general questions on banking and finance 3

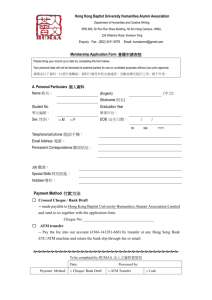

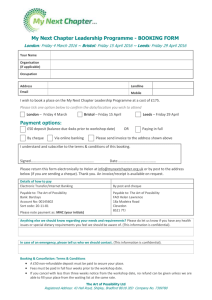

advertisement