Construction Risk Management: Non-Insurance Methods

advertisement

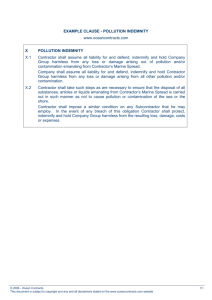

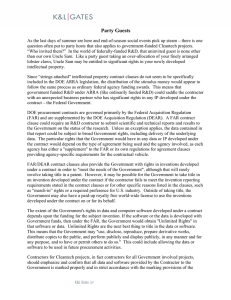

Noninsurance Methods of Handling Risk for Construction Firms With construction, there is always a risk that something will go wrong. Whenever it does, the usual consequences are delay and additional cost-which can range in degree from minor to catastrophic. Insurance is one method for dealing with potential risks. However, insurance is not often the most economical or efficient method. Some risk can be successfully handled by such methods as; risk avoidance, risk prevention, risk control, risk retention, risk sharing, and risk transfer. Each of these concepts is explored below. Risk Avoidance. Some risks are simply better if avoided. If you have reason to believe that corners will be cut on a project that may lead to unsafe conditions or results, the best way to handle the risk may be to avoid becoming involved. Similarly, if a supplier offers you cheaper material, but you suspect it may be defective, avoiding the risk makes sense. Risk Prevention and Risk Control. Because these two are often so closely related as a practical matter, we will discuss them together, although there is a technical distinction: Risk prevention is action to prevent a negative event, such as keeping debris out of passageways to prevent someone from tripping and falling. Risk control is action to reduce the amount of the loss should a negative event occur, such as having emergency phone numbers posted by the telephone so help can be quickly summoned if needed. Entire books are devoted to the subject of how to prevent and control risk on construction projects of every kind, so the topic is far too large to be covered in this brief article, except for a few main points. The first is that successful risk prevention must be lead from the top. Second, the responsibilities of supervisors, managers, and all other employees should include safety and risk prevention and control. Consequently, both supervisors and employees need loss prevention and loss control training on an ongoing basis. Risk Retention. Every construction firm retains some risk. Minor risks, such as having to redo a few days worth of work due to errors, are always retained and funded out of the operating budget. Retaining risk is a sensible option only when you can quantify the risk and know how you would fund the risk should a loss occur. Insurance policy deductibles are one way of retaining risk. Risk Sharing. In some cases, it's possible to share risk through agreements with other parties involved in a construction project. Typically, with regard to liability, a clause in the contract would stipulate that each party would be liable for any loss to the extent his actions or omissions contributed to the cause of the loss. Risk Transfer by Means Other than Insurance. Risk can be transferred to parties other than one's own insurers. One way to transfer risk is to be listed as a named insured on the other party's insurance contract, which would effectively extend the other party's coverage to you, as well. For example, as a general contractor, you may require an electrical contractor to add you to his liability insurance policy. If there were a loss covered by his policy, such portion of the loss that might otherwise fall on you would be covered by his insurance. Express indemnification clauses in contracts-also known as hold harmless clauses-are a common way of transferring risk in the construction industry. There are three types of clauses each representing a different degree of risk transfer. In a typical Type Two clause, a general contractor agrees to hold the owner harmless from any and all claims arising from the project, provided the claim is caused in whole or in part by the negligent act or omission of the contractor and regardless of whether the claim is caused in part by the negligent act or omission of the owner. As you can see, there are various methods of dealing with risk. Give us a call today to explore what combination of insurance and noninsurance ways of handling your company's risks makes sense for your firm.