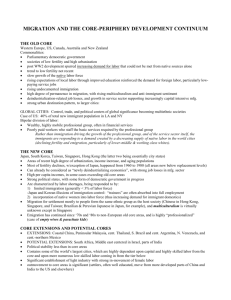

Economics and emigration - Center For Global Development

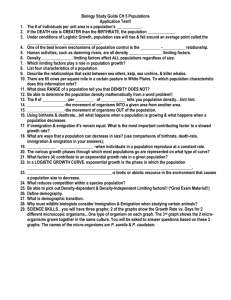

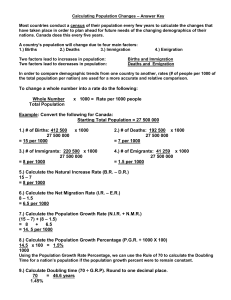

advertisement