Breaking into the Corporate Supply Chain

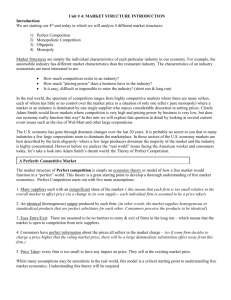

advertisement