Application Software for Insurance in the 1960s and Early 1970s

advertisement

Application Software for Insurance

in the 1960s and Early 1970s

JoAnne Yates •

MIT Sloan Schoolof Management

As Martin Campbell-Kelly[5] notesin his paperon this panel,dataon the

emergenceof the software industry is sparse,and "In the absenceof hard

quantitativedata, the besthistoricalapproachappearsto be one basedon case

studies." While his paperprovidescasestudiesof specificsoftwarefirms, this

paper providesa different type of case study:a study of the emergenceof

applicationsoftware,especiallypackagedsoftware,from the pointof view of one

userindustry,life insurance.

Fromthefirstadoptionsof UnivacsandIBM 650sbeginningin 1954/55into

the early 1960s, firms who bought or rented computerswere faced with the

formidabletaskof programming

them.Fromthe very beginningof insuranceuse

of computers,programmingtime and costs,consistentlyunderestimated,

were a

majorpartof the expenseof installingcomputersystems.Earlyestimatesranged

from onethird to two thirdsthe costof equipmentrental[ 11]. The representative

of oneinsurancecompany[30, p. 16] explainedthatmanyinsurance

firms turned

to computersin responseto a costsqueeze;yet, "This interestin usingcomputers

to performmanyof theroutinetasksof dataprocessing,

in turn,introduceda new

factor into the price cost squeeze":"the tremendouscostsbeing incurredby

companiesin the area of systemsdesignand programmingrequiredto install

computersto performthesevariousfunctions."He went on to claim that in many

cases,companies"were pointingout that programmingcostshad far exceeded

predictions,and the anticipatedcostsavingswere not forthcoming."

Initial attemptsto reduceprogrammingcosts(for otheruserindustriesas

well asinsurance)

camein theadoptionof programming

languages

easierto useand

morepowerfulthanmachinelanguage,ultimatelyincludingCOBOL for business

programming

[11, p. 235; 2, p. 364]. At thesametime,hardwarevendorswerealso

providingincreasedsupportto all usersin the form of programmedroutinesgiven

• I am gratefulfor theresearch

assistance

of Bob Hancke,HansGodfrey,CindyCollins,

HowardHecht,andPatMurrayin thisresearch.I alsoappreciatethe archivalassistance

of

Hal Keinerat thearchivesof CIGNA, DanielMay andthelibrarystaffof theMetropolitan

Life Archives,of Paul Lasewiczat the archivesof AetnaLife & CasualtyCompany,and

PhyllisSteeleat The New England.Hal KeinerandPhyllisSteelewerealsovery helpfulin

settingup interviewswith employees

for me. My work wasalsoaidedby accessto the

BostonInsuranceLibrary.

BUSINESS AND ECONOMIC HISTORY, Volume twenty-four,no. 1, Fall 1995.

Copyright¸1995 by the BusinessHistoryConference. ISSN 0849-6825.

123

124

to their customerswith the machines.Eventuallysuchcollectionsof software

routinestook on the identity of operatingsystems. Like improvementsin

programming

languages,

operating

systems

greatlyfacilitatedprogramming.

This paperfocuses,however,on softwareapplicationpackagesdesigned

specificallyto accomplishinsurancefunctions. For this story, IBM's 1969

unbundling

wasa crucialinflectionpoint. I will firstsurveytheemergence

anduse

of insuranceapplicationsoftwarebefore IBM's unbundlingin 1969, focusing

primarilyon IBM's bundledinsurancesoftwareandsecondarily

on the emerging

insurancecomputerserviceindustry.Then, I will look at the eventsfollowing

IBM's decisionto unbundle

hardwareandsoftwarein 1969,openingthewayfor

the rapidexpansion

of packagedsoftwareofferedby a varietyof newlyemerged

softwarespecialtyfirms.

Insurance Software before Unbundling

The earliestpre-developed

andtestedapplicationsoftwareavailableto the

insurance

industrywascreatedby thehardwarevendorsthemselves.Initially, the

vendorsprovidedtraining and aid to insurancefirm programmersto support

applicationprogramming.In addition,they suppliedlibrariesof routinesfor all

users[41]. As it becameclearthat costsof programmingwerea majorfactorin

decisions

to rentor buycomputers,

however,vendors

sawtheneedto do morethan

providegenericprogramssuchas reportgeneratingprograms.They beganto

supplyindustry-specific

applicationprograms.

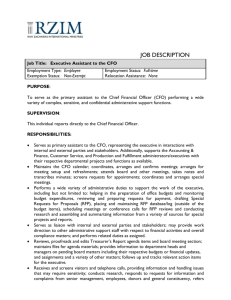

'62 CFO

IBM's '62 CFO (Consolidated

FunctionsOrdinary,1962),designedfor the

1401tapecomputer,

seemsto havebeenthefirst--andwascertainlythebestknown-of suchapplication

programs

designed

for theinsurance

industry.The software(it

wasactuallya setof programs)wasbasedon the Societyof Actuaries'notionof a

Consolidated

Functions

planfbr handlingordinaryinsurance

billing,accounting,

andrelatedfunctions,initiallyconceivedin the 1950sin preparation

for the first

computers(thoughbased on an earlier, tabulatorera notion of integrated

applications)

butonlyrarelyachieved

in thesoftwaredeveloped

by insurance

firms

in thefirstdecadeof computerization

[52, 53]. A fewyearslatertherepresentative

of oneinsurancefirm describedCFO's inceptionasfollows:

IBM, one of the computermanufacturers,

beingcloseto the

problem[of high applicationprogramming

costs]andawareof its

impactontheirmarketsetoutto do somethingaboutit. In addition

to engineering

changes

in computers

to simplifyprogramming,

they

assembleda systemsand programmingteam to develop a

ConsolidatedFunctionsSystemfor OrdinaryLife Insurancewith

threeprimaryobjectives:

1. To developa systemsapproachfor computers

that will allow

automaticprocessingof all scheduledtransactions

and requested

processing

for all non-scheduled

transactions

involvingOrdinary

Life contracts.

125

2. To writea seriesof computerprogramsfor the 1401 whichwill

performall record-keeping

functionson a daily, monthly,or annual

cycle for Ordinary Life Insurancecontractsand miscellaneous

accountingapplicationsthat are directlyrelatedto OrdinaryLife

Insurance contracts.

3. To test and documentthesecomputerprogramsto such an

extentthat theycan be usedbroadlythroughoutthe Life Insurance

Industry as operationalcomputerprogramsor as a guide in the

development

of personalized

totalsystems

on an individualcompany

basis[30, pp. 16-17].

In springof 1962,IBM helda one-weekcourseat theirEndicottfacility

to presenttheunfinished

softwarethencalledCFO '62 to interested

representatives

of thelife insurance

industry.Accordingto an attendee,in developingtheprograms,

"The PAL [ProgramApplicationLibrary] unit of IBM has been guidedby a

consultingactuaryand severallife companies"[34]. '62 CFO, as it cameto be

called,wasnotyetreadyfor customers,

but wasintendedto be field testedstarting

laterthatyear. Indeed,thefirsttworeferences

to CFO '62 in theproceedings

of the

Insurance

Accounting

andStatisticalAssociation(IASA--oneof severalinsurance

trade associationsto devote considerableattention to the use of computers)

appearedin 1963,andin neithercasehadit yet beenfully implemented[49, 50].

By the 1964IASA meetings,

however,'62 CFO wasclearlybeingusedin

variouswaysat severalmedium-sized

companies.Three presenters

discussed

it

extensively.Onepresented

a paperon "TheCFO Packageasa Guide"in whichhe

explainedthathiscompany's

specificequipmentconfiguration

precludedits using

thepackage

directlyaswritten;nevertheless,

thefirm wasfindingit veryusefulas

a guide in its own development

of a similarsystem[14]. The packageprovided

guidancein areasfrom systemdefinitionto documentation

techniques,

andfrom

recordformatdesignto training.In spiteof thislimiteduseof it, he announced

that

"Frankly, my impressionof the packageis rather favorable"[14, p. 13]. The

representativeof anotherfirm describedhis firm's adoptionof the packagewith

only minormodifications[30]. He was alsoenthusiastic

aboutit, but notedthat it

did noteliminateall workinvolvedin convertingoperations

ontoa 1401computer:

In closingI wouldlike to illustratemy appraisalof '62

CFO in this manner....We now have an objective we wish to

reach-- automaticprocessing

of ordinarylife insurance

-- '62

CFO is theSantaFe Trail fbr thisobjective.It is clearlymarked

and documented.There will be somehardshipsalongthe way.

However, if you follow the trail, I'm sure you will reach the

objective[30, p. 18].

In general,thepackageseemedto be well on its way towardswidespread

acceptanceby 1964. In that year the first of threeregionalCFO usergroupswas

established

by insurance

companies

in the westernpart of the country[46]. Papers

givenat IASA in the nextfew yearsillustratedthat acceptanceandgavethe clear

impression

thatbothinsurance

usersandIBM benefitedfrom it. One speaker,for

example,notedthat"If a companywereto adoptCFO in its entirety,about35 manyears of research,planning,and programmingwould be saved";even with his

126

company'smodifications

to CFO, "We realizeda savingsof approximately

22 manyearsin our installation"

[43, p. 13]. The representative

of anotherinsurancefirm

notedthathisfirm "decidedto orderanIBM 1401,specificallyto utilizetheIBM

'package'of programsfor Life Insuranceknown as '62 CFO" [48, p. 225].

Indeed, insuranceindustrysourcesfrom that era and from the present

consider'62 CFO the mostsuccessfulinsurancesoftwarepackageever, with the

estimatednumberof usersrangingfrom 200 to 300 insurancecompanies,manyof

whichhad multiple1400 seriescomputersin their operations[46, 19]. In 1972,

seventy-fivelife insurancecompaniesattendedthe Midwest-AtlanticCFO user

groupmeeting,one of threeregionalusergroups.

The popularityof '62 CFO wasclearlyinfluenced

by thepopularityof the

1401 computer,which,accordingto IBM accounts,"quicklybecameone of the

mostimportantandsuccessful

productsIBM hadeverannounced,"

the "Model-T

Ford of the computerindustry"with over 12,000 (far over the initial estimates)

produced[2, pp.473,676n]. But thehardware'spopularitywasin turn influenced

by industry-specific

softwarepackagessuchas '62 CFO, which allowedmedium

andsmallinsurance

firmsto computerizefor a reasonable

cost. Firmssuchasthe

onecitedaboveadoptedthe 1401becausetheCFO softwaremadedoingsofeasible

evenfor a smallfirm; theconversionprocessfor the firm's life andhealthpolicies

(thelatterrequiringsomemodifications

to theprograms)tookonly threeemployees

andwascompletedin one andone half months[48, p. 225]. While the insurance

industrywasonly oneindustryusingcomputers,

onesoftwarevendorservingthat

industryin 1970assertedthatit was"probablythe largestuserof computersoutside

thebankingindustry"[3, sec.2, p. 55]. Clearly,providingsuchsoftwarefree with

the hardwaremadethe 1401 moreattractiveto smallerinsurancefirms that might

otherwisehavedelayedcomputerizingor goneto other,lessexpensivevendors.

The largestinsurancefirms did not generallyuseCFO, for at leasttwo

reasons.First,firms suchas the Prudential,MetropolitanLife, andJohnHancock

dependedon much larger computersthan the 1401 to handle their enormous

numbersof policies[53]. In addition,thesefirmstendedto preferto programtheir

computersthemselves,

with only limitedhelpfrom vendorsor othersources.As

someoneworkingin the systemsareaat thePrudentialsaid,"We liked to do things

the Prudential way" [28]. Thus the vendorsmight provide supportand utility

programsto suchlargeinsurancefirms, but the targetsof '62 CFO were medium

and small firms.

TIP and ALIS

By the late 1960sIBM's successwith '62 CFO had beenobservedand

imitated by at least one other vendor and by itself with its next generationof

hardware. The three hardwarevendorsthat, accordingto insuranceindustry

sources,put the mosteffort intoattractingcustomers

from the insuranceindustry,

mountingexhibitsat IASA meetings,

LOMA (Life OfficeManagementAssociation)

triennialSystems

Forums,andotherindustryevents,wereIBM, Honeywell,andthe

UNIVAC Division of Sperry Rand Corporation[15, pp. 140, 155]. While

UNIVAC appearsonly to haveprovidedgeneralpurposeprogramsfor functions

suchas input-outputand reportgeneration(its lack of applicationprogramswas

undoubtedly

oneof itscompetitiveproblems),Honeywellwasmorecompetitiveon

the applicationprogrammingdimension.

127

At the end of 1963 when Honeywellannouncedits forthcomingH-200,

whichwasplug-compatible

with theIBM 1401(but much faster),it alsopromised

a programcalledLiberatorthatwouldtranslate1401programsfor the H-200 [38,

p. 162]. Liberatorwasintendedto makeit easyfor IBM 1401 usersto upgradeto

Honeywell'sfasterH-200. Thus this programwould translate'62 CFO for useon

the H-200. In addition,however,Honeywellsoonprovidedits own life insurance

applicationpackagecalledtheTIP (Total InformationProcessing)

System[15, p.

161]. Thispackagewas,according

to onesoftwarevendora few yearslater,"The

CFO system... putintoHoneywelllanguage

withfrontandrearextensions"

[46, p.

141]. He wenton to notethatit wasan exampleof "IBM competitionrecognizing

the importanceof industry-oriented

software."Judgingby thelack of discussion

of thispackagein paperspresented

at theIASA andLOMA conferences,

however,

its popularitydid not approachthat of '62 CFO.

A moreimportantdevelopmenteffort wasIBM's ALIS (AdvancedLife

InformationSystem),designed

to takeadvantage

of theIBM 360's newcapabilities.

While IBM alsoprovidedwaysof adapting'62 CFO to the 360 architectureand

languagethroughemulationandadaptation[26, p. 327], thesewaysdid not take

advantageof the 360 series' speednor its direct accessstorageand inquiry

capabilities.Thusin 1964a groupof insuranceindustryrepresentatives

andIBM

industrymarketers

cametogetherto discuss

a projectfor developing

a consolidated

functionsinsurance

packagefor the 360/30, andin 1965IBM beganworkingon the

project,with the participationof monitorgroupsof insurancerepresentatives

[46,

p. 140]. Scheduledfor releaseat the end of 1966, ALIS wasdelayedrepeatedly,

eventuallyappearingin Januaryof 1969 [36, 4].

ALIS wasdesigned

to process

a singledailyrunto accomplish

all routine

functionsconcerninga policy, as well as to processspecialperiodic runs for

reportingpurposes[26, 16]. Most importantly,as one IBM representative

explainedto membersof IASA, it madeuseof the360's directaccessstorageand

telecommunications

capabilities"to providestatusandseveraltypesof quotations

via a teleprocessing

terminal"[16, p. 123;seealso29, p. 119]. Thiscapabilitywas

perhapsto be the mostinnovativeandattractiveaspectof ALIS to potentialusers,

thoughit tooka longtimeto realize. For example,onecompanyinterested

in ALIS

noted that "the availability of mass storagefacilities with immediateaccess

capabilities"was particularlyattractiveto it [36, p. 319].

Someof the firmspreparingfor ALIS werequiteenthusiastic

aboutits

possibilities

in their presentations

to IASA andLOMA in 1967and 1968 [e.g.39,

40]. The views expressedby the representatives

from two of the five insurance

companyBetatestsites,however,weretempered[35, 36, 31]. Oneof thempointed

out severalareasthat might poseproblemsfor his company. Perhapsthe most

revealingproblemand its originwasdescribedasfollows:

The ALIS rate file will not be carried on disk. This will make it

necessaryto create an anniversaryextract and provide for a

specialrun againstthe rate tape to obtainanniversaryvalues.

The monitorcompaniesdid not agreewith thisphilosophy,but

IBM felt thedisk approachwouldraisethe minimummachine

configurationneededto install and operateALIS. Herein lies

one of the basic problems that must have contributed

substantially

to the unexpected

delaysin the completionof the

128

ALIS project. The companywascommittedto providesoftware

for a minimum configurationand this restriction worked

hardshipson the projectteam [36, p. 320].

While the360 serieswouldincludea widerangeof machines,

IBM wasattempting

to reachthe samesmallto mediumsizedsegmentthatit hadreachedwith '62 CFO.

In fact, at leastone of the largerBeta sites[35; 31] usingthe near-top-of-the-line

360/65, AetnaLife and Casualty,evidentlyultimatelyrejectedALIS in favor of

developingits ownsystem,LIAS (Life InsuranceAdministrationSystem),put into

place in 1972 [17].

This targetingdecisionclearlyhurtthepackage'schancesof succeeding

with firms buyingcomputers

in the middleand upperend of the 360 range.In

addition,thelatereleaseof ALIS, solongafterthefirst360 machines

wereshipped

in 1965 [38, p. 171], createdproblemsfor somepotentialusersof it [e.g., 36],

perhapsaccountingfor the large numberof userswho insteadopted for an

adaptationof •62 CFO to the 360 system,or who developedtheir own systems.

Prudential's

similarAdvancedOrdinarySystem(AOS), for example,wasconceived

before System360 was announced,built on that platformduringthe periodof

ALIS's development,and implementedin the sameyear that ALIS was finally

released[27, 35]. Moreover,ALIS's eventualreleaseoccurredonly monthsbefore

IBM's unbundlingof softwareand hardware,which, as will be shown below,

changed the nature of the software market permanently. One immediate

consequence

wasthataftertheunbundling,

ALIS wasno longerfree. Thesefactors

undoubtedlycontributedto its relatively modestlevel of successcomparedto that

of its predecessor,

'62 CFO. By 1972,whentheregionalmeetingof oneof three

usergroupsfor '62 CFO included75 companies,

the onlyALIS usergroupin the

U.S. includeda modest29 user firms. As a recentretrospectiveaccountof

computers and insurance described it, "While the 360 quickly became

overwhelminglysuccessful,

the insurancesoftwaresystemswrittenfor it by IBM

in 1965--ALIS (Advanced Life Insurance System) and PALIS (Property and

Liability InsuranceSystem)--didnot" [19, p. 28].

Service and Software Companies

In theera beforeIBM's 1969 unbundling,firms had a third alternativeto

developingtheirown softwareor adoptingthatofferedby theirhardwarevendor:

turning to outsidecompaniesas a sourceof data processingservicesand/or

software.Oneof theearliestandmostunusual

servicearrangements

beganin 1955,

whenthe relativelysmallAetna InsuranceCompany(a fire and casualtyinsurance

companynot at that time affiliated with the much larger Aetna Life Insurance

Company)persuadedthreeotherfire and casualtyinsurancecompaniesto buy a

computerto serve all of them [45]. SPAN (named for the four companies:

Springfield,Phoenix,Aetna, and National) startedwith the IBM 705 and later

progressed

to theIBM 7070 and7074, in eachcasedevelopingsoftwarepackages

that would serveall of the companiesowningandbuyingservicesfrom it. Thus

thesepackages

weremorewidelyusedthanthoseof a singlefirm, butnotaswidely

as'62. In 1963,SPAN was ultimatelyboughtby AetnaLife InsuranceCompany,

thoughit continuedto serveits former ownersas well as firms owned by Aetna

Life.

129

Oneof theearliestindependent

computerservicecompanies

targetingthe

life insurance

firmswasEDS (ElectronicData SystemsCorporation).Startedby

dissatisfiedformer IBM salesmanRoss Perot in 1962, EDS sold what came to be

calledfacilitiesmanagement

services:EDS wouldmakea contractto run a firm's

entiredataprocessing

operation[21, pp. 27-30]. Life insurancefirmswereamong

his early targets.and Mercantile SecurityLife in Dallas was one of his earliest

contractsandthe first amongmanyinsurancecompanyclients. A decadelater, a

member of anothersoftwareservicesfirm servingthe life insuranceindustry

referred to this contract as "One of the first (perhapsthe first) servicing

arrangements

in which a computerservicescompanyuseda packagesystemto

processthe businessof a life company"[46, p. 141]. This marketwas lucrative

enoughthat by the mid-1960s,EDS had hired two life insurancemen, who had

installed'62 CFO in theirformerlife insurance

firmsto developsoftwarefor and

sell servicesto life insurancefirms [42; 7, p. D4-1]. The EDS facilitiesmanagementapproachrequiredthat insurancefirmsgive up a greatdeal of control.

Other service companiesalso targetedthis life insuranceniche, though not

necessarily

withsocomprehensive

a bundleof services[46, p. 141]. Thusfacilities

managementand other servicecontractswere anotherroute by which smaller

insurance

firmsor firmsthatdidn't wantto developtheir own expertisein this area

couldgetapplication

softwarewithouthavingto developor eveninstallit. In this

independent

servicecompanyoption,softwarefor life insuranceapplicationswas

bundled with services, not with hardware.

Such firms continued to sell their

servicesafterthe unbundlingdiscussed

in the nextsection[7].

Finally,softwarefirmsin thestill-youngbutgrowingsoftwareindustryof

themid-1960sprovidedpackaged

general-purpose

softwareaswell ascustomized

softwareto clients[8, pp. 322-325],includinga few life insurance

firms. As early

as 1956,ComputerUsageCorporation,whichhasclaimedto be "theworld'sfirst

computersoftwarecompany,"hadprogrammed

its "first nontechnical

application"

for the Prudential,an actuarialprogramthatranon an IBM 650 [20, pp. 65, 67].

Around 1965 it developedPru-COBOL for that firm [27, p. 8; 28]. By 1969,

Prudentialhadalsoturnedto anotherindependent

softwarefirm, Informatics,Inc.,

for thatfirm's packagedfile management

system,Mark IV, to usein its pension

work [47]. These contacts,though limited and predominantlycenteringon

customizedor general-purpose

software,indicatethatthe insuranceindustryhad

somedealingswith the youngsoftwareindustrybeforeunbundling.

Unbundlingand the Emergenceof PackagedInsuranceApplication Software

In addition to the delaysin and lack of enthusiasmfor ALIS discussed

earlier, the major eventtriggeringan explosionof softwarefirms and software

packages

for the life insuranceindustrybeginningin 1969wasIBM's unbundling

of softwarefrom hardware[19, p. 32; 8, p. 323]. Whetherin reactionto anti-trust

pressures,

or asa way of raisingprices,or both,IBM ceasedto includesoftwareand

servicesin the priceof hardware[44, pp. 250-252;8, p. 323]. This moveprovided

an immediateimpetusto the insurancesoftwareindustry,still in its infancy.

In 1969,majorplayersin thissectorof the softwaremarketbeganto be

founded,by a varietyof differentprocesses

andconstituencies.

CybertekComputer

Productswasfoundedby a teamthatincludeda memberof the IBM programming

team that developed'62 CFO [19. p. 28]. Accordingto a later description,

130

"Cybertekwascreatedin 1969 to providea broadspectrumof computer-related

servicesto the life insuranceindustry.[...] Its main productsare an automatic

policyissuesystemandsupportsystems

for CFO andALIS" [6, p. 73] Its founders

clearlysawan opportunityfor profit openingup, and took advantageof it. Tracor

ComputingCorporation(TCC), a softwareand servicecompanyalso startedin

1969, developedits ownconsolidated

functionssystem,Life 70, to competewith

'62 CFO [6, p. 73; 22]. By 1971,EDS haddecidedto offer its insurancecustomers

a standard,

ratherthancustomized

facilitiesmanagement

package,includingitsown

standardsoftware[13, p. 58].

The insurance

industrywasnot,however,sittingbackawaitingactionfrom

softwarefirms;assomeinsurance

firmsin earliererashadenteredintorelationships

withtabulatorandearlycomputervendorsin orderto shapeavailabletechnology,

some of insurancefirms now took action to assuresoftwareavailability in the

unbundledera. In 1969, 15 largelife insurancefirms combinedforcesto found

InsuranceSystemsof America,Inc. "to developapplications

systemsandrelated

installationservicesfor the life insuranceindustry. ISA offers applications

packages,

consultingservices,andcustomcontractservices"[6, p. 73]. Similarly,

EquitableLite Assurance

societyestablished

a joint venturewith Informatics,Inc.,

a generalsoftwarevendor;the joint venture,called Equimatics,was intendedto

design software applicationpackagestargeted at the life insuranceindustry.

Whetherfoundedby usersor by softwareand serviceproviders,thesefirms and

many others founded within a few years of the unbundlingcontributedto an

expandingmarketfor insuranceapplicationsoftware.

While suchfirmsbeganto sproutimmediately,the life insuranceindustry

did not immediatelyrecognizethe importanceof the changestakingplace. The

IASA meetingsin 1970 showedthatinsurance

firmsandservicecompaniesserving

theinsurance

industrywerestruggling

to understand

theimpactthatunbundling

and

itsconsequent

highercostswouldhaveon their own operations[51; 18]. The one

conclusionthatseemedinescapable

wasthat"The new repricingof hardwareand

softwarewill makeall of usthinkquitedifferentlyin the future"[18, p. 92]. By

1971, however,theemphasishadshiftedto evaluatinginsurancesoftwaresystems

and servicesthat had proliferatedon the market[12, 37, 32]. At the 1971 IASA

conference,

onespeakergavehisassessment

of buyingpackagedsoftware:

It is usually,but not always,quickerto achieveresults,but for

this you mustpay moredollars. It may be moreerrortree, but

for thisyou haveto fit youroperationinto their package;it may

saveyousomeanalysisandprogramming

timeto implement,but

you maypay for thisby moretimeto adaptandmaintainthrough

itslifetime. Theseandmanyotheritemsareto be weighedin the

evaluationof a proposal[37, p. 47].

In spiteof thesetrade-offs,insurance

firmswereanxiousto takeadvantage

of the opportunities

createdby the proliferationof softwarefirms,products,and

servicesin the wakeof the unbundling.By 1972,responding

to "thevastnumber

of softwarepackages

beingdeveloped"for insurance,

to the "increasingutilization

of thesepackages

by thelife insurance

industry,"andto the manysoftware-related

inquiriesmadeto its offices,LOMA issuedthe first of its SoftwareCatalogs,a

seriesthat hascontinuedto the present[9]. The first editionwasactuallyin the

131

form of two Systemsand ProceduresReports: "EDP Software and Service

Companies,"and"EDP SoftwareCatalog"[23, 24]. The informationon software

and servicevendorscontainedin thesereportscame from a surveyof LOMA

memberlife insurance

firms[9, p. 23]. Thesevendorsweresubsequently

surveyed

to producedataon 81 vendorsandover275 softwarepackages.The catalogbroke

the applicationpackagesinto 25 categories,of which the mostnumerouswere

IndividualInsurance--Life,Actuarial,CFO SupportSystems,and ALIS support

systems.

A co-founder

of Cybertekexplainedlaterthat'"...nearlyall the[insuranceoriented]softwarecompaniesthat werefoundedright after IBM unbundledstarted

outby providingtheperipheralfunctions

a companyneededto make'62 CFO more

versatile'" [19, p. 28]. Even in the 1977 editionof the LOMA softwarecatalog,

mostof Cybertek'sproductsare still CFO-related,thoughrunningon the IBM 360

or 370 platform[22]. Many othercompanies

responded

to the marketopportunity

createdby ALIS's limitedsuccess

by developingalternativepackages

for moving

CFO usersupto IBM 360 hardware[19, p. 32]. Otherfirmsdevelopedapplication

packages for different hardware bases, such as Network Data Processing

Corporation'sLILA (Life InsuranceLogisticsAutomated)andrelatedprogramsfor

theBurroughs,Honeywell,UNIVAC, andNCR hardware[22, pp. 35-44; 6, pp. 7374]. But many of the firms listed in the LOMA cataloghad multiplepackages,

goingbeyondtheconsolidated

functionsoperationsintoa varietyof areasfrom file

managementsystemsto real estateand mutualfundsapplications.Thus software

packages

wereexpanding

fromtheconsolidated

functionsapplicationat thecenter

of life insurancedata processingto a variety of other applicationareasin the

insurance business.

1972wasan importantyearin theinsurance

industry's

recognition

of how

completelythe insurancesoftwarepicturehad changed. In additionto the first

LOMA softwarecatalog,a seriesof otherLOMA publicationsalso attemptedto

addressthe softwareand its evaluation[6, 25]. Similarly, the IASA conference

program for 1972 included several papers on evaluating software packages,

includingone by a representativefrom a firm that claimed it had evaluated20

softwarepackages/services

in the precedingfour years,andpurchased14 of them

[10]. These guides to evaluatingsoftware were designedto help member

companieschoosefrom the rapidly expandingarray of optionsin customand

packaged

softwareaswell ascomputerservices.In additionto suchguides,some

of the new softwarecompaniesthemselvespresentednew packagedsoftware

projects,suchas a packageto assistin underwriting,at the conference[33].

Conclusion

The explosivegrowthof insurance

application

softwarethatbeganin 1969

wasnotcausedsolelyby IBM's unbundling.As computertechnology

becamemore

powerful, especiallywith IBM's System/360line, more functionscould be

computerized;at the sametime, the enormityof the programmingtaskalsogrew,

makingpackaged

softwareincreasingly

attractivefinancially[8, p. 323]. But until

theunbundling

move,the largelife insurancefirmsgenerallydevelopedtheirown

software,andthe smallto mediumsizedonestendedto adoptIBM's bundledCFO

or, to a lesserextent,ALIS. Over time,the lowerlevelof popularityof ALIS might

have encouragedthe growth of the small independentsoftwareindustry. By

132

separating

the softwarefrom the hardwaredecisionandby increasingandmaking

visiblethecostof IBM software,however,theunbundling

decisiongaveimpetus

to theemerging

insurance-focused

application

softwareindustry.Moreover,from

SPAN to ISA andEquimatics,the insurance

industryalsocontinuedits traditionof

shaping,aswell asbeingshapedby, theinformation

processing

industry.

References

1.

2.

Robert E. Baines,"1410 ComputerApplicationsat RepublicNationalLife InsuranceCompany,"

Proceedingsre' IASA , 1964, pp. 35-40.

CharlesJ. Bashe,Lyle R. Johnson,

JohnH. Palmer,andEmersonW. Pugh,IBM's Early Computers

(Cambridge,MA, 1986).

3.

Walt Bohne,"SoftwareTravelingSpecializationRoad," ElectronicNews,(May 4, 1970), section

2, p. 55.

4. KennethR. Brown."The AdvancedLife InformationSystem- Its Value to You," Proceedit•gsqf

IASA, 1969, pp. 167-168.

5. MartinCampbell-Kelly,

"Development

andStructureof the International

SoftwareIndustry,19501990,"Bttsiness

and Ecomm•icHisrosy.24 (Winter 1995), forthcoming.

6. CharlesH. CissleyandJeanBarnes,EDP &,stemsandApl)licationsin Li/k btsurance(NY. 1972).

7. RaymondA. Duncan,"FacilitiesManagement:

Why Wouldan Established

Life Insurance

Company

Contractfor ComputerServiceswith a FacilitiesManagementCompany?"Proceedings•/' the

LOMA SystemsFot'ltm,1971, pp. D4-1--D4-3.

8. FranklinM. Fisher,JamesW. McKie, andRichardB. Mancke.IBM at•d the U.S. Data Processi•lg

hlduslrwAll Ec'OiIOiiI•('

Hi,•tot)'(New York, 1983).

9. JamesF. Foley,Jr., "LOMA DevelopsEDP SoftwareServicesCatalog,"Proceedingsqf IASA,

1972. pp. 23-26.

10. RayfordA. Freemort."FourteenSoftwarePackages

in Fore' Years"Proceedb•gs

of IASA. 1972.

pp. 27-28.

1I. GordonGoodwin, "TechmcalDevelopmentsin EDP - ProgrammingMethods,"Proceedingsof

IASA. 1960, pp. 234-236.

12. H. GordonGoodwin,"Evaluationof ComputerSoftwareSystems,"Proceedings

of IASA, 197I. pp.

49-55.

13. JerryGrisham,•'EDSWill Offer Life Insurance

Mgmt.Package,"

Electro•icNews,(April 19, 1971),

p. 58.

14. W.K. Headley.•'TheCFO Packageas a Guide," Proceeditlgso! IASA, 1964, pp. 13-16.

15. KennethM. Hills, blsura•lceDaterProcesstrig:Property--Liabili(v--Lil•k

(Philadelphia,1967).

16. AllenM. Johnson.

"ALIS andPALlS for HealthProcessing,"

Prm'eedil•gs

ef IASA, 1967,pp. 123126.

17. LeithG. Johnson,

comp.anded.."FromPunched

Cm'dstoSatellites,andBeyond:A historyof data

processingat AetnaLife & Casualtypreparedfor an exhibitheld in the AetnaInstituteGallery,"

April 5. 1984 (typescriptfrom Data Processing,

AetnaLife & CasualtyCompanyArchives).

18. JackK. Jones."Unbundle?!"Proceedit•gsq! IASA, 1970, pp. 93-94.

19. GregoryJordahl,"SoftwareExplosion:

The Choiceis Yours,"ln.•ttrro•ce

& Technology,18 (August

1993), 28-32.

20. Elmer C. Kubie, "Reflectionsof the First SoftwareCompany,"IEEE Amtalsq['the HistotT ql•'

Computitlg,16 (1994), pp. 65-7 I.

21. Doron P. Levin. Irreconcilable Diffkrem'es:RossPerot ue•xusGeneral Motors (Boston, 1989).

22. Life Office ManagementOrganization(LOMA), Operationsand SystemsReportNo. 38, "EDP

SoftwareCatalog"(NY, 1977).

133

23. __,

LOMA SystemsandProcedures

Report#14, "EDP SoftwareandServiceCompanies"

(NY, 1972).

24. __,

25.

LOMA SystemsandProcedures

Report#15, "EDP SoftwareCatalog"(NY, 1972).

, LOMA SystemsandProcedures

Report#16, "Evaluationof SoftwarePackages"

(NY,

1972).

26. Richard

W. Longing,

"A LookatC.O.S.ForC.F.O.on360,"Pr(;ceedmgx

o/' IASA,1967.pp.327329.

27. Malcolm MacKinnon, "A Brief History of the Developmentand Installationof Prudential's

AdvancedOrdinarySystem( 1963-73)," stenciledinternalPrudentialdocumentwith handnotation

of date andauthor,"presented

at lunchto commemorate

completionof AOS on Dec. 1l. 1973."

Documentobtainedfi'omMalcohn MacKinnonandconfmnedby him in interview.

28. __,

interviewconductedby RobertHancke,(Sunapee,NH, July 21, 1994).

29. ThomasP. Maher,"The IBM AdvancedLife lnfommtionSystem,"Proceedblgs

o/' IASA. 1968, pp.

118-122.

30. BraceK. McBeath,"Up-to-Date-Appraisal

of '62 C.F.O. Package."Proceedings

•/' IASA, 1964,

pp. 16-18.

31. RobertW. McComb,Jr., "TheIBM ALIS Package--Modification,

Conversion,

andImplementation

Problems,"Proceedings

q/'theLOMA AutomatiottFortim, 1968,pp. 189-191.

32. EarleA. McKever,"Experiencewith andevaluationof computersoftwareservices,"Proceedmg•

q/' IASA, 1971,pp. 53-55.

33. VaughnW. Morgan,"ComputerAssistedUnderwriting,"Proceedings

q/' IASA, 1972,pp. 48- 56.

34. NathanO'Neil, SystemsSupervisor,

menloto Irwin J. Sitkin,Asst.Secretary,AccountsDept., May

9, 1962.O'Neil DP Records,Chronological

File, 1959-1963,AetnaLife & CasualtyCompany

Archives.

35. __,

Administrator,

ComputerSe•Mces,memoto H.G. Goodwin,Asst.Secretary,Computer

Services,"Progress

ReportJanuary13to January26, 1967,"January27, 1967,O'Neil DP Records,

Chronological

File, 1967-68,AetnaLife & CasualtyCompanyArchives.

36. Dale H. Pearson,"An Evaluationof IBM's ALIS," Proceedi•gsq/' IASA, 1967,pp. 319-321.

37. RobertL Plageman,

"Experience

withandevaluation

of computer

softwarepackages,"

Proceeding

t?/'IASA, 1971,pp. 46-49.

38. EmersonW. Pugh, Lyle R. Johnson,and John H. Pahner.IBM'x 360 and EarIx' 370

(Cambridge,MA, 1991).

39. JamesR. Robinson,"A & S ALIS at Occidental,"Proceedings

o/' IASA, 1967,pp. 126-133.

40. RalphRoseman,"ALIS Implementation--One

Company'sExperience,"Proceedingxq/'the LOMA

AutoulatiotlFornm, 1968, pp. 192-196.

41. Norbert W. Schultz,"ConversionProblemsDuring the Initial ConversionTo ElectronicData

Processing,"

Proceedings

tt/'IASA,1962,pp. 593-599.

42. RobertShafto,CEO, The New England,formerlyof EDS, interviewconductedby JoAnneYates

andHansGodfrey(Boston,September1, 1993).

43. Douglas

L. Smith,"Experiences

of a Functioning

CFO '62Operation,"

Proceedmgx

q/' IASA, 1965,

pp. 13-17.

44.

Robert Sobel, IBM.' Coto.v.vus

i• Transition (NY, 1983).

45. SPAN Data Processing

Center, Inc., November16, 1964 report,"Developments-- June 1960 to

Date,"in Oversized

Documents:

SPANGuestRegister;

AetnaLife & CasualtyCompanyArchives.

46. D.W. Stinson,"Long-Range

ComputerSystemsPlanning- Software,"Proceedingxo/' IASA, 1972,

pp. 140-I41.

47. J.H. Talbot,Jr., "The Mark IV Programming

SystemUsedby the PrudentialInsuranceCompany

of America,"Proceedins,,x

o/' IASA, 1969,pp. '7-9.

134

48. GeorgeR. Tindall,Jr.. '"62 CFO For HealthPolicies,a Historyand Evaluationof One Installation,"

ProceediJ•gx

•i" IASA, 1966, pp. 225-227.

49. GeorgeR. Van Wyck, "Consolidated

Functions

- SmallScaleComputers,"Pr•;ceedt'm,,x

•;/the IASA,

1963, pp 80-82.

50. Gilbert M. Whitfill, "ConsolidatedFunctions- Small ScaleComputers,"Prt•ceedi•tg.v

t•l'the IASA,

1963, pp 82-83.

51. DonovanL. Wilson,"ComputerRelatedServices: Unbundling,"Pt't•ceedmgs

•[ IASA, 1970, pp.

92-93.

52. JoAnneYates,"Co-evolution

of InformationProcessing

TechnologyandUse:Interactionbetween

the Life InsuranceandTabulatingIndustries,"Btt.vine.v.v

HistoryReviews'.

67 (Spring 1993), 1-51.

53. __,

"FromTabulatorsto Early Computersin the U.S. Life InsuranceIndustry:Continuities

and Influences,"Sloan WP 3618-93 (October 1993), revised,September1994,