AMZN

Amazon

Restricted

Stock Units

Becoming an Owner

For employees in the United States

You Are an Amazon Leader;

You Are an Owner

Ownership is one of the leadership principles that guides every Amazonian.

Owners think long term. They act on behalf of the entire company. They never

say “that’s not my job.”

One of the ways we foster ownership among employees is through Restricted

Stock Unit (RSU) awards. RSUs are a key part of our global compensation

program, which has been carefully designed to help us attract, motivate and

retain employees of the highest caliber.

An RSU is a right to receive a share of Amazon.com common stock after

you’ve worked for the company for a certain amount of time and met other

service conditions.

RSUs are awarded at no cost to you, and you don’t have to enroll in the

program to participate, but you must activate and certify your RSU account

with our stock plan administrator Morgan Stanley.

This brochure will tell you what you need to know and how to accept your

RSU award. For more details about RSUs, visit the Employee Stock (RSU) page on

Inside Amazon, go to www.morganstanleyfa.com/amazon or call the Employee

Resource Center at 1-888-892-7180.

We’ve included a glossary of key terms at the end of this brochure to help

answer any questions you may have.

Our Mission

Amazon.com strives to be Earth’s most customercentric company, where customers can find and

discover anything they might want to buy online,

and endeavors to offer its customers the lowest

possible prices.

What’s Inside

What You Need to Know....................................................................................... 2

What Is an RSU?...................................................................................................................... 2

Who Is Eligible to Receive RSUs?....................................................................................... 2

When Are RSUs Awarded?................................................................................................... 2

What Is an Award Agreement?............................................................................................ 2

How Many RSUs Will I Receive?......................................................................................... 2

What Is a Vesting Period?..................................................................................................... 2

Will I Have to Pay Anything When My RSUs Vest?......................................................... 3

What Happens to My RSUs If I No Longer Work for Amazon?.................................. 3

Are RSUs Taxable?.................................................................................................................. 3

What You Need to Do.............................................................................................. 6

Activate and Certify Your RSU Account Online..............................................................6

Keep Your Contact Information Up-to-Date...................................................................6

What You Can Do With Your Shares............................................................. 8

Where to Get More Information..................................................................... 9

Morgan Stanley Service Center..........................................................................................9

Helpful Definitions...............................................................................................................10

1

What You Need to Know

What Is an RSU?

A Restricted Stock Unit (RSU) is a right to receive a share of Amazon.com

common stock after you’ve satisfied the vesting period.

Who Is Eligible to Receive RSUs?

Generally, all full-time Amazon employees in the United States are eligible to

receive RSU awards.

When Are RSUs Awarded?

In general, all eligible Amazon employees receive an RSU award at the time they are

hired. Additional RSU awards, if any, are determined on an annual basis in April.

What Is an Award Agreement?

The RSU Award Agreement is a legal document that describes your award’s

terms and conditions, such as the number of RSUs awarded and the vesting

requirements. When it’s time to review and accept your agreement, it will be

posted to your online RSU account and you will receive a notification email

from Amazon’s stock plan administrator Morgan Stanley.

How Many RSUs Will I Receive?

RSU awards are based upon job level. For certain job levels and positions, other

factors, such as an employee’s compensation range and the results of annual

performance reviews, may also be considered.

What Is a Vesting Period?

The vesting period is an amount of time you must work full-time as an Amazon

employee for your RSUs to become Amazon.com shares. For example, if

you were awarded 10 RSUs with a two-year vesting period on April 1, 2013,

the vesting period for those 10 RSUs would end on May 15, 2015. Generally,

to satisfy the vesting requirements, you can have no breaks in service during

the vesting period and you must be a full-time employee at the time the RSUs

vest. Information about breaks in service is located on Inside Amazon. Vesting

periods will be stated on your Amazon RSU Award Agreement.

2

Will I Have to Pay Anything When My RSUs Vest?

It depends. For employees in job levels 1 through 4, Amazon will pay associated

transaction fees at the time RSUs vest. All other employees will pay a fee of $11.95

per transaction when their RSUs vest. Fees and commissions also will apply when

you sell your vested shares. These rates are posted on Inside Amazon as well as

on Morgan Stanley’s Benefit Access website (www.benefitaccess.com). Turn to

What You Can Do With Your Shares on page 8 for more information.

What Happens to My RSUs If I No Longer Work for Amazon?

If your employment or service relationship with Amazon ends for any reason,

any unvested portion of your award will be forfeited. All the stock from vested

RSU awards will remain in your RSU account until you choose to sell it.

Are RSUs Taxable?

In general, the value of your RSUs is considered taxable income to you. On

each vest date, Amazon must collect from you enough cash to cover the

minimum tax-withholding obligation that arises on that date. By accepting your

RSU award, you are directing Morgan Stanley to sell enough of your vested

shares to pay the minimum tax withholding on each vest date. You can change

this election online during the vesting period. (See Paying Taxes: Your Options

on page 5.) Where required, Amazon will report your RSU income and taxes

paid through payroll; details will be available on your pay statement.

Tax laws are complex and vary by country and local tax jurisdiction. You should

consult a tax advisor regarding the tax consequences of any RSU transaction.

3

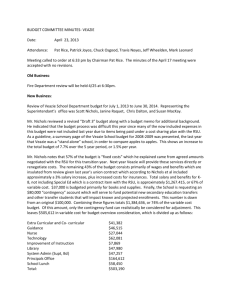

Tax Withholding Example

(For Illustration Purposes Only)

The details of your RSU award, the share price and your income tax withholding

may be different.

RSU Award Date:

April 1, 2013

Vesting Date:

May 15, 2015 (2-year vest period)

Number of RSUs Awarded:10

Fair Market Value on Vest Date:$350

Taxable Income:

10 x $350 = $3,500

Tax Due:

$3,500 x 35%* = $1,225

Shares Sold to Cover Taxes:

$1,225 ÷ $350 = 4 shares**

Net Shares Deposited in RSU Account:

10 – 4 = 6 shares

Value of Net Shares: 6 x $350 = $2,100

* Tax rates vary by country; this rate is for illustration purposes only. If your account is not

active and certified, backup withholding would apply to the sale of shares and is due at a

rate of 28% for U.S. individuals and 31% for non-U.S. individuals.

** Shares will be rounded up to the nearest whole share. Any cash resulting from selling

a whole share that is not used for taxes will be paid to you through payroll. Any shares

remaining will be deposited into your account.

A Note About Fractional Shares

Beginning April 1, 2014 any cash resulting from a fractional share will be paid to

you through your local payroll, and not through your RSU account.

4

Paying Taxes: Your Options

You can change your tax withholding election by logging in to your RSU

account at www.benefitaccess.com. Or, you can call a Morgan Stanley Service

Center representative. You have three options for paying your taxes:

1. Sell Enough Shares to Cover Taxes. Unless you choose a different option,

this is how your required tax withholding will be satisfied. On the vesting date,

Morgan Stanley will sell enough vested shares on your behalf to satisfy the

required tax withholding amount. The proceeds from the sale will pass through

your RSU account to Amazon, and then from Amazon to the relevant tax

authorities. Any cash remaining after your tax withholding is satisfied will be

refunded to you through local payroll.

2. Pay Cash. You may choose to pay your tax-withholding obligation with cash.

You must estimate the tax withholding and send sufficient money to your RSU

account by wire transfer two business days before your RSU vesting date. The

cash will cover your tax obligation and all shares will be deposited into your

RSU account.

3. Sell All Shares. This option, which is available only to Amazon employees in

job levels 1 to 8, allows you to direct Morgan Stanley to sell all your shares at

the time they vest. A portion of the cash generated from the sale will be used

to cover your tax obligation. At the time you change your tax election, you will

choose how you would like the cash distributed to you: by wire transfer, by

deposit to your RSU account or by check.

RSUs Are Subject to Amazon’s Insider Trading Policy

All employees are subject to Amazon’s Insider Trading Policy. In accordance

with this policy, certain employees can only trade Amazon.com securities

during designated trading windows, and certain employees must obtain

pre-clearance from the Amazon Legal Department before selling any shares.

For more information about Amazon’s Insider Trading Policy, visit Inside

Amazon > Employment > Employee Stock (RSU) page or send an email to

stockpolicy@amazon.com.

5

What You Need to Do

1. Activate and Certify Your RSU Account Online

You must activate and certify your RSU account at Morgan Stanley to receive

your first RSU award. This step is simple and can be completed in five to seven

minutes online.

Don’t Wait! If you do not have an active and certified RSU account at the

time your RSU award vests, you may be subject to backup withholding of

28% to 31%. Morgan Stanley is required by the United States Internal Revenue

Service (IRS) to apply backup withholding if you have not certified your tax

status. Backup withholding applies to all employees worldwide regardless

of country of citizenship. Additional shares will be sold automatically to

cover any backup withholding.

You’ll receive instructions for activating and certifying your account once your

RSU award has been approved by the Amazon Board of Directors. Generally,

this occurs about three months after your hire date.

Fulfillment Center (“FC”) Employees: You will receive two mailings at home

from Morgan Stanley. One mailing will include your RSU account user name;

the other will include your temporary password. If you have misplaced this

information, you can request new mailings by calling a Morgan Stanley Service

Center representative. See contact information on page 9.

Corporate/CS Employees: You will receive your instructions in a welcome

email from Morgan Stanley to your Amazon alias. Just click the link in the

email to get started. If you’ve misplaced the email, you can request a new one

by visiting www.benefitaccess.com and clicking on the Forgot User Name/

Password link.

2. Keep Your Contact Information Up-to-Date

Important RSU information, such as account statements, transaction

confirmation statements and tax information, are delivered to you based on

your contact information in PeoplePortal. Be sure to keep this information upto-date. You can contact your Human Resources representative to assist you.

6

Important Notes!

If you already have a Morgan Stanley or Smith Barney account …

If you previously worked for a company that had Morgan Stanley or Smith

Barney as its stock plan administrator, simply log in to your current account to

activate your RSU account. You do not need to update your tax status. Your

W-9 will carry over from your previous account. To verify your W-9 certification,

log in to your RSU account, click on the MyProfile tab and look under Tax and

Banking Information.

If you had Amazon RSUs in a Charles Schwab account …

Charles Schwab was Amazon’s stock plan administrator up to March 31, 2014.

As of April 1, 2014, any unvested RSUs were transferred automatically to your

new Morgan Stanley RSU account.

If you had any RSUs that vested before April 1, 2014, those shares will remain in

your existing Schwab One brokerage account. If you are interested in transferring

your shares from Charles Schwab to Morgan Stanley, download a Transfer Form

from Inside Amazon or call a Morgan Stanley Service Center representative.

For questions about your Schwab One brokerage account, contact Charles

Schwab directly at 1-800-654-2593. Additional information can be found on

Inside Amazon > Employment > Employee Stock (RSU) page.

If you need help activating and certifying your account …

For step-by-step instructions, use the RSU Account Activation Guide, which

is available on www.morganstanleyfa.com/amazon. Or, you can contact the

appropriate Morgan Stanley Service Center listed on page 9.

7

What You Can Do With Your Shares

Keep Them or Sell Them. It’s Up to You.

Once you satisfy the vesting period, your RSUs will become shares of Amazon.com

common stock and will be deposited into your RSU account (less any applicable

taxes). Once your shares are in your account, what you do with them is up to you.

Keeping Your Shares. As an Amazon.com shareholder, you’ll share in the

company’s success. The value of your shares will change over time depending

on Amazon’s stock price. Your vested shares are yours even if you leave the

company. They will remain in your RSU account until you sell them.

Selling Your Shares. You can sell your vested shares at any time, subject to

any applicable restrictions under Amazon’s Insider Trading Policy. All sales are

subject to Amazon’s Insider Trading Policy, so be sure you’re familiar with it.

You will be responsible for paying any fees or commissions resulting from

a sale. Morgan Stanley’s fees will apply whether you sell your Amazon shares

online or through a Morgan Stanley broker.

• Under 500 shares: $14.95 per transaction

• 500+ shares: $0.03 per share

For more information about selling shares, log in to your RSU account at

www.benefitaccess.com.

What Are My Shares Worth?

Number of Shares (vested or unvested)

x Fair Market Value of Amazon.com Stock

= Value of Your Shares

Track your share price by visiting the Investor

Relations home page on Amazon.com or by

going to www.nasdaq.com and typing in our

stock ticker AMZN.

8

Where to Get More Information

Access Your RSU Account

www.benefitaccess.com

Learn More About Amazon Restricted Stock Units

• Inside Amazon > Employment > Employee Stock (RSU) page

• www.morganstanleyfa.com/amazon

Morgan Stanley Service Center

+1 866-533-2575 (toll-free)

+1 801-617-7471 (toll)

8 a.m. to 8 p.m. Eastern Time

Monday through Friday

Scan this code with your

Kindle or smartphone to learn

more about Amazon RSUs and

to watch a short RSU video.

9

Helpful Definitions

Agreement: (Also known as “Grant Agreement” or “Award Agreement”) The RSU

agreement is a legal document that sets forth the terms and conditions that

apply to your award.

Fair market value: The average price at which all shares are sold on behalf of

Amazon employees to cover withholding taxes on a given RSU vest date.

Grant: An award of RSUs.

Grant or award date: The date your award was granted to you.

Restricted Stock Unit (RSU): An RSU is the right to receive one share of

Amazon.com, Inc. common stock in the future, provided you meet certain

conditions. When an RSU award vests, the shares automatically become yours.

Shares: Shares of stock in a company, representing ownership.

Unvested grant: The portion of a grant that has not yet met the vesting criteria

as set forth in the Grant or Award Agreement.

Vested grant: A grant that has met the vesting criteria as set forth in the Grant

or Award Agreement.

Vesting period: The length of time or waiting period before the RSUs vest.

Vesting schedule: The number or percentage of RSUs that vest over a particular

time period and the dates on which they vest.

Form W-9: Form used by a U.S. individual to establish tax status for U.S.

withholding tax purposes.

Form W-8BEN: Form used by a non-U.S. individual to establish foreign status

for U.S. withholding tax purposes. If applicable, this form can be used to claim

a reduced rate of, or exemption from, withholding as a resident of a foreign

country with which the U.S. has an income tax treaty.

10

This brochure highlights the terms of the Amazon Restricted Stock Units program for

employees in the United States. It is not intended to provide a complete description of

the plan. Although every effort has been made to ensure information in this brochure

is accurate, the provisions of the official plan documents will govern in case of any

discrepancy. Amazon’s Benefit Plans and Programs are subject to review by the Company

and may be modified or terminated at any time for any reason. This Guide does not create

a contract of employment between Amazon and any employee.

© 2013 Amazon.com, Inc. All rights reserved.