10_d_2011-12 - Central Excise

advertisement

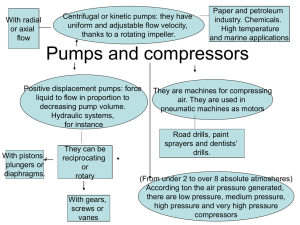

ORDER-IN-ORIGINAL No. : 10 / D/2011-12 M/s. Bharat Pump Industries, Kailashpati Society, Street No. 4, Opp. Plot No. 27, Dhebar Road (South), Rajkot (hereinafter referred to as “the noticee No.1”) are engaged in the manufacture of Power Driven Pump Sets for handling water, viz., Submersible Pumps (of V3, V4, V5 & V6 bore sizes) and Open well pumps falling under CETSH 8413 of the Central Excise Tariff Act, 1985 and are not registered with the Central Excise department. The noticee No. 1 was availing SSI exemption benefit under notification No.8/2003-CE dated 01.03.2003, for the power driven pumps manufactured and cleared by them. Brief Facts of the case : 2. Briefly stated the facts of the case are that on the basis of specific information that the Noticee No.1 was engaged in the manufacture and clearance of power driven pumps, which did not conform to the Bureau of Indian Standards (BIS) and are not eligible for SSI exemption under notification No. 08/2003-CE dated 01.03.2003, a team of officers of the Head Quarter Preventive, Central Excise, Rajkot, visited and searched the premises of the noticee No. 1 on 09.03.2010. During the course of search, it was found that the noticee No.1 was engaged in the manufacture of power driven pumps, viz., submersible pumps and open well pumps of various sizes, specifications and capacities, primarily designed for handling water [viz., V3, V4, & V6 bore-sizes submersible pumps and open well pumps] for which BIS certification was not obtained by them. In the presence of panchas Shri Bharatbhai G. Vekaria, authorized person of the noticee No.1 admitted that they had not obtained the ISI Certificate from Bureau of Indian Standards for their products, viz., submersible pumps and open well pumps manufactured and cleared by them. He further admitted that from 01.01.2007 onwards, the SSI exemption was not available to power driven pumps under the notification No. 08/2003-CE dated 01.03.2003, if the same do not confirm to BIS standards. 3. During the course of Panchnama drawn in presence of two independent panchas , total four (04) number of pumps (submersible & open well) totally valued at Rs. 12,200/-, not conforming to BIS standards were found in the said factory premises of the noticee No.1 , that the said power driven pumps were placed under seizure under the reasonable belief that the same were manufactured with an intent to clear without payment of duty by the Noticee No.1. The said seized pumps were then handed over to Shri Gordhanbhai Jadavbhai Vekaria, Partner of noticee No.1 under Supratnama dated 09.03.2010, for safe custody. 3. A statement of Shri Bharatbhai Gordhanbhai Vekaria, Authorised Person of noticee No.1, was recorded under Section 14 of the Central Excise Act, 1944 on 09.03.2010 . He stated that they were engaged in manufacturing and clearing of V3 to V6 size submersible pumps of ‘BHARAT’ brand since the year 1992; that he and his father were looking after the entire business of the noticee No. 1; that they were manufacturing and clearing V3, V4, V5 & V6 bore sizes submersible pumps and various open well pumps; that the noticee No. 1 was a partnership firm and his father, mother and wife were the partners in the said firm, but the entire function, i.e., purchase, sales and financial transactions, etc., of the firm was being looked after by him and his father Shri Gordhanbhai Vekaria; that he was not holding any post in the firm and not getting any salary from the firm being a family member; that their brand name “Bharat” was not a registered brand 1 and they are not using any other brand; that they had not obtained BIS certification for any of their products; that he was aware of the provision that for the purpose of availing benefit of SSI exemption, they were required to obtained BIS Certification from 01.01.2007; they were clearing the pumps under the bills of job work; that the sales were made without bills and on cash payment. He presented a cheque totally amounting to Rs. 3,00,000/- towards their duty liability for the said clearances. 4. Shri Gordhanbhai Jadavbhai Vekaria, one of the Partner of noticee No.1 (hereinafter referred to as Noticee No. 2) in his statement dtd. 12.03.2010 recorded under Section 14 of the Central Excise Act, 1944 inter alia, stated that they were engaged in manufacturing and clearing of V3 to V6 size submersible pumps of ‘BHARAT’ brand since the year 1992; that entire business of the noticee No. 1 was handled by him and his son Shri Bharatbhai Gordhanbhai Vekaria; that due to his old age, he was only supervising the business activities of the noticee No.1 and all other work was being handled by his son Shri Bharatbhai who was fully authorized to handle all the activities; that Shri Bharatbhai was not taking any salary from the noticee no. 1; that they were required to obtain BIS certification for availing benefit of SSI exemption w.e.f. 01.01.2007, but procedure thereof being lengthy and expensive, they have not obtained the same for their products; that their sales remains limited within the area of Rajkot and nearby villages, and due to lack of knowledge of excise laws, they have not got registered with the Central Excise Department; that he agreed with the contents of the Panchnama dated 09.03.2010 drawn at the factory premises of the noticee No. 1; that he has also agreed with the contents of the statement of his Son Shri Bharatbhai Vekaria recorded on 09.03.2010; that they were preparing the sales invoices under the guise of ‘job work’ to track the sales details; that within short period, after taking stock of all the raw materials and after taking it on records they will obtain Central Excise Registration and henceforth they will make clearances of their finished goods after preparing Central Excise Invoices and after payment of duty. 5. Statement of Shri Mansukhbhai Mavjibhai Virparia, Partner of M/s. Jalganga Electricals, Near ST Workshop, Gondal Road, Rajkot, was recorded under Section 14 of the Central Excise Act, 1944 on 23.07.2010, wherein he, interalia, stated that he was one of the partners in M/s. Jalganga Electricals which was engaged in manufacture of the submersible pumps of various size and open well pumps since 1998 and they were registered with Central Excise Department since August, 2008; that they have purchased V6 Submersible Pumps from the noticee No.1 in the year 2009-10 . He produced purchase invoices and ledger account of noticee No.1 for the years 2009-10 towards their purchase ; that they have made payment by cheque to the Noticee No. 1 as per details in their ledger account; that they have purchased/received V6 Submersible Pumps in finished condition only; that they have not carried out any manufacturing process on the pumps purchased from the Noticee No.1; that they did not get any goods manufactured on job work basis from noticee No.1. 6. Statement of Shri Ashok Jinabhai Vekaria, Partner of M/s. Rotec Pumps Pvt. Ltd., 3, Samrat Industrial Estate, Rajkot, was recorded under Section 14 of the Central Excise Act, 1944 on 27.07.2010, wherein he, inter alia, stated that he was one of the Directors in M/s. Rotec Pumps Pvt. Ltd., Rajkot, which was engaged in manufacture of submersible pumps of various size and open well pumps since 2003; that they were registered with Central Excise Department since November, 2009; that they have purchased V5 Submersible Pumps 2 from noticee No.1 in the year 2009-10. He produced ledger account of the noticee No.1 for the years 2009-10 towards their purchase ; that they have made payment by cheque to noticee No.1 as per details in ledger account; that the purchase invoices towards their purchase from the noticee No.1 were not available with them as the same have been submitted to their Chartered Accountant for audit purpose; that they have purchased/received V5 Submersible Pumps in finished condition only; that they have not carried out any manufacturing process on the pumps purchased from the noticee No.1; that they have not got any goods manufactured on job work basis from the Noticee No.1. 7. Shri Mansukhbhai Bhurabhai Bhesaniya, Power of Attorney Holder of Smt. Kusumben Mansukhbhai Bhesaniya, Prop. of M/s. Shree Sadgurukrupa Engineering, Yogeshwar Main Road, Kailashpati Society, Atika, Dhebar Road, Rajkot in his statement dtd. 23.07.2010 recorded under Section 14 of the Central Excise Act, 1944 inter alia, stated that he was engaged in manufacturing and clearing of S.S. 410, submersibles spares and also in trading of submersibles spares and parts(assembly); that they were purchasing goods from the noticee No.1 for trading purpose; that they were generally purchasing Balancing Rings from noticee No.1. He produced the photocopies of the invoices received from the noticee No.1, in support of such purchases. 8. In view of the above facts, it appears that the said Noticee No.1 was engaged in manufacture and clearance of power driven pumps, i.e., submersible pumps of V3, V4, V5 and V6 type and open well pumps, which do not conform to BIS specifications, that the noticee No.1 had neither obtained Central Excise Registration for manufacture of the said submersible pumps and open well pumps nor has maintained any records regarding its production , that the said noticee in order to wrongly avail the benefit of SSI exemption notification No. 08/2003-CE dated 01.03.2003, had suppressed the production and clearance of submersible pumps of various type and open well pumps and have only shown to have manufactured and cleared the parts & kits of submersible pumps, with a clear intention to evade the payment of Central Excise duty on the power driven pumps which do not conform to BIS specifications/standards. In view of the above facts, it appears that the said Noticee No.1 has contravened the provisions contained in the Central Excise Act and Rules . 9. Noticee No. 2 was knowingly concerned in the acts of manufacturing, keeping, storing etc. of the excisable goods which he knew or had reasons to believe that the same were liable to confiscation under the said Act or the rules framed there under. These acts on his part had made him liable for personal penalty under Rule 26 of the Central Excise Rules, 2002. 10. Hence a Show Cause Notice No V.84(4)-09/MP/D/2010 dated 23.08.2010 was issued asking them as to why : a. Central Excise duty of Rs. 2,85,455.05 (Rs. Two lacs, Eighty Five thousands, Four hundreds, Fifty Five & Five Paisa only) (including Education Cess & S &HE. Cess) as detailed in the “Annexure- ‘X” & ‘Y’ to this notice, should not be recovered from them under the proviso to Section 11A of the said Act. b. The interest of Rs. 56,976/- (Rupees Fifty Six Thousand Nine Hundred Seventy Six Only) on the aforesaid duty 3 amount should not be recovered from them under Section 11AB of the said Act. c. The penalty under Section 11AC of the said Act read with Rule 25 of the said Rules should not be imposed upon them. d. Against the above duty demand, the amount of Rs. 3,00,000/- already deposited through cheque by the noticee no. 1, should not be adjusted against Central Excise duty mentioned at (i) above and against interest mentioned at (ii) above. e. the 04 Nos. of power driven pumps totally valued at Rs. 12,200/- placed under seizure under the Panchnama dated 09.03.2010 drawn at their factory premises should not be confiscated under Rule 25 of the Central Excise Act, 2002; The above Show Cause Notice was also issued to the Noticee No. 2 asking them to explain as to why; (i) Personal penalty should not be imposed upon them under Rule 26 of the said Rules. DEFENCE AND PERSONAL HEARING: Shri J.V Busa the consultant of the noticee no.1 has filed their defence reply vide their letter dtd.14.09.2011 wherein they stated that they deny all the allegations made in the SCN stating that pump manufactured by them i.e. submersible pumps and openwell pumps were without motor , that party was actually manufacturing only ‘pump kit’ which is supplied to pump manufacturers who subsequently attach the motor to make it power driven pumps.. He also added that since their product could not be considered as PD Pump there was no requirement for getting the BSI certification to avail the benefit of exemption Notification No.8/2003. That the 4 pump kits seized on 09.03.2010 are not power driven pumps , that they have only sold mini openwell kits which do not have any rewinding motor so as to connect with electric power. They also submitted that they have supplied submersible pumps and openwell pumps kits to pump manufacturers viz. M/s. Jalganga Electricals & M/s. Rotec Pumps Pvt. Ltd. etc. who subsequently attach the motor and clear the product finally on payment of Central Excise duty at appropriate rate. They also submitted the affidavit filed by two of their clients, Shri Ashokbhai Jinabhai Vekariya, Director of M/s Rotec Pump Pvt Ltd and Shri Mansukhlal Mavjibhai Virparia, Partner of M/s Jalganga Pump to the effect that they were purchasing pump kits from the assessee and finally clearing their final product after winding of Motor, on payment of duty. They further submitted that in the case of M/s Jalganga Electricals, the Commissioner(Appeals), has held that if the pumps manufactured by the noticee were of BIS standards and specifications, the condition contained in the notification 8/2003-CE stands satisfied. They also added that the Departmental stay petition against the issue, was rejected by CESTAT , Ahmedabad. They have also obtained a certificate from a private agency, ‘Labh Consultancy’, to the effect that their products confirms to the ISI standards. They further added that the Show Cause Notice demanding duty on their job work income as detailed in the Annexure X attached with the SCN , is not proper and needs to be set aside since the job work income is noting but repairing income earned by them. They also argued that it can be very well verified from their purchase bill files that they have not purchased any winding wires and cables during the period under reference, and the same was required for manufacture of 4 Power Driven Pumps. They once again reiterated their stand that they were actually manufacturing only ‘Pump Kits’ and not P D Pumps. The noticee also added that the benefit of cum duty price should be extended to them in view of the settled legal position as laid down by CBEC Circular No 803/36/2004- CX dtd 27.12.2004. They also placed reliance upon the decision of Hon’ble Supreme Court in the case of Govt. Of India Vs. MRF Ltd. Reported in 1995 (77) ELT 43 (SC) and Shrichakra Tyres Ltd Vs. Collector of Central Excise, Madras reported in 1999 (108) ELT 361 (Tri. LB) The noticee no. 1 was given an opportunity for personal hearing and the consultant of the Noticee, Shri J.V Busa , appeared for Personal hearing on 15.09.2011 and submitted their detailed written submission and reiterated the facts stated in their defence submission dated.14.09.2011 and he further requested for 10 days time to submit Chartered Engineers Certificate to prove their stand that Pump Kit was distinct from P.D. Pumps. They finally submitted certificate of Chartered Engineers and photographs regarding their product on 23.09.2011. FINDINGS : I have carefully gone through the records of the case, SCN issued and submissions made by the noticee in written reply as well as during personal hearing. I find that the limited issue to be decided in the case in hand is – whether the Turbine pumps manufactured and cleared by the noticee no – 1, are to be considered as power driven pumps or otherwise and whether they are covered under the purview of Notf. 8/2003-CE requiring them to obtain BIS certification. The noticee no 1 has argued that since the goods cleared by them were submersible and open well pump kits , wherein no motor was fitted, the same cannot be considered as Power Driven pumps requiring the BIS certification as contained in Notification 8/ 2003-CE as amended. There is no force in this argument because the fact remains that they had manufactured and cleared pumps for the purpose of drawing water, which could only be run with the aid of power. Hence even though the said pumps were not fitted with motor, they are rightly classifiable under CHSH 8413. It has been held by the Hon’ble Tribunal in the case of Commissioner of Central Excise , Ahmedabad Vs Jyoti Electrical Motor Ltd reported in 2003 (162) E.L.T. 1117 (Tri-Del) that “………. The power driven pumps even when they are cleared without motor are classifiable under the heading 8413……” Since the noticee has not disputed the fact that the pumps manufactured by them were intended for drawing water and could only be run with the aid of power, there is no force in their argument that they are not covered under the purview of Notf. 8/2003-CE requiring them to obtain BIS certification. They were rightly required to obtain BIS certification in terms of entry no (xl) in the SSI Notification. The noticee has further argued that they have supplied the submersible pumps and open well pumps kits to pump manufacturers who subsequently attach the motor and clear the product finally on payment of Central Excise duty at appropriate rate. They have submitted the affidavit filed by two of their clients to the effect that they were purchasing parts from the assessee and finally clearing their final product on payment of duty. The said affidavits filed by their clients are clearly an after thought in as much as, the statements were recorded as early as July 2010 wherein they confessed that they have received pumps in finished condition and have not carried out any manufacturing activity. The filing of affidavit in September 2011, after a lapse of more than a year is clearly an afterthought. The noticee has further relied upon the CESTAT’s order dismissing the 5 departmental stay petition, however the same is not relevant in the present case since the facts of the case are not identical since, in the case cited, the party was having BIS Certification for some of their brands and moreover, the order in question is only a stay order. As this is only a stay order and not final order, it can’t be said to be laying any law. The noticee has argued that the duty demanded on income shown as ‘job work’ income should be set aside since the same is nothing but the income earned by them for repairing of pumps. However, there is no force in this argument and it is clearly an after thought since Shri Bharatbhai Gordhanbhai Vekaria has clearly confessed in this statement dated 09.03.2010 that such job work bills were raised only as per the direction of their accountant for accounting purpose. And in reality they were not doing any such labour work and when any of their customers were insisting on bills, they were raising such a bill. And that the said bills were all fictitious bills reflecting the cost of the pumps sold by them. Since this statement has never been challenged, there is no force in the argument put forward now, stating that they were carrying out repairing activity. The noticee has requested for the benefit of cum duty price, and I find that in view of the settled legal position, they are rightly entitled to the benefit of cum duty price. Hence the duty demanded is accordingly being reworked out as shown in Annexure – X. It is also clear that these acts of contravention on the part of the noticee No. 1 has been committed with sole intention to evade payment of duty. The noticee No. 1 suppressed the fact of the manufacture of pumps which did not conform to the standards specified by the Bureau of Indian Standards(BIS) from the department and cleared the said pumps without payment of duty, with an intention to evade Central Excise duty by suppressing the material facts although they were aware about the specific provision of law. They have thereby rendered themselves liable to penal action under Section 11AC of the said Act read with Rule 25 of the Central Excise Rules, 2002 for the acts and omissions as described above. Further the noticee No. 2 being the partner was knowingly concerned in the acts of manufacturing, keeping, storing etc. of the excisable goods which he knew or had reasons to believe that the same were liable to confiscation under the said Act or the rules framed there under. These acts on his part had made him liable for personal penalty under Rule 26 of the Central Excise Rules, 2002. In view of the above, I pass the following order. ORDER (i) I order confiscation of the seized 4 (four) Nos. of pumps (submersible and open well) not confirming to the BIS standards, valued at Rs. 12,200/-,seized under panchnama dated 09.03.2010 under Rule 25 of the Central Excise Rules, 2002. However, I give an option to M/s. Bharat Pumps Industries, Rajkot to redeem the goods within 30 days of receipt of this order on payment of fine of Rs. 3,000/(Rs. Three Thousand only) under the provisions of Section 34 of the Central Excise Act, 1944. (ii) I confirm the Central Excise duty amounting to Rs.2,67,908/(Rupees Two Lakhs Sixty Seven Thousand Nine Hundred and Eight only), after giving the benefit of cum-duty price, under the provisions of Section 11 A (1) of the Central Excise Act, 1944, as per Annexure X, 6 attached to this OIO. As the amount of Rs. 3,00,000/- (Rupees Three Lakh only) has already paid I appropriate the same against the duty confirmed. (iii) I order to charge and recover the interest of Rs. 48106/- (Forty eight thousand one hundred and six only) under the provisions of Section 11 AB of the Central Excise Act, 1944. (iv) I impose a penalty of Rs.2,67,908/- (Rupees Two Lakhs Sixty Seven Thousand Nine Hundred and Eight only) upon M/s. Bharat Pumps Industries, Rajkot under the provisions of Section 11 AC of the Central Excise Act, 1944 read with Rule 25 of the Central Excise Rules, 2002.As provided under proviso to Section 11AC of the Central Excise Act, 1944, an option to pay only 25% of the penalty amount is available to the party, if the amount confirmed hereinabove for recovery, is paid by them within thirty days of the receipt of this order. (v) I impose a penalty of Rs. 1,00,000/- (Rupees One Lakh only) upon Shri Gordhanbhai Jadavbhai Vekaria, Partner under the provisions of Rule 26 of the Central Excise Rules, 2002. (T. SAMAYA MURALI) ASSISTANT COMMISSIONER CENTRAL EXCISE DIVISION –I RAJKOT. F. No. V.84(4)-09/MP/2010-11 Date : 29.09.2011 To (1) M/s Bharat Pumps Industries, Kailashpati Society, Street No.4, Opp. Plot No.27, Dhebar Road (South), Rajkot. (2) Shri Gordhanbhai Jadavbhai Vekaria, C/o M/s Bharat Pumps Industries, Kailashpati Society, Street No.4, Opp. Plot No.27, Dhebar Road (South), Rajkot. Copy to: 1. The Assistant Commissioner (AE), Central Excise, HQ, Rajkot 2. The Superintendent, AR-III, Central Excise Division-I, Rajkot. 3. Guard File/Spare copy. 7 In view of the above, I pass the following order. ORDER (vi) I order confiscation of the seized 4 (four) Nos. of pumps(submersible and open well) not confirming to the BIS standards, valued at Rs. 12,200/-,seized under panchanama dated 09.03.2010 under Rule 25 of the Central Excise Rules, 2002. However, I give an option to M/s. Bharat Pumps Industries, Rajkot to redeem the goods within 30 days of receipt of this order on payment of fine of Rs. 3,000/- (Rs. Three Thousand only) under the provisions of Section 34 of the Central Excise Act, 1944. (vii) I confirm the Central Excise duty amounting to Rs.2,67,908/(Rupees Two Lakhs, Sixty Seven Thousand Nine Hundred and Eight only), after giving the benefit of cum-duty price, under the provisions of Section 11 A (1) of the Central Excise Act, 1944, as per Annexure X, attached to this OIO. As the amount of Rs. 3,00,000/- (Rupees Three Lakh only) has already paid I appropriate the same against the duty confirmed. (viii) I order to recover the interest at the applicable rate on the duty so arrived at after giving the benefit of cum-duty price, under the provisions of Section 11 AB of the Central Excise Act, 1944. (ix) I impose a penalty of Rs.2,67,908/- (Rupees Two Lakhs, Sixty Seven Thousand Nine Hundred and Eight only) upon M/s. Bharat Pumps Industries, Rajkot under the provisions of Section 11 AC of the Central Excise Act, 1944 read with Rule 25 of the Central Excise Rules, 2002.As provided under proviso to Section 11AC of the Central Excise Act, 1944, an option to pay only 25% of the penalty amount is available to the party, if the amount confirmed hereinabove for recovery, is paid by them within thirty days of the receipt of this order. (x) I impose a penalty of Rs. 1,00,000/- (Rupees One Lakh only) upon Shri Gordhanbhai Jadavbhai Vekaria, Partner under the provisions of Rule 26 of the Central Excise Rules, 2002. (T. SAMAYA MURALI) ASSISTANT COMMISSIONER CENTRAL EXCISE DIVISION –I RAJKOT. F. No. V.84(4)-09/MP/2010-11 Date : 29.09.2011 To (1) M/s Bharat Pumps Industries, Kailashpati Society, Street No.4, Opp. Plot No.27, 8 Dhebar Road (South), Rajkot. (2) Shri Gordhanbhai Jadavbhai Vekaria, C/o M/s Bharat Pumps Industries, Kailashpati Society, Street No.4, Opp. Plot No.27, Dhebar Road (South), Rajkot. Copy to: 01.The Assistant Commissioner (AE), Central Excise, HQ, Rajkot 02.The Superintendent, AR-III, Central Excise Division-I, Rajkot. 03.Guard File/Spare copy. 9