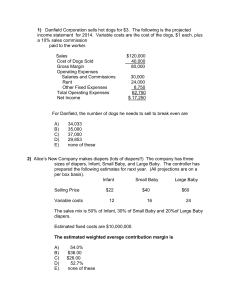

Annual Report 2014 (PDF:3072KB)

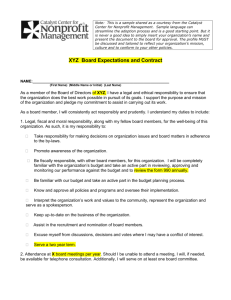

advertisement