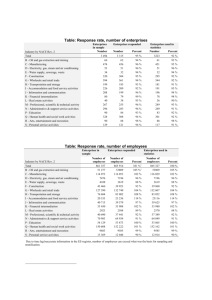

The Role of Information and Communication Technology for Small

advertisement