2012 Wells Timberland REIT Annual Report

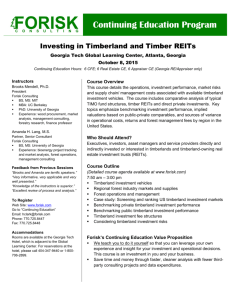

advertisement