, computer generated document number is assigned. * In case further modification is required, it can be done at clearing modification option under clearing schedule. Following the completion of posting of cheques, an add list is prepared to calculate the total amount of cheques which is further cross-checked with the clearing display on the system. As cheques can be either of Rawalpindi or Islamabad, so separate add lists are prepared and enclosed with the cheques in the NIFT envelopes. In other case, if cheque is of city other than Rawalpindi and Islamabad, it's either sent in intercity clearing or as OBC (Outward Bill Collection). Intercity is presented through NIFT whereas OBC is either sent through Courier or Dispatched to the desired branch of the bank. Stamps in each case is as follows Types of cheques Stamps over cheques Endorsement Local - Consumer • • Crossing Clearing Received Payment Local – Commercial • • Crossing Clearing Payee's Account Credited Intercity • Crossing Clearing Intercity Clearing Payee's Account will be Credited upon realization. Crossing OBC Number Payee's Account will be Credited upon realization. • • OBC • • Cleared Cheques Now the next day when clearing is confirmed by NIFT, respected accounts are debited. We go into the banking option and in transfer, we debit all the respected accounts. Same is the case with intercity and OBC cheques. In documentation, debit and credit vouchers are made, which show total amount of clearing as per day. Returned Cheques All the cheques which are returned, due to any reason, are then reversed. They are debited back in the clearing schedule. All the returned cheques are documented in the 23 cheque return registers and all the account holders of returned cheques are charged with service penalty. *All the vouchers are signed by the designated officer and all the entries over 50,000 are supervised 24 Remittances: Demand Draft DDs are always a secure way of paying remittances in other cities. Both account holders and walk in customers can avail the facility of DDs. Charges tend to differ for both customers but the advantage tend to be same. DDs are made in the favour of beneficiary and remitter either pays in cash or through cheque. Charges for DDs are Up to Rs. 100,000/- 0.10%, Min Rs. 100 for A/C holders 0.20%, Min Rs. 200 for Non A/C holders Over Rs. 100,000/- 0.05%, Min Rs. 150 for A/C holders 0.15%, Min Rs. 250 for Non A/.C holders Issuance of duplicate DD Rs. 150 for A/C holders Rs. 250 for Non A/.C holders When DDs are issued, head office account are debited and remitters account is credited, on presentation, head office account is credited and beneficiary's account is debited. Pay Order POs are another safe way of paying your remittances within the city. They are payable at any branch and then are forwarded for clearing. There charges are Issuance of PO Rs. 75 for A/C holders Rs. 250 for Non A/C holders Cancellation of PO Rs. 75 for A/C holders Rs. 250 for Non A/.C holders Issuance of duplicate PO Rs. 150 for A/C holders Rs. 300 for Non A/.C holders In case of PO, remitter account is credited and PO A/C of branch is debited. At presentation, Beneficiary is debited and PO A/C of branch is credited. Uni Remote Uni Remote is the online facility of depositing cash to any account in UBL. With on-line banking, you are connected to the complete network of UBL all over Pakistan. Uni Remote charges are Rs. 200 for cash withdrawal and Rs. 100 for cash deposit. 25 Security Deposit Receipts (SDR) Security deposit Receipts are your safe way of making payments. Not only its free of cost for A/C holders, it also offers you the best liquidity solution as the cash continues to be with you until and unless your deal gets final and you pay off. In case of cancellation, it's also free of cost for A/C holders and their amount is returned to their normal account balance. *for non A/C holders, Rs. 250 is charged. Duplicate fee is Rs. 250 (flat) 26