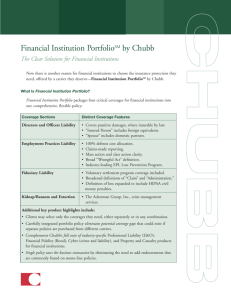

Employment Practices Liability

advertisement

CHUBB SPECIALTY INSURANCE Employment Practices Liability Insuring against the rising tide of employment practices litigation Employers face a rising tide of employment practices litigation alleging discrimination, sexual harassment, retaliation, and other torts. Our cutting-edge insurance protection, loss control expertise and solutions, and partnership approach set us apart from other insurers. Employment Practices Liability (EPL) EPL insurance protects against liability arising from employment practices with respect to claims by current, former or potential employees. An EPL policy can provide coverage for: • • • • • • • • • • • • • • discrimination (both in the hiring process and during employment) constructive dismissal, wrongful dismissal harassment (including workplace or sexual harassment) wrongful failure to employ or promote wrongful discipline wrongful deprivation of a career-opportunity failure to grant tenure negligent evaluation invasion of privacy employment-related defamation wrongful infliction of emotional distress employment-related misrepresentation breaches of occupational health and safety legislation and other employment related claims Coverage can also include protection against liability arising from a third party ie. customer, vendor, service provider or other business invitee of the organization for discrimination or harassment. Coverage is provided to the employer, its directors and officers and employees. CHUBB INSURANCE COMPANY OF CANADA Coverage can include amounts that the organization become legally obligated to pay as a result of a claim, which may include judgments, settlements and defence costs. In some cases, punitive or exemplary damages may be covered as well. As one of the leading providers of employment practices liability coverage, the Chubb Group of Insurance Companies believes that preventative measures to these liability issues include knowledgeable governance and sound risk management practices. It may not be possible for employers to completely eliminate the possibility of an employment practices liability (EPL) lawsuit. But you can reduce that threat. Employers can take steps to help reduce their EPL exposure and to prepare for a claim by positioning themselves to put forth a strong defence if a claim does hit. To that end, Chubb has developed its unique Chubb’s EPL Loss Prevention Program—available to Chubb EPL Insurance customers where permitted by law. It includes the following: 1. Workplace Law in Canada: A Primer 2. ChubbWorksSM Website 3. Loss Prevention Consultant Services CH07 05/2015 V01 Workplace Law In Canada: A Primer Chubb and the law firm of Hicks Morley LLP, a national recognized employment firm with offices across the country, have prepared this EPL risk management guide for employers in Canada. This guide is designed as an overview to help employers protect themselves against litigation and to educate them with respect to the general principles governing employment practices liability in Canada. It is not intended as a substitute for prudent legal advice and we encourage all employers to seek advice from experienced legal counsel for any and all specific issues that arise. ChubbWorksSM Website (www.chubbworks.com)— An online resource for customers seeking assistance with employment issues. Offers convenient access to: • • • • • Online training modules addressing sexual harassment, discrimination, termination, retaliation, and incident management. A comprehensive Model Employee Handbook with more than 90 model policies ranging from equal employment to social media. Best Practices Minutes—Short, on-demand presentations on important workplace topics such as disability discrimination, social media, workplace bullying, and retaliation. Employment practices self-assessment checklists and numerous other model forms and policies. Informational periodicals, employment journals, and an entire library of articles relevant to employment practices, as well as links to other valuable resources. Loss Prevention Consultant Services Chubb’s network of more than 120 top law firms, HR consulting firms, and labour economist statistical firms offer specialized services designed to help our customers create customized solutions to their employment issues. • • • • Pre-approved firms are available to customers at preferred rates Chubb chose its network of quality vendors with the goal of assuring customer satisfaction. Quality of the services offered and expertise of the service providers are our most important considerations in approving a vendor Wide selection of vendors helps ensure you will be able to find someone that meets your needs, even when your needs change Chubb will reimburse customers for a portion of the cost of preventive services (50% of the cost up to 10% of the annual EPL Insurance premium) that directly relate to the coverage offered under our EPL Insurance policy. Please note that services must be rendered and invoices must be submitted to Chubb during the applicable policy’s policy period. Services rendered by one’s own organization are not eligible for reimbursement. The Chubb Advantage Financial stability – Our financial stability and ability to pay claims rate among the best in the insurance industry, as attested by the rating we receive from the leading independent insurance rating services. The member insurers of the Chubb Group of Insurance Companies earn the highest rating for financial strength from A.M. Best. Three of our members are among the few insurers that have achieved A.M. Best’s highest rating for more than 75 years. Superior claims management – The true measure of an insurance carrier is how it responds to and manages your claim. Chubb is renowned in the industry for fair, prompt claims handling and unparalleled claims service. We understand that when you buy insurance, you’re really buying peace of mind. You want your claims handled in a professional manner that is as painless to you and your business as possible. This is the Chubb difference. Chubb Insurance Company of Canada www.chubbinsurance.com For promotional purposes, Chubb refers to member insurers of the Chubb Group of Insurance Companies: Federal Insurance Company, Vigilant Insurance Company, Great Northern Insurance Company, Pacific Indemnity Company, Northwestern Pacific Indemnity Company, Texas Pacific Indemnity Company, Executive Risk Indemnity Inc., Executive Risk Specialty Insurance Company, Quadrant Indemnity Company, Chubb Custom Insurance Company, Chubb Indemnity Insurance Company, Chubb Insurance Company of New Jersey, Chubb National Insurance Company, Chubb Atlantic Indemnity, Ltd., Chubb Insurance Company of Australia, Limited, Chubb Insurance Company of Canada, Chubb Insurance Company of Europe S.A., Chubb Argentina de Seguros, S.A., Chubb do Brasil Companhia de Seguros, Chubb de Colombia Compania de Seguros S.A., Chubb de Chile Compania de Seguros Generales S.A., Chubb de Mexico, Compania Afianzadora, S.A. de S.V., Chubb de Mexico, Compania de Seguros, S.A. de S.V., Chubb de Venezuela Compania de Seguros C.A., PT Asuransi Chubb Indonesia. Not all insurers do business in all jurisdictions. This literature is descriptive only. Whether or not or to what extent a particular loss is covered depends on the facts and circumstances of the loss and the terms and conditions of the policy as issued. Claims examples are based on actual cases, composites of actual cases, or hypothetical situations. Actual coverage is subject to the language of the policies as issued.

![9_Komlenac - start [kondor.etf.rs]](http://s2.studylib.net/store/data/005352037_1-bdc91b0717c49a75493200bca431c59c-300x300.png)