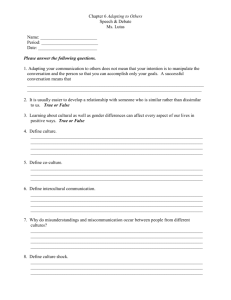

managing across cultures

advertisement