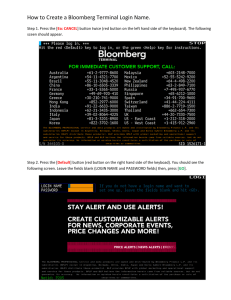

Bloomberg

advertisement

1001: Getting Started

OBJECTIVE

This session is designed to help you gain an understanding of how information is organized in the Bloomberg system for

easy rebieval.

BU

Use BU to display a menu of Bloomberg's training resources, seminars worldwide.

HELP

.

Use HELP to search Bloomberg's database for information using a word or a phrase. It can also be used to find help on a

specific function.

HELP HELP

To submlt a questlon to our 24-hour analyttcs desk, press <HELP> twice from anywhere else on the system

HDSK

Use HDSK to display a list o l your outgoing Help Desk messages sent using HELP HELP.

PDF

Use PDF to modify the default analytical parameters of your Bloomberg. You can also modify the defaults for your

keyboard and the appearance of printed screens. Each user with their own login name and password can create a unique

set of personal defaults.

EASY

Use EASY to display a list of tips and shortcuts you can use on Bloomberg.

MSGM

MSGM displays all of the message functions available on the Bloomberg.

EXCH

Use EXCH to display a list of all the exchanges that are available through the Bloomberg.

N

Enter N <Go> to access the extensive world of Bloomberg News.

BBXL

Use 6BX.L to display a menu of functions !ha! provide a comprehens;~!c: overvie>*! 3! hsw !o impor! and use B!oombeq data

in Excel, including a step-by-step guide, cheat sheets and descriptions of recent enhancements. You can also use BBXL to

display information on performing Bloomberg calculations in Excel (Calculation Overrides) and to view demonstration

spreadsheets.

BREP

Use BREP to display a menu of Bloomberg sales and installation representatives and their phone numbers. BREP allows

you to send messages directly to your sales or installation representatives or to the Analytics Desk.

PHON

Use PHON to set your defaults for accessing the Bloomberg PnON service that allows you to retrieve e-mail, quotes and

other information via a telephone or PDA when you are away from the Bloomberg Professional Service. You can use

PHON to add or change your ID number. PIN number and data categories.

BLP

Bloomberg Launchpad is a customizable, dynamic user interface, which takes extsting Bloomberg Professional service

functions and allows them to exist on your computer desktop. Bloomberg Launchpad builds an interactive workstation

riven by the Bloomberg Professional service's data, news and analytics in a format which allows YOU to access the

information you need, when you need it.

Bloomberg

1002: Introduction to Real-time Monitoring

OBJECTIVE

This session is designed to help you creale market monitors in the Bloomberg system to track securities,

monitor orice movements and news that move markets, to create charts on vour monitor screens and to view

slldtng lockers 'or up-to-date prce mon tonng The benef 1s are lnat yo^ wlll be a0 e to watch markets cnanse in

real-t~meallowlng you to ma6e your in/eslment dec~slonsmore 'ap~dlyand effic.enl,

IN THE BEGINNING THERE WERE 'NEW WORKSHEETS'

NWEG

You can review a set of samole 'New Worksheet' s. These are temDiates based on different reaions and

markets. You may select a template, modify it and save it as your own.

-

NW

Use NW to display 8 create a list of Market Monitors. Once inside an NW. you may edit it to change its makeAND THEN CAME LAUNCHPAD1

up and appearance.

....

BLP

Bloomberg Launchpad is a customisable, dynamic user inledace, which takes existing Bloomberg Professional

service functions and allows them to exist on your computer desktop. Bloomberg Launchpad builds an

interactive wot%station driven by the Bloomberg Professional se~vice'sdata, news and analyiics in a format

which allows you to access the information you need, when you need it.

PDF

Use PDF<GO> 6cGO> to mod~tythe default parameters of your Launchpad and Worksheet Monitors

To launch Launchpad

To start using Launchpad type BLP <GO> on your Bloomberg. This will open the Launchpad toolbar. The

Toolbar is your main navigation point for your desktop. It provides navigation to Launchpad components and to

traditional Bloomberg appiication in lhe Bloomberg window.

Launchpad Toolbar

The Launchpad Toolbar consists of 5 buttons: File. Launch, Tools. Reveai and Help.

File

The File button will let you save, store, recall, delete, rename, edit and share views

Launch

The Launch button is used to open Launchpad components and access your favourites.

Tools

The Tools button lets you accesssample views. the group manager and the edit favourltes tool

Reveal

The Reveal button brings all of the open Launchpad components to the foreground of your desktop.

Help

The Help button allows you l o access the users guide for Launchpad or can be used to contact the Help Desk.

Group Manager

Use the Group Manager to link single security components together. This allows you to change multiple

Components instantly and quickiy access ail the single security information you need to make quick decisions.

Favourites

The Favorites tool lets you build links to tradilional Bloomberg applications that are not Launchpad

COmpOnentS. This gives you access to everything you need directly from your desktop. You can use the

Favorites loo1 to incorporate previously created Bioomberg custom buttons.

Bloomberg

1002: Introduction to Real-time Monitoring - Page 2

Launchpad Components

Each Launchpad component has a toolbar lhat allows to control and customize thal component.

Monitors

Bring your lisl of securities to the desktop to gain faster access to Launchpad components and all other

Bloomberg functions. Link or import your security list from Portfolios. Indices. Lists. NWs, and Excel. Monitors

are unique to your login and can be re-used in multiple views. Drag and Drop securities to and from the monitor

to anywhere on your desktop.

Auto Launch at login

Launchpad can be set to open automatically when you login. Auto Launch will save you time and give you

quick access to all the infomation in your view. Type PDF <GO> on the Bloomberg to set your Launchpad

defaults,

Bloomberg

1003: Charting On Bloomberg

OBJECTIVE

This session is designed to help you gain an understanding on how to use the various charting functions available on the

Bloomberg system. We will look at the Standard charting functionality along with the Customized Graphics area of G<GO>

TDEF

Use TDEF to customize all the default settings within your login. Set your favourite Moving Averages and lndicator settings

so that you can see your charts in the format you want. You can also enableidisable the Interactive buttons that appear on

your charts to be cerlain you are getting all the options important to you.

GP 1 GPO l GPC

Use GP. GPO or GPC to graph Historical Line Bar and Candlestick charts along with Moving Averages and Volume

Information. Data used to construct the charts is available by hitting the Page Forward key. Draw Trend Lines. Fibonacci

retracements, % Change targets on the chart for use during your session.

GX24

This allows you to display an inlraday currency prices graph with 24-hour price data. The function charts the last, change.

open, high and low values for each of the three major currency markets: New York. London and Tokyo.

GPL

GPL will graph historical Line. Bar and Candlestick charts for selected securities on a logarithmic scale. Use GPL f o ~

analysing very long range trends especially on a Weekly or Monthly periodicity as they can sometimes be more

advantageous than an arithmetic scale.

RSlllRSl

Use RSI or lRSl to see a Historical or lntraday chart of the Relative Strength Index. Hin~ngthe MENU key whilst viewing

this chart will show all the other historical and intraday technical indicator charts that are available.

GIP

Use GIP to graph lntraday Tick charts. Show single day trading activity or up to 30 days of Tick action with GIP30. You can

also go back to a specific trading day with the Page Back key.

IGPO IIGPC

Use IGPO or IGPC to graph lntraday Bar and Candlestick charts along wlth Movlng Averages and Volume lnformat~on

Sett~ngsfrom Page 3 of TDEF<GO> are used to d~splayyour favourtte lntraday data per~od

HMSM

Use HMSM to graph historical reiailonships among market indices, economic statistics, equltles, bonds and pomollos over

specific time frames. You can Normalize the display for direct market comparisons and also access the data points used to

construct the chart by hitting the Page Forward key.

G

Use G to create and maintain customized technical charts thal highlight the trading patterns of a selected security on an

inlraday or historical basis. By graphing multiple technical sludies on the same chart, you can determine whether their

slgnals concur, thereby ga~ninginsight into the future movement of a security. Trend Lines drawn on the single security

Historical and lntraday charts G will remain on the charls unlil you remove them, allowing quick reference to previously

conducted analysis. G will also allow you to create Multiple Security graphs which can display up to 4 items. Spreads and

Ratios can also be created and dis~lavedfor comoarative analvsis. G offers vou access to the most advanced charting

functlonallty available and can be completely custom~zedto s u ~your

i

needs charts can be used as templates thal wlli

apply to any securlty or they can be created to dlsplay the same data items for the same security each tlme referenced

GEG

Use GEG to access easy loaded G worksheets. Both Single security and multiple security worksheets are available from

this section along with Line, Bar and Candle charts. Many popular lndicator charts are already set up and a large selection

of the DeMark lndicalors are also available. You can choose from the available lists to see the chart in question and then

save the worksheet templalc in your own login for.convenierd retrieval.

Bloomberg

OBJECTIVE

N

Enter N <GO> to access the extensive world of Bloomberg News.

TOP

Type TOP <GO> for instant access to the top Bloomberg News headlines from various market sectors and

around the world.

NI

Use NI <GO> to search for news based on one keyword or news code. For example, type NI FED <GO> for

the latest insights in US monetary rate policy. Then use the amber search box to find a pafiicular word or

phrase

TNI

Use TNI <GO> to search for news by subject, company, andlor person, using filters such as keywords. date

ranges and different newswires as sources.

NH

Type NH <GO> for a scrolling list of current news headlines from various newswires. The Bloomberg

newswire code is BN, so type N H BN <GO> to see all headlines from Bloomberg News.

NRC

Type NRC <GO> for a directory of all the news sources and research contributors on Bloomberg To disable

a news or research contributor enter an X in the yellow box beside its code Type 22<GO> to enable or

disable all newswires in a specific language

WECO

Use WECO <GO> to display a calendar of both current and expected economic releases from around the

world. The combination of the BLOOMBERG NEWS Survey and a historical database of the economic

statistics to be released, keeps you informed of what is happening with the global economy, allowing you to

make better market decisions

CECO

Use CECO <GO> to create a customized calendar of upcoming economic events that you can d~splay

through EVNT <GO>. You can create up to 45 different country and calendar type combinations.

ECST

Use ECST <GO> to display current and historical economic statistics for selected natlons. You can use

ECST to analyze trcnds in economic statistics using links to historical graphs. description pages and iiews.

ECST can help you ar?!icipate the possiblc future direction of an economy.

CBQ

CBQ <GO> displays a market summary of benchmark statistics, a graph of recent moves in the benchmark

equity index, and a list of the three most active stock5 for a specific country. CBQ also displays long-term

debt ratings, economic statistics, top news headlines, and also provides access to calendars of economlc

releases. corporate events, and earnings repoils. CBQ presents all of this lnforrnation on a single screen.

so you can easily keep abreast of the developments in a selected country's markets from one screen

Bloomberg

,.IT~gs

.

GLOBAL PRQDUc

.g

h

CERTIFICATION PROG

GET M

E $EST OUT OF BLOWBERG

1005: Introduction to API

OBJECTIVE

This session is designed to help you and show how to use Bloomberg API wizards to download data Onto your MS

Excel applications or proprietary models.

1

117 ,1

& & IK \ & . ,

The Bloomberg toolbar and drop down menu provide access to the wizards.

m\

TABLE WIZARD

The Table Wizard is a tool used to download current data ranging from indicative data, such as ticker symbols to

complex calculations such as dutatlon and risk. It does also allow you to download real-time prices to create monitor in

MS Excel.

HISTORY WIZARD

The Bloomberg History Wizard helps you to retrieve historical prices and fundamentals for a security or securities of

your choice and it does also allows you to create charts in MS Excel, using data downloaded.

1% INTRADAY HISTORY WIZARD

The lntraday History helps you to set up spreadsheets with historical lntraday data quickly and easily in order to aid you

to monitor lntraday tends.

BULK WlZARO

The Bulk Wizard can be used to download blocks of data. For example, you can use the Bulk Wizard to download the

members of an index, the cashflows for a bond, or the dividend history for a stock.

' B

OTHER TOOLS:

In addition to the Wizards. the Fill Ranae and Field Search allows you to download data by expanding existing tables or

by creating new ones.

-

4

FIELD SEARCH

The Field Search is a search tool which allows you to locate the field codes or mnemonics to download a particular

piece of data. For example, the mnemonic for PIE Ration is PE RATIO.

FILL RANGE

The Fill Rangc works along side ltle Fieid Search to fiii in the Data for a range of tlelds and a range of Securities

selected. To use the Fill Range, locate the master cell on your table and then click on the Fill Range icon and the data

will then be populated accordingly. The master cell is the connecting cell above the first security, left of the first Cell.

j7 REAL TIME UPDATES

The Enable Real Time Updates icon allows you to freeze your real time quotes, or refresh any stalic data in a

spreadsheet.

I

I

1

--

- ...

.

BBXL

Use BBXL to display a menu of functions that provide a comprehensive overview of how to import and use Bloomberg

data in Excel. including a step-by-step guide, cheat sheets and descriptions of recent enhancements. You can also use

BBXL to display information on perlorming Bloomberg calculations in Excel (Calculation Overrides) and lo view

demonstration spreadsheets.

Bloomberg

CERTIFICATION PROGRAM

GET THE BEST OUT OF BLOOMBERG

-

t i u i : lnrroaucrlon to rqutty moaule i

OBJECTIVE

~ h , ssesston IS deslgned to help you to use Bloomberg to access informalion and perform analysis on stocks.

TOP STK

Use TOP STK to &splay the b p BLOOMBERG NEWS headlines relating to stocks

DES

DES displays fundamental background information and financial data for a specific mmpany, warrant. mutual fund or equity option.

You can use DES tu quickly view this information in one convenient location.

RELS

Use RELS to display a comprehensive overview of a selected company. The ovewiew includes a list of all of the company's equity,

debt. preferred and money markel securitres as well as its description and lists of major subsidiaries and brand names.

-

-

BQ atspays a con?os le oveN8ew of key prce and lraoe 3ala I~,ldamenlal!nlormal on and n r r s for a se ecled eqully You can Lse

BQ lo v ew several sca eo-down Bloomberg f~nctlonson a s ryie screen

QRM

QRM displays individual trades with best bidlask quotes in chronological order for a selected exchange listed or over-the-munler

security for a specific time period. You can user QRM to gauge a security's intraday price movement to make timely trading decisions.

CF

CF displays and searches for corporate filings. Securities & Exchange Commission's EDGAR (itings and Canadlan SEDAR filings for

a selected equity or corporate security.

ERN

Y

ERN displays eor7rngs-per-s9are sdmmarfcz for a selecteo eqcan use ERN to delnmlnr trmcs &a l y of earnlngs and

numbers mnst d~rectlycornparaole lo analysts' estimates in oroer 13 c z ' l ~ rana yse a company's lundamenrals

I,

DVD

DVO displays detailed information about a selecled security's dividendlsplil history Use DVD to determine how a security's gross or

nel dividend yield contributes to its overall returns.

Use EE lc o spay earnmngs prqecoons from 1,B.E S '.s.si.n Zacks. Frsl Call ano loyo Aeza for a seecled el(u11y seculy

collects a I earr rqs est.m;~lcsfor a company in one pl;lcr .,c P a l you can quocrly gntlgc market expectat ons

EE

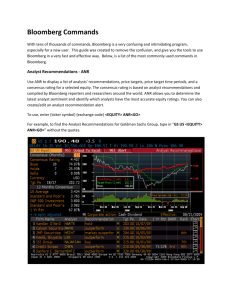

ANR

ANR dlsplays a llst of analysts' recommendat~onsand a consensus rating for a selected equlty The consenSus ratlng is based on

analyst recommendatsons complied by Bloomberg reports and researchers around the world

MOST

Use MOST to display the day's most active stocks by volume. the leading advancers and decline- by percentage or net gainlioss and

stocks with the most value traded for a parficuiar exchange.

HlLO

HlLO wlli drsplav Informatton on common stocks. deposltow receipts. closed end funds and real estate lnveslment trusts that have

reached a 5Kweek h~ghor low price

LVI

Use LVI to monitor equlttes with the largest volume increases by percentage when compared to thelr 1.5.20 or 90 day movlng average

volumes

HALT

HALT provldes you wlth a list of suspended or halted stocks for a selected stock exchange on a speclfic date

BLP

Bloor~~aerg

-a.ncr;ao

s a c-stom sane dynamr jse, ~P.C.,'~;F: wn ch lams existing Oloomnerg p~3fessnna seNca f.onCt.OnS an0

illlols them to ex:sS0- ,c9r cornpaler oesdop. Bloomberg ~d-rc:pao b ~ l o an

s lnleractwc worKstat or cr ,el by the Bluomoerg

v~olessionalsew ces oa: 4 -nhs ano analyt cs .n a furrn.rt, ni;

a :AS la. to acrcss i!re nformatton jo.. nee ! + ?i?n fo. nee0 I

-.-

Bloomberg

..

I

.

. .

I

-,:

= =GET THE BEST OUT OF BLOOMBERG

-

E102: Introduction to Equity Module 2

OBJECTIVE

This session is designed lo help you to use Bloomberg to access information and perform anaiysls on stocks.

TOP STK

Use TOP STK to display the top BLOOMBERG NEWS headlines relating to stocks

WElS

WElS ranks the returns for a group of equity indices over a specified period in either local currency of each index or in an adjusted

base currency. You can use WElS to identify opportunities in global markets.

GRR

GRR ranks the returns of all industry groups in a selected index during a specified time. GRR displays the returns for all of the

components of an index in a single locations and gives you an overview of what constituted the performance of the index.

MRR

Use MRR to display Ule 10 best and 10 worst performing stocks of an index. MRR also ranks the returns of ail the components of a

selected index by simple price appreciation for a specified lime period.

RV

RV displays customised reports with key technical and fundamental data that you can use to compare a selected equity to securities

wtth the same industry index or portfolio.

FA

FA dcsplays Bnancual analysds statements for a selected company You can use FA to analyse the current fundamental strength and

h~stoncaltrends in spectfic areas of a company s balance sheet, Income and cash Row statements

-

-

GE provloes a graph ca 0 splay of lhe hslonwl prce an? maraet ratlos lor a seleclec secdr ty over a specified perlon 31 1 i e Use

GE to show wnethcr or no! a secdrtly 1s traalng a1 h slorica r gr or lo* raloos to oeterm.ne 'c rc-lakve va1t.e

,

ACDR

Use ACDR to disDiav exoected earninss announcement estimates and dates for comDanies in a selected reaian or countrv. You can

use ACDR to compare f"ture earningsaf a specific company against others in the company's country or region.

BBEA

BBEA shows all news relating to earnings categorised according to regions It includes earnings estimates produced by analysts as

well as reports on profit warnings.

CACT

Use CACT to d i s ~ l a va calendar of CorDorate actions includina various corDorate events. ca~italchanges and distributions. You can

search the corp&at; action database by date range, country."corporate adtioddate types and cornpa& name. CACT allows you to

stay on top of the changing corporate climate. Use CACS to look up corporate actions for a speuflc security.

COMP

COMP compares the returns of a selecterl sncority !n its belchmark index and indust?+group (if auailable; ;

;;

: t.vc other selected

securities. You can use COMP to evaluate a security's relative value and determine if it is ouUunderperforming other securilies or

indices.

HS

Use HS to graph the spread between two securities using the price or yield over a specific time period. You can use HS to identify

opportunities to trade securtties based on the widening or tightening of spreads.

CIX

CIX is used to create custom index expressions using mathematical relationships, securities andlor numerlcai vaiues. Once you

create a CIX, you can use it to run analytic functions and monitor the CIX in Launchpad and NW.

BLP

Bloomberg Launchpad is a customisable, dynamic user interface, which takes existing Bloomberg Professional service functions and

allows them to exist on your computer desktop. Bloomberg Launchpad builds an interactive workstation driven by the Bloomberg

Protessional service's data, news and analytics in a format, which allows you to access the informatlon you need, when You need it.

Bloomberg

E103: Real-time Monitoring of Equities

- Module 1

OBJECTIVE

This session is designed to help you use Launchpad in Spreadsheet Mode to perform calculations that used to be

done in an Excel Spreadsheet on your Launchpad monitors lo obtain highly customized results.

Spreadsheet Mode

A spreadsheet is an interactive display and calculation application. This means that you are able to input data into

cells and perform custom calculations upon that data.

Adding Blank Columns

To add more columns right click on the existing column header and select "insert column"

Adding Spreadsheet Info

1) A coordinate grid will appear so that individual cells are now defined in the monitor

2) A spreadsheet expression box pop up will appear to enter formulae and change characteristics of

individual cells or multiple cells

Expression Box

The Expression box allows you to enter formulae based on other cells of information and also change attributes of

that cell. It consists of several drop down items. namely:

Layout: Allows you to justify cell information left, right or center.

Format: Changes the decimal place precision of the number or allows for number as fraction or integer.

ForegroundlBackground: Allows changing the color of the selected cell

Functions: Several Excel type functions for example SUM to be applied in selected cell formula.

-,

.

Syntax of Fomlulas

Formulas follow a similar syntax that is used in Microsofl Excel. For example:

=B2+C2

=((C2-B2)'100)lB2

=SUM(B2:815)

The following rules apply:

-Each formula should begin with an (=) equals sign.

-Cells are referred to by their column letter and row number, starting with A! at the top left corner.

-Cell ranges are represented using a ( : ) colon. For example. =B2:815.

-The column or row in each cell reference can be "fixed" for fill operations using a ($)dollar sign. For example.

AS1 to 6x the reference so it always refers to row !

-Operators are executed left to right, unless surrounded by parentheses. For example, there is no automatic order

of

precedence to place ' above +. So. =A1t(B212) is the correct way of causing the 12 to happen first, not =AI+B2/2.

Built-in functions

Some of the functions built-in to the expression evaluator are as follows:

=SUM (range) - Calculates the sum or all cells within the range

=INT (value) - Returns the integer value (no rounding)

-ROUND (value) - Returns the rounded Integer value

=MAX (valuel, value2) - Returns the largest of valuel and value2

=MIN (valuel, value2) - Returns the smallest of valuel and value2

=AVERAGE (range) -Calculates the average of all cells within range

=STDEV (range) - Calculates the standard deviation of all cells in range

=STOEVP (range) - Calculates the population standard deviation of all cells in range

=WTSUM (range) - Calculates a we~ghtedsum or range

=WTAVG (range) - Calculates a weighted average of range

=MID (valuel, value2) - Returns the middie value between valuel and value2, unless value1 or value2 is zero, in

which case the other value is returned

-

Bloom berg

E104: Real-time Monitoring of Equities

- Module 2

OBJECTIVE

This session is designed to help you use the dynamic new user interface called Launchpad.

BLP

Bloomberg Launchpad is a customizable, dynamic user interface, which takes existing Bloomberg Professional

service functions and allows them to exist on your computer desktop. Bloomberg Launchpad builds an interactive

workstation driven by the Bloomberg Profess~onalservice's data, news and analyiics in a format which allows you

to access the information you need, when you need it.

To launch Launchpad

To start using Launchpad type BLP <GO> on your Bloomberg. This will open the Launchpad toolbar. The Toolbar

is your main navigation point for your desktop. It provides navigation to Launchpad components and to traditional

Bloomberg application in the Bloomberg window.

Launchpad Toolbar

T i e Launchpad Toolbar consists of 5 buttons: File. Launch, Tools, Reveal and Help

File

The File button will let you save, store, recall, delete, rename, edit and share vlews

Launch

The Launch button is used to open Launchpad components and access your favourites.

Tools

The Tools button lets you access sample views, the group manager and the edit favourites tool.

Reveal

The Reveal button brings all of the open Launchpad components to the foreground of your desktop.

Help

The Help button allows you to access the users guide for Launchpad or can be used to contact the Help Desk.

Group Manager

Use the Group Manager to link single security components together. This ailows you to change multiple

components inslantly and quickly access all the single security information you need to make quick decisions.

Favourites

The Favorites tool lets you build links to traditional Bloomberg applications that are not Launchpad components.

This gives you access to everything you need directly from your desktop. You can use the Favorites tool to

Incorporate previously crcatcd Bloimberg ciistom buiiut~s.

Launchpad Components

Each Launchpad component has a toolbar that allows to control and customue that component

Monitors

Bring your list of securities to the desktop to gain faster access to Launchpad components and all other Bloomberg

functions. Link or import your security list from Porifolios, Indices. L~sts,NWs. and Excel. Monitors are unique to

your login and can be re-used in mult~pleviews. Drag and Drop secur~tiesto and from the monitor to anywhere on

your desktop.

.-

-

.

Auto Launch at login

Launchpad can be set to open automatically when you login. Auto Launch will save you time and give you quick

access to all the information in your view. Type PDF <GO> on the Bloomberg to set your Launchpad defaults.

-

Bloomberg

E201: Equity Searches

OBJECTIVE

This session focuses on using Bloomberg to perform equity search functions.

WE1

Use WE1 to monitor intraday changes and display historical returns for indices in NorthILatin America, EuropeIAfrica

and the Pacific Rim. WE1 enables you to stay abreast of changes in broad and overnight markets.

CBQ

Use CBQ to display a market summaly of benchmark statistics, a graph of recent moves in the benchmark equity index

and a list of the three most active stocks for a specific country. CBQ also displays long-term debt ratings, economic

statistics, top news headlines and provides access to calendars of economic releases, corporate events and earnings

reports.

IBQ

IBQ displays a comprehensive analysis of a specific industry and links to other related functions. You can use IBQ to

nionitor industry news and developments, analyse benchmark statistics and trace individual and group performance so

you can quickly address issues that impact your investment strategies.

ECO

Use ECO to display a calendar of economic releases. You can use ECO to monitor both historical, current and

expected releases of economic numbers around the world to stay abreast of market and financial activity on a global

scale.

DSRC

Use DSRC to generate a list of companies or mutual funds based on a set of criteria you select. The criteria are based

on specific words (from the DES paragraph). country of domicile or whether a company is publicly or privately traded.

You can use DSRC to export your results to a porlfolio, NW worksheet, Launchpad, or Excel spreadsheet.

QSRC

Use QSRC to generate a list of equity securities based on a set of criteria you select. A set of criteria can include

country, exchange, security type, index, industly group and a variety of numeric values. You can use QSRC to find

equities that meet your fundamental and technical criteria.

BQ

BQ displays a composite overview of key financial information for a selected security.

RV

Use RV to display customised reports with key technical, fundamental and industry-specific data that you can use to

compare a selected equity to secur~tieswithin the same industry, index or portfolio.

G

Use G to create and maintain customised technical charts that highlight the trad~ngpatterns of a selected security on

an intraday or h~storicalbasis. By graphing multiple technical studies on the same chart, you can determine whether

their signals concur, thereby galnlng inslght into the future movement of a security.

CNP

CNP creates customised tours based on commands you select, with as many as 100 functions in each set. Each tour

can have up to 5 pages of commands. w~th20 lines on each page. You can have up to 35 pages of tours with 15 tours

on each page.

BLP

Bloomberg Launchpad is a customisable, dynamic user interface, which lakes existing Bloomberg Professional Service

functions and allows them to exist on your computer desktop. Bloomberg Launchpad builds an interactive workstation

driven by the Bloomberg Professional service's data, news and analytics in a format. which allows you to access the

information you need, when'you need it.

Bloomberg

E202: Equity Portfolio

OBJECTIVE

This session demonstrates the depth and power of Bloomberg analytics for an equity portfolio.

MSCl

MSCl displays the Morgan Stanley Capital International (MSCI) indices menu

WElS

WElS ranks the returns for a group of equity indices over a specified time period in either the local currency of each

index or in an adjusted base currency.

G

Use G to create and maintain customized technical charts that highlight the trading patterns of a selected security

on an intraday or historical basis.

QSRC

Use QSRC to generate a list of equity securities based on a set of criteria you select

PRTU

Use PRTU to display a list of portfolios you are entltled to update and delete. You can also create a portfolio using

PRTU.

PLST

Use PLST to display a list of portfolios that you have permission to view andlor update.

PDSP

PDSP displays the current position, cost, price. principal, and change from cost for each security in a selected portfolio. If the

portfolio has 50 securities or fewer, you can also calculate the total principal, cost, dollar, and percentage change. PDSP can be

used to evaluate the performance of the securities within your portfolio.

PBSK

Use PBSK to create, update, and display a custom basket, which is a selected group of securities that you can link

to a worksheet or convert to an index.

PUD

PUD displays infotmationlinstructions for uploading/downloading portfolios from your personal computer to the

BLOOMBERG PROFESSIONALTMservice.

PCPY

PCPY copies the contents of a portfolio or macro to an existing basket. You can use PCPY to combine portfolios or macros and

analyze them together using analytics available for baskets.

PHST

PHST generates price history for a selected basket.. A basket is a selected group of securities you can link to a worksheet or

turn into a custom index. Once you generate a price history, you can use a~ialyticalfunctions to assess the petiormance of the

basket.

PTD

Use PTD to display trade tickets that you entered through PTT <Go>. You can display all tickets, or tickets for a specific

portfolio.

PTT

Use PTT to enter Portfolio Trade Ticket to update positions in your portfolio. Use PTT to fill in the trade ticket for

the number of shares either bought or sold and the price.

Bloomberg

E202: Equity Portfolio

- Page 2

PRPT

PRPT creates a customized report for a selected portfolio Or macro. You can select the data by which each sector

and security in the report is separated allowing you to determine if your portfolio needs to be rebalanced.

RVP

RVP displays customized reports with key technical and fundamental data that you can use to compare equities

within a selected portfolio.

PTE

PTE allows you to set up and generate reports based on a number of different report categories. Menu items 1-5

allow you to generate a pre-set report on a selected portfolio or macro: Menu items 11-15 allow you to customise

your own report with data you specifically wish to view. Once you have set up/customised a report. they will be

saved on the PTE menu.

NPH

NPH displays up to three of the most recent news stories and research reports from the current and previous business day for

each security in a selected portfolio.

PRTS

Use PRTS to create a report on a selected portfolio or macro of portfolios for a selected time period or against the

original cost. PRTS summarises the performance of lhe entire portfolio and each security within the portfolio. You

can generate the report immediately or schedule it to run periodically at a time of your choice. PRTS allows you to

quantify your gainsllosses over a selected period of time and measure porifolio averages so that you can make

informed decisions about possible restructuring of your portfolio.

RPT

RPT displays reports that are generated off-line for various analytic functions. RPT may be used to schedule future reports on a

daily, weekly, or monthly basis as well as on a specific business day. Reports are deleted after 5days.

Bloomberg

zkt

.*

2:

ri

1!

1

,I

I

E203: Advanced API for Equity

OBJECTIVE

This seminar demonstrates the power of writing BLP. BLPH. BLPSH. BLPlT and BLPB statements in an Excel

Spreadsheet application. Through this course. we will also learn how to use calculation overrides and cell

referencing to link Bloomberg data in an effective manner.

WRITING A STATEMENT

Data can be filled onto your spreadsheet by writing simple formulas or BLP statements. The statements allow

flexibility in the data layout and the customization of your own proprietav formulas and each statement retrieves a

particular type of data.

Parameters can be a cell reference e.g. A1 or a string, e.g. "SIA SP EQUITY"

=BLP(Security, Field(s))

The BLP() Statement is used to download current prices and descriptive information. This statement allows you to

create real time monitors.

e.g., = BLP ("TLS AU <EQUITY>", "LAST PRICE") o r =BLP(AZ, $851)

CALCULATION OVERRIDES

Calculation override is a powerful feature within our Bloomberg API that allows you to study the relationships

between two or more financ~aivariables. Where two or more financial variables have a relationship, it is posslble to

override or assign a value for one of the variables to see the outcome in the other. In short, calculation override

provides you with the ability to perform Bloomberg's financial calculations in Excel over multiple securities. This

applies to fundamentals, currency adjusted market cap and volume weighted average price scenarios.

e.g.,

= BLP ("T MK <EQUITY>",

"EQY FUND YEAR, NET INCOME. "1995") or =BLP(AZ, $ B $ l : $ C $ l , D2)

=BLPH(Security, Field@). Start Date, End Date', Number of Points', Chronological Order*, Periodicity", NonTrading Days*, Filler', Show Dates*. Rows, Columns, Direction', Show Price', Currency',GPA')

The BLPH() Statements retrieves historical data, pricing or fundamental, for an indicated period or range in a highly

customizable manner.

e g . . = BLPH ("8 HK <EQUITY>". "PX LAST'. "01101102"...:Wj or =BLPH(A2, 01. C1 D l )

'optional parameters

....

=BLPSH(Security, Field(s), Date, Non-trading Days', Filler', (Omit), Currency')

The BLPSHO statements allows you to download a single point historical data for an lnd~cateddate.

e g . = BLPSH ("IBM <EQUITY>". "LAST PRICE". "10112102) or =BLPSH(AZ. $BS1. SBSZ)

'optional parameters

=BLPIT(Security, Field<s>. Start Datemime, End Datemime', Bar Size', Reverse Order'. DatelTime'.Rows,

Columns, Direction', Filler')

The BLPIT Statemerlts retrieves lntraday pricing to allow you to study lntraday market activity and identify arbitrage

opportun~tiesthat may arise from lntraday price actions.

e g . = BLPlT ("VOD LN <EQUITY>''. ''LAST PRICE", "10/12102 09 00". "10112102 1 1 . 0 0 , "10") or

=BLPIT(B3, 84, 05. 06. 07) ^optional parameters

=BI.PB(Securit?, Hulk Ficld)

The BLPB() Statements allows you to eas~lyaccess bulk data for a secur~tyYou can download data such as the

members of an index, bond cash flows, calllput schedules, optlon cha~nsetc

e.g. = BLPB ("NIFTY INDEX", "INDX MEMBERS") or =BLPB(AI, 01)

For parameter dcscription. please refer to BBXL<GO>. 4 < G 0 > Worksheet Funct!onslBypassin~?"?iza:ds.

€204: Introduction to Equity Futures and Options

OBJECTIVE

This session is designed to help you gain confidence in using Bloomberg system as your Desktop for Exchange

Traded Futures and Options Markets.

CEPR

Use CEPR to display a menu of futures and options exchanges. The directory provides lhe symbol, address.

phone and fax numbers, and Internet address for each exchange.

CTM

Use CTM to locate futures contracts when you are unsure of the exchange the contract trades on or do not know

of all the available exchanges on which a type of future contract trades.

OTM

OTM displays a menu of futures contracts for which listed options are available, grouped by financial, equity and

index, soft commodity, and hard commodity contracts. You can also sort the futures mntracts by predetermined

criteria or display the options for each contract.

WElF

This stand-alone function gives an overview of latest prices for world equity index futures. The FEPS function will

dictate whether you see day or night session prices or both.

TKAlMOSO

TKA is a list of the 20 most active futures contracts worldwide. MOSO displays the day's most active options by

volume and the leading advancers and decliners by percentage or net gainlloss for a particular exchange.

DES

Use DES to display financial information for a selected futures contract, as supplied by its exchange. DES

displays margin limits and daily up and down price limits allowing hedgers and speculators to view !he minimum

amounts they must post when buying or selling a futures contract.

CT

CT allows you to monitor price movements across all expiries for a given underlying contract. such as the future

on the Standard and Poor's 500 index.

FHG

Use FHG to graph historical data for a selected future contract andior equity. The data items Consist of Statistics

on the selected security and/or their traded options.

FEPS

FEPS may be used to set futures and optlons session defaults for all exchanges that have multiple trading

sessions.

FSM

FSM displays the spreads between futures contract months for a given future.

The values appear in an eight by eight matrix and provide a quick snapshot of

all current spreads in a particular contract series.

Bloomberg

E204: Introduction to Equity Futures and Options -Page 2

OMON

OMON displays real-time pricing for a selected exchange-listed security's call and put options. You can

customize multiple templates according to the option information you need. such as implied volatility levels. risk

measurements, and historical volatility. You can also filter the options according to center price, strike price, and

exchange criteria you select.

OMST

OMST displays the most active options - and the greatest upward and downward movers - for an underlying

equity or index. You can use OMST to identify which options for an underlying security best meet your trading

needs.

OV/OVX

Use OVIOVX to create or calculate option values for a selected index or equity option using pricing assumptions

you define. You can use OVIOVX to save the options, so you can value them and mark to market your positions.

You can also use OVX to search for specific option types and model exotic options that you can send to other

BLOOMBERG PROFESSIONAL service users.

HVTlHVGlHlVG

HVT displays historical price volatilities for a selected security. You can use HVT to determine short- and longterm trends in historical volatility so that you can predict future volatility. This helps in the analysis of an

appropriate implied volatility to pay for an option. HVG graphs historical price volatility for a selected security.

HlVG graphs the historical implied volatility and prices for a selected security.

Bloomberg

E205: Technical Analysis

- Module 1

OBJECTIVE

This session is designed to help you gain an understanding of what Technical Analysis is. We will look at some basic chart patterns along

with various indicators that can assist in analysing the current and future direction of a particular market.

-

SUPPORT 8 RESISTANCE Support is found at levels where there are more buyers than sellers. Resistance is found where there are

more sellers than buyers. Buyers at support levels place stop loss orders below the level and sellers at resistance levels place stop loss

orders above the level.

G - Use G <GO> to create and maintain customized technical charts that highlight the trading patterns of a selected security

on an intraday or historical basis. Charts can be used as templates that can be applied to any security or they can be

created to display the same data for the same security each time the template is used. GEG <GO> will also provide

examples of G worksheets that you can copy into your own login for future retrieval.

-

UPTRENDS / DOWNTRENDS 8 TREND CHANNELS Uptrend lines are drawn between a minimum of two low points on the chart whilst

downtrend lines are drawn between two high points. The more often the line is tested the more valid the line becomes for support or

resistance. Copying an Uptrend line and runrting this off a significant high or copying a Downtrend line and running this offa significant low

will provide a parallel trend channel.

DOUBLE TOPS 8 DOUBLE BOTTOMS -Formed when price touches a level and then moves in the opposite direction. It then retouches

the oflginal level and again moves away but does not return to original level. Sometimes referred to as an M top or a W bottom. The pattern

is confirmed when the level between the two topsibottoms is broken. A price target objective is given when this occurs which can be

referred to as a counterswing target.

HEAD B SHOULDER TOPS 8 BOTTOMS - A top consists of 3 distinctive peaks with the centre peak (head) higher than both peaks either

side (shoulders). A break of support (neckline) confirms the validity of the formation. A bottom consists of 3 distinctive lows with the centre

low (head) higher than both lows either side (shoulders). A break of resistance (neckline) confirms the validity of the formation. The distance

between the head and the neckline is used as a price objective when the neckline is breached. Subtract the value from the neckline for a

top and add the value to the neckline for a bottom.

TRIANGLE FORMATIONS -Symmetrical, Ascending and Descending -Can occur in both up and down trends.

Symmetrical triangles are formed by two converging, angled support and resistance lines.

Ascending triangles generally occur in uptrends and are formed by two converging lines. A flat or almost flat resistance line and a sharply

angled support line which supports rising prices. Break-outs generally occur through the flat line.

g

lines. A flat or almcst flat support linc and o

Descending triangles generally occur in down trends and are formed by t l ~ converging

sharply angled resistance line which supports rising prices. Break outs generally occur through the flat line.

MOVING AVERAGES -(MA) (Trending indicator) Trend following indicators that remove the market noise to reveal "actual" direction.

When using 2 moving averages together (usually 1 short period and 1 longer period) n hlly signal is generated when lha shorter period M 4

cuts through the longer period MA from below to above. A sell signal

is generated

when the shorter period MA cuts through the longer

.

period MA from above to below.

-

STOCHASTICS (Non Trending Indicator) Comprised of 2 lines (%K & %D) that oscillate between 0 and 100. An overbought zone Is set

between 80 - 100 and an oversold zone between 20 - 0.Signals are generated wheri a crossing of %K 8 %D from above or below the

zones occurs.

DIVERGENCE 8 CONVERGENCE -Applicable to many oscillators and is read as a comparison of the lower indicator chart and the upper

price chart. Divergence occurs at highs and is signalled when price continues to make a series of higher highs whtlst the indicator makes

lower highs. Convergence or bullish divergence occurs at lows and is signalled when price makes a series of lower lows whilsl the indicator

makes higher lows.

Bloomberg

E301: Advanced Fundamental Analysis

OBJECTIVE

This seminar focuses on advanced equity analytical functions. We will be looking at functions thal estimate, from

past data, the projected price movement of an equity relative to lhat of an index or another equity, the intrinsic

value of an equity, the risk of bankruptcy, also the implications of changes in capital structure.

FA

FA displays financial analysis statements for a selected company. You can use FA to analyze the current

fundamental strength and historical trends in specific areas of a company's balance sheet, income stalement, and

cash flow statement.

BR

Use BR to access research provided by contributors. BR categorizes research by company. pornolio, equity. and

fixed-incomeieconomic relaled stories. BR also lists several companies as additional sources of research

information.

BETA

BETA displays the historical volatility of a selected equity compared to a broad based market index. You can use

BETA to help determine an equity's risk level. The beta is an essential calculation in computing the weighted

average cost of capital.

CRP

CRP d~splaysthe country rrsk premlum, whlch is a counlry's expecled n~arketrellrrn minus the corrcspono ng rfs<

free rate for all counlr~es/reg#ons

thal are currently avallablc The market return 1s c;i culated by taklnq a capllal

weighled average of the internal rate of relurn overall the members of the country's major index

EQRP

Use EQRP to calculate the expected additional return (equity risk premium) sought above a specific

country/region's risk-free rate when investing in a selecled equity. You can use EQRP lo help measure the relative

riskheward of investing in a selected equity and/or equity market.

WACC

WACC dlsplays a selected company's cdrrent capttal structure You can use WACC to calc.jlatu ttw . v p f ~ xiriaie

WSI

of a company lncreaslng thelr long-term capltal ana lhe econom c ampact on shareholder v m e WACC ' , I n?

whether a company has been increasing or destroying shareholder value The above functions are essenllal to the

calculabon of WACC.

DDM

DCM ~ I c u I a t o sthe in::insic value of a selected e q ~ i l yusing the present value of :uture cash flows dia~uuniadd l

an appropriate rate. You can compare this theoretical value to the current price of the equity to determine whether

it is under or overvalued.

AZS forecasts the prooab.lily of a selected company enter ng bankr~ptc)htnm t l e next [no ,ea's YOL can " s u

AZS lo e v a l ~ a l ethe genera financna. condtlon of a company an0 lne assoc alec r s6 c l mes: 13 r tne se eaeo

security. You can brini this value Into Excel to see a historical trend

QSRC

You can use QSRC to find ecjuilies that meet your fundamental and technical criteria. In particular the Historical

Growth Expression Builder can be used to screen equ~tiesto locate those thal have a consistent record in lerms of

your key fundamental ratios.

A .

i..;:

!.:

r. .-,!:

. i

'*A,.

*..

Bloomberg

..

i

3cERTIF

~

.

~

>

.

, ,

,,,.

,, ~ .

GET THE BEST OUT OF BLOOMBERG

E302: Options and Warrants on Equities and Indices

OBJECTIVE

This seminar will discuss both exchange traded options and over-the-counter options and warrants. You will leam

how to use advanced analylics to customize an option monitor, to conduct valuation, to create options and

warrants, and perform scenario analysls on single and multipie options.

OSCNNVSRC

Use OSCN to senerate a list of options based on a set of criteria you select. A set of crlteria can include countrv.

exchange, secinly type. Index. ~ndustrygroup, an0 a varlety of underlying and opl,on fmttlng values YOL can U&

OSCN lo find options tndl meet ,o.r f~noamentalJn? lecln cai cr.ter8a ASRC ,s tne cdslom.zeo searcn faolnty for

warrants.

OV/OVX

OVIOVX can be used to create or calculate optton values for a selected Index or equity optlon using pricing

assumptions you define

OMONMCM

OMON displays reai-time pricing for a selected exchange-listed security's call and put options. You can customize

multiple templates according to the option information you need, such as implied volatility levels, risk

measurements, and h~storicalvolatilitv. You can also filter the o ~ t i o n saccordina to center Drice. strike orice. and

excnange crflerla you select Lahe 0 t . 6 ~ .WCM &!I1dosplay you; selected data iems Iwarrants (options) exlst on

the Jndertylng an0 1s t h ~ ~sefi,

s

as a search fa-: illy

COAT PCAT o.sp'a) ca optson va.bal on scns t.vtty rneasdres for variods slr6e prlces lor an "nderiy~ngeqully

COAT allows you to evaluate scveral call opl~onsat once lo help you tdentlty the opllons that meet your v a l ~ eand

volatility objectives

HVGIHVT

HVG graphs historical price or yield volatility for a selected security. You can use HVG to identity trends in

historical volatility in order to help predict future volatility and thus more accurately price options and warrants. HVT

is invaluable in getting an overview of historical volatilities over various periods.

HlVG

HlVG helps gauge historical price movement and volatility versus the market's prediction (implied) of volatility over

time. You can use HlVG to identity trends in price direction, predict trends in future volatility or draw correlations

between priceslyields and volatility.

HRH

HRH displays a hlsloncai return hlstogmm for a seiected securily. Yuu can use t1RI-l lo determine if a sccu~ity's

returns follow a normal theoretical distribution and, therefore, determine the validity of pricing model aSSumpti0nS.

SKEW

SKE'N displays implied volatilities across differf!nt strike prices for a selected epuity. currency, commodity, or index

security. You can use SKEW to detect higher implied volatilities. which indicate that the security has a greater

chance of reaching a strike prlce than the odds predicted by a lognormal probability distribution.

cws

CWS d~sulaysthe slandstil bleakeven, and 8'-exercised relu.ns 131 an ~ S tj.L ?ot.cii con!rrct sere5 a 1cn.nrJ ,Ow

oe:crrnane anacn slrlde &,ices m.gnt best ennanca yo-r profsl ;ma loss. Wrttlng covcrru calls is a loglcal

method of generating incremental returns on a portfolio,

13 4: CK

,

OSA

OSA calculates the potential profit or loss of an option strategy for a selected equity. You can use OSA to evaluate

how dianges in the horizon dale. underlying price, interest rates, and implied volatility affect an equity option. OSA

also allows you lo save your positions to a portfolio.

OPDFIRDFL

YOUcan use these two functions to set the defaults for optton madel ,d!v~dendmpul and Interest rate Inputs

Bloomberg

E303: Equity Arbitrage

OBJECTIVE

The aim of this seminar is to ensure that participants are familiar with the many Bloomberg functions that can highlight

price discrepancies between the main and secondary listings of a company or between a main listing and an ADR for

example. Where possible this can lead to risk free profits. or the cheapest way to gain exposure to an equity. The

seminar also looks at functions fwgenerating profits from the buying and selling of multiple securities.

QMC displays quotes from all the forefgn excnanges .pon wh~cha selected equlry trades. You can use OMC to convert

the bld, ask. and last prlces of the equ.ty into a commcn c-rrency and adlust for the number of shares per rece.pt anolor

certificate (excluding taxes or other charges) in order to find arbitrage opportunities

EAR6

Use EARB to display a list of stocks. American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs)

that trade on two exchanges and contain price differentials. EARB allows you to see possible arbitrage opportunities.

--,...,

ADRM can be used to search for Depository Receipts by exchange and by country of origin. The function will convert the

ADR price into the base currency and show premium or diswunf so that arbitrage possibilities can be isolated.

POD grapns a selecteo Depos~toryReceipl's currency adjusled price against that of tne ,noer.y,ng equity pnce You can

use POD to aelerm ne poren: a aroltrage opportunlt~esbetween receipts and the r ~nderlylngoca, shares as the prlces

of the two securities d~vergeover time.

NAV

Use NAV to graph a selected closed-end fund's price and net asset value, as well as the discount or premium of its price

to net asset value. You can use NAV to determine if a fund is trading under or over its historical discount or premium.

SRCHMlSRC

These two functions can be used to search for instruments tradino at a discount and hence to locate arbitraae

opportunities.

-

-

MA

Use MA to find comprehensive coverage on global merger and acquisition activity. You can use a standardized deal

search or create a customized search based on criteria that you specify. Up to the minute information can assist in

isolating arbitrage opportunities between bid terms and target price.

ClXiGiNW

Use CiX to create a custom index expression (CiX) by applying an algebraic expression to an underlying set of

component securities. By allowing you to monitor the relationship between data series more easily, arbitrage

opportuni:ies can be made more obvious. The G and Launchpad functions can be used to display tnls dam and calculate

real-time PBL.

HS

Use HS to graph the spread using the price or yield of two selected sea!rifins nvar a Tpecifll: time rrame. You can use

HS to identify opportune times to trade securities based on widening or tightening spreads.

HRA

tiRA estimates the strcngth of a hislortcal re a ' o l i n r >i?hcena depended var'able and anotlar ii~deprodl?nl

Val o 5 e .

YOL can study the relationsn#pbetween tne vni ai4o j lo sat>er lnslghts lnlo futdre price movements

CORR

CORRcan be used these functions to determine if securities, interest rates, currencies, and indices move inversely Or in

tandem with each other by ident~fyingpositive and negative-correlations between them. You can Compare VarlOUS

correlalions to one another in order to identify trade opportunities through changing spreads as well as evaluate

opportunities to minimize currency risk by hedging. FVIFVD Use FV to determine whether an equity-index futures

Contract is mispriced relative to the value of the corresponding cash index. FV determines a theoretical value of the

futures Contract based on the number of davs until the contract exoires.

the dividends oaid on the underlving

.

. - stocks 10

the index an0 Teva llng monef mjrkct rate: It the fut~rescontract is mkpr cec :wre r a , tie lmtrnla for a profitable

arollrage onlneen 1r.e mdex an0 tnc future FVD nlghlights the re3at.onsh.poetnee? tne ic.ertl:il flacx and .Is two eqd.tY

index futures contracts that are nearest to explratlon

- -

.. . . - . .

E304: Executing a Trade

OBJECTIVE

Thcs session is designed to help gain an understanding of how to Perform pre-trade analpis and then use of Bloomberg's

electronic lrading platform to perform a trade.

QMC

QMC displays quotes from all the foreign exchanges upon which a security trades. You can use OMC to ConveR the bid, ask

and last prices of the equity into a common currency and adjust for the number of shares per receipt andlor certificate

(excluding taxes and other charges) in order to find arbitrage opportunities.

BBO

Use BE0 to monitor the best bids and olfers for trades on any of the available equity exchanges. wmmodih/ exchanges,

indices and currency exchanges. BBO is only available to users who subscribe lo real-time data provided by the associated

exchange.

AQR

Use AOR to display the IargesUmost recent trades and volume weighted average trade value over a specified period of time

and date interval for a selected +ecurity. AQR also displays information for index futures that have volumes available. AOR

displays trades that have the largest potential effect on a stock so you can gauge market sentiment through current trading

activity and determine short-term buying and selling pressure. AOR also allows you to customise your VWAP calculation to

include or exclude cerlain condition code trades.

VAP

VAP displays a bar chart of lhe total number of shares traded at each price during the day for a selected security. VAP

itlustrales intraday supporl and resistance levels so that you can determine the price at which a buyer or seller would most

likely execute a trade VAP Is not available for currencies.

ORM

~

Use ORM lo asplay -no v c,a traces v\ In hest oldlask quotes in chron01og~calorccr lcr a seected excnange Isled or averthe-cou#ilersec~rllyfor a spec fc t me p?.#ofl. Yo2 can use ORM lo gauge scctrr 1, s nl.aoa, :r#ce movement. so )ou can

make more timely trading decisions

;,

lOlM

lOlM displays a menu of fundcons relating to lndications of Interest (101). All 101s w m e from participating sellside

brokeridealerswho feed the indications directly into the BLOOMBERG PROFESSIONAL"" service.

101

Use 101to create real-time composcte monitors of all indications of lnteresl (101s) and trade advertisement for customized

profiles. 101aliows you to easily w p y each profile's securities from an index or LIST <Go> (Your Lists). You can use 101 to

identify trends in supply and demand for equity markets and to find traders who provide the most liquidity in the stocks you

trade.

lOlD

Use IOlD to create. delete, copy, and edit custom lists of up lo 100 institutional buyside firms. Sellside senders of indications

use these lists in conjunctton with Indications of Interest Send (IOIS <Go>) and 101Multpte Message Send (MIOI <Gm) to

target specific buyside firms.

Lse IIA to d$splaya real-lime compos.te irlcrl 1c.r -.'n nc c.a!ton%2nd lc9do ?d~,ec~,:.?*:!?-I? see! k- Z Y V .'c'~ 3~, c!czk.:

rot. <:an Lse IlA to ;dent ty trends # I s ~ p p y;wd uamanc n lne eq. ty markets and respond to traders *no Sraie 5 m :3r tllcru

parameters

EET

Use EET to display Bloomberg's equity order routing menu NOTE: You must eslablish a trading relallanship wlth the broher

before you can execute a trade on-line

BYlSY

Use BYlSY to execute an equity trade through a Blwmberg Electronic Equity Marketplace contributor from which you

choose. Nole: You must be enabled by the broker you seled lo buylsell securities using BYiSY.

BLOT

BLOT displays a lhst of your auto-execul~ontrades you can use BLOT to follow an aulo-execntlon transaction through the

entlre trade process

Bloomberg

€305: Technical Analysis -Module 2

OBJECTIVE

Tn:s sess Jn is ddsgneo to nr. :

ga.n an i.noeistaic og of s.me Car0 es: cn panerns alori?; H .r s o r e b i j s ~

ir!erpretatons of tecnn ca nc colors. Floonacc ;Irld ,s s an0 the use of Ltore, :.ow

,.,,

-

CANDLESTICK CHART (CNDL) Requires open, high. low and close data with greatest emphasis placed on the

relationship between the open and close. The region between the open and close is called the real body. A

coloured real body indicates a close lower than the open whilst a blank real body indicates a close higher than the

open. A vertlcal line extending above and below the real body represents the overall range on the day behveen the

high and low traded levels. This part of the candle is known as the shadow.

Sinale Candle Patterns:

Hammer Real body can be coloured or blank. Lower shadow is long 8 twice the length of the real body. Upper

shadow is short or non-existent. This candle represents a possible turning point at a low.

Shooting Star Real body can be coloured or blank. Upper shadow is long 8 twice the length of the real body.

Lower shadow is short or non-existent. This candle represents a possible turning

..point at a high.

Double Candle Patterns:

Bullish Engulfing -Signals a reversal to a downtrend. Highlighted by a small coloured real body candle which is

engulfed by a long blank reai body candle the next day.

Bearish Ensulfina Sianals a reversal l o an uotrend. Hiahliahted

bv a small blank real bodv candle which is

.

engulfed b) .I c r 9 W l o ~ r e orcJl boo, 2ano.e the next day

frorl t t rnan q ves dcfin;t.Cn Caltrrni

Use ChD-<GO, to see char:s %. tn candle v;ltttrrns ' o e l l ' ~ . ~1<GO,

t

ClvD.cnE~?> Y<GOr 6<GO> i\ a l s o g ve det18:.on 3f nany Candle patterns

-

-

-

-

-

-

"

-

MOVING AVERAGE CONVERGENCE DIVERGENCE (MACD) - A trending indicator that consists of a MACD line

and a Signal line. The MACD line is the difference between 2 exponential moving averages, generally a 12 period

sell sianals are aiven

and a 26veriod. The Slanal line is oenerallv. a 9 .period exoonential movina averaae. ~ u v a n d

wnen t h e ' h * lone

~ ~ crosses

~

acove or oelow the S.gna r l r Tne r(lstogri!m s h o i s tnedntlerence oilween In; two

I nes ti-, or Sell slgna s a,e s-a y represented wnen tne nstogram is in ?o, I .e or negntve lerrtor, aouve or

below zero. Divergence occurs at highs and is signalled when price continues to make a series of higher highs

whllst the ~ndicatormakes lower htghs. Convergence or bullish divergence occurs a l lows and is signalled when

price makes a series of lower lows whilst the ind~catormakes higher lows.

-

RELATIVE STRENGTH INDICATOR (RSI) A non-trending indicator that measures momentum by oscillating

between 0 and 100. An overbought condition is represented when the indictor is above the 70180 ievei 8 an

oversold condition is represented when the indicator IS below 30120. 75 and 25 are generally accepted levels.

Divergence and Convergencelbullish divergence can also exist within this indicalor and is determined in the same

way described for the MACD indicator above

FIBONACCI ANALYSIS (GPF)- Developed by Leonardo Fibonacci. a 13"' century mathematician. The Fibonacci

Sequence of numbers 1s 1. 1, 2, 3, 5. 8, 13, 21. 34, 55, BY, 144. 233. Where each 2 numbers added together

provide the next number in the sequence or where 1 number divided by the preceding number equals a constant

1.618. The main retracement and projection percentages used in trading are ,382. SO0 and 6 1 5 Once a range

has been identified, these levels become significant targets for any retracement or continuation move that occurs.

MONEY FLOW (GM)- Measure the net amount of money flowing into or out of a specified stock or index. It is a

cumulallve calculalion starting from the day prior to !he first trading dale being analysed hence it is dependent on

your start date. Dwergcncc, Convcrgence, or bullish divergence can also exist between price and the money Row

line. MFcGO> will provide a monitor of Weekly and Monthiy money flow for specific markets.

-

GcGO> Combine all of the above lndlcators on one chart wlth GcGO> Flnd example templates under the

GEG<GO> command In relatlon to F ~ b o n a ~relracernents,

c~

you can set your own ranges by ustng the Fibonacci

button located w~thinthe dropdown 'lines' button at the top edge of the graph

DEMARK INDICATORS - A sophisticated suite of indicators developed by Tom DeMark.

Please see G<HELPs 9<GO> 2cG0, 14iGO> for access lo the complete HELP section for all available indicators.

Bloomberg

GET THE BEST OUT OF BLOOMBERG

E306: Volatility Risk

OBJECTIVE

The vulnerability of all market sectors to changes in volatility poses signifcant risk to equity p o m o ~ i o ~ .

This seminar shows you tools to help manage risk. It looks at analyzing

. .volatility exoosure and

implementing hedging strategies.

OMON

OMON displays real-time pricing for a selected exchange-listed security's call and put options. You can

customize multiple templates according to the option information you need, such as implied volatility

levels, risk measurements, and historical volatility.

ov/ovx

OVlOVX can be used to create or calculate option values for a selected index or equity option using

pncing assumptions you define.

HVG

HVG graphs historical price volatility for a selected security. You can use HVG to identify trends in

historical volatilily in order lo help predtct future volatility and hence an appropriate implied volatility lo

pay.

HlVG

HlVG graphs the historical implied volatility and priceslyields for a selected security. HlVG helps gauge

historical price movement and volatility versus the market's prediction (implied) of voiatility over time.

You can use HlVG to identify trends in price direction, predict trends in future volatility, or draw

correlations between priceslyields and volatility.

HRH

HRH displays a historical return histogram for a selected security. You can use HRH to determine if a

security's returns follow a normal theoretical distribution and, therefore, determine the validity of pricing

model assumptions.

TRMS

TRMS displays an equity or index's options series, implied call and put volatiiily for at-the-money

options, and historical volatility for up to 10 years. You can use TRMS to view the overall perspective on

a security's volatility across the entire term structure to assist in better pricing.

SKEW

SKEW displays implied volatilities across different strike prices for a selected equity, currency,

commodity. or index security, You can use SKEW to detect higher Implied volatilities, which indicate

lhat the secunty has a greater chance of reaching a strike price than the odds predicted by a lognormal

probability distribution.

OHT

Use OI-IT to disp!ay cp!ion hcrizcn anabsis for co!l and pii: strikes fa; a selected eqbitj with unde(iying

optlons. OHT allows you to modify the underiying and option price. days lo expiration. horizon date.

short-term finance rale volatility at the horizon date so you can calculate future price changes based on

your own market assumptions.

OSA

--

OSA catculates the potential profit or loss of an ootton strateqv for a selected eaultv You can use OSA

interest rates, and implied volatil~tyaffect

to evaluate how changes in the horizon date, underlying

an equity option. OSA also ailows you to save your positions to a portfolio.

Bloomberg

E307: M 8 A Analysis

OBJECTIVE

This session is designed to help you gain an understanding of how to find information, such as news,

deal multiples and advisor involvement in the Mergers and Acquisitions field on Bloomberg.

TOP DEAUNI MNA

TOP DEAL <GO> will bring you to the top corporate finance stories. NI MNA <GO> IS the command to

access news in the mergers and acquisition field.

MA gives comprehensive coverage on global merger and acquisition activity. You can use a

standardized deal search or create a customized search based on criteria that you specifv. MA also

orovides YOU with a snaoshot of the dav's too deals. a comorehensive list of ~nanciaiand-leoal advisor

;ankings,'and a breakddwn of global merge; and acqutsltlon statlsBcs

CACSl CACT

Yotr can use CACS tc u splay a 11stof corporate ana munlclpal acldons taken by a se~ectedcompany cr

mun~cipaiityover a giver^ date range CAC- ~..owsyou lo searcti by act.on type across mult~p~e

securities or markets or just a single company like CACS

FA

You can use FA to analyze the current fundamental strength and hlstor~caltrends in spec~ficareas of a

company's balance sheet, Income statement. and cash flow statement

CF

You can use CF to d~splayand download corporate fillngs for a given equlty or corporate security

GPCA

GPCA displays a graph of historical corporate actions for a selected security. You can use GPCA to

gain insight into the market's reaction to company's corporate actions and how they may have impacted

the price of ib stock or debt. Bear in mind that the 'news' bulton on a GP graph allows you to link price

action to news on a more general level.

CIX

The CIX f-ncBon. because it allows "sols to create data hasea on an anlhmetcal formt. a s a valdable

fbna o r for track.ng uhether a p a l cd8ar bld is falrly valulr 2 a target company

RV

You can use RV to do peer group analysis with respecl to deal multiples on a current merger or

acquis~t~on.

LEAG

LEAG a's;lays underwriter rank ?js across a varlely uf marcets lncludlrlg equlty and eq. :/-lnnked. fixed

~ n ~ ? - aec t sy?l!ca!ed !ce" rarie:s I;!,&.

L <GO, v.!l % r?

~ c !c

s 3 Iru.:ue tebe 'cr 1 l a l c a ! s l d lesa'

..

.

advisors.

~~~~

~

DSRC

DSRC uenerates a list of comoanies or mutual funds based on a set of criteria vou select. The criteria are based on

spec~fil:uores country o l dumicle cr nhutticr a company 1s p i ~ uc y traded. You wr~use DSR: to save our r e s ~ l t stu

a ponfo 0 hv\r worksheet, or Exze spreaoslleet ana even o l l c hlorger ana Acqu.s 1 an Searcn l o look tor potenla (1A

activities between companies fourtd

Bloomberg

E308: Equity Portfolio Management Strategy

OBJECTIVE

his session is designed to help you perform in-depth valuation and risk analysis for your equity porffolio

using an array of tools on the Bloomberg Professional that will help you to make better informed

investment decisions.

PUD

Use PUD to quickly upload portfolios from your personal computer to the Bloomberg Professional so

that you can run Bloomberg ri:;k and performance analytics on it. Tnis will allow you to determine your

portfolio's strengths and weaknesses and adjust your investment strategy accordingly.

PVAR

Use PVAR to measure the maximum potential loss on a security or group of securities from a selected

portfolio or macro for a specified period and probability (degree of confidence). Value-At-Rlsk (VAR)

locuses on the potentlal occurrence of losses which are statistically unlikely, but not inconceivable.

PCMP

"our ,ooriioiio's Benchmark Risk. PCMP allows vou to create a renort that

Use PCMP to consider ,

compares your specific portfolio (or macro of portfolios) with a Benchmark Index to see how the

performance and risk of your portfolio measures up against its benchmark.

PBAL

Use PBAL to re-weight the securities within your portfolio (or macro of portfoiios). PBAL will help you to

rebalance by market capitalisation, risk. market value or equal positions. PBAL will even generate a

report for you displaying the effects of the re-weighting or physically change the portfolio positions if you

wish.

PER

Use PER to calculate the total market risk for your portfolio (or macro of portfolios). PER will help you to

maximise your returns according to youimarket risk. PER displays the beta for your porliolio overall as

well as by market sector and individual security, helping you consider your market risk on many levels

and assist In your investment decisions.

OPSA

Use OPSA to help you with optlon porliolio scenario analysis. Use 9PSA to evaluate the potential profit

or loss of a selected securitfs option strategy on your porlfoiio. OPSA will help you to vlew the proill or

loss given changes in the underlying security or changes in implied volatility.

PVEG

the 1% change in implied volatility) of your porlfolio

BLP

Use Bloomberg's Launchpad as a single platform for monitoring holdings, benchmarks, news.

Communications and more so that can most eiflcientiy manage your portfolio holdinys.

-

F101: Introduction to Fixed Income Module 1

OBJECTIVE

This session is designed to help you retrieve securities and perform top down analysis on the Bloomberg so that you

can leverage the market standard data and powerful analytic to make better researched decisions.

BTMM

BTMM provides a comprehensive picture of the current interest rate outlook by rnonltorlng all major rateslsecurities

and economic releases for a selected country.

GGR

Access a global summarj of government bill, note, and benchmark bond rates for individual countries. Use the

generic bond tlckers to monitor yield changes in government bond markets for individual countries.

IYC

Analyze both current and h~storicalbenchmark international yield curves to determine where you can be best

positioned in the market.