Notice of Annual Meeting of Shareholders - Investors

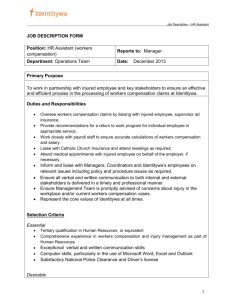

advertisement