SUSTAINING EXCELLENCE

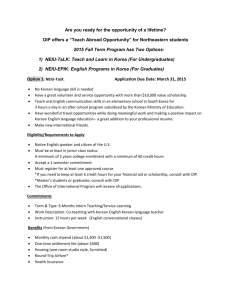

advertisement