Generalists versus Specialists: Lifetime Work Experience and CEO

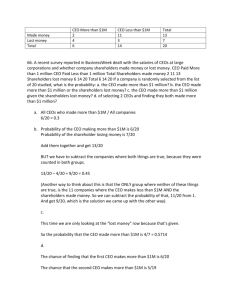

advertisement