Leave of Absence Form

advertisement

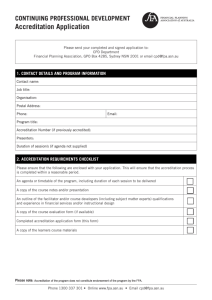

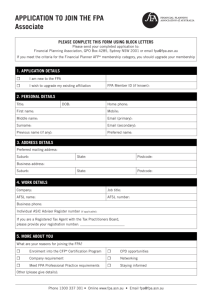

FPA MEMBER LEAVE OF ABSENCE Leave of Absence Policy & Application Leave of Absence is a means of putting your FPA membership on hold for temporary situations where you are anticipating a return to financial planning after a period of time. A discounted rate of FPA fees applies for the period of absence. This ensures that you still receive all communications from the FPA including the Financial Planning magazine, electronic newsletter and press releases. The main reasons for being on Leave of Absence relate to: • • • • medical grounds family leave redundancy leaving the financial services industry on a temporary basis. A practitioner on Leave of Absence becomes an Affiliate, losing both voting rights and the right to hold themself out as a practising member. During the period of absence, you cannot represent yourself either as a Financial Planner AFP® or as a CERTIFIED FINANCIAL PLANNER® practitioner. Use of all the FPA designations and trademarks is prohibited. As you are an affiliate while you are on leave of absence, you do not need to maintain CPD hours, but you do need to undertake CPD when reinstating your membership. Non-practising categories of full membership Both categories of FPA practitioner membership now have a non-practising option. It is therefore possible to retain membership either as a CFP® professional or as a Financial Planner AFP® when in a role that does not include Authorise Representative or Representative status. (In the past, it was necessary to have this status, or be supervising those that did.) Both a non-practising CFP practitioner and a non-practising Financial Planner AFP are bound by the FPA Code of Ethics and the obligation to maintain Continuing Professional Development hours. A member who is not currently a representative simply needs to advise the FPA, (as per rule 7.18 of the FPA Rules of Professional Conduct) of a material change. FPA records are then amended to show you as a non-practising member. The only difference you will experience is that you will not be listed on Find a Planner. (You can return to practising status simply by providing evidence of 3 months again with representative status.) The FPA Rules of Professional Conduct (Rule 7.18) state that: A member shall advise the FPA within 28 business days of any material change to their employment or authorised representative status details. If the material change is expected to be short-term (for example, you are waiting for new Authorised Representative status following a change of employment), CFP practitioners have 28 days to provide details of their new status to the FPA. Change to an Affiliate member (Associate) If you have changed to a different working role and do not wish to retain full membership in a non-practising category, another option is to change to being an Associate of the FPA. This is not a practitioner category so does not have voting rights or obligations under the FPA Code of Professional Practice or with CPD. Phone 1300 337 301 • Online www.fpa.asn.au • Email fpa@fpa.asn.au REINSTATEMENT REQUIREMENTS TO FULL MEMBERSHIP Reinstatement of CFP designation after Leave of Absence Reinstatement of CFP designation after termination or resignation Reinstatement for Financial Planner AFP after Leave of Absence, termination or resignation Leave of absence of less than one year • All CPD hours in arrears • Three months of Authorised Representative status Termination less than one year prior • Degree requirement waived • All CPD hours in arrears • Payment of all unpaid fees • Three months of Authorised Representative status • CFP1 (if not previously completed) Full • • • • Leave of absence of more than one year and less than three years • 40 CPD hours within the last two years OR • Pass CFP Certification examination (three hour multiple choice exam); AND • Three months of Authorised Representive status Termination more than one year prior and less than three years Degree requirement waived • 40 CPD hours within the last two years OR • Pass CFP Certification examination • CFP1 (if not previously completed) • Payment of LOA fees for each year unpaid • Three months of Authorised Representative status Full reinstatement after more than one year and less than three years • Degree requirement waived • 30 CPD hours within the last two years • Complete the FPA Code of Professional Practice e-learning program • Payment of LOA fees for each year unpaid • Three months of Authorised Representative status Leave of absence of more than three years • Pass the CFP Certification examination • Three months of Authorised Representative status Termination more than three years prior and less than five years • Degree requirement waived • Pass the CFP Certification examination • CFP1 (if not previously completed) • Payment of LOA fees for each year unpaid to a cap of $500 inc GST • Three months of Authorised Representative status Full • • • • • reinstatement after less than one year Degree requirement waived All CPD hours in arrears Payment of all unpaid fees Three months of Authorised Representative status reinstatement after more than three years Degree requirement waived 30 CPD hours within the last two years Complete the FPA Code of Professional Practice e-learning program Payment of LOA fees for each year unpaid to a cap of $500 inc GST Three months of Authorised Representative status Note: Individuals wanting to reinstate CFP®/AFP® designation must complete the requirements relevant to the time elapsed since termination or resignation. The FPA will assess each application and confirm both further study/assessment requirements and fees payable. An interim level of membership will be required while undertaking study/assessment. Phone 1300 337 301 • Online www.fpa.asn.au • Email fpa@fpa.asn.au APPLICATION FOR LEAVE OF ABSENCE PLEASE COMPLETE THIS FORM USING BLOCK LETTERS Please send your completed application to: Financial Planning Association, GPO Box 4285, Sydney NSW 2001 or email fpa@fpa.asn.au 1. PERSONAL DETAILS Title: DOB: Home phone: First name: Mobile: Middle name: Email (primary): Surname: Email (secondary): Previous name (if any): Preferred name: Preferred mailing address: Suburb: State: Postcode: State: Postcode: Business address: Suburb: 2. REASON FOR LEAVE OF ABSENCE Please tick the appropriate box and supply evidence. Please note that if you are working in the financial planning industry and no longer providing advice, you can convert to a non-practising category. I wish to apply for Leave of Absence from ___________________(date) on the following grounds: ☐ Leaving the industry ☐ Family leave ☐ Medical grounds ☐ Redundancy Other (please give details): 3. DECLARATION ☐ I confirm that all statements made by me in this form are complete and true and I have read, understood and consent to the terms and conditions set out in this application form and Leave of Absence Policy. ☐ I confirm that I am not currently a representative or Authorised Representative of a financial services licensee. ☐ I acknowledge that I have read and understood the FPA Privacy Statement/Privacy (see overleaf), as amended from time to time. I acknowledge that in the course of the FPA’s activities, the FPA will collect, hold, store, use and disclose my personal information, both within Australia and overseas, in accordance with and for the purposes outlined in the FPA Privacy Policy, and I consent to this collection, holding, storage, use and disclosure contained in this Application Form, and during the term of my membership (if approved). ☐ I understand that my membership with the FPA is at the FPA’s discretion and my membership may be revoked at any time without notice. Applicant signature: Date: Phone 1300 337 301 • Online www.fpa.asn.au • Email fpa@fpa.asn.au 4. PAYMENT DETAILS The Leave of Absence fee is $95 (GST inclusive) per financial year. Please charge my credit card for $95 Card number: ☐ Mastercard ☐ Visa Expiry: CCV/CVC: Cardholder’s name: Cardholder’s signature: Date: PRIVACY STATEMENT The FPA is committed to ensure the personal information of all members are collected, used, handled, stored and disclosed in compliance with the Privacy Act 1988 (Cth) (Privacy Act) and the Australian Privacy Principles (APPs). The FPA’s Privacy Statement (also referred to as Privacy Policy) (available online at www.fpa.asn.au/privacy, or upon request) outlines the way in which the FPA will comply with the obligations under the Privacy Act, including an outline on the kind of personal information that will be collected and held, how personal information is collected and held, the purpose of the collection of personal information, how an individual can access personal information and the way in which the FPA will store and disclose personal information. In the course of FPA activities, the FPA collects and holds personal information. Please be aware that the main purposes for collecting that personal information include those set out in FPA’s Privacy Statement. Please ensure that you read this Privacy Statement prior to completing this form. Please send your completed application with supporting evidence to: Financial Planning Association, GPO Box 4285, Sydney NSW 2001 or email fpa@fpa.asn.au Phone 1300 337 301 • Online www.fpa.asn.au • Email fpa@fpa.asn.au