Banks Delay Sale Of Chrysler Debt As Market Stalls - WSJ.com

http://online.wsj.com/article_print/SB118537491026477594.html

July 26, 2007

PAGE ONE

DOW JONES REPRINTS

Banks Delay Sale

Of Chrysler Debt

As Market Stalls

By DENNIS K. BERMAN, SERENA NG and GINA CHON

July 26, 2007; Page A1

Wall Street's corporate-debt machine has helped to finance the

increasingly exotic takeover deals of the buyout boom and to shore up

some of the nation's ailing industries with cheap loans and bonds. Now,

that machine is sputtering.

This copy is for your personal,

non-commercial use only. To order

presentation-ready copies for

distribution to your colleagues,

clients or customers, use the Order

Reprints tool at the bottom of any

article or visit:

www.djreprints.com.

• See a sample reprint in PDF format.

• Order a reprint of this article now .

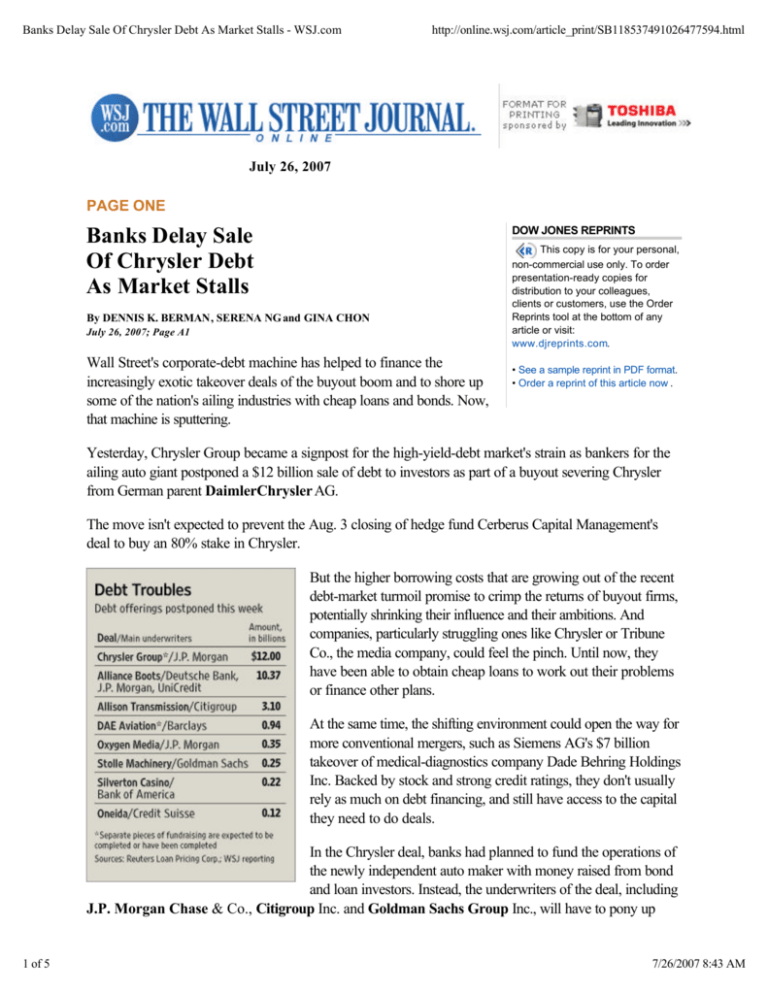

Yesterday, Chrysler Group became a signpost for the high-yield-debt market's strain as bankers for the

ailing auto giant postponed a $12 billion sale of debt to investors as part of a buyout severing Chrysler

from German parent DaimlerChrysler AG.

The move isn't expected to prevent the Aug. 3 closing of hedge fund Cerberus Capital Management's

deal to buy an 80% stake in Chrysler.

But the higher borrowing costs that are growing out of the recent

debt-market turmoil promise to crimp the returns of buyout firms,

potentially shrinking their influence and their ambitions. And

companies, particularly struggling ones like Chrysler or Tribune

Co., the media company, could feel the pinch. Until now, they

have been able to obtain cheap loans to work out their problems

or finance other plans.

At the same time, the shifting environment could open the way for

more conventional mergers, such as Siemens AG's $7 billion

takeover of medical-diagnostics company Dade Behring Holdings

Inc. Backed by stock and strong credit ratings, they don't usually

rely as much on debt financing, and still have access to the capital

they need to do deals.

In the Chrysler deal, banks had planned to fund the operations of

the newly independent auto maker with money raised from bond

and loan investors. Instead, the underwriters of the deal, including

J.P. Morgan Chase & Co., Citigroup Inc. and Goldman Sachs Group Inc., will have to pony up

1 of 5

7/26/2007 8:43 AM

Banks Delay Sale Of Chrysler Debt As Market Stalls - WSJ.com

http://online.wsj.com/article_print/SB118537491026477594.html

much of the money themselves, at least until the market settles down. Cerberus and DaimlerChrysler will

also be contributing to the kitty.

An additional $8 billion fund raising, which will be used to bolster Chrysler's finance arm, is expected to

proceed in coming days, though at higher interest rates than originally planned.

"For all practical purposes the markets are closed right now," said Chad Leat, co-head of Global Credit

Markets at Citigroup. "But they're not closed forever," he added, noting that his firm expects activity to

pick up in the fall.

Debt markets have been chaotic for weeks, as investors coped with more than $200 billion of deals

waiting to get funded. There is also nervousness about how much risk the market can bear. While

corporate defaults still hover near record lows, the recent turmoil in the subprime-mortgage market

illustrates how quickly conditions can change.

Yesterday's setback doesn't necessarily mean the buyout boom is over. Bankers managed to sell

investors $325 million in junk bonds to fund Dubai Aerospace Enterprise Ltd.'s $1.9 billion purchase of

two aircraft servicing companies from the Carlyle Group LP, though they postponed a separate sale of

$937 million in loans tied to the same deal.

But with banks now sitting on an expanding pile of unwanted loans and high-yield bonds, Wall Street's

top bankers have begun to acknowledge that deals will get more expensive.

That means the five-year run of leveraged buyouts that has poured cash into struggling industries like

automobiles and newspapers, will slow considerably. Most of those takeovers were fueled by large sums

of money borrowed at low interest rates.

The market's new wariness is already redefining the standards of the buyout game, which once let

private-equity firms dictate terms to banks, while using the easy availability of debt to finance ever-richer

offers for takeover targets.

"Prices have gotten much higher than historical trading levels for many of these companies," said Scott

Sperling, co-president of buyout firm Thomas H. Lee Partners, in an interview. "That's probably not

sustainable if debt markets adjust to more normalized levels."

The higher borrowing costs mean auto companies, for example, will be paying out more money in debt

service, leaving less money available to develop new products and technology, which are critical to

attracting customers in an increasingly competitive market.

Chrysler was already facing a buyout-related increase of at least $200 million-a-year in its debt costs.

That's roughly equivalent to the sum needed to give a significant facelift to a car model. Now, those

interest costs could potentially go even higher.

In recent months, cheap loans have given even weak companies more time to work out their problems. In

December, Ford Motor Co. easily raised $23 billion in loans and bonds to help fund its restructuring. In

late May, Tribune Co. obtained more than $7 billion in loans to finance the first part of a going-private

transaction. The media company yesterday posted a 59% drop in second-quarter net income, slightly

2 of 5

7/26/2007 8:43 AM

Banks Delay Sale Of Chrysler Debt As Market Stalls - WSJ.com

http://online.wsj.com/article_print/SB118537491026477594.html

above market expectations.

For others, that road may be closed. "The escape hatch is completely gone," says Michael Difley, a

high-yield portfolio manager at investment firm American Century. "They're going to have to fix their

businesses or instead look for a strategic buyer."

Deals across the globe are getting pinched. In Europe, bankers say they have had to hit the brakes on

nearly all big private-equity-related deals.

One such deal is the sale of Cadbury Schweppes PLC's drinks business, which has attracted attention

from a host of private-equity firms including Blackstone Group and Kohlberg Kravis Roberts & Co.

The business was expected to fetch as much as $15 billion. Now, potential buyers are saying that due to

lending conditions the deal could be postponed by months.

Europe's biggest private-equity deal to date -- the $20 billion purchase of pharmacy chain Alliance Boots

PLC by KKR and an Alliance Boots executive -- has also run into trouble. Yesterday, the banks that

arranged financing for the deal said they would hold the main £5.05 billion ($10.4 billion), eight-year term

loan portion of the debt off the market until conditions are calmer. (See related article 1.)

Few industries are as exposed to a turn in debt-market conditions as the auto industry. Detroit is already

far down the path of selling assets and issuing debt to raise cash as it tries to sort out a hornet's nest of

problems, including declining U.S. sales and massive health and pension obligations to workers. But the

process is far from complete.

Ford, for instance, is still trying to sell its Jaguar and Land Rover brands. Parts suppliers like Delphi

Corp. are also on the block. Uncooperative debt markets could complicate these sales, putting added

pressure on the companies and their work forces.

"It's a challenged auto industry running into a challenged financing market," says Brett Barragate, a

partner in the banking and finance group at law firm Jones Day. "This means deals will become more

expensive and take longer to get done."

Earlier this week, Wall Street firms postponed a sale of $3.1 billion in loans to finance the buyout of

General Motors Corp.'s Allison Transmission by Carlyle Group and Onex Corp. The buyout will go

forward, but again banks will be on the hook, possibly making them wary of getting involved in future

auto-related financings.

Just four weeks ago, such deals would have been a cinch for a corporate seller. Debt investors had for

years gobbled up hundreds of billions of bonds used to fund buyouts for vast tracts of the stock market,

ranging from Dunkin' Donuts to pipeline operator Kinder Morgan Inc. These investors seemed to

tolerate increasingly risky terms, helping fuel Wall Street's imagination as bankers and private-equity firms

batted around $50 billion and $100 billion deals.

But the rapid pace of deal making has created an oversupply of high-yield debt securities for the hedge

funds, insurers, and other institutions who buy it. They have now simply turned their backs on deals

coming to the market, causing some embarrassing turnabouts.

3 of 5

7/26/2007 8:43 AM

Banks Delay Sale Of Chrysler Debt As Market Stalls - WSJ.com

http://online.wsj.com/article_print/SB118537491026477594.html

After struggling for weeks to find investors to buy $20 billion of Chrysler Group debt, Wall Street firms

postponed the sale of $12 billion in loans for the loss-making auto maker. Instead, they will fork out $10

billion from their own pockets to finance the deal, according to people familiar with the matter.

Both Cerberus and Daimler will be lending $2 billion to Chrysler's auto business after investors shunned

the risky loans. The debt underwriters, which also include Bear Stearns Cos. and Morgan Stanley,

will initially lend the auto maker $10 billion, but intend to sell some of that to institutional investors later

on.

Chrysler also needs to raise $42 billion, much of it to compensate Daimler for existing Chrysler debt it still

holds.

The new climate in the debt market is likely to be more conservative, reining in prices paid for companies

in leveraged buyouts and tightening the lending terms underlying those purchases. But just how

conservative is a subject of debate on Wall Street.

One top lender said it would be possible over the next few weeks to stage leveraged buyouts of at least

$10 billion, and perhaps as large as $15 billion. That's a far cry from the $50 billion deals some

envisioned a few weeks ago, but still far from a moribund market. Others said it would be months before

there was real clarity about the market's appetite.

The market could tighten further, pinching banks hoping for an easier fund-raising environment in

September. In one notable development, issuance of investments called collateralized loan obligations has

waned sharply. CLOs, as they are known on Wall Street, hold large numbers of corporate loans, the

same way a mutual fund holds securities like stocks. The decline in demand for these products could be a

sign of a deeper downturn in investor demand for corporate debt.

--Tom Lauricella and Jason Singer contributed to this article.

Write to Dennis K. Berman at dennis.berman@wsj.com2, Serena Ng at serena.ng@wsj.com3 and Gina

Chon at gina.chon@wsj.com4

URL for this article:

http://online.wsj.com/article/SB118537491026477594.html

Hyperlinks in this Article:

(1) http://online.wsj.com/article/SB118540922405478308.html

(2) mailto:dennis.berman@wsj.com

(3) mailto:serena.ng@wsj.com

(4) mailto:gina.chon@wsj.com

Copyright 2007 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our

Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones

Reprints at 1-800-843-0008 or visit www.djreprints.com .

4 of 5

7/26/2007 8:43 AM

Banks Delay Sale Of Chrysler Debt As Market Stalls - WSJ.com

http://online.wsj.com/article_print/SB118537491026477594.html

RELATED ARTICLES AND BLOGS

Related Articles from the Online Journal

•

•

•

•

Banks May Sweeten Terms Of Loans for Chrysler Deal

Cerberus to Start Chrysler Road Show

Banks Plan Fundraising Effort For Cerberus's Chrysler Deal

Red-Flag Sale: LBO Debt Deals Face New Snags

Blog Posts About This Topic

• Nobody Wants to Buy Chrysler's Debt autosavant.net

• Money News - Banks Postpone Chrysler Funding Plan - AOL Money & Finance money.aol.com

More related content

5 of 5

Powered by Sphere

7/26/2007 8:43 AM