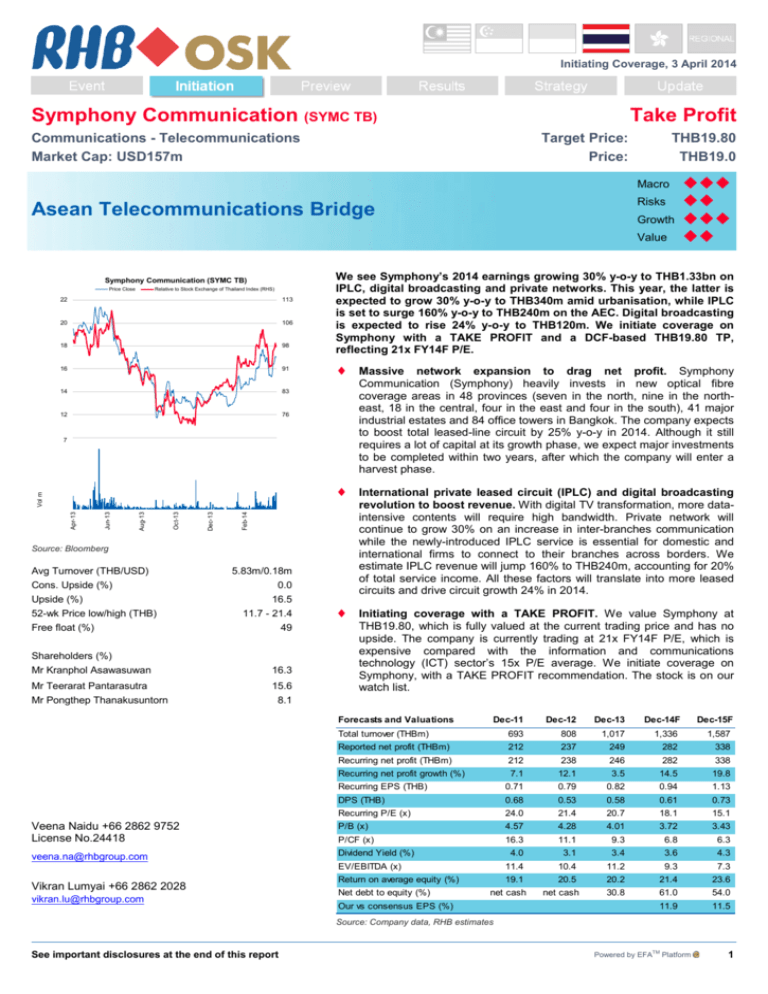

Initiating Coverage, 3 April 2014

Symphony Communication (SYMC TB)

Take Profit

Communications - Telecommunications

Market Cap: USD157m

Target Price:

Price:

THB19.80

THB19.0

Macro

Risks

Asean Telecommunications Bridge

Growth

Value

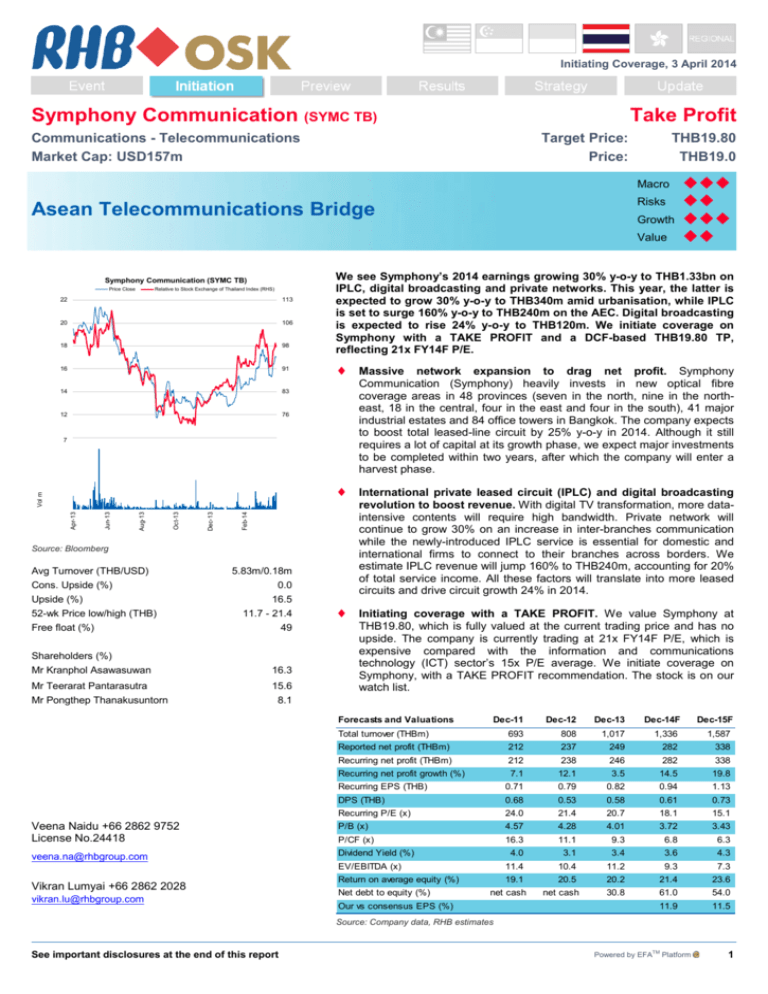

Symphony Communication (SYMC TB)

Price Close

Relative to Stock Exchange of Thailand Index (RHS)

22

113

20

106

18

98

16

91

14

83

12

76

10

7

68

5

4

Feb-14

Dec-13

Oct-13

Aug-13

Jun-13

1

Apr-13

Vol m

2

Source: Bloomberg

Avg Turnover (THB/USD)

Cons. Upside (%)

Upside (%)

52-wk Price low/high (THB)

Free float (%)

5.83m/0.18m

0.0

16.5

11.7 - 21.4

49

Shareholders (%)

Mr Kranphol Asawasuwan

16.3

Mr Teerarat Pantarasutra

Mr Pongthep Thanakusuntorn

15.6

8.1

Massive network expansion to drag net profit. Symphony

Communication (Symphony) heavily invests in new optical fibre

coverage areas in 48 provinces (seven in the north, nine in the northeast, 18 in the central, four in the east and four in the south), 41 major

industrial estates and 84 office towers in Bangkok. The company expects

to boost total leased-line circuit by 25% y-o-y in 2014. Although it still

requires a lot of capital at its growth phase, we expect major investments

to be completed within two years, after which the company will enter a

harvest phase.

International private leased circuit (IPLC) and digital broadcasting

revolution to boost revenue. With digital TV transformation, more dataintensive contents will require high bandwidth. Private network will

continue to grow 30% on an increase in inter-branches communication

while the newly-introduced IPLC service is essential for domestic and

international firms to connect to their branches across borders. We

estimate IPLC revenue will jump 160% to THB240m, accounting for 20%

of total service income. All these factors will translate into more leased

circuits and drive circuit growth 24% in 2014.

Initiating coverage with a TAKE PROFIT. We value Symphony at

THB19.80, which is fully valued at the current trading price and has no

upside. The company is currently trading at 21x FY14F P/E, which is

expensive compared with the information and communications

technology (ICT) sector’s 15x P/E average. We initiate coverage on

Symphony, with a TAKE PROFIT recommendation. The stock is on our

watch list.

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

Total turnover (THBm)

693

808

1,017

1,336

1,587

Reported net profit (THBm)

212

237

249

282

338

Recurring net profit (THBm)

212

238

246

282

338

Recurring net profit growth (%)

7.1

12.1

3.5

14.5

19.8

Recurring EPS (THB)

0.71

0.79

0.82

0.94

1.13

DPS (THB)

0.68

0.53

0.58

0.61

0.73

Recurring P/E (x)

24.0

21.4

20.7

18.1

15.1

Veena Naidu +66 2862 9752

License No.24418

P/B (x)

4.57

4.28

4.01

3.72

3.43

P/CF (x)

16.3

11.1

9.3

6.8

6.3

veena.na@rhbgroup.com

Dividend Yield (%)

4.0

3.1

3.4

3.6

4.3

EV/EBITDA (x)

11.4

10.4

11.2

9.3

7.3

Return on average equity (%)

19.1

20.5

20.2

21.4

23.6

30.8

61.0

54.0

11.9

11.5

Shariah compliant

Vikran Lumyai +66 2862 2028

vikran.lu@rhbgroup.com

Forecasts and Valuations

Net debt to equity (%)

net cash

Our vs consensus EPS (%)

net cash

Source: Company data, RHB estimates

See important disclosures at the end of this report

3

.

2

0

.

3

0

0

.

2

0

0

We see Symphony’s 2014 earnings growing 30% y-o-y to THB1.33bn on .

0

IPLC, digital broadcasting and private networks. This year, the latter is 0

expected to grow 30% y-o-y to THB340m amid urbanisation, while IPLC 0

is set to surge 160% y-o-y to THB240m on the AEC. Digital broadcasting

is expected to rise 24% y-o-y to THB120m. We initiate coverage on

Symphony with a TAKE PROFIT and a DCF-based THB19.80 TP,

reflecting 21x FY14F P/E.

6

3

Powered by EFATM Platform

1

Symphony Communication (SYMC TB)

3 April 2014

Table Of Contents

See important disclosures at the end of this report

Valuation And Recommendation

3

Shareholder Structure

4

Core Business

5

Technology And Service Application

8

ICT & Communication Industry

9

Competition In The Industry

12

Financial Analysis

14

2

Symphony Communication (SYMC TB)

3 April 2014

Valuation And Recommendation

Long-term growth is questionable. We believe Symphony deserves to trade at a

premium, although its long-term growth is questionable. Hence, we do not expect the

company to trade at the same level as it did previously, since it is still in the

investment cycle and earnings will likely be depressed this year.

Moats: medium

o

o

o

o

Economies of scale: yes

Network effect: no

Switching cost: low

Rights/trademarks: yes

Five forces analysis

o

o

o

o

o

New entrance: high

Substitute services: low

Power of customers: medium

Power of suppliers: low

Competitors: medium

Valuation. We estimate Symphony’s TP at THB19.80, based on the following

assumptions: i) WACC of 10.55%, ii) terminal growth of 3%, and iii) using long-term

growth for stabilised services, ie access network and internet access at 5% and 8%

respectively. For growing business such as IPLC, private networks and digital

broadcasting, we assume growth rate of 160%, 30% and 24% respectively. Using the

DCF method, we calculate an equity value of THB5.93bn.

Recommendation. Our new THB19.80 TP is pegged to a P/E of 21x, which is 20%

above its long-term mean of 17.5x P/E. Investors should take profit on Symphony, or

add the stock to a further buy list due to its: i) questionable long-term growth and a

no-switching cost business model, ii) a deterioration in net profit margin to 24% from

35%, iii) change towards increasing capital because of its negative free cash flow,

and iv) high interest-bearing debt from heavy investment.

Figure 1: ICT sector’s P/E band

Figure 2: SYMC’s P/E band

Source: Bloomberg

Source: Bloomberg

Figure 3: Peer comparison

Company

P/E (x)

Market Cap (THB)

2014F

P/BV (x)

2015F

2014F

EV/EBITDA (x)

2015F

2014F

2015F

Dividend yield (%)

2014F

2015F

ROE (%)

2014F

2015F

SYMC

5,130

21.06

17.58

3.37

3.10

8.54

6.66

3.97

4.75

20.59

22.70

CSL

6,300

11.93

11.09

4.68

4.40

7.75

7.35

7.45

7.89

38.91

39.39

SAMART

18,415

10.76

9.61

2.26

1.74

6.19

5.41

4.92

5.57

22.71

21.45

SAMTEL

8,524

8.90

8.61

2.35

2.11

5.48

5.25

5.96

6.64

28.64

26.47

SIM

15,030

14.59

13.08

4.25

3.63

11.82

10.82

3.35

4.03

29.39

28.37

THCOM

45,200

25.74

20.18

2.78

2.53

10.07

9.09

1.96

2.53

11.16

12.98

JAS

56,385

15.15

12.27

4.32

3.69

8.31

7.19

3.25

4.27

31.33

31.42

AIT

5,931

11.15

10.08

2.99

2.31

7.76

7.69

5.82

6.28

26.72

23.98

MFEC

3,664

10.12

8.45

1.92

1.76

6.95

5.91

5.98

7.13

19.05

20.89

TRUE

100,258

N/A

N/A

9.41

7.27

9.81

8.22

N/A

N/A

N/A

N/A

DTAC

275,850

20.21

16.53

8.01

7.98

8.90

7.78

4.98

6.08

40.20

46.80

ADVANC

671,920

17.30

15.67

14.33

14.07

9.98

8.92

5.75

6.40

84.10

89.37

INTUCH

247,695

15.04

12.88

9.18

8.99

69.42

58.83

6.32

7.42

76.58

79.07

15.16

13.00

5.37

4.89

13.15

11.47

4.98

5.75

35.78

36.91

Average

Source: Bloomberg, RHB estimates

See important disclosures at the end of this report

3

Symphony Communication (SYMC TB)

3 April 2014

Shareholder Structure

Symphony was founded in Nov 2005. The company’s major shareholders are the

Asawasuwan (16.36%) and Pantarasutra families (15.6%). Mr Kranphol

Asawasuwan, the company’s CEO, had been working at United Communication Co

Ltd (UCOM) as a network engineer for more than 15 years before he founded two

companies – Violin and Symphony. With his extensive experience and connection in

the telecommunication business, we believe that he will guide the company in the

right direction.

Figure 4: Symphony’s shareholder structure

Source: Company data

Company has five operation licenses

consisting of:

o Internet type I

o Internet type II with network

o Telecom type II with network

o Telecom type III

o TV broadcasting license

FTTx

(fibre optic to X) is an internet

technology using fibre optic network to

transmit data. X represents the destination

of the recipients which comes in various

forms such as FTTH (fibre to the home),

FTTO (fibre to the office) or FTTB (Fibre to

the building)

In 2006, Symphony received Telecom license type II (15 years), which allowed the

company to have its own network. It also received “right of way” permit which allowed

the installation of optical fibre on electrical posts in 2007. Consequently, the company

installed a 97km optical fibre and rented an additional 125km fibre from CAT

Telecom. Moreover, the company landed a 10-year contract to install a 192-core fibre

optic along the BTS line to serve massive number of BTS passengers. In 2011,

Symphony received Telecom license type III (15 years) to operate an IPLC service.

New subsidiary to serve last-mile networks services. The company founded

Diamond Line Services in 2013 to offer installation, repairing and maintenance

service for telecommunication equipment and last-mile networks. Recently,

Symphony started a fibre optic to X (FTTx) service using GPON (gigabit passive

optical network) via fibre optics for small and medium enterprises (SMEs).

Figure 5: Company structure

Source: Company data

Core Business

See important disclosures at the end of this report

4

Symphony Communication (SYMC TB)

3 April 2014

The optical fibre network has unlimited speed

and carries a vast amount of data with almost

no risk of data losing. In Thailand, the price of

fibre optic cables is lower than that of copper

wires. A new 60-core (30 pairs) fibre costs

about THB50 per metre

Fibre optics a back-bone of all communication services. Symphony provides a

premium hi-speed communication network service using optical fibre. The optical

fibre network is a highly efficient infrastructure. One small optical fibre can transmit

up to 100Gbps in 20km distance without signal lost because of its insulation property,

hence leaving no electromagnetic or interference issues. The company’s services

comprise six main categories – Internet access, access network, base station

network, private network, IPLC and digital broadcast. Symphony is positioned to be

the regional network service provider and will move forward to be the Asean

telecommunication highway.

Figure 6: Symphony’s services

IPLC / Local Loop

Internet Access

Access Network

For Data Center

Telecommunication

network technology is

divided into two parts: i) core network which

is the infrastructure of service providers, and

ii) last mile which is the last section of

network connecting service providers to endusers such as 3G, Wi-Max or 4G LTE.

Symphony’s technology belongs to the first

part, which will not be negative affected by

technology changes

Base Network

For operators

Fiber Optic

Network

Private Network

Digital Broadcast

Source: Company data

New core network will support long-term growth. By expanding into major hubs,

Symphony’s infrastructure currently covers over 48 provinces, 41 industrial estates

and 84 office towers. The company heavily invests in a brand-new network to

substitute an Electricity Generating Authority of Thailand (EGAT) network, which will

save the company THB60m per year. It plans to invest THB500m on backbone

network this year to capture major rural areas and introduce FTTx services to SMEs.

Another THB350m will be spent on last-mile network to utilise its core network with a

target of 1,200 new leased circuits (5,000 circuits in 2013 – revenue per circuit at

around THB0.2m). The company needs to invest on backbone equipment worth

THB200m every year and THB200-300m on last-mile network equipment depending

on revenue growth. We estimate Symphony’s capex at THB1,000m, THB560m and

THB650m during 2014-2016.

Figure 7: Symphony’s network coverage

Source: Company data

See important disclosures at the end of this report

5

Symphony Communication (SYMC TB)

3 April 2014

IPLC,

private network and digital broadcast,

which are Symphony’s flagship products in

the coming years, will boost its 2014 revenue

by 30%

Revenue

drivers are: i) an increase in the

number of leased line circuit, and ii) revenue

per circuit increment, for example customers

request more speed. Depending on the types

of services and maximum speed, revenue per

circuit varies from THB10,000 to THB100,000

per month

Application trend is changing. With global connectivity, international enterprises

need a service to connect their international branches to domestic headquarters. An

IPLC provides the best solution. As this service requires high reliability and extra-high

speed, synchronous digital hierarchy (SDH) technology is used for the core network.

The connections need a delicate leased circuit to carrying data across the borders.

Currently, the company has four IPLC gateways at Sakaew, Singkhla, Nong-Khai and

Tak provinces, which connect to Cambodia, Malaysia, Laos and Myanmar

respectively. With the media convergence era approaching, Symphony signed a 3year contract in 2012 with the Cable Thai Holding Public Company (CTH), a cable TV

service provider, to provide backbone networks for broadcasting to major provinces,

eg Phuket, Chiang Mai, Udon Thani and Khonkaen. The company plans to develop

multi-platform broadcasting for TV programme producers and contents providers on

various platforms such as TVs, smartphones, tablets or computers.

Shift in revenue contribution. In the past two years, Symphony has successfully

expanded into two new segments – IPLC and digital broadcasting, each contributed

9.40% of its 2013 revenue. Internet access and private network revenue contribution

decreased to 63% in 2013 from 75% in 2010 due to a new service introduction. With

revenue shifting to IPLC service, we estimate 160%, 30% and 24% growth from

IPLC, private network and digital broadcasting respectively. IPLC service will

contribute 19% to the company’s topline this year.

Figure 8: Revenue contribution by application

Source: Company data, RHB estimates

Figure 9: Revenue by technology

Figure 10: Revenue compared to leased circuit market

Source: Company data

Source: SIPA, ATCI, NSTDA, RHB estimates

See important disclosures at the end of this report

6

Symphony Communication (SYMC TB)

3 April 2014

Figure 11: Ready Ethernet area – 84 buildings with Ready Ethernet available

Source: Company data

Figure 12: Industrial coverage area – 41 industrial estates available

Source: Company data

See important disclosures at the end of this report

7

Symphony Communication (SYMC TB)

3 April 2014

Technology And Service Application

Source: Company data

Comparison

Min speed: SDH > ME > RE > EoSDH > TDM

Max speed: ME > RE = SDH = EoSDH >

TDM

Price: SDH > TDM > EoSDH > > ME > RE

Response time (lesser is better)

EoSDH < SDH < SDH < ME < RE

Six applications for six technology types. Each technology type suits a particular

application. Both Metro Internet (ME) and Ready Internet (RE) are Ethernet services,

except RE focuses on leading commercial buildings in the Bangkok Metropolitan area

and offers lower prices. Digital broadcasting companies, data centres and internet

service providers (ISP) normally prefer ME over RE because it has a delicate circuit

without shared bandwidth with other companies in the same building. Time division

multiplexing (TDM), synchronous digital hierarchy (SDH) and Ethernet over SDH

(EoSDH) are similar technologies, except TDM’s last mile uses copper wires that limit

maximum speed to 2Mbps. Customers who are time-sensitive and need large

bandwidth, ie telecom operators and securities companies, normally use SDH. As

dark fibre is a naked optical fibre service, customers need to have their own

management and maintenance team. This service is usually used by commercial

banks like Siam Commercial Bank (SCB TB, NEUTRAL, TP: THB156) and Kasikorn

Bank (KBANK TB, NEUTRAL, TP: THB170).

Figure 13: Symphony’s customers

Application

Technology

Internet Access

ME, RE, TDM

Access Network

(Data Center)

ME, RE

Base Station Network

(Mobile Operators)

SDH

IPLC / International Circuit Local Loop

SDH, EoSDH

Digital Broadcast

ME, RE

Private Network

ME, RE, TDM,

Dark Fiber

Source: Company data, RHB estimates

See important disclosures at the end of this report

8

Symphony Communication (SYMC TB)

3 April 2014

ICT And Communication Industry

ICT market to grow modestly in 2014. According to the National Science and

Technology Development Agency (NSTDA), Thailand’s ICT market (comprises

computer hardware, software & software services and communications) – which

includes both public and private sectors – is worth an estimated THB750bn and

grows at an average 8% per year. The communication sector – which is worth

THB444bn or 60% of the ICT market – is the most essential function in the ICT

industry. This sector accounted for 4% of the country’s GDP in 2013 and rising. The

NSTDA estimates that 2014 ICT spending will grow 10% y-o-y, supported by

continuous investments from 3G networks, as well as a decline smartphone prices.

Figure 14: ICT industry map

Source: NSTDA, RHB estimates

The communication sector – which is divided

into equipment and services – is the main

driver of the ICT market

Communication service is growth leader. Communication service consists of five

sub-segments – fixed-line, mobile, internet service provider, international call/VoIP

and data communication. The National Broadcasting and Telecommunication

Commission (NBTC) estimates a 18% CAGR over the next three years, driven by

non-voice services, broadband internet and leased circuits. Given the proliferation of

3G technology, non-voice mobile services have become a part of our daily life.

Mobile operators reported data usage growth of 34% CAGR during 2010-2012.

Meanwhile, Thailand’s fixed-line internet broadband penetration rate is as low as 7%,

compared to neighbouring countries such as Hong Kong, Japan, Singapore, China

and Malaysia, at 31.6%, 27.9%, 26.1%, 13% and 8.4% respectively. While Advanced

Info Service or AIS (ADVANCE TB, BUY, TP: THB248), Total Access

Communication (DTAC TB, BUY, TP: THB116) and True Corp (TRUE TB, NR))

dominate in the mobile broadband arena, the fixed-line broadband market is

dominated by TRUE, TOT and 3BB with market share of 36.8%, 31.7% and 28.7%

respectively. The Ministry of Information and Communication Technology (MICT)

estimates broadband internet subscribers to reach 10 million people by 2020.

Rising demand for data communication services. As Thailand is approaching the

Asean Economic Community (AEC), demand for high-speed leased circuit will

increase exponentially over the next five years, supported by international firms such

as Verizon, SingTel, Google or Facebook, as well as domestic companies such as

Thai Beverage (THAIBEV SP, BUY, TP: SGD0.67), Siam Commercial Bank and

Central Retail Corp. Consequently, Data communication companies such as

Symphony, Jasmine International (JAS) and TRUE pre-expand their networks across

the country in order to support growing demand. More FTTx will be needed to serve

high-definition content like digital-TV and TV-on-demand. Fibre last mile will be

expanded to urban areas of each region. Based on industry estimate, leased circuit

services are set to grow to THB30bn, or a 15% CAGR over the next five years. The

sector is expected to outperform in the long run.

See important disclosures at the end of this report

9

Symphony Communication (SYMC TB)

3 April 2014

Figure 15: Communication services sector

Data

communication service is divided into

two sub-categories – leased circuit and

others such as virtual private network (VPN),

frame relay and ATM. Total market value of

data communication service in 2012

amounted to THB28bn, of which 40% or

THB12bn was leased circuit

Source: NSTDA, RHB estimates

Thai Telecom Master Plan will boost ICT spending. The MICT announced the

Smart Thailand 2020 mega project, which contains Smart Network with a total value

of THB30bn. The project aims to standardise Thailand’s national broadband by

connecting 80% of population to hi-speed internet up to 2Mbps, establishing ICT

centres in the community such as schools and hospitals, and connecting at least

50,000 households to hi-speed internet in commercial underserved area.

Figure 16: ICT market value and its sub-segments

Figure 17: Communication sector’s market value

Source: NBTC, RHB estimates

Source: NBTC, RHB estimates

ICT spending expects to slowdown in 2014. With no clear solutions to political

crisis in the near term, many large-scale government projects such as Smart

Network, 3G Phases II, FTTx and free Wifi, which require Cabinet approval, will be

delayed to 2015. Private companies are likely to postpone their investments until the

political situation shows signs of improvement. However, we expect the slowdown in

ICT spending to be temporary as the new Government will likely be formed in 3Q14.

See important disclosures at the end of this report

10

Symphony Communication (SYMC TB)

3 April 2014

Figure 18: International broadband policies

Figure 19: Thailand’s broadband penetration rate

Source: NBTC / G = Government / R = Regulator

Source: NBTC, RHB estimates

Figure 20: Global ICT developments

Source: ITU World Telecommunication/ ICT Indicators database/ * Estimate

See important disclosures at the end of this report

11

Symphony Communication (SYMC TB)

3 April 2014

Competition In The Industry

Infrastructure

business is capital-intensive

and has high fixed costs

Data communication service requires a lot of capital investment because network

infrastructure is a foundation of telecommunication services. Hence, competition is

not intense and there are only a few major players in the industry. There are

Government entities such as Electricity Generating Authority of Thailand (EGAT),

Metropolitan Electricity Authority (MEA) and Provincial Electricity Authority (PEA),

which own and operate national fibre optic network for electrical purposes. On the

other hand, stated-own enterprises (SOEs) such as CAT Telecom and TOT own fibre

optic network in specific routes, but they do not focus on commercial purposes.

Direct competitors are listed telecom companies such as Advanced Info Service

(AIS), Total Access Communication (DTAC), Jasmine International (JAS) and True

Corporation. Others are private-owned companies such as United Information

Highway (UIH), KIRZ and OTARO. Most of them provide various communication

services which overlap each other. From NSTDA estimates, total leased-line market

value was around THB14.5bn in 2013 and Symphony had a market share of 6.78%.

Competitors

Parents

United Information Highway (UIH)

-

Leased line, MPLS, IP VPN, IP Transit, Metro B, Hosting

Services

BB Connect

UIH

IPLC, IP VPN, IP Transit

Super Broadband Network

AIS

IPLC, IP VPN, VoIP, MPLS, Metro LAN, IIG, ISP

Advanced Data Network Communications (ADC)

AIS

ME, ATM, MPLS

DTAC TriNet

DTAC

IPLC, International Calling Service, Mobile Service

True Universal Convergence (TUC)

TRUE

Calling Service, Fixed Line

True International Gateway

TRUE

IPLC

Triple T Broadband

JAS

VoIP, IPTV, MPLS, Internet, Fixed Line

JiNet

JAS

VoIP, MPLS, Metro Ethernet

JASTEL

JAS

IPLC, IP VPN, IP Transit, Metronet, MPLS, Data Centre

Triple T Global Net

TT&T

International Gateways, Access Network

KIRZ

-

IPLC, Metro Ethernet, Leased Line, Data Centre, ISP

OTARO

-

Leased Line, Data Centre, Hosting, MPLS

CS LOXINFO

CSL

ISP, International Call, Leased line, Data Centre

INTERLINK Telecom

ILINK

Cabling, Submarine Fibre Optic Cabling

SAMART INFONET

SAMART

MPLS, Leased Line, Gigabit Internet

THAICOM

THCOM

IPSTAR, Video Broadcasting, Transponder Leasing

Symphony Communication

SYMC

ME, RE, TDM, SDH, EoSDH, IPLC, VPN, IIG, BTS Wi-Fi

Source: Companies data

Figure 21: Revenue of major data communication service companies

Source: Company data, DBD (2012 data),

Note: DTAC not included

See important disclosures at the end of this report

12

Symphony Communication (SYMC TB)

3 April 2014

Offering premium quality with neutral services. Symphony focuses on premium

services which cost 30-50% more than its competitors. Additionally, the company

mainly concentrates on business-to-business (B2B) instead of business-to-customer

(B2C) as the former generates high income per client. While leased-line service

providers normally guarantee a minimum 98% up-time via fibre-link, Symphony offers

the 99.9% Service Level Agreement (SLA), which means that it guarantees a

maximum downtime of merely 44 minutes per month. The company remains its

neutral business position as its business never overlaps with that of its customers. In

the network engineer community, Symphony is preferred as the essential link, UIH or

ADC usually serves as a secondary link, while CAT is considered the last or back-up

link.

Companies

UIH

Revenue

Net Profit

NPM (%)

3,016.35

80.33

2.66%

478.79

-45.18

-9.44%

Super Broadband Network

3,481.45

1,110.67

31.90%

True Universal Convergence

8,359.50

208.01

2.49%

True International Gateway

1,035.53

148.38

14.33%

Triple T Broadband

4,751.44

1,380.00

29.04%

551.40

7.14

1.29%

1,130.20

192.44

17.03%

195.99

1.94

0.99%

10.68

-0.85

-7.96%

1,946.64

437.96

22.50%

125.12

-2.97

-2.37%

THAICOM

5,086.12

785.99

15.45%

Symphony Communication *

1,017.09

249.37

24.52%

ADC

JiNet

JASTEL

KIRZ

OTARO

CS LOXINFO

SAMART INFONET

Average

10.17%

Source: Information from DBD website with 2012 data

Note: *Company data (2013)

See important disclosures at the end of this report

13

Symphony Communication (SYMC TB)

3 April 2014

Financial Analysis

Symphony’s

2014 revenue is expected to

grow 30% y-o-y as a result of the country’s

digital age transformation

For 2014/2015, we project Symphony’s service income to grow 30%/19% y-o-y and

net profit to grow 13%/20% y-o-y respectively, on the back of the country’s digital TV

migration and urbanisation from the AEC.

Symphony’s 2014 revenue to grow 30% to THB1.33bn. Symphony’s 2013

total revenue surged 25% y-o-y to THB1bn, mainly driven by new services ie

digital broadcast and IPLC, as well as growing demand. IPLC revenue soared 24

times to THB95m due to a lower base, while digital broadcast revenue grew 24%

to THB118m, backed by a 3-year contract with CTH. Private network revenue

grew 51% to THB261m, buoyed by expansion of coverage area. For 2014, we

expect Symphony’s service revenue to continue to grow 30% y-o-y to

THB1.33bn, supported by 160%, 30% and 24% y-o-y revenue growth in

international private leased circuit (IPLC), private network and digital

broadcasting respectively.

Figure 22: Revenue contribution

Source: Company data

The

company’s FY14 NPM will decline to

21% due to higher revenue contributions from

IPLC, which have a lower profit margin

See important disclosures at the end of this report

Service cost up 46% y-o-y to THB475m. Symphony’s service cost increased in

2013 due to cash costs such as network rental and employee expenses. Since

rental fee is in proportion to data usage, many customers use long-distance

services connecting their regional and international offices via IPLC, which push

cost beyond management’s control. This was reflected in the company’s

bottomline growth of merely 5% y-o-y as well as a decline in margin to 25% in

2013 from 29% in 2012. Symphony expects net profit margin to continue to

decline, and turn stable at 20% upon completion of its network expansion.

Provincial network rental will be reduced by the second half of the year. We

estimate sustainable gross margin of 50% and net margin of 21% over the next

three years. We expect 2013 earnings to grow 13% y-o-y from an expanded

revenue base.

Net profit margin to decline with changes in revenue contribution. In 2013,

internet access and private network were major sources of service income,

contributing 37% and 26% of total service income respectively. Access network

and international local-loop leased circuit both contributed 7%. New services ie

IPLC and digital broadcast, contributed 9% each. Revenue from IPLC services –

which are purely international services – will boost Symphony’s topline while

depress its net profit margin. We project IPLC revenue to grow 160% y-o-y to

THB247m, approximately one-fifth of 2014 total revenue.

Change estimated useful life of network assets. The company changed its

accounting estimates for useful lives of assets in 2013. Useful life of fibre optic

cables was raised to 20 years from 10, while that of telecom equipment was

increased to seven years from five. The change is positive to net profit by around

THB65m and will relieve cost pressure in 2014. As the company is operating on

its own network, operating cost will likely reduce further.

14

Symphony Communication (SYMC TB)

3 April 2014

Figure 23: Revenue, EBITDA and net profit

Figure 24: Gross profit and net profit margin

Source: Company data, RHB estimates

Source: Company data, RHB estimates

As at 4Q13, Symphony’s interest-bearing D/E stood at 32%, which was significantly

lower than the bank’s covenant requirement of 2.5x, while its interest coverage ratio

stood at 33.8x in 2013. We expect its 2014 interest-bearing D/E to increase to 63%

and interest coverage ratio to decrease to 18.6x due to long-term debt. As such, we

are confident that the company will be able to repay its debt. After significant network

investment, we estimate Symphony’s interest-bearing D/E to decrease slightly to

56% in 2015, as earnings outpace cost.

Figure 25: Interest-bearing debt-to-equity ratio

Source: Company data, RHB estimates

The company is likely to see negative free cash flow given its intensive core network

investment this year. However, its cash flow from operations is expected to grow 37%

in FY14 due to higher revenue and lower expenses, as the company has its own

network. Meanwhile, its free cash flow from operations will likely remain negative in

2014. We expect a risk of capital increase because Symphony will not have enough

cash to pay dividends.

(THBm)

CFO

CFI

FCF

CFF

Ending Cash

2010

2011

2012

2013

2014F

2015F

2016F

272.77

312.10

458.40

549.10

754.22

814.02

936.94

(491.78)

(367.87)

(309.67)

(926.81)

(1,015.70)

(562.08)

(651.11)

83.17

(138.94)

(73.08)

(373.92)

(261.48)

251.93

285.82

561.89

(124.37)

(154.77)

225.04

275.62

(245.70)

(281.96)

351.46

171.32

165.28

12.62

26.76

32.99

36.86

Source: RHB estimates

See important disclosures at the end of this report

15

Symphony Communication (SYMC TB)

3 April 2014

Financial Exhibits

Profit & Loss (THBm)

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

Total turnover

693

808

1,017

1,336

1,587

Cost of sales

(244)

(323)

(475)

(668)

Gross profit

448

485

542

668

793

(156)

(187)

(229)

(300)

(357)

Operating profit

292

298

313

368

437

Operating EBITDA

412

473

489

639

814

(119)

(175)

(176)

(271)

(377)

437

Gen & admin expenses

Depreciation of fixed assets

Operating EBIT

(793)

292

298

313

368

Other recurring income

13

12

5

5

5

Interest expense

(0)

(0)

(9)

(20)

(19)

Other non-recurring income

-

Pre-tax profit

305

(2)

308

4

312

-

-

353

422

Taxation

(93)

(71)

(63)

(71)

(84)

Profit after tax & minorities

212

237

249

282

338

Reported net profit

212

237

249

282

338

Recurring net profit

212

238

246

282

338

Source: Company data, RHB estimates

Cash flow (THBm)

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

Operating profit

292

298

313

368

437

Depreciation & amortisation

119

175

176

271

377

Change in working capital

(16)

47

121

207

99

9

10

12

405

530

621

Other operating cash flow

Operating cash flow

Interest paid

(2)

5

845

918

(19)

(0)

(0)

(9)

(20)

Tax paid

(93)

(71)

(63)

(71)

(84)

Cash flow from operations

312

458

549

754

814

(451)

(531)

(923)

83

222

Cash flow from investing activities

(368)

(310)

(927)

(1,016)

(562)

Dividends paid

(204)

(159)

(174)

(183)

(220)

400

459

(26)

Capex

Other investing cash flow

Increase in debt

69

(1)

Other financing cash flow

10

5

Cash flow from financing activities

Cash at beginning of period

Total cash generated

Implied cash at end of period

(124)

(155)

351

171

(180)

171

(6)

165

(4)

(1)

(1,016)

-

-

(562)

-

0

225

276

(246)

27

165

13

(153)

14

6

13

27

33

Source: Company data, RHB estimates

See important disclosures at the end of this report

16

Symphony Communication (SYMC TB)

3 April 2014

Financial Exhibits

Balance Sheet (THBm)

Total cash and equivalents

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

391

165

13

27

33

4

5

11

15

18

98

94

162

213

253

Inventories

Accounts receivable

Other current assets

12

21

47

47

47

Total current assets

506

285

233

302

351

Tangible fixed assets

828

1,182

1,929

2,673

2,855

Intangible assets

15

16

20

27

30

Total other assets

28

36

74

74

74

871

1,234

2,023

2,774

2,959

Total non-current assets

Total assets

1,377

1,519

2,256

3,076

3,310

Short-term debt

-

-

191

312

336

Accounts payable

126

204

438

601

714

56

39

64

163

192

182

243

693

1,076

1,242

501

Other current liabilities

Total current liabilities

Total long-term debt

1

2

213

551

Other liabilities

79

82

79

79

79

Total non-current liabilities

80

84

292

630

580

Total liabilities

262

326

985

1,706

1,822

Share capital

300

300

300

300

300

Retained earnings reserve

237

314

388

487

605

Other reserves

579

579

583

583

583

1,115

1,192

1,271

1,370

1,488

Shareholders' equity

Other equity

-

-

-

-

Total equity

1,115

1,192

1,271

(0)

1,370

1,488

Total liabilities & equity

1,377

1,519

2,256

3,076

3,310

Dec-11

Dec-12

Dec-13

Dec-14F

Dec-15F

21.3

16.6

25.9

31.4

18.8

Operating profit growth (%)

8.5

2.0

5.0

17.5

18.8

Net profit growth (%)

7.1

11.4

5.4

13.1

19.8

EPS growth (%)

7.1

11.4

5.4

13.1

19.8

Bv per share growth (%)

0.3

6.9

6.6

7.8

8.6

Operating margin (%)

42.2

36.9

30.8

27.5

27.5

Net profit margin (%)

30.7

29.3

24.5

21.1

21.3

Return on average assets (%)

16.1

16.3

13.2

10.6

10.6

Return on average equity (%)

19.1

20.5

20.2

21.4

23.6

(35.0)

(13.7)

30.8

61.0

54.0

DPS

0.68

0.53

0.58

0.61

0.73

Recurrent cash flow per share

1.04

1.53

1.83

2.51

2.71

Source: Company data, RHB estimates

Key Ratios (THB)

Revenue growth (%)

Net debt to equity (%)

Source: Company data, RHB estimates

See important disclosures at the end of this report

17

Symphony Communication (SYMC TB)

3 April 2014

SWOT Analysis

A fibre optic service provider need a license

First mover in providing premium high-speed

communication service. Its Service Level Agreement

(SLA) guarantees 99.9% service reliability

to operate business and requires a “Right of

Way” permit from EGAT, PEA or MEA to

install optical fibre

CAT Telecom

may enter the

commercial

leased-line

business

Difficulty in getting the “Right of Way” permission due

to limited space on electricity posts

New entrants

may offer same

quality of

service with

lower costs

Its IPLC

business grows

along with the

AEC

Potential FTTx

business

emerges after

urbanisation

Digital TV

transformation

will accelerate

growth in the

broadcasting

industry

Needs to invest regularly due to customer

requirement

A potential

takeover

candidate

High fixed costs

High debt as the business is still in the investment

phase

P/E (x) vs EPS growth

P/BV (x) vs ROAE

17%

15

13%

10

8%

5

4%

P/E (x) (lhs)

EPS growth (rhs)

Source: Company data, RHB estimates

Jan-15

Jan-14

Jan-13

Jan-12

0%

Jan-11

0

20.0%

3.5

17.5%

3.0

15.0%

2.5

12.5%

2.0

10.0%

1.5

7.5%

1.0

5.0%

0.5

2.5%

0.0

0.0%

P/B (x) (lhs)

Jan-15

20

22.5%

4.0

Jan-14

21%

25.0%

4.5

Jan-13

25

5.0

Jan-12

25%

Jan-11

30

Return on average equity (rhs)

Source: Company data, RHB estimates

Company Profile

Symphony Communication is a domestic network provider of high-speed data communication circuits which cover the entire business

area of Bangkok and its vicinity. The company uses optical fibre cable for its core network for infrastructure of telecommunication and

transmission such as intranet, inter-office data exchange and internet connection for large enterprises.

See important disclosures at the end of this report

18

Symphony Communication (SYMC TB)

3 April 2014

Recommendation Chart

Price Close

25

23

21

19

17

15

13

11

9

7

Nov-10

Oct-11

Aug-12

Jun-13

Source: RHB estimates, Bloomberg

Date

Recommendation

Target Price Price

2014-04-02

Source: RHB estimates, Bloomberg

See important disclosures at the end of this report

19

RHB Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

Disclosure & Disclaimer

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any representation or

warranty, express or implied, as to its accuracy, completeness or correctness. No part of this report is to be construed as an offer or solicitation of an offer

to transact any securities or financial instruments whether referred to herein or otherwise. This report is general in nature and has been prepared for

information purposes only. It is intended for circulation to the clients of RHB and its related companies. Any recommendation contained in this report does

not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This report is for the

information of addressees only and is not to be taken in substitution for the exercise of judgment by addressees, who should obtain separate legal or

financial advice to independently evaluate the particular investments and strategies.

This report may further consist of, whether in whole or in part, summaries, research, compilations, extracts or analysis that has been prepared by RHB’s

strategic, joint venture and/or business partners. No representation or warranty (express or implied) is given as to the accuracy or completeness of such

information and accordingly investors should make their own informed decisions before relying on the same.

RHB, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions in

securities of the company(ies) covered in this research report or any securities related thereto, and may from time to time add to, or dispose off, or may be

materially interested in any such securities. Further, RHB, its affiliates and related companies do and seek to do business with the company(ies) covered

in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies),

may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant investment banking, advisory or

underwriting services for or relating to such company(ies), as well as solicit such investment, advisory or other services from any entity mentioned in this

research report.

RHB and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise

from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are

alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.

The term “RHB” shall denote where applicable, the relevant entity distributing the report in the particular jurisdiction mentioned specifically herein below

and shall refer to RHB Research Institute Sdn Bhd, its holding company, affiliates, subsidiaries and related companies.

All Rights Reserved. This report is for the use of intended recipients only and may not be reproduced, distributed or published for any purpose without prior

consent of RHB and RHB accepts no liability whatsoever for the actions of third parties in this respect.

Malaysia

This report is published and distributed in Malaysia by RHB Research Institute Sdn Bhd (233327-M), Level 11, Tower One, RHB Centre, Jalan Tun Razak,

50400 Kuala Lumpur, a wholly-owned subsidiary of RHB Investment Bank Berhad (RHBIB), which in turn is a wholly-owned subsidiary of RHB Capital

Berhad.

Singapore

This report is published and distributed in Singapore by DMG & Partners Research Pte Ltd (Reg. No. 200808705N), a wholly-owned subsidiary of DMG &

Partners Securities Pte Ltd, a joint venture between Deutsche Asia Pacific Holdings Pte Ltd (a subsidiary of Deutsche Bank Group) and OSK Investment

Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity is referred to as “RHBIB”, which in turn is a whollyowned subsidiary of RHB Capital Berhad). DMG & Partners Securities Pte Ltd is a Member of the Singapore Exchange Securities Trading Limited. DMG &

Partners Securities Pte Ltd may have received compensation from the company covered in this report for its corporate finance or its dealing activities; this

report is therefore classified as a non-independent report.

As of 1 April 2014, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd do not have proprietary positions

in the securities covered in this report, except for:

a)

As of 1 April 2014, none of the analysts who covered the securities in this report has an interest in such securities, except for:

a) Symphony Communication PCL

Special Distribution by RHB

Where the research report is produced by an RHB entity (excluding DMG & Partners Research Pte Ltd) and distributed in Singapore, it is only distributed

to "Institutional Investors", "Expert Investors" or "Accredited Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not

an "Institutional Investor", "Expert Investor" or "Accredited Investor", this research report is not intended for you and you should disregard this research

report in its entirety. In respect of any matters arising from, or in connection with this research report, you are to contact our Singapore Office, DMG &

Partners Securities Pte Ltd

Hong Kong

This report is published and distributed in Hong Kong by RHB OSK Securities Hong Kong Limited (“RHBSHK”) (formerly known as OSK Securities Hong

Kong Limited), a subsidiary of OSK Investment Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity is

referred to as “RHBIB”), which in turn is a wholly-owned subsidiary of RHB Capital Berhad.

20

RHBSHK, RHBIB and/or other affiliates may beneficially own a total of 1% or more of any class of common equity securities of the subject company.

RHBSHK, RHBIB and/or other affiliates may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain

compensation for investment banking services from the subject company.

Risk Disclosure Statements

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that

losses will be incurred rather than profit made as a result of buying and selling securities. Past performance is not a guide to future performance. RHBSHK

does not maintain a predetermined schedule for publication of research and will not necessarily update this report

Indonesia

This report is published and distributed in Indonesia by PT RHB OSK Securities Indonesia (formerly known as PT OSK Nusadana Securities Indonesia), a

subsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-owned

subsidiary of RHB Capital Berhad.

Thailand

This report is published and distributed in Thailand by RHB OSK Securities (Thailand) PCL (formerly known as OSK Securities (Thailand) PCL), a

subsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-owned

subsidiary of RHB Capital Berhad.

Other Jurisdictions

In any other jurisdictions, this report is intended to be distributed to qualified, accredited and professional investors, in compliance with the law and

regulations of the jurisdictions.

DMG & Partners Research Guide to Investment Ratings

Kuala Lumpur

Hong Kong

Singapore

Malaysia

Tel : +(60) 3 9280 2185

Fax : +(60) 3 9284 8693

19 Des Voeux Road

Central, Hong Kong

Tel : +(852) 2525 1118

Fax : +(852) 2810 0908

Tel : +(65) 6533 1818

Fax : +(65) 6532 6211

Buy: Share price may exceed 10% over the next 12 months

Trading Buy:Malaysia

Share price

may exceed 15% over theRHB

nextOSK

3 months,

however longer-term outlook remains uncertain

Research Office

Securities Hong Kong Ltd. (formerly known

DMG & Partners

Neutral: Share

mayInstitute

fall within

months

as 12

OSK

Securities

Securities Pte. Ltd.

RHB price

Research

Sdn the

Bhdrange of +/- 10% over the next

Take Profit:

Target

price One,

has RHB

beenCentre

attained. Look to accumulate at lower

Honglevels

Kong Ltd.)

Level

11, Tower

10 Collyer Quay

Sell: Share price may

more than 10% over the next 12 months

Jalanfall

TunbyRazak

12th Floor

#09-08 Ocean Financial Centre

Lumpur

World-Wide House

Singapore 049315

Not Rated: Stock isKuala

not within

regular research coverage

DISCLAIMERS

Phnom

Penh

This research is issuedJakarta

by DMG & Partners Research Pte Ltd and it is forShanghai

general distribution only. It does not have any regard

to the

specific investment

objectives, financial situation and particular needs of any specific recipient of this research report. You should independently evaluate particular

PT RHB OSK and

Securities

Indonesia

(formerlyfinancial

known asadviser

RHB

OSK (China)

Advisory

Ltd. into any

RHBtransaction

OSK Indochina

Securities

Limited

(formerly

investments

consult

an independent

before

makingInvestment

any investments

or Co.

entering

in relation

to any

securities

or

PT OSKmentioned

Nusadana in this report.

(formerly known as OSK (China) Investment

known as OSK Indochina Securities Limited)

investment instruments

Securities Indonesia)

Plaza CIMB Niaga

Advisory Co. Ltd.)

Suite 4005, CITIC Square

No. 1-3, Street 271

Sangkat Toeuk Thla, Khan Sen Sok

Tel : +(6221) 2598 6888

Tel : +(8621) 6288 9611

Fax: +(855) 23 969 171

The information contained

herein has been obtained from sources 1168

we believed

to be reliable but we do not make any representation

or warranty nor

14th Floor

Nanjing West Road

Phnom Penh

accept any responsibility

or liability

as to its accuracy, completeness orShanghai

correctness.

are subject to change

Jl. Jend. Sudirman

Kav.25

20041Opinions and views expressed in this report

Cambodia

without notice.

Jakarta Selatan 12920, Indonesia

China

Tel: +(855) 23 969 161

Fax

: +(6221)

2598or6777

Faxof: +(8621)

6288

9633or sell any securities.

This report does

not

constitute

form part of any offer or solicitation

any offer

to buy

Bangkok

DMG & Partners Research Pte Ltd is a wholly-owned subsidiary of DMG & Partners Securities Pte Ltd, a joint venture between OSK Investment Bank

Berhad, Malaysia which have since merged into RHBRHB

Investment

Bank Berhad (the merged entity is referred to as “RHBIB” which in turn is a whollyOSK Securities (Thailand) PCL (formerly known

owned subsidiary of RHB Capital Berhad) and Deutsche Asiaas

Pacific

Holdings Pte

Ltd (a PCL)

subsidiary of Deutsche Bank Group). DMG & Partners Securities

OSK Securities

(Thailand)

Pte Ltd is a Member of the Singapore Exchange Securities Trading

Limited.

10th Floor,

Sathorn Square Office Tower

98, North Sathorn Road, Silom

Bangkok 10500

DMG & Partners Securities Pte Ltd and their associates, directors,Bangrak,

and/or employees

may have positions in, and may effect transactions in the securities

Thailand

covered in the report, and may also perform or seek to perform broking and

other corporate finance related services for the corporations whose securities

Tel: +(66) 2 862report.

9999

are covered in the report. This report is therefore classified as a non-independent

Fax : +(66) 2 108 0999

As of 1 April 2014, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd, do not have proprietary positions

in the subject companies, except for:

a)

As of 1 April 2014, none of the analysts who covered the stock in this report has an interest in the subject companies covered in this report, except for:

a) Symphony Communication PCL

DMG & Partners Research Pte. Ltd. (Reg. No. 200808705N)

21

Thai Institute of Directors Association (IOD) – Corporate Governance Report Rating 2013

ADVANC

AOT

ASIMAR

BAFS

BANPU

BAY

BBL

2S

ACAP

AF

AHC

AIT

AKP

AMANAH

AMARIN

AMATA

AP

APCO

APCS

ASIA

ASK

ASP

BCP

BECL

BKI

BROOK

BTS

CIMB

CK

CPF

CPN

CSL

DRT

DTAC

EASTW

EGCO

AYUD

BEC

BFIT

BH

BIGC

BJC

BLA

BMCL

BWG

CCET

CENTEL

CFRESH

CGS

CHOW

CM

ERW

GRAMMY

HANA

HEMRAJ

ICC

INTUCH

IRPC

CNT

CPALL

CSC

DCC

DELTA

DTC

ECL

EE

EIC

ESSO

FE

FORTH

GBX

GC

GFPT

IVL

KBANK

KKP

KTB

LPN

MCOT

MINT

GL

GLOW

GOLD

GSTEL

GUNKUL

HMPRO

HTC

IFEC

INET

ITD

JAS

JUBILE

KBS

KCE

KGI

NKI

NOBLE

PAP

PG

PHOL

PR

PRANDA

KKC

KSL

KWC

L&E

LANNA

LH

LHBANK

LHK

LIVE

LOXLEY

LRH

LST

MACO

MAJOR

MAKRO

PS

PSL

PTT

PTTEP

PTTGC

QH

RATCH

MBK

MBKET

MFC

MFEC

MODERN

MTI

NBC

NCH

NINE

NMG

NSI

NWR

OCC

OFM

OGC

ROBINS

RS

S&J

SAMART

SAMTEL

SAT

SC

OISHI

PB

PDI

PE

PF

PJW

PM

PPM

PPP

PREB

PRG

PT

PYLON

QTC

RASA

SCB

SCC

SCSMG

SE-ED

SIM

SIS

SITHAI

SABINA

SAMCO

SCCC

SCG

SEAFCO

SFP

SIAM

SINGER

SIRI

SKR

SMT

SNP

SPCG

SPPT

SSF

SNC

SPALI

SPI

SSI

SSSC

SVI

SYMC

TCAP

THAI

THCOM

THRE

TIP

TASCO

TKT

STANLY

STEC

SUC

SUSCO

SYNTEC

TASCO

TCP

TF

TFD

TFI

THANA

THANI

THIP

TICON

TIPCO

TK

TLUXE

TMILL

TMT

TNL

TOG

TPC

TPCORP

TPIPL

TRT

TRU

TSC

TSTE

TSTH

TTA

TBSP

TCCC

TEAM

TGCI

TIC

TIES

TIW

TKS

TMC

TMD

TMI

TNDT

TNPC

TOPP

TPA

TPP

TR

TTI

TVD

TVI

TWZ

UBIS

UEC

UOBKH

UPF

UWC

VARO

VTE

WAVE

WG

TMB

TNITY

TOP

TRC

TRUE

TTW

TVO

UV

VGI

WACOAL

TTCL zZMICO

TUF

TWFP

TYM

UAC

UMI

UMS

UP

UPOIC

UT

VIBHA

VIH

VNG

VNT

YUASA

*** PHATRA was voluntarily delisted from the Stock Exchange of Thailand effectively on September 25,2012

A

AAV

AEC

AEONTS

AFC

AGE

AH

AI

AJ

AKR

ALUCON

ANAN

ARIP

AS

BAT-3K

BCH

BEAUTY

BGI

BLAND

BOL

BROCK

BSBM

CHARAN

CHUO

CI

CIG

CITY

CMR

CNS

CPL

CRANE

CSP

CSR

CTW

DEMCO

DNA

DRACO

EA

EARTH

EASON

EMC

EPCO

F&D

FNS

FOCUS

FPI

FSS

GENCO

GFM

GJS

GLOBAL

HFT

HTECH

HYDRO

IFS

IHL

ILINK

INOX

IRC

IRPC

IT

JMART

JMT

JTS

JUTHA

KASET

KC

KCAR

KDH

KTC

KWH

LALIN

LEE

MATCH

MATI

MBAX

MDX

PRINC

MJD

MK

MOONG

MPIC

MSC

NC

NIPPON

NNCL

NTV

OSK

PAE

PATO

PICO

PL

POST

PRECHA

PRIN

Q-CON

QLT

RCI

RCL

ROJNA

RPC

SCBLIF

SCP

SENA

SF

SGP

SIMAT

SLC

SMIT

SMK

SOLAR

SPC

SPG

SRICHA

SSC

STA

SUPER

SVOA

SWC

SYNEX

WIN

WORK

*** CIMBI was voluntarily delisted from the Stock Exchange of Thailand effectively on September 25, 2012.

IOD (IOD Disclaimer)

การเปิดเผลผลการสารวจของสมาคมส่งเสริมสถาบันกรรมการบริษัทไทย (IOD) ในเรื่องการกากับดูแลกิจการ (Corporate Governance) นี้เป็นการ

ดาเนินการตามนโยบายของสานักงานคณะกรรมการกากับหลักทรัพย์และตลาดหลักทรัพย์ โดยการสารวจของ IOD เป็นการสารวจและประเมินจากข้อมูลของบรษัทจด

ทะเบียนในตลาดหลักทรัพย์แห่งประเทศไทยและตลาดหลักทรัพย์เอ็มเอไอ ที่มีการเปิดเผยต่อสาธารณะและเป็นข้อมูลที่ผลู้ งทุนทั่วไปสามารถเข้าถึงได้ ดังนั้นผลสารวจ

ดังกล่าวจึงเป็นการนาเสนอในมุมมองของบุคคลภายนอกโดยไม่ได้เป็นการประเมินการปฏิบัติและมิได้มีการใช้ข้อมูลภายในในการประเมิน

อนึ่ง ผลการสารวจดังกล่าว เป็นผลการสารวจ ณ วันที่ปรากฎในรายงานการกากับดูและกิจการบริษัทจดทะเบียนไทยเท่านั้น ดังนั้นผลการสารวจจึงอาจ

เปลี่ยนแปลงได้ภายหลังวันดังกล่าว ทัง้ นี้บริษัทหลักทรัพย์ อาร์เอสบี โอเอส เค จากัด (มหาชน) มิได้ยืนยันหรือรับรองถึงความถูกต้องของผลการสารวจดังกล่าวแต่อย่างใด