Annual Report 2013 (PDF:3.28MB)

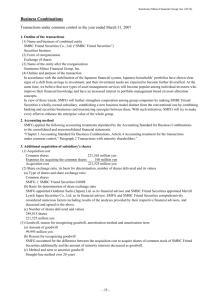

advertisement