AMP Capital Investment Funds

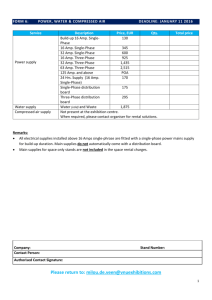

advertisement