Aerospace & Defense Industry in Arizona

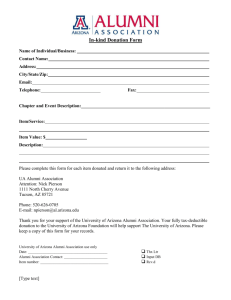

advertisement