EG and Corporate Fraud - Manchester Business School

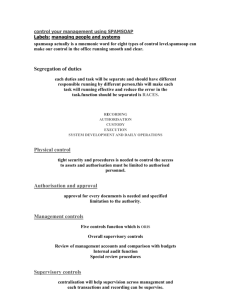

advertisement