Alternative Minimum Tax Worksheet

advertisement

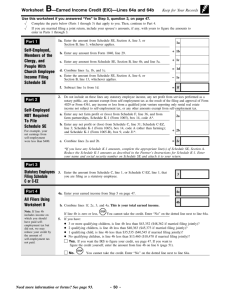

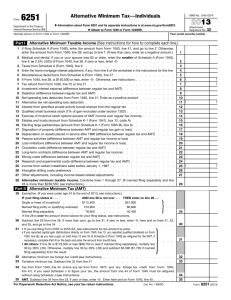

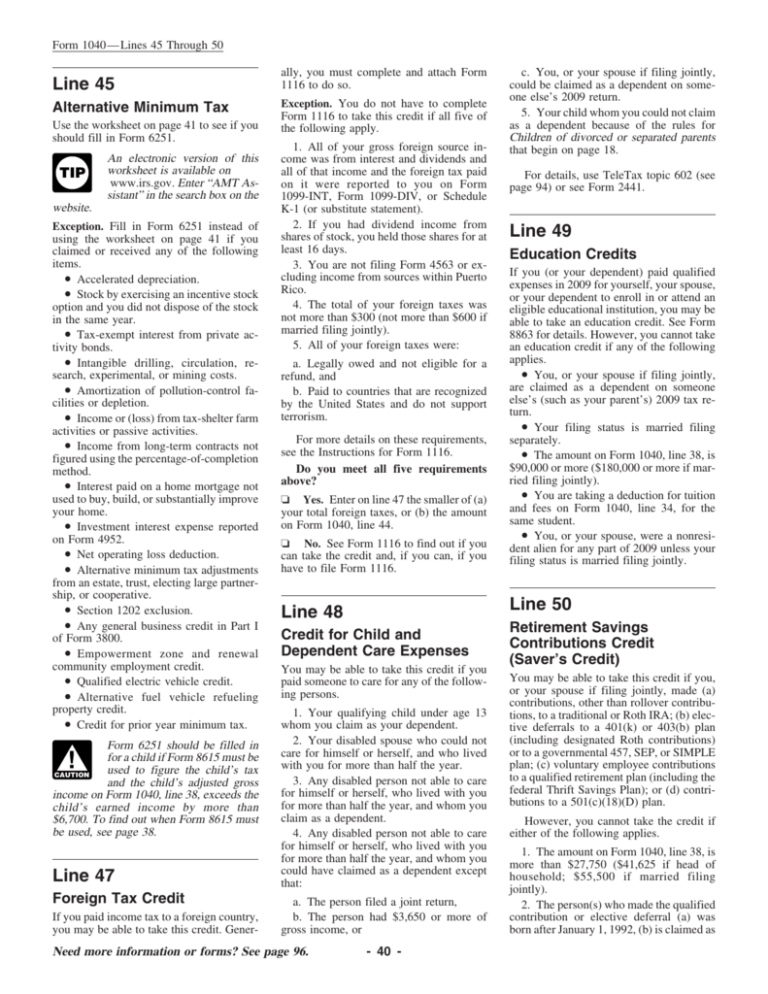

Form 1040 — Lines 45 Through 50 Line 45 Alternative Minimum Tax Use the worksheet on page 41 to see if you should fill in Form 6251. TIP An electronic version of this worksheet is available on www.irs.gov. Enter “AMT Assistant” in the search box on the website. Exception. Fill in Form 6251 instead of using the worksheet on page 41 if you claimed or received any of the following items. • Accelerated depreciation. • Stock by exercising an incentive stock option and you did not dispose of the stock in the same year. • Tax-exempt interest from private activity bonds. • Intangible drilling, circulation, research, experimental, or mining costs. • Amortization of pollution-control facilities or depletion. • Income or (loss) from tax-shelter farm activities or passive activities. • Income from long-term contracts not figured using the percentage-of-completion method. • Interest paid on a home mortgage not used to buy, build, or substantially improve your home. • Investment interest expense reported on Form 4952. • Net operating loss deduction. • Alternative minimum tax adjustments from an estate, trust, electing large partnership, or cooperative. • Section 1202 exclusion. • Any general business credit in Part I of Form 3800. • Empowerment zone and renewal community employment credit. • Qualified electric vehicle credit. • Alternative fuel vehicle refueling property credit. • Credit for prior year minimum tax. Form 6251 should be filled in for a child if Form 8615 must be used to figure the child’s tax CAUTION and the child’s adjusted gross income on Form 1040, line 38, exceeds the child’s earned income by more than $6,700. To find out when Form 8615 must be used, see page 38. ! Line 47 Foreign Tax Credit If you paid income tax to a foreign country, you may be able to take this credit. Gener- ally, you must complete and attach Form 1116 to do so. Exception. You do not have to complete Form 1116 to take this credit if all five of the following apply. 1. All of your gross foreign source income was from interest and dividends and all of that income and the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or Schedule K-1 (or substitute statement). 2. If you had dividend income from shares of stock, you held those shares for at least 16 days. 3. You are not filing Form 4563 or excluding income from sources within Puerto Rico. 4. The total of your foreign taxes was not more than $300 (not more than $600 if married filing jointly). 5. All of your foreign taxes were: a. Legally owed and not eligible for a refund, and b. Paid to countries that are recognized by the United States and do not support terrorism. For more details on these requirements, see the Instructions for Form 1116. Do you meet all five requirements above? ❏ Yes. Enter on line 47 the smaller of (a) your total foreign taxes, or (b) the amount on Form 1040, line 44. ❏ No. See Form 1116 to find out if you can take the credit and, if you can, if you have to file Form 1116. For details, use TeleTax topic 602 (see page 94) or see Form 2441. Line 49 Education Credits If you (or your dependent) paid qualified expenses in 2009 for yourself, your spouse, or your dependent to enroll in or attend an eligible educational institution, you may be able to take an education credit. See Form 8863 for details. However, you cannot take an education credit if any of the following applies. • You, or your spouse if filing jointly, are claimed as a dependent on someone else’s (such as your parent’s) 2009 tax return. • Your filing status is married filing separately. • The amount on Form 1040, line 38, is $90,000 or more ($180,000 or more if married filing jointly). • You are taking a deduction for tuition and fees on Form 1040, line 34, for the same student. • You, or your spouse, were a nonresident alien for any part of 2009 unless your filing status is married filing jointly. Line 50 Line 48 Credit for Child and Dependent Care Expenses You may be able to take this credit if you paid someone to care for any of the following persons. 1. Your qualifying child under age 13 whom you claim as your dependent. 2. Your disabled spouse who could not care for himself or herself, and who lived with you for more than half the year. 3. Any disabled person not able to care for himself or herself, who lived with you for more than half the year, and whom you claim as a dependent. 4. Any disabled person not able to care for himself or herself, who lived with you for more than half the year, and whom you could have claimed as a dependent except that: a. The person filed a joint return, b. The person had $3,650 or more of gross income, or Need more information or forms? See page 96. c. You, or your spouse if filing jointly, could be claimed as a dependent on someone else’s 2009 return. 5. Your child whom you could not claim as a dependent because of the rules for Children of divorced or separated parents that begin on page 18. - 40 - Retirement Savings Contributions Credit (Saver’s Credit) You may be able to take this credit if you, or your spouse if filing jointly, made (a) contributions, other than rollover contributions, to a traditional or Roth IRA; (b) elective deferrals to a 401(k) or 403(b) plan (including designated Roth contributions) or to a governmental 457, SEP, or SIMPLE plan; (c) voluntary employee contributions to a qualified retirement plan (including the federal Thrift Savings Plan); or (d) contributions to a 501(c)(18)(D) plan. However, you cannot take the credit if either of the following applies. 1. The amount on Form 1040, line 38, is more than $27,750 ($41,625 if head of household; $55,500 if married filing jointly). 2. The person(s) who made the qualified contribution or elective deferral (a) was born after January 1, 1992, (b) is claimed as Form 1040 — Lines 45 Through 50 a dependent on someone else’s 2009 tax return, or (c) was a student (defined next). You were a student if during any part of 5 calendar months of 2009 you: • Were enrolled as a full-time student at a school, or • Took a full-time, on-farm training course given by a school or a state, county, or local government agency. A school includes a technical, trade, or mechanical school. It does not include an Worksheet To See if You Should Fill in Form 6251—Line 45 Before you begin: ⻫ ⻫ on-the-job training course, correspondence school, or school offering courses only through the Internet. For more details, use TeleTax topic 610 (see page 94) or see Form 8880. Keep for Your Records Be sure you have read the Exception on page 40 to see if you must fill in Form 6251 instead of using this worksheet. If you are claiming the foreign tax credit (see the instructions for Form 1040, line 47, on page 40), enter that credit on line 47. 1. Are you filing Schedule A? No. Enter the amount from Form 1040, line 38. .............................. Yes. Enter the amount from Form 1040, line 41. 2. Enter any amount from Form 8914, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. 3. If filing Schedule L, enter the total of lines 6 and 20 from Schedule L. Otherwise, enter -0- . . 3. 4. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. Subtract line 4 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. If filing Schedule A, enter the smaller of the amount on Schedule A, line 4, or 2.5% (.025) of the amount on Form 1040, line 38 (but not less than zero). Otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. If filing Schedule A, enter the total of the amounts from Schedule A, lines 5, 6, 8, and 27. Otherwise, enter -08. Add lines 5 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. Enter any tax refund from Form 1040, lines 10 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. Enter the amount shown below for your filing status. • Single or head of household — $46,700 • Married filing jointly or Qualifying widow(er) — $70,950 .............................. • Married filing separately — $35,475 12. Is the amount on line 10 more than the amount on line 11? No. STOP You do not need to fill in Form 6251. } } Yes. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. Enter the amount shown below for your filing status. • Single or head of household — $112,500 • Married filing jointly or qualifying widow(er) — $150,000 ................ • Married filing separately — $75,000 14. Is the amount on line 10 more than the amount on line 13? No. Skip lines 14 and 15; enter on line 16 the amount from line 12, and go to line 17. Yes. Subtract line 13 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. Multiply line 14 by 25% (.25) and enter the smaller of the result or line 11 above . . . . . . 16. Add lines 12 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. Is the amount on line 16 more than $175,000 ($87,500 if married filing separately)? Yes. STOP Fill in Form 6251 to see if you owe the alternative minimum tax. } . . 1. . . 4. . . 5. . . . . . . . . . . 6. 7. 8. 9. 10. . . 11. . . . . . . . . . . . . . . . . 12. . . . . . . . . . . . . . . . . 13. . . . . . . . . . . . . . . . . 14. . . . . . . . . . . . . . . . . 15. . . . . . . . . . . . . . . . . 16. No. Multiply line 16 by 26% (.26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. 18. Enter the amount from Form 1040, line 44, minus the total of any tax from Form 4972 and any amount on Form 1040, line 47. If you used Schedule J to figure your tax, the amount for Form 1040, line 44, must be refigured without using Schedule J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. Next. Is the amount on line 17 more than the amount on line 18? Yes. Fill in Form 6251 to see if you owe the alternative minimum tax. No. You do not owe alternative minimum tax and do not need to fill in Form 6251. Leave line 45 blank. - 41 - Need more information or forms? See page 96.