AFI AR 2009 - Ayala Foundation, Inc.

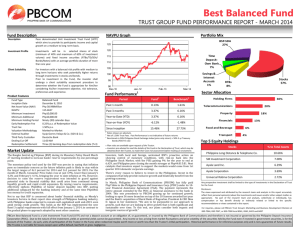

advertisement