OCFN 10-K 12-31-12 - Omega Commercial Finance Corp

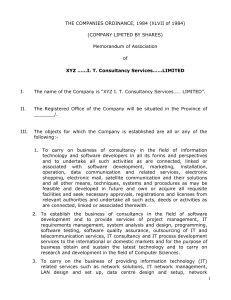

advertisement