A Silent Crime You Can Prevent

advertisement

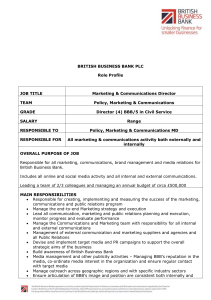

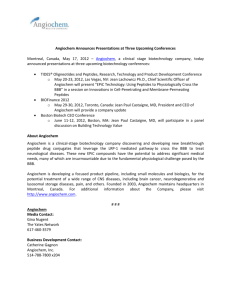

Media Contact: Peggy Penders 716.923.4490 Cell – 716.830.3238 ppenders@upstatenybbb.org A Silent Crime You Can Prevent Free Identity Theft Prevention Event Aims to Arm Attendees with Important Information, Free Credit Reports and On-Site Document Shredding Buffalo, NY – October 12, 2009 – More than eight million Americans have their identities stolen each year. In 2008, 10 million Americans fell victim to identity theft fraud costing more than $48 million. There have been breaches of secure information in nearly every sector of the business community, not just in the credit industry. It also reaches into education, health care, banking, and even into government sectors. Anyone can be affected by identity theft. The Better Business Bureau (BBB), in partnership with the National Foundation of Credit Counseling, is working daily to build awareness of this problem. To help consumers and business alike, the BBB and Consumer Credit Counseling Services of Buffalo (CCCS) will host “Secure Your ID Day” on October 17th, to kickoff National Protect Your Identity Week which runs until the 24th. Western New Yorkers are invited to learn more about how to prevent the silent crime that could strike anyone and focus on this important aspect of overall personal financial literacy. The average victim’s loss per identity theft incident is $4,849, but more than that, the victim of identity theft will spend an average of 600 hours and $496 resolving the issues related to the crime. Prevention is the best answer to this growing problem. “Shredding sensitive paper documents is a good start, but there’s more for people to know and do,” said David Polino, Better Business Bureau president. “The BBB is dedicated to building trust in the marketplace and part of that work includes educating the public on ways they can protect themselves from scam artists often behind this crime and learn simple steps everyone can take to prevent ID theft in their daily lives, both online and off.” Secure Your ID Day Details: Who: Presented by the BBB and Consumer Credit Counseling Services of Buffalo (CCCS), along with Evans Bank, WGRZ-TV and Shred-it as event sponsors. What: Free on-the-spot document shredding, Free credit reports by request, Educational Seminars, tips and resources to help you learn how to protect your identity. Bring up to three boxes or bags of documents to be shredded and take home tips and resources to help protect you from identity theft. Documents to be shredded should be removed from binders and staple free. When: Where: Saturday, October 17, 2009, from 10AM to 2PM E.C.C. North Campus, corner of Main St. and Technology Drive, Building 300, Williamsville, New York, 14221 (716-851-1433, Day of Site Contact) ID Theft FACTS: • • • • • • Data breaches rose 68 percent in 2008 over the previous year 42 percent of victims discovered that their identity was stolen more than seven months after it first occurred In 35 percent of all cases, the victim knew who had misused their personal information 26 percent of identity theft victim information was misused through credit card fraud 24 percent of identity theft complaints were a part of Generation Y (ages 18-29) It is estimated that 13 percent of all victims reported a family member or relative as the person responsible for misusing their personal information “Access is a significant factor linked to this crime,” said Paul Atkinson, CCCS president. “Our goal is to help people make their information less accessible and empower them to be their own first line of defense against identity theft.” ### About BBB BBB, the leader in advancing marketplace trust, is an unbiased not-for-profit organization that sets and upholds high standards for fair and honest business behavior. Businesses that earn BBB accreditation contractually agree and adhere to the organization’s high standards of ethical business behavior. BBB provides objective advice, free business BBB Reliability ReportsTM and charity BBB Wise Giving ReportsTM, and educational information on topics affecting marketplace trust. To further promote trust, BBB also offers complaint and dispute resolution support for consumers and businesses when there is difference in viewpoints. The first BBB was founded in 1912. Today, 124 BBBs serve communities across the U.S. and Canada, evaluating and monitoring nearly 4 million local and national businesses and charities. Please visit bbb.org for more information about BBB. About CCCS CCCS of Buffalo, Inc. has been helping Western New Yorkers with financial education and credit repayment problems for over 40 years right here in Western New York. The Agency also offers Creditor Repayment Plans, One-On-One Budgeting Sessions, Credit Report Reviews, and Reverse Mortgage Counseling and Foreclosure/Loss-Mitigation Counseling. CCCS of Buffalo, Inc. offers free financial education courses at the main West Seneca location. CCCS is a member of the National Foundation for Credit Counseling, accredited by the Council on Accreditation of Services for Families & Children (COA), Inc., a member of the Better Business Bureau and is a certified HUD counseling agency. CCCS of Buffalo, Inc. can also provide a variety of workshops and seminars to local organizations on topics such as Credit Repair, Credit Report, Identity Theft and other valuable services to consumers at low or no charge. For more information please call 716-712-2060 or visit www.consumercreditbuffalo.com.