Tax Fax

advertisement

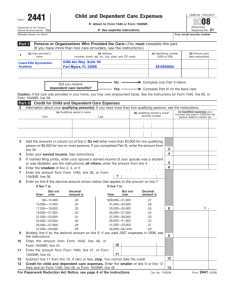

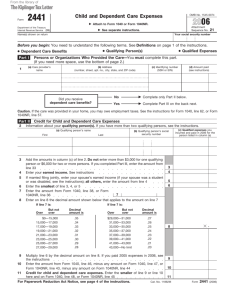

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT IRS Fax Forms for Business Catalog 16055 16106 Pages Item 4 4 61437 8 10164 4 10220 10225 2 4 11234 4 13660 10983 4 4 11242 11282 22386 50002 11285 4 6 10 17 6 11294 10642 8 2 50003 11334 8 2 24329 14374 6 2 11344 24332 11346 24333 11358 24334 2 5 2 5 2 3 Form SS-4 Application for Employer Identification Number Form SS-8 Determination of Employee Work Status for purposes of Federal Employment Taxes and Income Tax Withholding Form W-2c Statement of Corrected Income and Tax Amounts Form W-3c Transmittal of Corrected Income and Tax Statements Form W-4 Employee’s Withholding Allowance Certificate Form W-4P Withholding Certificate for Pension or Annuity Payments Form 940 Employer’s Annual Federal Unemployment Tax Return Instructions for Form 940 Form 940EZ Employer’s Annual Federal Unemployment Tax Return Form 941c Supporting Statement to Correct Information Form 990 Return of Organization Exempt from Income Tax General Instructions for Form 990 and 990EZ Specific Instructions for Form 990 Form 990 (Sch A) Organization Exempt Under Section 501(c)(3) Instructions for Form 990 (Schedule A) Form 990EZ Short Form Return-Organization Exempt from Income Tax Specific Instructions for Form 990EZ Form 1040 (Sch C) Profit or Loss from Business (Sole Proprietorship) Instructions for Form 1040 (Sch C) Form 1040 (Sch C-EZ) Net Profit from Business (Sole Proprietorship) Form 1040 (Sch E) Supplemental Income and Loss Instructions for Form 1040 (Schedule E) Form 1040 (Sch F) Profit or Loss From Farming Instructions for Form 1040 (Schedule F) Form 1040 (Sch SE) Self-Employment Tax Instructions for Form 1040 (Schedule SE) From Your Fax Machine Call (703) 368-9694 Catalog Pages Item 11700 64188 20604 2 4 2 11250 18629 49978 11980 10 2 2 2 12625 41721 12906 12907 13086 13087 13117 13715 4 2 2 12 2 4 2 3 62133 4 63987 64728 2 1 10322 2 12081 12311 12597 13232 15683 22851 2 2 2 1 3 2 24833 2 Form 2106 Employee Business Expenses Instructions for Form 2106 Form 2106-EZ Unreimbursed Employee Business Expenses Form 2290 Heavy Vehicle use Tax Return Form 2553 Election by a Small Business Corporation Instructions for Form 2553 Form 2848 Power of Attorney and Declaration of Representative Form 4136 Credit for Federal Tax Paid on Fuels Form 4506 Request for Copy or Transcript of Tax Form Form 4562 Depreciation and Amortization Instruction for Form 4562 Form 4797 Sales of Business Property Instructions for Form 4797 Form 4835 Farm Rental Income and Expenses Form 6781 Gains and losses From Section 1256 Contracts and Straddles Form 8300 Report of Cash Payments Over $10,000 Received In a Trade or Business Form 8586 Low-Income Housing Credit Form 8718 User Fee for Exempt Organization Determination Letter Request Form 8809 Request for Extension of Time to File Information Returns Form 8822 Change of Address Form 8824 Like-Kind Exchanges Instructions for Form 8824 Form 8829 Expenses for Business Use of Your Home Instructions for Form 8829 Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity and Welfare-to-Work Credits Instructions for Form 8850 (Rev. 10-97) DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT IRS Fax Forms for Individuals Catalog Pages Item 10220 2 Form W-4 Employee’s Withholding Allowance Certificate 10225 4 Form W-4P Withholding Certificate for Pension or Annuity Payments 10227 2 Form W-5 Earned Income Credit Advance Payment Certificate 10229 3 Form W-7 Application for IRS Individual Taxpayer Identification Number for Pending U.S. Adoptions 24309 Form W-7A Application for Taxpayer Identification 2 10231 2 Form W-9 Request for Taxpayer Identification Number and Certification Instructions for Form W-9 20479 2 Form W-10 Dependent Care Provider’s Identification and 10437 1 Certification Form 709 U.S. Gift (and Generation-Skipping Transfer) Tax 16783 4 Return Instructions for Form 709 16784 8 Form 709A United States Short Form Gift Tax Return 10171 2 Form 843 Claim for Refund and Request for Abatement 10180 1 Form 1040 U.S. Individual Income Tax Return 11320 2 Line Instructions for Form 1040 11325 19 General Instructions for Form 1040 24811 16 Tax Table and Tax Rate Schedule for Form 1040 24327 13 Form 1040 (Sch A & B) Itemized Deductions and Interest & 11330 2 Dividend Income Instructions for Form 1040 (Schedule A & B) 24328 7 Form 1040 (Sch C) Profit or Loss from Business (Sole 11334 2 Proprietorship) Instructions for Form 1040 (Schedule C) 24329 6 Form 1040 (Sch C-EZ) Net Profit from Business (Sole 14374 2 Proprietorship) Form 1040 (Sch D) Capital Gains and Losses 11338 2 Instructions for Form 1040 (Schedule D) 24331 4 Continuation Sheet for Form 1040 (Schedule D) 10424 2 Form 1040 (Sch E) Supplemental Income and Loss 11344 2 Instructions for Form 1040 (Schedule E) 24332 5 Form 1040 (Sch EIC) Earned Income Credit 13339 2 Form 1040 (Sch F) Profit or Loss From Farming 11346 2 Instructions for Form 1040 (Schedule F) 24333 5 Form 1040 (Sch H) Household Employment Taxes 12187 2 Instructions for Form 1040 (Schedule H) 21451 8 Form 1040 (Sch R) Credit for the Elderly or the Disabled 11359 2 Instructions for Form 1040 (Schedule R) 11357 2 Form 1040 (Sch SE) Self-Employment Tax 11358 2 Instructions for Form 1040 (Schedule SE) 24334 3 Form 1040A U.S. Individual Income Tax Return 11327 2 12075 1 Form 1040A (Sch 1) Interest and Dividend Income Form 1040A (Sch 2) Child & Dependent Care Expenses 10749 2 Form 1040A (Sch 3) Credit for the Elderly or the Disabled 12064 2 Instructions for Form 1040A (Schedule 3) 12059 3 Form 1040-ES Estimated Tax for Individuals 11340 6 Form 1040EZ Income Tax Return for Single and Joint Filers 11329 2 With No Dependents Form 1040NR U.S. Nonresident Alien Income Tax Return 11364 5 Form 1040NR-EZ U.S. Income Tax Return for Certain 21534 2 Nonresident Aliens With No Dependents Instructions for Form 1040NR-EZ 21718 12 Form 1040X Amended U.S. Individual Income Tax Return 11360 2 Instructions for Form 1040X 11362 4 Form 1116 Foreign Tax Credit 11440 2 Instructions for Form 1116 11441 9 Form 1310 Statement of Person Claiming Refund Due a 11566 2 Deceased Taxpayer Form 2106 Employee Business Expenses 11700 2 Instructions for Form 2106 64188 4 Form 2106-EZ Unreimbursed Employee Business Expenses 20604 2 Form 2119 Sale of Your Home 11710 2 Instructions for Form 2119 18038 6 Form 2120 Multiple Support Declaration 11712 1 24731 5 Publication 2186 Penalties 24732 6 Publication 2187 Support Test and Worksheet for Dependency requested From Your Fax Machine Call (703) 368-9694 Catalog Pages Item 24733 4 Publication 2188 Request for IRS to Figure Taxable Part of Annuity 24734 5 Publication 2189 Worksheets to Figure Taxable Social Security and Equivalent Railroad Retirement Benefits 24735 4 Publication 2190 Deduction or Credit for Amounts You Repaid 24636 3 Publication 2191 Unemployment Compensation 11744 3 Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts 63610 Instructions for Form 2210 5 11862 Form 2441 Child and Dependent Care Expenses 2 10842 Instructions for Form 2441 3 11900 Form 2555 Foreign Earned Income 3 11901 Instructions for Form 2555 4 13272 Form 2555-EZ Foreign Earned Income Exclusion 2 14623 Instructions for Form 2555-EZ 3 11958 Form 2688 Application for Additional Extension of Time to 2 File U.S. Individual Income Tax Return 11980 Form 2848 Power of Attorney and Declaration of Representative 4 12490 Form 3903 Moving Expenses 2 12493 Form 3903-F Foreign Moving Expenses 2 12626 Form 4137 Social Security and Medicare Tax on Unreported 2 Tip Income 41721 Form 4506 Request for Copy or Transcript of Tax Form 2 12997 Form 4684 Casualties and Thefts 2 12998 Instructions for Form 4684 4 13117 Form 4835 Farm Rental Income and Expenses 2 13141 Form 4868 Automatic Extension of Time to File U.S. Income 4 Tax Return 13177 Form 4952 Investment Interest Expense Deduction 2 13187 Form 4972 Tax on Lump-Sum Distributions 2 13188 Instructions for Form 4972 4 13329 Form 5329 Additional Taxes Attributable to Qualified Retirement 2 Plans (including IRAs), Annuities, and Modified Endowment Contracts, and MSAs 13330 50012 50013 13600 64277 13601 64262 61924 62299 62730 13910 4 1 7 2 8 1 2 2 2 4 1 62474 63704 64294 63966 2 3 10 2 64113 2 10002 2 10750 2 10822 2 12081 13232 15683 22843 23077 24091 2 1 3 2 4 2 24188 24479 14842 8 2 2 Instructions for Form 5329 Form 6198 At-Risk Limitations Instructions for Form 6198 Form 6251 Alternative Minimum Tax-Individuals Instructions for Form 6251 Form 6252 Installment Sale Income Instructions for Form 6252 Form 8271 Investor Reporting of Tax Shelter Registration Number Form 8283 Noncash Charitable Contributions Instructions for Form 8283 Form 8332 Release of Claim to Exemption for Child of Divorced or Separated Parents Form 8379 Injured Spouse Claim and Allocation Form 8582 Passive Activity Loss Limitations Instructions for Form 8582 Form 8606 Nondeductible IRAs (Contributions, Distributions and Basis) Form 8615 Tax for Children Under Age 14 Who Have Investment Income of More Than $1,300 Form 8801 Credit for Prior Year Minimum Tax-Individuals Estates & Trusts Form 8814 Parent’s Election to Report Child’s Interest and Dividends Form 8815 Exclusion of Interest from Series EE U.S. Savings Bonds Form 8822 Change of Address Form 8829 Expenses for Business Use of Your Home Instructions for Form 8829 Form 8839 Qualified Adoption Expenses Instructions for Form 8839 Form 8853 Medical Savings Accounts & Long-Term Care Insurance Contracts Instructions for Form 8853 Form 8859 First-Time District of Columbia Homebuyer Credit Form 9465 Installment Agreement Request (Rev.10-97) DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT Tele-Tax Topics Topic No. Subject IRS Help Available 101 102 103 104 105 IRS services— Volunteer tax assistance, toll-free telephone, walk-in assistance, and outreach programs Tax assistance for individuals with disabilities and the hearing impaired Small Business Tax Education Program (STEP)—Tax help for small businesses Problem Resolution Program—Help for problem situations Public libraries—Tax information tapes and reproducible tax forms IRS Procedures 151 152 153 154 155 156 157 911 Your appeal rights Refunds—How long they should take What to do if you haven’t filed your tax return (Nonfilers) Form W-2—What to do if not received Forms and publications—How to order Copy of your tax return—How to get one Change of address— How to notify IRS Hardship assistance applications Collection 201 202 203 204 The collection process What to do if you can’t pay your tax Failure to pay child support and other Federal obligations Offers in compromise Alternative Filing Methods 251 252 253 254 255 Form 1040PC tax return Electronic filing Substitute tax forms How to choose a tax preparer TeleFile From Your Fax Machine Call (703) 368-9694 Topic No. 305 306 307 308 309 310 302 303 304 When, where, and how to file Highlights of tax changes Checklist of common errors when preparing your tax return Extensions of time to file your tax return Recordkeeping Penalty for underpayment of estimated tax Backup withholding Amended returns Tax fraud—How to report Power of attorney information Filing Requirements, Filing Status, and Exemptions 351 352 353 354 355 356 Who must file? Which form—1040, 1040A, or 1040EZ? What is your filing status? Dependents Estimated tax Decedents 401 402 403 404 405 406 407 408 409 410 411 412 413 414 415 Wages and salaries Tips Interest received Dividends Refunds of state and local taxes Alimony received Business income Sole proprietorship Capital gains and losses Pensions and annuities Pensions—The general rule and the simplified general rule Lump-sum distributions Rollovers from retirement plans Rental income and expenses Renting vacation property and renting to relatives 452 453 454 455 417 418 419 420 421 422 423 424 425 Farming and fishing income Earnings for clergy Unemployment compensation Gambling income and expenses Bartering income Scholarship and fellowship grants Nontaxable income Social security and equivalent railroad retirement benefits 401(k) plans Passive activities— Losses and credits Individual retirement arrangements (IRAs) Alimony paid Bad debt deduction Tax shelters Moving expenses Itemized Deductions 501 502 503 504 505 506 507 508 509 510 511 512 513 514 515 Should I itemize? Medical and dental expenses Deductible taxes Home mortgage points Interest expense Contributions Casualty losses Miscellaneous expenses Business use of home Business use of car Business travel expenses Business entertainment expenses Educational expenses Employee business expenses Disaster area losses Tax Computation 551 552 553 554 555 556 601 602 416 Subject Adjustments to Income 451 Types of Income General Information 301 Subject Topic No. 603 604 Standard deduction Tax and credits figured by the IRS Tax on a child’s investment income Self-employment tax Five- or ten-year tax options for lump-sum distributions Alternative minimum tax 653 654 655 656 657 658 659 660 Notices—What to do Notice of underreported income—CP 2000 IRS notices and bills and penalty and interest charges Notice of change to return We changed your account CP11—Notice of change to return We corrected your return—Amount due IRS Subject We changed your account (Refund) CP12—We changed your return—You are due a refund CP22A—We changed your account Basis of Assets, Depreciation, and Sale of Assets 701 702 703 704 705 706 Sale of your home— General Sale of your home—How to report gain Sale of your home— Exclusion of gain, age 55 and over Basis of assets Depreciation Installment sales Employer Tax Information 751 752 753 754 755 756 757 758 759 Tax Credits 760 Earned income credit (EIC) Child and dependent 761 care credit Credit for the elderly or the disabled 762 Advance earned income credit IRS Notices and Letters 651 652 Topic No. Social security and Medicare withholding rates Form W-2—Where, when, and how to file Form W-4—Employee’s withholding allowance certificate Form W-5—Advance earned income credit Employer identification number (EIN)—How to apply Employment taxes for household employees Form 941—Deposit requirements Form 941—Employer’s Quarterly Federal Tax Return Form 940/940-EZ— Deposit requirements Form 940/940-EZ— Employer’s Annual Federal Unemployment Tax Return Form 945—Annual Return of Withheld Federal Income Tax Tips—Withholding and reporting Magnetic Media Filers—1099 Series and Related Information Returns (For electronic filing of individual returns, listen to topic 252.) 801 802 803 804 805 Topic No. Subject Tax Information for Aliens and U.S. Citizens Living Abroad 851 852 853 854 855 856 Resident and nonresident aliens Dual-status alien Foreign earned income exclusion—General Foreign earned income exclusion—Who qualifies? Foreign earned income exclusion—What qualifies? Foreign tax credit Tax Information for Puerto Rico Residents (in Spanish) 901 902 903 904 Who must file a U.S. income tax return in Puerto Rico Deductions and credits for Puerto Rico filers Federal employment taxes in Puerto Rico Tax assistance for Puerto Rico residents Other Tele-Tax Topics in Spanish 951 952 953 954 955 956 957 958 959 960 961 IRS services— Volunteer tax assistance, toll-free telephone, walk-in assistance, and outreach programs Refunds—How long they should take Forms and publications—How to order Highlights of tax changes Who must file? Which form to use? What is your filing status? Social security and equivalent railroad retirement benefits Earned income credit (EIC) Advance earned income credit Alien tax clearance Who must file magnetically Applications, forms, and information Waivers and extensions Test files and combined Federal and state filing Electronic filing of information returns Topic numbers are effective January 1, 1998. (Rev. 10-97)