Comparing E-Satisfaction Ratings between Click-and

advertisement

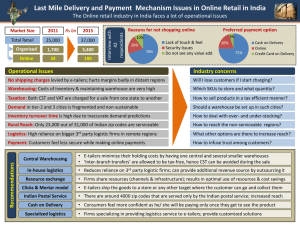

Comparing E-Satisfaction Ratings between Click-and-Brick and Pure-Online E-Tailers Vishwanath G Hegde • Zinovy Radovilsky • Tobias Gabriel California State University East Bay, Hayward, CA Alan S. Khade California State University, Stanislaus, CA Online e-satisfaction rating systems have become popular lately and have been serving as a digital word-of-mouth platform for online customers. This also initiated academic research towards understanding the link between e-satisfaction ratings and various capabilities of e-tailers. In this paper, we examine whether the physical infrastructure capabilities of the click-and-brick e-tailers results in better e-satisfaction ratings than that of pure-online e-tailers. We discuss the implications of our findings for e-tailing operations, and also provide future research agenda in this area. I. INTRODUCTION In recent years, we have witnessed a proliferation of online rating sites that report the online or e-satisfaction ratings of e-tailers. Online ratings sites such as BizRate.com, Shopzilla.com, Dealtime.com, PriceGrabber.com, and Nextag.com, are widely used by online customers. Many online intermediaries such as google.com and shopping.com report e-satisfaction ratings on etailers that are derived from these online rating sites. The online rating sites are third party systems that serve as a platform for online shoppers to share their purchasing experience. Customers who have made purchases over the Internet write their e-satisfaction ratings and comments on the e-tailers they have used. As an increasing number of online rating systems become available, more and more online shoppers post ratings on different systems and also use these ratings in making purchasing decisions. across different systems. Also, the averaged esatisfaction ratings of the same e-tailer inside a rating system remained consistent over a one- Thousands of e-tailers volunteer to participate in the data collection attempts by the online rating systems because of the significance of these ratings on their sales. For example, almost 99,000 e-tailers are listed on BizRate.com site as off September 2007. Many of these e-tailers display the BizRate symbol on their websites in order to notify perspective customers that these e-tailers have been rated by a well-established online rating system. In addition, these online rating systems have been used by e-tailers to benchmark their performances against competitors. Many online rating systems also provide market reports from their customer database via advanced research tools and analysis. This industry development has influenced academic research as well. Many research articles have been published lately that examine the relationship between e-satisfaction ratings and various aspects of e-tailing. For example, Wang (2005) showed that the averaged esatisfaction ratings of an e-tailer were consistent year period. Wang (2005) concluded that the esatisfaction rating systems are reliable and not misleading to customers. Heim and Sinha (2001) Volume 6, Number 1, pp 140-148 California Journal of Operations Management © 2008 CSU-POM Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers online rating systems. We investigated whether there is a significant difference between the esatisfaction ratings of click-and-brick and pureonline e-tailers in the durable consumer products category. The next section of this paper describes the e-satisfaction rating system, consumer durable product segments, comparison methodology, and research hypothesis. found that the order procurement variables (website navigation, product information, price, etc.) and order fulfillment variables (product availability, timeliness of delivery, and ease of return) monitored by BizRate, have significant impact on customer loyalty. Heim and Sinha (2002) developed a taxonomy to differentiate electronic service products according to their digital content (website features) and target market segment (relative frequencies of customer needs). Their empirical analysis based on 52 electronic food retailers showed that the electronic service configuration has a significant impact on the BizRate e-satisfaction ratings. Thirumalai and Sinha (2005) examined whether customer expectations of order fulfillment processes vary across product types. Their empirical analysis was based on a sample of 256 e-commerce firms rated on BizRate. The authors found that customer satisfaction with order fulfillment will decrease moving along a continuum of product types: convenience goods, shopping goods, and specialty goods. It is evident from the literature that operations management is playing a critical role in earning the customers loyalty in e-tailing. However, the relationship between the physical infrastructure of the e-tailer and the esatisfaction ratings has not been examined. Specifically, is there a synergy between the physical and online channels when traditional retailers embrace hybrid brick-and-click model? E-commerce researchers have shown that traditional retailers are increasingly following a click-and-brick strategy, whereby online and physical retail channels are becoming more integrated (Steinfield et al. 2002). The click-andbrick strategy is likely to be more valuable in case of complex consumer durable products, for example specialty products like appliances, computers, electronics, etc. (Thirumalai and Sinha, 2005). The objective of this research is to examine whether the physical infrastructure capability of the click-and-brick e-tailers have an impact on their order fulfillment performance as rated in II. RESEARCH BACKGROUND AND HYPOTHESES 2.1 BizRate Online e-Satisfaction Ratings As previously described, a number of online rating sites post e-satisfaction number on a large number of e-tailers. Different online ratings systems track different e-satisfaction measures. Field et al (2004) listed and compared the dimensions of e-satisfaction monitored by eight major online rating systems. They concluded that e-satisfaction measurements tracked by the online rating sites match well with those reported in academic literature. BizRate.com is one of the most popular and credible ratings sites that are listed in their research. In fact, BizRate’s e-satisfaction ratings are used in many of the research articles cited in this paper. Hence, we have chosen BizRate as a source to providing esatisfaction ratings in our study. Details on the BizRate’s data collection procedures and data property are discussed below. BizRate surveys B2C online customers and asks them to evaluate the services provided by the e-tailer from whom merchandize is bought. To ensure that the respondents to BizRate’s survey are representative of the population and not just fans or detractors, BizRate conducts validity checks on its non-respondents chosen randomly. This validity check involves e-mail follow-up to non-respondents to see whether the answers by them were any different from those who had responded earlier (Reibstein, 2002). The survey results are published on BizRate’s website. The ratings are not self reported by firms, but are based on feedback provided by other customers from their purchase experience. California Journal of Operations Management, Volume 6, Number 1, February 2008 141 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers 2.2 Operational Performance BizRate organized the e-satisfaction measurements into three groups which are based on the data collection process: Pre-Ordering Satisfaction, Post-Fulfillment Satisfaction and Detailed Store Ratings. However, these measurements are grouped differently by the academic articles based the business processes. For example, Field et al (2004) groups the measurements by website design, fulfillment reliability, customer service and privacy/security. We have chosen nine esatisfaction measures out of fifteen reported by BizRate and have organized them into four categories as shown in Table 1. We removed website design/technology and privacy/security measurements since our focus is to study the operational performances. 2.3 Consumer Durable Product Segment As mentioned in the introduction section, we have chosen to compare the performance of click-and-brick and pure-online e-tailers in consumer durable product segment. We have made this decision based on the findings of the prior research, which indicated the increased importance of the physical order fulfillment and service infrastructure in the consumer durable product segment. For example, Thirumalai and Sinha (2005) showed that the customer satisfaction with order fulfillment will decrease moving along a continuum of product types: convenience goods, shopping goods and specialty goods. TABLE 1: DESCRIPTION OF BIZRATE’S E-SATISFACTION MEASURES USED IN THIS STUDY E-satisfaction Measure/Dimension Selection of products Availability of product you wanted Prices relative to other online merchants Variety of shipping options Shipping charges Order tracking On-time delivery Product met expectations Customer support Description Types of products available Product was in stock at time of expected delivery Prices relative to other web sites Desired shipping options were available Shipping charges Ability to track orders until delivered Product arrived when expected Correct product was delivered and it worked as described/depicted Availability/Ease of contacting, courtesy and knowledge of staff, resolution of issue ESatisfaction Category Click-and-Brick” Compared to PureOnline E-tailer Product Selection and Price Worse Shipping Alternatives and Cost Better Order Fulfillment Customer Support Better Better California Journal of Operations Management, Volume 6, Number 1, February 2008 142 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers customers choose the option of local store pickup. We expect that a click-and-brick e-tailer is better equipped to fulfill the order quickly and reliably because of the synergy between the physical and online businesses. This synergy plays a bigger role in case of consumer durable products which are heavy and pose larger logistical challenges. Further, a common order processing system shared between online and physical channels is another source of synergy. Steinfield (2007) indicates that more firms build their e-commerce capability in conjunction with an existing IT infrastructure. Hence, the clickand-brick retailers are in a better position to provide order tracking capability. This is evident from the inability of the popular pure-online etailers such as Amazon.com to provide order status online. Based on this analysis, we established research Hypothesis 3: click-andbrick e-tailers have better e-satisfaction ratings than those of pure-online e-tailers in the Order Fulfillment category (see Table 1). Physical and online channel synergies can be exploited towards better online customer service. For example, this may refer to prepurchase services such as helping customer in assessing needs and selecting appropriate products, and testing out products. Also, physical locations can augment purchase services that include ordering, customization, and complementary products/services. This process is likely to result in better match between the product capabilities and customer expectations. Post-purchase services such as installation, repair, extended warranty and training, can be provided effectively through physical stores. Many click-and-brick firms implemented a store-based return policy. Even products ordered online and shipped from a central facility can be returned to a local store rather than requiring customers to return items via courier. Overall, this analysis led to establishing research Hypothesis 4: click-andbrick e-tailers have better e-satisfaction ratings than those of pure-online e-tailers in the Customer Support category (see Table 1). 2.4 Performance of E-Tailers and Research Hypothesis The product selection and pricing is one of the esatisfaction areas where pure-online e-tailers are reported to have advantages over click-and-brick e-tailers. Pure-online e-tailers can offer broader product scope and product depth compared to physical or hybrid channels. In addition, the pure-online e-tailer is likely to have much lower cost structure both in terms of facility and inventory, which enables pure-online e-tailer to offer lower prices. Further, the click-and-brick retailers face channel conflict and online/offline synchronization issues, and, thus, their online channel may not be able to cut prices. Based on this analysis, our research Hypothesis 1 is the following: the e-satisfaction of click-and-brick retailers is lower than that of pure-online etailers for the Product Selection and Price category (see Table 1). On the other hand, click-and-brick e-tailers are likely to have a number of potential advantages versus their pure-online counterparts, especially in the last three e-satisfaction categories listed in Table 1. A click-and-brick etailer can leverage the logistical network used for the in-store retailing business. For example, online customer can pick up and return purchases in a local store. We would expect the click-and-brick e-tailers can offer broader shipment options. Also, these shipping options can be offered at a lower cost. All this led us to establish the research Hypothesis 2: click-andbrick e-tailers have better e-satisfaction ratings than those of pure-online e-tailers in the Shipping Alternatives and Cost category (see Table 1). Besides, click-and-brick e-tailers have the ability to fulfill orders quicker and more reliably compared to pure-online e-tailers. Typically, click-and-brick firms has large retail network with multiple inventory locations spread over the geographical areas served. They are able to search local store inventories or transfer inventory from one location to the other using established logistics infrastructure. Often online California Journal of Operations Management, Volume 6, Number 1, February 2008 143 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers Musical Instruments and Accessories” that fall into consumer durables as shown in Table 2. We selected 18 e-tailers in Appliances department, 41 e-tailers in Sports Equipment category and 46 e-tailers for Musical Instruments category from the large number etailers listed in each product departments. We employed the following procedure to select the study sample: : Step 1: E-Tailers listed in each product department who is not ranked by customer yet, were dropped from the dataset. : Step 2: Each department is too broad and includes large categories of products. For example, Appliances department is further classified into 57 product categories that included simple appliances such as Toasters to complex ones such as Dishwashers. Our objective is to select e-tailers who sell products with the following attributes: (1) III. EMPIRICAL ANALYSIS Performance measurements of e-tailers, obtained from BizRate.com, are considered the dependent variables in our empirical analysis. The independent variables are based upon defining etailers as pure-online or click-and-brick. The details of the data collection of these two categories of data are described below. The data was collected during the months of AugustSeptember 2007. 3.1 BizRate Performance Data Collection BizRate reports e-satisfaction ratings on more than 98,687 individual e-tailers, which are organized by 21 departments. We chose three product departments representing durable specialty products: Heavy Home Appliances, Sports Equipment and Outdoor Gear, and TABLE 2: DESCRIPTION OF THE STUDY SAMPLE Product Department Products category (used to select E-Tailers) Heavy Home Appliances : Dishwasher : Washer and Dryer : Ranges : Freezers : Ovens : Refrigerators : Treadmill : Trainer : Exercise Bike : Home Gym Sports Equipment and Outdoor Gear Musical Instruments and Accessories : Mixers, Amplifiers, Speakers : Multi-track recorders : Microphones : Guitar, Drums, etc : DJ Retailer category who carry these products (Binary variables) : Home Stores : Electronics : General Retailer : Dedicated Exercise machines : Outdoor Products : Other products : General retailers : Dedicated musical instruments : CD and DVD : Electronics : Computer : General retailers Number of E-Tailers ClickPureandOnline Brick 4 14 12 29 6 40 California Journal of Operations Management, Volume 6, Number 1, February 2008 144 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers : : analysis. These variables describe whether the etailer also has both physical and online retailing or not. This is a binary variable which indicates “0” if the e-tailer has pure-online model and indicates “1” if the e-tailer has both online and the physical retailing models (click-and-brick). higher purchase price, (2) higher product weight, (3) higher product complexity, and (4) higher customer support (during order life cycle). To achieve this objective, we selected specific product categories within each department (as shown in Table 2) based on these four criteria. Step 3: We selected e-tailers who are selling all product categories listed within each department for our empirical analysis. This judgment was done by visiting each e-tailer’s webpage and verifying whether all the product categories are sold there. 3.4 Multiple Regression Analysis To determine whether the physical retailing infrastructure has any influence on the e-tailers’ performance, we used multiple regression analysis on the three data sets in Table 2 using SPSS software. The regression results are presented in Tables 3, 4 and 5. The rows in each table describe the dependent variables for each dataset. The columns represent the independent variables (coefficients of the regression) and constant in each regression equation. The tables also contain associated p-values in parentheses. The overall model fit is measured by the coefficient of determination R2, which is presented in the last column. In this selection process we also noticed that a number of e-tailers did not sell the product categories and department even though they are listed under them. This error was also got corrected because of our sample selection method. 3.2 Control of Cross-Department Differences An important property of the BizRate data was related to the fact that the aggregated esatisfaction ratings were listed at the e-tailer level. An individual e-tailer may be listed in multiple product departments. Hence, the ranking of a company listed in Appliances department can be also derived from products of multiple departments. For example, Best Buy's ratings can be derived from multiple departments such as Appliances, Electronics, Computers and Software, etc. We assumed that each department could have different esatisfaction rating patterns. We defined variables to categorize the retailer based on the types of product departments they are selling. These retailer categories are binary variables which would be treated as control (independent) variables and capture cross-product department patterns. IV. DISCUSSIONS OF THE FINDINGS AND CONCLUSIONS The significance of the theoretical development and the model specification is evident from the R2 values of the regression equations. The R2 value varied from as high as 0.569 to as low as 0.128. These R2 are significant as compared to the R2 values used in e-tailing research articles such as Steinfield et al. (2005). The coefficients that are significant at p-value of 0.05 or lower are highlighted in bold. The significance of the product department level differences is evident from the significance of the coefficients in the control variables columns for many of the esatisfaction ratings. The base case represents the pure-online e-tailer with dedicated/niche product range. The e-satisfaction of General Retailers and retailers with broader product-line either not significant or worse compared to the base case in all the three product segments. The only exception is the “Electronics” category as shown by the coefficients in Table 3 and Table 5. 3.3 Data on Pure-Online and Click-and-Brick Classification As previously stated, e-tailer classification variables (brick-and-click and pure-online etailers) are the independent variables in our California Journal of Operations Management, Volume 6, Number 1, February 2008 145 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers TABLE 3: REGRESSION RESULTS FOR HEAVY HOME APPLIANCES E-tailer Category ** ClickR2 (Control Variables) andVariables Constant Brick General Electronics Retailer 0.129 0.164 8.700 0.160 Selection of products 0.569 (0.594) (0.875) (0.000) (0.005) Price relative to other online 0.209 0.027 8.729 -0.526 0.560 merchants (0.150) (0.878) (0.000) (0.008) 0.253 8.557 0.679 -0.616 Availability of product 0.565 (0.349) (0.000) (0.005) (0.029) 0.347 8.143 0.621 -0.584 Variety of shipping options 0.543 (0.165) (0.000) (0.005) (0.024) 0.610 0.375 -0.659 7.800 0.232 Shipping charges (0.134) (0.453) (0.185) (0.000) 0.560 -0.510 8.186 1.016 Order tracking 0.541 (0.111) (0.134) (0.000) (0.002) 0.637 -0.480 8.171 1.025 0.464 On-time delivery (0.117) (0.215) (0.000) (0.004) 0.246 -0.372 8.557 0.522 Product met expectations 0.341 (0.394) (0.193) (0.000) (0.033) 0.563 0.191 -0.095 7.786 0.129 Customer support (0.183) (0.713) (0.851) (0.000) ** Retail store category “Home products” is dropped from regression; hence it is the base case TABLE 4: REGRESSION RESULTS FOR SPORT EQUIPMENT AND OUTSIDE GEAR E-tailer Category ** (Control Variables) Click-andVariables Brick Other General Outdoor Products Stores 0.033 -0.143 0.083 8.618 -0.354 Selection of products (0.836) (0.331) (0.346) (0.000) (0.000) Price relative to other online -0.007 -0.096 -0.022 8.696 -0.268 merchants (0.967) (0.517) (0.805) (0.000) (0.005) -0.053 -0.210 8.990 -0.540 -0.318 Availability of product (0.838) (0.153) (0.000) (0.027) (0.030) 0.487 0.201 -0.047 0.092 8.149 Variety of shipping options (0.179) (0.538) (0.811) (0.645) (0.000) -0.287 0.109 -0.362 8.341 -0.926 Shipping charges (0.479) (0.766) (0.113) (0.000) (0.000) 0.127 -0.186 0.001 8.706 -1.106 Order tracking (0.688) (0.285) (0.996) (0.000) (0.000) 0.447 -0.048 0.088 8.657 -0.632 On-time delivery (0.147) (0.771) (0.602) (0.000) (0.027) 0.120 -0.275 -0.010 8.750 -0.299 Product met expectations (0.572) (0.159) (0.930) (0.000) (0.013) 0.627 -0.072 0.078 8.247 -0.822 Customer support (0.151) (0.759) (0.744) (0.000) (0.041) ** Retail store category “Dedicated Exercise Machines” is dropped; it is the base case Constant California Journal of Operations Management, Volume 6, Number 1, February 2008 146 R2 0.325 0.199 0.206 0.074 0.414 0.323 0.223 0.207 0.196 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers TABLE 5: REGRESSION RESULTS FOR MUSICAL INSTRUMENTS AND ACCESSORIES Variables Selection of products Price relative to other online merchants Availability of product Variety of shipping options Shipping charges Order tracking On-time delivery Product met expectations Customer support Constant 8.572 (0.000) 8.895 (0.000) 8.581 (0.000) 8.578 (0.000) 8.316 (0.000) 8.169 (0.000) 8.299 (0.000) 8.760 (0.000) 7.860 (0.000) CD and DVD 0.128 (0.685) -0.245 (0.174) 0.469 (0.139) 0.122 (0.689) -0.566 (0.322) 0.631 (0.188) 0.701 (0.104) -0.210 (0.517) 0.940 (0.212) E-tailer category ** (Control Variables) General Electronics stores 0.134 0.137 (0.372) (0.434) 0.054 -0.148 (0.527) (0.141) 0.611 0.365 (0.000) (0.042) 0.141 -0.167 (0.334) (0.326) -0.477 -0.674 (0.084) (0.038) 0.714 0.665 (0.003) (0.015) 0.750 0.653 (0.001) (0.008) 0.257 -0.008 (0.102) (0.964) 0.462 0.682 (0.199) (0.106) Computer ClickandBrick -0.372 (0.386) 0.005 (0.983) 0.219 (0.607) -0.978 (0.022) -1.916 (0.017) 0.431 (0.505) 0.501 (0.388) -0.260 (0.556) -0.760 (0.456) -0.369 (0.052) -0.439 (0.000) -0.667 (0.001) -0.342 (0.062) 0.014 (0.967) -0.522 (0.068) -0.593 (0.022) -0.325 (0.095) -0.522 (0.240) R2 0.128 0.424 0.435 0.284 0.191 0.258 0.331 0.191 0.129 ** Retail store category “Dedicated Musicals” is dropped from the regression; it is the base case Home Appliances) and on-time delivery (in Musical Instruments and Accessories). The associated coefficients were either negative or insignificant. This led us to conclude that the established Hypotheses 2 and 3 have to be rejected, i.e., click-and-brick e-tailers did not produce better e-satisfaction ratings in Shipping Alternatives and Cost, and Order Fulfillment categories as compared with those in pure-online e-tailers. Surprisingly, click-and-brick e-tailers did not show a better performance on the customer support dimensions. The coefficients for these dimensions were negative but statistically insignificant in all three product departments (see Tables 3-5). This means that our hypothesized comparative advantages of clickand-brick e-tailers in the customer support dimension are not supported by the regression results. Thus, we need to reject Hypothesis 4 that the brick-and-click e-tailers have better e- According to the results in the tables, click-and-brick e-tailers performed worse than pure-online companies on the first three esatisfaction dimensions, i.e., selection of products, price compared to competition and product availability. The coefficients for these dimensions in the “Brick-and-Click” columns of the Tables 3-5 are either negative (the opposite relationship) or insignificant. The only exception was the Heavy Home Appliances department where click-and-brick e-tailers showed better selection of products. Thus, our Hypothesis 1 of e-satisfaction on the Product Selection and Price category is supported. Overall, this means that pure-online e-tailers provide a better e-satisfaction for this category and its respective measurements/ dimensions than those of the brick-and-click counterparts. The results in Tables 3-5 also demonstrate that click-and-brick e-tailers did not show better performance compared to pure-online companies in terms of variety of shipping options (in Heavy California Journal of Operations Management, Volume 6, Number 1, February 2008 147 Hegde, Radovilsky, Gabriel and Khade Comparing E-Satisfaction Ratings Between Click-and-Brick and Pure-Online E-Tailers Process Model,” Production and Operations Management, 13(4), 2004, 291-307. Heim, G. R, Sinha, K. K., “Operational Drivers of Customer Loyalty in Electronic Retailing: An Empirical Analysis of Electronic Food Retailers,” Manufacturing and Service Operations Management, 3(3), 2001, 264271. Heim, G. R., Sinha, K. K., “Service Process Configurations in Electronic Retailing: A Taxonomic Analysis of Electronic Food Retailers,” Production and Operations Management, 11(1), 2002, 54-75. Randall, T., Netessine, S., Rudi, N., “An Empirical Examination of the Decision to Invest in Fulfillment Capabilities: A Study of Internet Retailers,” Management Science, 52(4), 2006, 567-580. Reibstein, D. J., “What Attracts Customers to Online Stores, and What Keeps Them Coming Back?” Journal of the Academy of Marketing Science, 30(4), 2002, 465-473. Steinfield, C, “Capitalizing on Physical and Virtual Synergies: The Rise of Click and Mortar Models,” Retrieved from: www.telecommunication.msu.edu/faculty/ste infield/clickmortarunpub.pdf, 2007. Steinfield, C. Adelaar, T., Liu, F., “Click and Mortar Strategies Viewed from the Web: A Content Analysis of Features Illustrating Integration Between Retailers’ Online and Offline Presence,” Electronic Markets, 15(3), 2005, 199–212. Thirumalai, S., Sinha, K. K., “Customer Satisfaction with Order Fulfillment in Retail Supply Chains: Implications of Product Type in Electronic B2C Transactions,” Journal of Operations Management, 23(3/4), 2005, 291303. satisfaction ratings in the Customer Support category that those of pure-online e-tailers. The results of this study have significant implications for academic research and also for managers of click-and-brick e-tailers. Several research articles have been proposing the hybrid click-and-brick model based on the concept of the synergy between physical and online models (for example, Steinfield et al., 2005; Steinfield, 2007). There have been discussions on the impact of the investment in physical/supply chain infrastructure by e-tailers on the financial performance (For example, Randall et al., 2006). However, our findings do not show any advantage for the click-and-brick e-tailers as far as online e-satisfaction is concerned. This raises the following questions: (1) is poor online and offline channel integration by click-and-brick etailers driving this? (2) is outsourcing supply chain processes by pure-online e-tailers a better alternative than developing their own capabilities. The future research should be able to find the answer to these questions. Answering these two questions may be also important for brick-and-click managers to develop more efficient e-commerce strategy. This study was intended to be an exploratory in nature and has certain limitations. First, we have examined only three product departments that fall into consumer durable product segments. Extension of this inquiry into other product categories within consumer product segments is necessary to ascertain our findings, and also to generalize the results. V. REFERENCES Field, J. M., Heim, G. R, Sinha, K. K., “Managing Quality in the E-Service System: Development and Application of a California Journal of Operations Management, Volume 6, Number 1, February 2008 148