............

........... ......

...........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

...................

Executive White Paper

Pan-Regional Marketing

Productivity Dividends

from Outsourced

Collateral Operations

How to redirect savings from outsourced pan-regional collateral operations to

additional media placements and campaigns within existing operational budgets

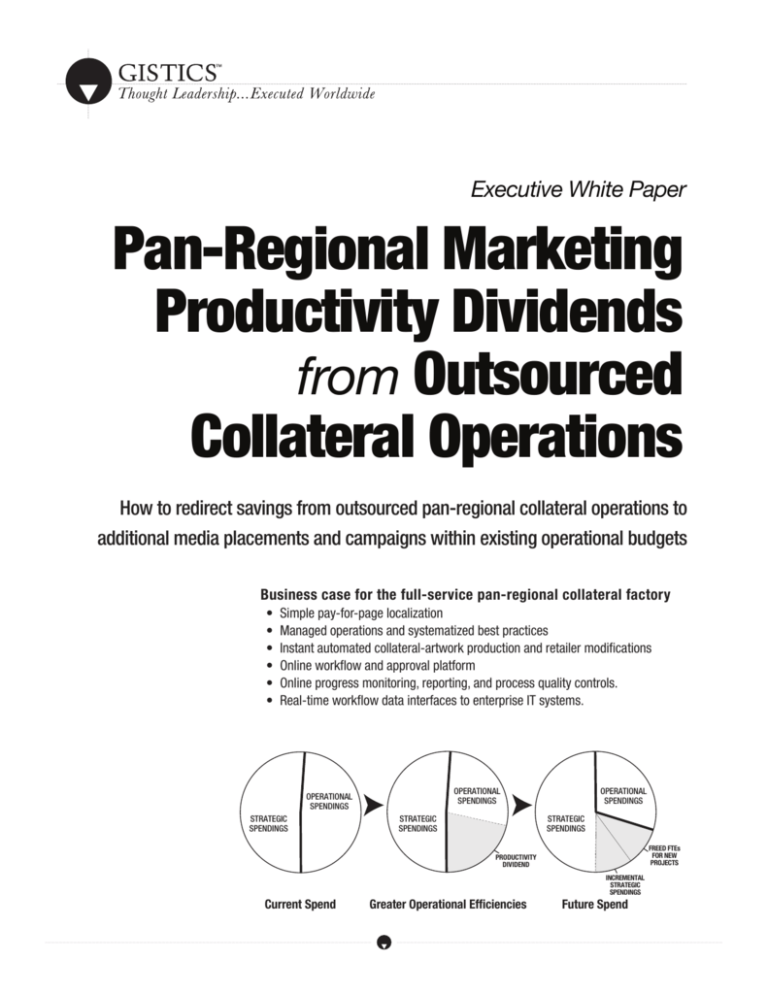

Business case for the full-service pan-regional collateral factory

• Simple pay-for-page localization

• Managed operations and systematized best practices

• Instant automated collateral-artwork production and retailer modifications

• Online workflow and approval platform

• Online progress monitoring, reporting, and process quality controls.

• Real-time workflow data interfaces to enterprise IT systems.

STRATEGIC

SPENDINGS

STRATEGIC

SPENDINGS

STRATEGIC

SPENDINGS

FREED FTEs

FOR NEW

PROJECTS

PRODUCTIVITY

DIVIDEND

INCREMENTAL

STRATEGIC

SPENDINGS

Current Spend

Greater Operational Efficiencies

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

ProductivityDividend.1.5 ©2008 GISTICS, All rights reserved.

OPERATIONAL

SPENDINGS

OPERATIONAL

SPENDINGS

OPERATIONAL

SPENDINGS

Future Spend

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

Who helped produce this white paper? Who is GISTICS?

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

AUTHOR

THINK TANK FOR EARLY-STAGE MARKETS

Michael Moon

GISTICS constitutes a think tank that speeds the

adoption of new technology and disruptive innovations

among enterprises and consumers. Founded in 1987,

GISTICS Incorporated minimizes the risk of potential

buyers through the following:

• Interviews with successful early adopters of new

technologies

• Definition of the critical success patterns of

successful early adopters

• Activity-based analyses of adoption benefits on

supply chains, workflows, and user activities

• Visual explanations of how new technologies

produce economic value

• Investment analyses that justify the purchase of

new technical systems

• Project roadmaps that break down large-scale

organizational changes into smaller two-week to

two-month projects

• Practitioner portals that clarify the next steps in

rapid deployment and payback

• Certified consultants that provide essential skills

and resources

President, CEO

GISTICS Incorporated

moon@gistics.com

Charles caldwell

President, CEO

NextQuarter

chas@nextquarter.com

DESIGN, LAYOUT,

EDITING, PRODUCTION

LIANNE MUELLER

Art Director

Fly Design Media

lianne@flydesignmedia.com

iris alroy

Production Artist

GISTICS Incorporated

research@gistics.com

Kathleen McFadden

kmcfadden@writetools.com

Steve Turner

Turner Associates

steve@turnersf.com

GISTICS drives the emergence of shared vocabularies,

the adoption of effective problem-determination methods,

and the development of unassailable investment analyses

that justify purchases of new technologies or disruptive

innovations.

GISTICS attracts early adopters and pace setting

solutioneers, demonstrating how they can use new

technologies or disruptive innovations to make money by

delivering new complex, integrated solutions to enterprise

or consumer clients.

GISTICS develops breakthrough market-making

strategies for vendors of new technologies or disruptive

innovations, using industry thought leadership, executive

white papers, Webcasts, specialized Web sites, and a

global trust network of advanced project managers within

large enterprises, independent consultants, and small

master-class solution providers.

G i s t ic s h e l p s e n d - u s e f i r m s h a r n e s s n e w t e c h n o l o gi e s a n d

di s r u p t iv e i n n o va t i o n s

MAJOR LAUNCH: Products, Campaigns, Partnerships, Business Models

GISTICS Incorporated

4171 Piedmont Avenue, Suite 210

Oakland CA 94611 USA

www.gistics.com

+1.510.450.9999 tel

+1.510.450.0954 fax

©2008 GISTICS Incorporated. All rights

reserved. Printed in the U.S.A.

GISTICS and its agents have used their

best efforts in collecting and preparing information published in this white

paper Pan-Regional Marketing Productivity

Dividends from Outsourced Collateral

Operations.

GISTICS does not assume, and hereby disclaims, any liability for any loss or damage caused by errors and omissions in

this white paper, whether such errors or

such omissions resulted from negligence,

accident, or other causes.

V a l u e - C r e a t i o n

Offer—market

development

T1

GISTICS

Sales

conversion

Satisfaction

fulfillment

Primary Market

C o l l a b o r a t i v e

T2

P r o c e s s

Strategic

development

Aftermarket

Market-making scenario 1

Market-making scenario 2

S o l u t i o n e e r i n g

Cycle time gain

Necessary Conditions

Strategic Value

• Rationalized market and definitive

business case

• Differentiated value propositions

• Completed satisfaction-fulfillment

methodologies

• Testimonials of early adopters

• Network of certified consulting

solutioneers

• Thought-leadership Web destination

• Leadership positioning in the market

• Advantaged category definitions

• Growing perception as the dominant

“gorilla”

• New “green field” markets and

revenue streams

• Loyalty lock-ins of category-defining

marquee accounts

MarketMakingScenarios.A.1.4 © 2007 GISTICS All rights reserved.

GISTICS reduces the organizational and market barriers to the adoption of new technologies or disruptive innovations,

publishing a variety of papers, presentations, and Web sites that explain how to realize the economic and social value of new

technologies or disruptive innovations in a variety of organizations.

..................................................................................................................................................................................................................................................................................................................................................................................................................................................

2

Demand

creation

Concept Market

Market-making Scenarios

gist \’jist\ n -s [AF, it lies (said of

a legal action), fr. MF, 3d pers.

sing. pres. indic. of gesir to lie, fr.

L jacére to lie, fr. jacere to throw

— more at jet (to spout)] 1: the

ground or foundation of a legal

action without which it would not

be sustainable 2: the main point

or material part (as of a question

or debate) : the pith of a matter :

essence (the ~ of a question) <the

~ of all that can be said upon the

matter—R. L. Stevenson>

—Webster’s Third New International Dictionary Unabridged

.......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

executive white paper

Pan-Regional Marketing

Productivity Dividends

from Outsourced

Collateral Operations

How to redirect savings from outsourced pan-regional collateral operations to

additional media placements and campaigns within existing operational budgets

PAGE

3

7

13

21

27

37 47

CONTENTS//SECTIONS

Executive Summary

Business Case Summary

Marcom Supply Chains

Center of Excellence for Pan-Regional Collateral Operations

Payback Scenarios for outsourcing with Collateral Operations

Activity-Automation Cells

About GISTICS

ABSTRACT

Pan-regional collateral operations unlock the full potential of bringing attractive

value propositions to market:

• Speeding the localization and production of print-ready advertisements and

marcom collateral by three to five weeks

• Reducing the total cost of one localized page of collateral by 70 percent

• Reducing the total print cost of one localized page by 30 percent

• Freeing 35 percent of collateral production budgets for reinvestment in more

media, online promotions, or direct mail

• Enabling four to seven marcom staffers to perform higher added-value work

These reductions of time to market and costs entail the following capabilities:

• Centralized localization of copy and graphic images

• Automated production of finished print-ready ads and collateral

• Strategic sourcing of print production through print management firms

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

How do we summarize the business case for outsourcing

international marketing communications to a center of excellence?

EXECUTION THAT DRIVES SUCCESS REQUIRES AUTOMATION

OF MARCOM PROCESSES

This paper advances the proposition that effective marketing

brings an attractive value proposition to those customers

most likely and able to buy.

However attractive a value proposition, it will fail to

produce results without effective market coverage — the

function of marketing communications or marcom.

Effective market coverage entails the synchronized

and rapid execution across multiple markets, multiple

communication channels (print, online, broadcast), and

multiple marcom formats (brochures, direct mail, trade

promotions, point-of-purchase materials, and multimedia

content for the Web and mobile devices).

Research conducted by GISTICS of global marcom

processes and workflows reveals a critical factor

undermining effective market coverage: redundant, manual

procedures and duplications associated with the time- and

cost-intensive production and sourcing of collateral across

global markets, multiple channels, and various collateral

formats.

This paper examines automation strategies for

maximizing the productivity of collateral operations and in

particular how to achieve these aims:

• Reduce time-to-market for revenue-producing collateral

• Maintain consistent brand-marketing messages

• Increase the number of effective selling days

• Reduce overall labor content, redundancies, and costs of

marketing communications.

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

TH I S P A P ER C L A R I F I ES THE OUTSOUR C I N G OF P A N - RE G I ON A L C OLL A TER A L

LOINNOVATION

C A L I Z A T I ON

A NProducts

D P RO Dor

U CServices,

T I ON Enhanced Customer Value, Process Optimization

: New

MAJOR LAUNCH: Products, Campaigns, Partnerships, Business Models

Offer—market

development

vendor

Demand

creation

Sales

conversion

Satisfaction

fulfillment

external market

Strategic

development

customer

V a l u e - C r e a t i o n

vendor

P r o c e s s

T1 10-week Time to market scenario

Time to Value Scenarios

T2 2-week Time to market scenario

8-week Cycle time savings

Higher productivity

Strategic value

• Higher productivity of staff

and trade partners

• Fewer steps in end-to-end processes

• Elimination of redundant activity

• Greater transparency leading to

insight and improvement

• New markets and revenue streams

• Greater competitiveness and market

shares

• Increased market coverage

and faster time-to-market

• Variable and fixed-cost reductions–

source of productivity delivered

Productivity drivers

• Simplified architecture for global

brand-voice

• Central repository of marcom

assets and design masters

• Standardized localization procedures,

systems, and tools

• Database of translated terms

Productivity

Dividend:

12.4%

OF CURRENT

MARCOM BUDGET

NOW AVAILABLE

FOR MORE

STRATEGIC USES

• Automated XML publishing

processes

• Automated page-assembly and

on-demand customization

• Online review, approvals, and

color-matched proofs

• Real-time dashboards

TimeToValue.D.1.7 ©2008 GISTICS All rights reserved.

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

4

GISTICS

Senior management of

global brand-marketing

organizations will find this

paper useful in assessing

the merits of outsourcing

production and localization

of collateral to centers of

excellence in pan-regional

collateral operations..

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

executive white paper

How do we calculate productivity dividends, demonstrating how

greater operational efficiency translates into higher sales?

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

ECONOMIC EFFECT OF FASTER CYCLE TIME

SHORTER PRODUCT LIFE CYCLES CAN LIMIT PROFITS

Most firms drive innovation to market, offering new

products, formulations, and packaging, or new services,

enhancements, or configurations. In all but a few cases,

these firms drive marketing communications to market by

• Publishing printed ads, marketing collateral, and

promotional materials

• Broadcasting electronic ad spots and infomercials

• Provisioning digital content and interactive engagement

services to stationary PCs, mobile devices, and digital

kiosks or point-of-purchase displays.

As once noted by Peter Drucker, the expert on

management and business, “Only two things add value:

innovation and marketing. All else is cost.”

This rather pithy and sage remark calls attention to what

aspects of innovation and marketing create value, as well as

how firms can use automation to maximize those aspects

that deliver the greatest value.

Simply put, most firms that sell products can maximize

their profits by achieving two, , often offsetting, goals:

• Sell goods or services with adequate, if not superior,

profit margins, and

• Sell higher unit volumes of these goods or services

Profit margins reflect selling the right mix of products

or services at prices that buyers will pay. Seasonal factors,

the comparative value of one firm’s offering to another’s

offering, and other factors will affect price sensitivity—what

customers will pay.

Another dimension of cycle time economics relates

to velocity or how much annual revenue a firm can earn

for each dollar or euro it has invested in its assets and

operations—factories and people, respectively.

Combined, margin and velocity become the most

important measurement to a firm—return on investment—

how we measure the effectiveness of automation and best

practices.

d e l ay e d p r o d u c t l a u n c h e s

The pace of innovation continues to accelerate across all

technical realms, giving large and small firms worldwide a

real opportunity to develop new breakthrough products or

services and drive them to market. This quite simply means

that competition will continue to expand and intensify

without a foreseeable end in sight.

The figure below depicts how faster time to market of

new products or services can produce incremental profit and

revenues, as well as reduce total development costs with the

desirable result of capturing lost margin or profits.

For more about how firms can use automation to speed

up their innovation processes, GISTICS offers the white

paper entitled, the Impact of Enterprise Collaboration on

Productivity of Intangible Assets. To find the white paper,

just “Google” the title.

The figure below also depicts how faster time to market

of marketing communications helps maximize the value of

bringing new products or services to potential customers.

CYCLE TIME ACCELERATION FOR PAN-REGIONAL MARCOM

Delays in getting to market reduce the effectiveness of

otherwise attractive goods and services, representing the loss

of days or weeks of product sales life cycles—unrecoverable

in competitive markets—and therefore representing lost

revenues and margin.

Our research shows no greater loss than in delayed time

to pan-regional markets.

This paper identifies a primary source of these losses:

distributed in-country localization of marketing collateral

and ads, combined with low or nonexistent levels of reuse of

digital brand and marcom assets.

In significant part, the inefficiencies lead to excessive

levels of project coordination (wasted staff time), extra cost

(vendor charges), brand inconsistencies, and less net funds

spent on strategic things such as media placements, fuller

coverage of a market, ad words, etc.

steal revenues and profits

$600,000

Delayed product launches incur

additional development costs as

well as missed revenues and lost

profit.

Lost Margin from Delayed Launch

$300,000

$0

Additional Development Cost from Delay

($100,000)

0

6

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

SERIE S//MANAGEMENT ADVISORY

Realized Margin

Incremental Revenues

from Faster

Launches

12

18

MONTHS

24

CycleTimePaysOff.1.8 ©2008 GISTICS Incorporated, All rights reserved.

EXPENSE AND MARGIN

Incremental Profit from Faster Time-to-Market

30

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

GISTICS

5

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

How an outsourced pan-regional collateral operation

deliver productivity dividends?

motto declared: “Infrastructure: Got to have it. Build it. The

revenues will come.” However, many firms built it, and the

revenues did not come, or least, not as expected or needed to

recoup the basic investments.

COMPLEXITY TAX OF THE INTERNET

Strategy constitutes a mechanism for marshalling or

directing available resources to achieve maximum

competitive strategy.

While simple in concept, effective strategy requires a

systems-based, holistic view of a marketing operation,

the objectives the marketing team commits to achieve,

and trade-offs between available resources and ways of

harnessing these resources.

However, the Internet compounds this formulation in

several ways, adding dazzling new resources that often come

with a heavy “complexity tax”—a requirement to develop

new ways of thinking about strategy, managing an operation,

and engaging customers.

Internet complexity taxes come due for payment in these

new resources:

• Corporate Web content management systems and

customer-facing content and Web services

• Product or consumer engagement Web sites, content

management systems, and content development

• Search engine marketing, content optimization, and

faceted taxonomy-driven searches on corporate and

product web sites

• Sponsored content and social networks, including viral

videos, Webcasts, blogs, forums, etc.

• Interactive services of a multimedia call center or help

desk

• Marketing services portals that integrate content and,

increasingly, information of production systems through a

marketing supply chain

A close examination of the public financial reports of

major brand-marketing firms indicates that the total expense

for customer-facing and operational marketing systems,

processes, and staffing remains the fastest growing category

of corporate budgets. Yet much of this expense remains

opaque, hidden, and largely unquantified.

GISTICS’ research reveals that productivity gains (the

ability to get more work done with the same number or

fewer personnel) and cost-cutting measures (such as more

uniform procurement processes and vendor consolidations)

have paid much of the Internet complexity tax. The de facto

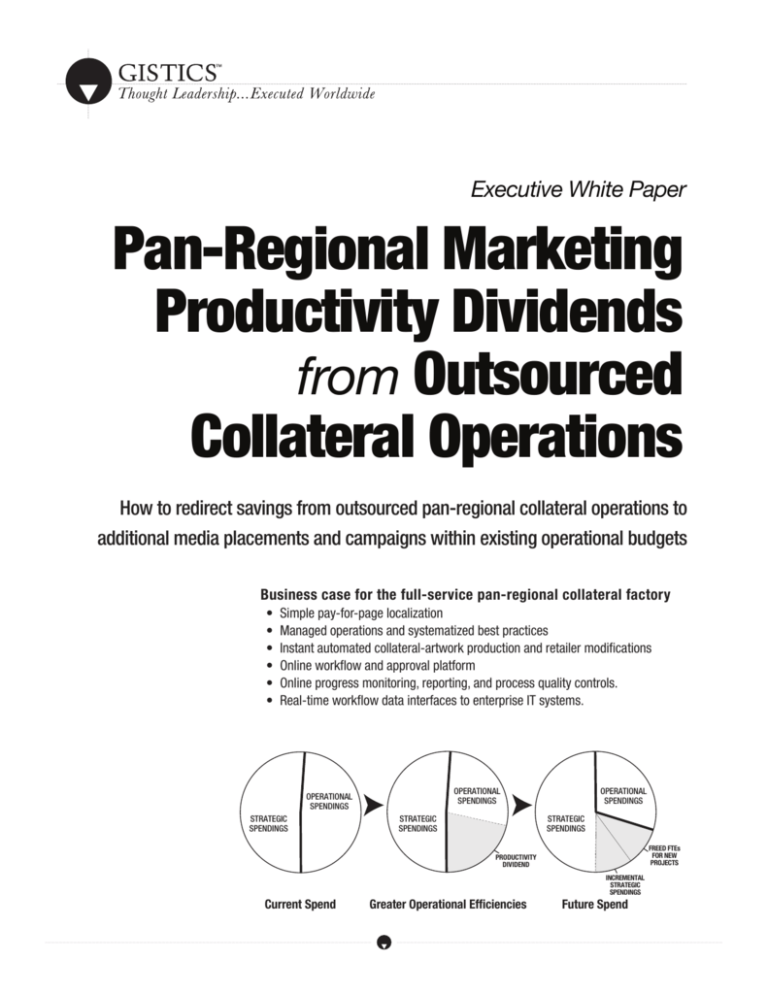

OPERATIONAL AND STRATEGIC SPENDINGS

The figure below depicts one of the strategic initiatives

of most chief marketing officers, framing these essential

questions:

• What comprises the low added-value work of our

marketing operations?

• Where do our staff or partners expend a lot of time getting

higher added-value work done?

• What activities in higher added-value work of marketing

suffer from high defect rates (requiring rework and added

cost)?

• What systems, processes, and accountabilities can

deliver continuous, ongoing reductions of time, cost, and

complexity within our marketing operations?

• What activities and tasks can we outsource to partners

better suited and equipped to deliver on time and within

budget?

The figure below suggests that a better, more efficient

way to localize marcom materials and produce finished

print-ready advertisements and collaterals can achieve

significant levels of cost avoidance—what we call a

productivity dividend.

Later in this paper we analyze typical productivity

dividends for outsourcing localization to a pan-regional

collateral operation.

This analysis identifies the number of full-time

equivalents (FTEs) or staff that the productivity dividend

makes available for new projects.

This analysis also identifies how many already-budgeted

funds the productivity dividend frees up for more strategic

spendings.

In summary, this paper makes the case that outsourcing

the localization and production of ads and marcom materials

to a collateral operation not only produces a productivity

dividend with FTEs and new monies, but outsourcing also

reduces the complexity tax through a global marketing

operation.

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

G RE A TER O P ER A T I ON A L EFF I C I EN C Y C RE A TES NEW MONEY FOR STR A TE G I C S P EN D I N G S

STRATEGIC

SPENDINGS

STRATEGIC

SPENDINGS

FREED FTEs

FOR NEW

PROJECTS

PRODUCTIVITY

DIVIDEND

INCREMENTAL

STRATEGIC

SPENDINGS

Current Spend

Greater Operational Efficiencies

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

6

GISTICS

ProductivityDividend.1.5 ©2008 GISTICS, All rights reserved.

STRATEGIC

SPENDINGS

OPERATIONAL

SPENDINGS

OPERATIONAL

SPENDINGS

OPERATIONAL

SPENDINGS

Future Spend

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

executive white paper

...................

12

11

10

9

What process maturities maximize the competitive advantage of a global marketing operation?

What slows cycle times and increases cost in localizing printed

collateral for pan-regional markets?

What summarizes the progressive productivity dividend across the process maturities of a pan-regional collateral operation

What financial analysis justifies the business decision to outsource localization to a pan-regional collateral operation?

What capabilities comprise each stage of a process-maturity model for pan-regional collateral operations?

8

ESSENTIAL QUESTIONS ADDRESSED IN THIS SECTION:

PAGE

7

GISTICS

series//Management Advisory

B us ines s C as e S um m ar y

SECTION II

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

Pan-Regional Marketing

Productivity Dividends from

Outsourced

Collateral Operations

...........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

...................

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

What process maturities maximize the competitive

advantage of a global marketing operation?

PROGRESSIVE LEVELS OF PROCESS AUTOMATION

Most executives know from experience that the right

combination of process automation and operational

excellence can produce stunning results: dramatic reduction

in costs, improvement in business agility (or the ability to

exploit short-lived opportunities), etc.

Research performed by GISTICS spanning 20 years

reveals that the concept of process-maturity levels

summarizes the right combinations of process automation

and operational excellence.

The figure below depicts six levels of process maturity

for pan-regional marketing communications and the

localization of printed ads and collateral.

OPTIMIZATION IS A JOURNEY, NOT A DESTINATION

marcom supply chain, adding global transparency and status

reporting for all active projects.

Strategic Sourcing of Creative, Marketing Content, and

Production produces a sizeable productivity dividend—new

money to spend on more media, fuller market coverage,

more ad words, specialized promotions, higher levels of

personalized interaction or engagement with buyers, etc.

Strategic sourcing entails the systematic reduction of

inefficiency, operational costs, and cycle time delay and the

reinvestment of those savings—productivity dividends—in

more strategic areas.

In no small part, greater levels of competitive bidding

among all suppliers to the marketing supply chain—

achieving lower costs on smaller aspects of a campaign,

promotional items, collateral pieces, or constituent

elements such as photography or translation—produce this

productivity dividend.

Concurrent Global or Pan-Regional Marketing across all

media and collateral formats moves a marketing operation

even closer to maximum competitive advantage. Here

efficiencies enable a firm to coordinate and synchronize all

of the marketing efforts and marcom assets, producing an

“echo effect” in key markets.

This echo effect results from broadcast, print, online,

out-of-home/billboards, and in-store merchandising to

surround and envelop targeted customers. This not only

cuts through the noise and clutter of a market, but the echo

effect also ensures that consumers notice an attractive value

proposition and engage the vendor or provider in some form

of instant, online interaction: on-demand customerization of

promotional offers.

m a t u r i t y y i e l d s h ig h e r p r o d u c t ivi t y divid e n d s

GREATER

EM

EN

TA

MAXIMUM

COMPETITIVE

ADVANTAGE

L

ST

AB

OR

AT

NG

LL

DI

CO

EN

W

SP

LI

N

L

C

A

CO

O

GI

Q

U

TY

TR

TE

IO

N

RA

CONSISTENCY

CR

LESSER

IN

Fast, low-defect expression of brand-voice and differentiated offerings

A successful firm, by the very nature of its success, does

several, if not many, things right. However, rapid change or

growth can induce otherwise successful firms to stumble;

these firms must grow, adapt, and stabilize new levels of

performance and operational excellence.

Research of global or large regional marketing operations

conducted by GISTICS indicates that most of these

operations have thousands to tens of thousands digital files:

editable and reusable marcom assets and fixed final-form

content.

Many but not yet most of these firms have achieved the

first process maturity of marketing operations: a Global

Marcom Asset Repository—a well-organized collection of

marcom assets and content that authorized users can access

by Web browsers.

Fewer firms have achieved the

g r e at p r o c e s s

second process maturity of Centralized

Collateral Production. This capability

entails new investment in a basic

collateral factory with dedicated

project teams, systematized

procedures, sophisticated XML copytext repositories, specialized ingest

engines that transform collateral

design masters into XML style sheets

and automate publishing templates.

Sourcing Alignment of Creative

Partners entails changing how global

or pan-regional marketing operations

buy creative work products, using

a growing network of lower cost,

higher quality creative teams and

boutique firms. The combination of

a Global Marcom Asset Repository

and Centralized Collateral Production

enables a marketing operation

to maintain brand consistency,

provisioning templates, images,

and design standards to individual

creatives, teams, or firms.

Asset

Asset

Federated Localization Processes

Consolidation Consolidation

(DAM only)

with Manual Centralized

expands the operational capabilities

Localization

and Production

of the collateral factory and

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

O

F

RK

LO

PR

O

W

S

CE

U

S A

M

TO

AT

ION

0 1 2 3 4 5 6

LESSER

Centralized

Collateral

Production

and Localization

Sourcing

Alignment

of Creative

Partners

Federalized

Localization

Workflows and

Processes

Strategic

Sourcing

Creative Content

and Production

Concurrent

Global

Marketing

ProductivityDividend.C.1.5 ©2008 GISTICS Incorporated, All rights reserved.

EFFECTIVENESS

GREATER

Crisp, timely, and relevent localized messages and imagery

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

8

GISTICS

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

executive white paper

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

What slows cycle times and increases cost in localizing

printed collateral for pan-regional markets?

Finally, many localized adaptations of promotional

materials will publish the names, contact information, and

location of retail outlets of partners—who open new stores

or relocate existing ones throughout the year.

In summary, the figure to the right depicts a largely

manual, nonautomated process that takes four to six weeks

per design master. Research by GISTICS reveals that a

major new product launch for EMEA markets will produce

6 to 10 pieces of collateral for each of the 20 to 40 markets

serviced. This typically results in one or two delayed pieces

per launch market; retailers often wait until they have a

complete set before fully promoting the new product.

The delay of one or two pieces will hold everything up,

stealing effective product-sale days of a limited product

lifecycle of 240 days or so. As shown elsewhere in this

paper, a mere 25-day gain in time to market represents $8.3

million in incremental revenue.

MANUAL, OFFLINE WORKFLOWS

Pan-regional marketing communications consists of several

thousand discrete projects per year.

An in-depth examination of a typical project, from its

specification in strategy to its production and delivery to

points of sale and consumption, reveals several workflows,

involving tens to hundreds of individuals across a panregional marketing operation.

The figure to the right depicts three key workflows of

pan-regional marketing operations and related marcom

groups.

Creative workflows entail the work of a marketing team

at a headquarters and of global creative partners, producing

master campaigns and brand identities. If the offered

products include packaging and retail point of purchase

merchandising, creative workflow will include two or more

creative partners or teams. Creative workflow nonetheless

will produce a design master and copy text; usually

delivered as an Adobe InDesign or QuarkXpress

file with companion illustrations, images, and

P L A NN I N G A N D S C HE D UL I N G C OLL A B OR A T I ON

fonts to a regional marketing operation, such as

one focused on Europe, the Mideast, or Africa

d I nsigh t s

C reat ive Deve

y an

lop m

teg

1

(EMEA).

en

3

tr a

t

Localization workflows start with a regional

marketing group that provides adaptation

EMEA

Creative

Marketing

insights and a localization brief—instructions

Operations

Workflow

and guidelines for each regional localization

team—5 to 15 teams for EMEA. Translations

4 C

2

of each language often require translation

Collab

nt

r ea tive E uti on

o r a ti ve R e f i ne m e

xec

treatments—two or three ways of interpreting

5

English text into a local language.

Design Master (DM) and Copy

Adaptation workflows often start with the

delivery of finalized translations to a local

Ins i gh t s

Translation Tre

tion

at m

pta

6

ent

8

da

A

s

marketing office that coordinates with a local

creative partner to rework the English-language

design master for local market and production

Localization

EMEA

Marketing

requirements for 20 to 40 markets.

Workflow

Operations

Adaptation workflows produce certified

production-ready output, usually Acrobat

9 Fina liz ed at io n

7

PDF files that a print specialist has processed,

Loc al izat i on Brie f

Transl

quality checked, and certified for the technical

10

production requirements of a specific print and

Localized Text

printing press.

hts

n Ins i g

Adaptation Trea

atio

The number of these technical requirements

tme

apt

11

nt s

13

Ad

for display ads and printed collateral exceed

40,000 for EMEA alone, and change whenever a

printer updates or replaces a printing press.

Local

Adaptation

Marketing

The certified production-ready output

Office

Workflow

addresses the added complexities of different

page designs.

14 Fi

12

na liz ed

Loc al izat i on Brie f

Ada pta ti on

Some page designs incorporate advanced

graphic designs, such as spot varnishes, diecuts, six-color processes, and close alignment or

registration of vector and rasterized artwork.

15

Other page designs use product information

Certified Production-ready Output

tables, commonly used in catalogs and in direct

response promotions, that may also display

DESIGN MASTER DESIGN MASTER DESIGN MASTER DESIGN MASTER

technical data and prices in a local market

Complex

Simple

Catalog

Technical

currency—any of which may change at the last

Design

Design

Table

Data

minute.

Pages

Pages

Placement

Pages

1

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

SERIE S//MANAGEMENT ADVISORY

2

3

4

Global

Creative

Partners

Local

Creative

Partners

]

5-1

5T

ea

ms

Regional

Localization

Teams

]

20

-40

Off

ice

s

4 to 6 weeks

S

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

DESIGN MASTER

Local

Partner

Pages

5

LocalizationWorkflows.A.1.5 ©2008 GISTICS Incorporated, All rights reserved.

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

GISTICS

9

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

What summarizes the progressive productivity dividend

across the process maturities of a pan-regional collateral operation?

Time-to-market days gained represents total potential

acceleration of marcom workflows and processes. However,

A process-maturity level constitutes a stabilized operational

in practice, most firms “reinvest” 30 to 50 percent of the

capability of a center excellence such as a pan-regional

days gained in achieving greater refinement or optimization

collateral operation.

of individual marcom projects, greater levels of integration

The figure and table below depict the typical savings

with other marcom activities, and fewer late-night hours

accrued by level of process maturity of a pan-regional

and weekends.

collateral operation. These figures represent the new savings

Total number of staff days saved aggregates hundreds to

realized by each level and do not include savings from

thousands of 5- to 20-minute slices of each worker’s day.

previous levels.

Days available for new projects summarizes these - 5Estimated cost avoidance represents a total potential

to 20-minute slices of time across an entire marketing

savings, including hard-cost savings in the form of lower

operation.

direct expenses and soft-cost savings in the form of

Total number of staff full-time equivalents (FTEs) saved

unburdening employees and independent contract workers.

represents a realistic summary of operational efficiency

Productivity dividend represents the amount of money—

gains. However, to realize this gain, managers must

hard-cost savings—that a firm can reallocate to other

reallocate and reprioritize the work assignments of their

spendings. For this reason, we call the productivity dividend staff and contractors.

new money, calling attention to the opportunity to buy

FTEs available for new projects represents the realistic

more media or creative within a preexisting budget.

outcome of such a reallocation of work among staff and

contractors.

FUN D S A V A I L A B LE FROM G RE A TER P RO D U C T I V I TY I N C RE A SE STR A TE G I C S P EN D I N G S

EACH PROCESS-MATURITY LEVEL PAYS

OPERATIONAL

SPENDINGS

OPERATIONAL

SPENDINGS

OPERATIONAL

SPENDINGS

STRATEGIC

SPENDINGS

STRATEGIC

SPENDINGS

STRATEGIC

SPENDINGS

FREED FTEs

FOR NEW

PROJECTS

PRODUCTIVITY

DIVIDEND

INCREMENTAL

STRATEGIC

SPENDINGS

Current Spend

Greater Operational Efficiencies

ProductivityDividend.1.5 ©2008 GISTICS, All rights reserved.

The greatest savings and

number of freed up FTEs result

from Centralized Collateral

Production, emphasizing

the dramatic reduction of

local in-country resources

dedicated to translation of copy,

regionalization of imagery, and

production of final artwork for

printed collateral.

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

Future Spend

SIX STAGES OF A PROCESS-MATURITY MODEL FOR A COLLATERAL OPERATION

0 1 2 3 4 5

Asset

Consolidation

Asset

Consolidation

(DAM only)

with Manual

Centralized

Localization and

Production

Centralized

Collateral

Production

Sourcing

Alignment

Federalized

Localization

Strategic

Sourcing of

of Creative Partners

Workflows and

Processes

Creative Content

and Production

and Localization

PROGRESSIVE ECONOMIC GAINS BY LEVEL OF PROCESS-MATURITY PHASE

Estimated cost avoidance

$2,124

$815,918

$6,632,361

$728,516

$1,849,227

$2,436,274

Productivity dividend: new money

$1,487

$571,143

$4,642,653

$509,961

$1,294,459

$1,705,392

24 DAYS

13 DAYS

35 DAYS

12.5 DAYS

12.5 DAYS

26.5 DAYS

Total number of staff days saved

2,575 DAYS

973 DAYS

8,014 DAYS

874 DAYS

2,142 DAYS

2,905 DAYS

Days available for new projects

1,674 DAYS

633 DAYS

5,209 DAYS

568 DAYS

1,392 DAYS

1,888 DAYS

Time-to-market days gained

Detail data items

$2,017

$762,125

$6,276,467

$684,430

$1,677,361

$2,275,235

Total Material Savings

$65,345

$36,320

$231,573

$28,064

$129,485

$111,017

Total Overhead Savings

$41,917

$17,473

$124,321

$16,021

$42,207

$50,022

Total Labor Savings

FULL-TIME EQUIVALENTS (FTEs) ADDED BY GREATER OPERATIONAL EFFICIENCY

Total number of staff FTEs saved

11

4

34

4

9

12

FTEs available for new projects

7

3

22

2

6

8

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

10

GISTICS

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

executive white paper

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

What financial analysis justifies the business decision to

outsource localization to a pan-regional collateral operation?

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

OUTSOURCING ECONOMICS

Outsourcing to a pan-regional collateral operation entails

little or no upfront costs. Most of these operations charge

by the individual unit cost of a localized, print-ready

page, achieving a 70 percent cost reduction at level two,

BUSINESS ASSUMPTIONS

Annual revenues from EMEA operations

Centralized Collateral Production. Additional dividends

accrue in the form of lower costs for creative designs at

level three, Sourcing Alignment of Creative Partners,

faster time to secondary markets at level four, Federated

Localization Processes, et cetera.

COUNTS

1

FINANCIALS

$1,000,000,000

Annual EMEA marketing spend

$100,000,000

Amount spent on creative and related work

($30,000,000)

Amount spent on media planning and placement

($49,000,000)

Amount spent on collateral printing and distribution

($21,000,000)

COLLATERAL PRODUCTION (averaged to industry benchmark)

Number of outlets serviced

8,000

Number of annual product campaigns

40

Number of collateral format types per product

9

Number of pages per collateral format type

1

Number of pages to localize

360

Number of markets requiring localized collateral

25

Total number of pages localized

9,000

Number of localized pages with photographic images

4,500

Number of printed copies per collateral piece

10,000

Total number of printed collateral pieces

PRODUCTION COSTS (averaged to industry benchmark)

90,000,000

INTERNAL

EXTERNAL

BASELINE

Total labor costs of collateral printing and distribution

$21,000,000

Create local market concept

68%

32%

$4,200,000

Photography and retouch

34%

66%

$4,410,000

Copy translation and design localization

18%

82%

$336,000

Printing

12%

88%

$10,584,000

22%

78%

Distribution

PRODUCT LIFE CYCLE DATA (averaged to industry benchmark)

$1,470,000

1

$90

Annual product line revenues

$0

$160,000,000

Number of days in product lifecycle

240

Percentage of total sales realized in first 90 days

65%

Revenues per day in first 90 days

$1,155,555

Number of days to produce localized collaterals

25

Revenues lost due to nonavailability of collaterals

50%

Percentage of total lifecycle revenues lost

5.21%

Total life cycle revenue lost due to nonavailability of collaterals

14.73%

$2,016,626

($8,333,333)

MATERIAL

SAVINGS

$65,345

Global Marcom Asset Repository

5.57%

$762,125

$36,320

$17,473

$571,143

Centralized Collateral Production

45.84%

$6,276,467

$231,573

$124,321

$4,642,653

CYCLE TIME AND PRODUCTIVITY DIVIDENDS

Baseline: DAM at headquarters; assets not localized

Sourcing Alignment of Creative Partners

LABOR SAVINGS

OVERHEAD

SAVINGS

$41,917

NEW MONEY

$1,486,721

5.00%

$684,430

$28,064

$16,021

$509,961

Federated Localization Processes

12.25%

$1,677,361

$129,485

$42,207

$1,294,337

Strategic Sourcing of Creative, Marketing Content, and Production

16.62%

$2,275,235

$111,017

$50,022

$1,705,392

Total Labor Savings

Total Material Savings

Total Overhead Savings

New Money

Incremental Revenue created by recouping 25 days to market

TOTAL ECONOMIC BENEFIT

$13,692,243

$601,805

$291,962

$10,210,207

$8,333,333

$33,129,550

1 150 marketing and support staff in EMEA headquarters and 150 marketing and marcom staff in local countries

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

SERIE S//MANAGEMENT ADVISORY

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

GISTICS

11

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

What capabilities comprise each stage of a

process-maturity model for pan-regional collateral operations?

operational capabilities of a pan-regional

collateral operation

collateral operation achieves continuous, ongoing reduction

of costs, defects, and process cycle times.

Share and connect represents the integration of information

and IT processes among loosely coupled systems of a

marketing supply chain.

The table below depicts the operational capabilities of a

pan-regional collateral operation, calling attention to four

domains.

Collaboration support entails a growing set of best

practices and system capabilities for speeding the

communication, interaction, and collaboration among

geographically dispersed teams.

Asset quality control describes how a pan-regional

GLOBAL MARCOM

ASSET REPOSITORY

1

Higher quality, on-brand,

collateral DESIGNS brought

to market faster shared

more wisely

Process automation emphasizes the reengineering of

business processes, the automation of workflows, and the

development of real-time, policy-managed supply chains for

marketing operations.

CENTRALIZED

COLLATERAL

PRODUCTION

SOURCING

ALIGNMENT WITH

CREATIVE PARTNERS

FEDERALIZED

LOCALIZATION

PROCESSES

STRATEGIC SOURCING OF

PRODUCTION

More relevant, on brand

LOCALIZED VERSIONS of

the central marketing

materials at lower costs

brought to market faster

Greater pan-regional

transparency and process

controls enables more

precise synchronization

and faster roll out of

COLLATERAL CAMPAIGNS

Central production of

PRINT COLLATERAL with

fewer defects and review

cycles at much lower cost

to a more standardized

quality

Faster and better

controlled distribution

leads to the COLLATERAL

FACING THE CUSTOMER at

the point and time where

it matters

2

3

4

CollateralOperations.2.9 ©2008 GISTICS All rights reserved

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

5

Collaboration Support

• Creative Project Workflows

• Smart folders and work-inprocess queues

• Web workbenches for

creative and production

groups

• Auto-notification of asset

users

• Supported localization

process

• Project rooms and detailed

Web-based notes

• Certified “trusted advisors”

on call

• Auto-notification user in the

process

• Shared generation process

for creative material

• Standardized creative briefs

• Generic Brand guidelines

• Planning information and

support on upstream process

• Pan-Regional team

• Pan-regional project status

reporting

• Instant work load

prioritization and load

balancing

• Pan-Regional sourcing

process

• Pan-regional networked

supply chain

• Pan-regional planning &

forecast

• Pan-regional capacity

forecast

• Standardized processing of

assets

• Shared collateral-publishing

templates

• Multi-level user group and

user permissions

• Remote review and

approvals with visual

annotation

Project-activity reporting

• Standardized supply

creative materials

• Technical artwork standards

for Agencies

• Central execution and

responsibility for image

standardization

• Central font and color

management

• Shared effectiveness

information on assets and

materials

• Shared in store collateral

evaluation teams

• Distribution of efficiency data

of items and campaigns

• Standardized materials and

paper types

• Central paper buying

• Central materials sourcing

• Central supplier accreditation

Digital print standards

• Joined platform to work on

• Classified and searchable

Wiki-like collections of

project notes

• Controlled access to projects

and assets

• Single sign-on

• Joined platform for agencies

to supply to

• Use of local agencies

• Local generated creative

ideas in Pan-Regional

platform

• Electronic exchange

mechanisms for data

• Versatile Web Service

framework

• Published SDK and APIs

• Publish structured content

to enterprise Web content

management systems

• Shared network of suppliers

• Actively managed print

supply network including

local suppliers

• Active bidding procedure for

each within supplier network

• Channel partner access

• Automation to increase

productivity and consistency

of data

• Rules-based translation of

copy-text and metadata

• Company specific terms

reference

• Integration with Product Data

Management systems

• Integration with life cycle

management systems

• Automation to increase

productivity and consistency

of ordering

• Integrated “my price”

quotation service for print

and advertising

• Integrated budget

management

• Channel partner bonus

schemes

Asset quality control

• Standardized collection &

storage of assets

• Multiple views of a single

asset

• Detailed asset-use reporting

• User-generated metadata

(IPTC, EXIF, XMP)

• Asset version & status

control

Share and connect

• Easy distribution of assets

• Automated metadata

synchronisation with ERP

• Authorization based

access control

Asset distribution tools

Automation of manual work/process reengineering/productivity enhancement

• Automated or facilitated

processing of assets

• Auto-generation of previews

• On-demand generation of

versions of a single asset.

• Auto generation of asset

property metadata

• Auto-classification of textual

content (MS Office, Adobe

CS)

• Auto-tagging assets with

metadata

• Hot folders, scripts and wizards

• Automated artwork

generation & application of CI

• Automated artwork

generation (DTP robot)

• XML Style sheets and forms

• Print or publication-ready

files

• Automated intake and quality

control processes

• Automated check incoming

artwork against standards

• Automated check incoming

artwork against printer

requirements

• Automated PDF workflow

• On-demand refresh of

collateral layouts and

versions

• On-demand file transformation

.....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

12

GISTICS

....................................................................................................................................................................................................................................................................................................................................................................................................................................................................

executive white paper

...................

...................

SECTION III

SERIES//MANAGEMENT ADVISORY

...................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

Pan-Regional Marketing

Productivity Dividends from

Outsourced

Collateral Operations

...........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

Marc om S upply C hains

PAGE

14

15

16

17

18

19

20

ESSENTIAL QUESTIONS ADDRESSED IN THIS SECTION:

What constitutes the operational strategy of most CMOs?

What confuses many executives about the key functions of a brand and related marketing?

What single outcome must every marketing campaign, sales call, and eBusiness Web site accomplish?

How has the structure of marketing communications evolved to maximize coverage across international markets?

What constitutes a marketing supply-chain?

How do pre-press activities of marketing collateral for a new product launch run into almost unfathomable complexity and time delay?

How have marketing operations responded to globalization, integration of marcom supply chains, and demands for accountability with process transparency?

GISTICS

13

Pan-Regional

Marketing

Productivity Dividends

from Outsourced

Collateral Operations

What constitutes the operational strategy of most CMOs?

create and sustain competitive advantages in its selected

markets. This includes the creation of the following:

• New markets and revenue streams

• New customers of existing and new offerings

• Larger and more frequent orders from customers

• Greater loyalty and acceptance of system lock-ins

• Higher barriers to market entry

Each business will emphasize one or more of these

competitive advantages over others, reflecting economic

conditions, corporate lifecycles, business process maturities,

etc.

One fact, however, remains constant: the demand to

change with little or no forewarning.

This calls attention to two more critical operational

capabilities: business agility and organizational change

management.

Business agility describes the ability to reconfigure

processes and workflows within a day or less. This

capability requires an on-demand IT service management

infrastructure and the technical capability to rapidly

integrate new services to the all-important brand theaters

of the firm. For many marketing operations, this means

securing much of needed application software “as a

service.”

Organizational change management describes the

systems, processes, and accountabilities for facilitating

the rapid deployment of new systems, processes, and

accountabilities. In many respects, organizational change

management will determine medium- to long-term success

in volatile markets punctuated by all manner of disruptive

innovations and economic discontinuities.

MARSHALS AVAILABLE RESOURCES

Strategy constitutes a mechanism for directing available

resources to achieve maximum competitive strategy.

Most chief marketing officers (CMOs) know that

this mechanism comprises systems, processes, and

accountabilities for directing the resources of a complex

marketing operation.

The figure below depicts key dimensions of strategy,

emphasizing how CMOs formulate strategy as an integrated

system where each element interacts and affects all other

elements of the system.

Brand integrity defines an operational capability of a

marketing operation: how marketing staff and partners

create and execute marcom with clear brand values,

consistent expressions, and credible messages. Brand

integrity succeeds when customers and other stakeholders

develop deep, resonant emotional connections with the

brand and the brand’s community of users and advocates.

Strategic differentiation entails the translation of

customer insights and buying criteria to marcom, eliciting

desire or need for the offered product or service. Strategic

differentiation succeeds by achieving leadership in its

market category.

Market coverage describes the delivery of promotions and

marcom to all the key touchpoints with customers and trade

partners, integrating digital online channels and traditional

print and broadcast channels with point of purchase

promotions and packaging. Market coverage succeeds

with the convergence of all marcom at points of purchase,

creating an “echo effect” in the market.

Marcom supply-chain orchestration describes the

increasing levels of process integration among industry

partners, emphasizing more agile

sourcing and procurement of creative M A NY F A C TORS C ONTR I B UTE TO A SUST A I N A B LE C OM P ET I T I V E

service, marketing content, and

A D V A NT A G E

production. Marcom supply-chain

orchestration succeeds by producing

productivity dividends: new money

for strategic spendings.

Digital brand interaction

describes the newest and fastest

USE SYSTEMS, PROCESSES, AND ACCOUNTABILITIES TO MARSHAL THESE RESOURCES OF A MARKETING OPERATION

growing operational capability,

provisioning contextualized

BRAND

STRATEGIC

MARKET

MARCOM

DIGITAL BRAND

INTEGRITY

DIFFERENTIATION

COVERAGE

SUPPLY-CHAIN

INTERACTION