202D-BANKING LAW AND PRACTICE

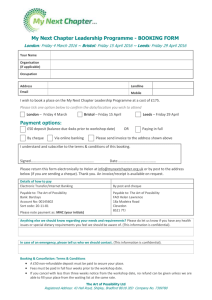

advertisement

1 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... Dr.G.R.Damodaran College of Science (Autonomous, affiliated to the Bharathiar University, recognized by the UGC)Reaccredited at the 'A' Grade Level by the NAAC and ISO 9001:2008 Certified CRISL rated 'A' (TN) for MBA and MIB Programmes I-B.COM [2015-2018] SEMESTER-II SKILL BASED SUBJECT: BANKING LAW AND PRACTICE - 202D Multiple Choice Questions. 1. The primary relationship between a banker and customer starts from the time A. when customer visits that bank B. when customer opens C. when customer visits that bank to made queries D. All of the above ANSWER: B 2. 2. The primary relationship between banker and customer is a ------------------ relationship A. Mutual B. Contractual C. Personal D. None of the above ANSWER: B 3. 3. Which one of the following is the most important relationship between banker and customer A. A. Debtor and Creditor B. Bailee and Bailor C. Agency and Principal D. Trustee and Beneficiary ANSWER: A 4. When customer's account overdrawn or when customer has taken loan from banker, then the customer A. Creditor B. Agent C. . Debtor D. . Bailor ANSWER: C 5. When banker received deposits from the customer, then the banker becomes -------------- of the customer A. Debtor B. Creditor C. Bailee D. Trustee ANSWER: A 1/21/2016 3:28 PM 2 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 6. ------------- accepts the bailment of certain things on the condition that the things bailed will not utilised A. Bailor B. Trustee C. Bailee D. Beneficiary ANSWER: C 7. It is a ----------------- obligation of a banker to honour the cheques of the customer drawn against current account A. Mutual B. Statutory C. Unstatutory D. All of the above ANSWER: B 8. Which bank have given the instructions to the commercial banks regarding the immediate credit of outstation cheques? A. Reserve Bank of India B. Central Bank C. World Bank D. All of the above ANSWER: A 9. Dishonour of cheque by a banker without any justifiable reason is called A. Valid dishonour of cheques B. Unmindful dishonour of cheques C. Negligence dishonour of cheques D. Wrongful dishonour of cheques ANSWER: D 10. Special damages refers to damages payable by a banker to his customer for the actual ------------- loss suffered by customer A. Financial B. Special C. Unpecuniary D. Unfinancial ANSWER: A 11. ---------- is the right of a person to retain the property of another person in his possession untill the debt from that owner of that property is repaid A. Lien B. Retainment C. Retrenchment D. Libel ANSWER: A 12. The bank can consider ------------------ lien as their protection against loss on loan or overdraft which 1/21/2016 3:28 PM 3 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... was given to its customers A. Special B. Particular C. General D. Lending ANSWER: A 13. The idea behind the bankers right to set-off is to enable the banker to reduce the -------------- amount due to him from a customer A. Gross B. Net C. Partial D. None of the above ANSWER: B 14. A ---------------- refers to the right of banker to adjust the credit and debit balance of customers without obtaining any letter of set-off or without giving any notice to the customers A. Automatic set-off B. Proper set-off C. Legal set-off D. Special set-off ANSWER: A 15. The right of set-off customers account can be exercised only by a A. Creditors A. Creditors B. Debtors C. . Banker D. Customer ANSWER: C 16. Usually incidental charges are levied on which type of account holders A. Savings account B. . Fixed deposit account C. Current Account D. Recurring deposit account ANSWER: C 17. The -------------- rule is followed in appropriation of accounts if neither debtor nor creditors does not makes any specific appropriation A. Pagets B. Kinlay C. Sheldon D. Claytons ANSWER: D 18. The word "Garnishee" is derived from a latin word A. Garnire B. Garn 1/21/2016 3:28 PM 4 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... C. Garnish D. Garni ANSWER: A 19. The meaning of the word "Garnishee" means A. to consult B. . to warn C. to punish D. to convince ANSWER: B 20. MICR technology used for clearance of cheques by banks refers to A. Magnetic Ink Character Recognition B. Magnetic Ink Company Recognition C. Magnetic Ink Cross Recognition D. Magnetic Ink Community Recognition ANSWER: A 21. In India, the law regulating the Negotiable instruments are A. Banking Regulation Act 1949 B. Reserve Bank of India Act 1934 C. Negotiable Instruments Act 1881 D. Companies Act 1956 ANSWER: C 22. Which banks which accept deposits from the public and lend them mainly to commerce for short periods? A. Commercial Bank B. . Industrial Bank C. Agricultural Bank D. Central Bank ANSWER: A 23. Which bank is otherwise called as Investment banks? A. Exchange Bank B. Reserve Bank of India C. Industrial Bank D. Agricultural Bank ANSWER: C 24. A company who accepts demand deposit is called __________ A. Joint stock company B. Banking company C. Manufacturing company D. . IT company ANSWER: B 25. Current Accounts are mainly opened by 1/21/2016 3:28 PM 5 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... A. Professionals B. Agriculturalist C. Salaried class people D. Trading and industrial concern ANSWER: D 26. Who controls credit in India? A. Government of India B. Reserve Bank of India C. State Bank of India D. . Indian Bank ANSWER: B 27. Fixed Deposits is otherwise called as A. Accrued Deposits B. Time deposits C. . Recurring Deposits D. Demand Deposits ANSWER: B 28. In the which type of deposit, the high rate of interest is provided by the Bank? A. Current Account B. Recurring Deposit Account C. Fixed Deposit Account D. Savings Account ANSWER: C 29. Loan is a financial arrangement under which an advance is granted by a bank to a borrower on a separate account called A. Cash credit account B. . Overdraft account C. Loan account D. Discount account ANSWER: C 30. The rate of interest charged for the loan by the banker compared to overdraft and cash credit is generally A. High B. Low C. Same D. Based on the amount ANSWER: B 31. Which type of account holder has the permission to overdraw the amount from his/her account A. Savings account B. Current account C. Fixed deposit account D. Recurring deposit account 1/21/2016 3:28 PM 6 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... ANSWER: B 32. Usually in Overdraft, to protect the interest of the banker, they levy ------------------- Discounting of Bills of Exchange is an arrangement under which an banks takes a bill of exchange maturing with a short period of A. 20 days or 40 days B. 50 days or 100 days C. 60 days or 90 days D. 35 days or 75 days ANSWER: C 33. The main aim of a banker for performing the subsidiary services is to earn a ------------ of the customers A. Money B. Documents C. Valuables D. Goodwill ANSWER: D 34. The services rendered by a banker as an agent of his customers are called A. Principal services B. Agency services C. General utility services D. Social services ANSWER: B 35. The written instructions given by the customers to banker to perform the services like collection and payment of money is noted down in A. Written Instructions Book B. Standing Instructions Book C. Banking Instructions Book D. Services Instructions Book ANSWER: B 36. A -------------- is a person who is entrusted with some property by the settler or the author of the trust for the benefit of another person called beneficiary A. Attorney B. Executor C. . Administrator D. Trustee ANSWER: D 37. An -------------- is a person appointed by a testator to execute his will A. Executor B. Attorney C. Trustee D. Administrator ANSWER: A 1/21/2016 3:28 PM 7 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 38. Services rendered by a banker not only to his customers, but also to the general public are called as A. Principal services B. Agency services C. General utility services D. Social services ANSWER: C 39. In Negotiable Instruments Act 1881, which section defines promissory note? A. Section 1 B. Section s C. Section 3 D. Section 4 ANSWER: D 40. . ------------ is a system under which an individual bank carries on banking business with a network of branches spread all over the country. A. Mixed Banking B. Branch Banking C. Unit Banking D. Corresponding Banking ANSWER: B 41. A cheque dated subsequent to the date of its issue is A. Post dated cheque B. Blank cheque B. Blank cheque C. Crossed cheque D. Account payee cheque ANSWER: A 42. A cheque date before the date of its issue is A. Worth cheque B. Full worth cheque C. Preemptive cheque D. Ante dated cheque ANSWER: D 43. A drawer in the bill of exchange can also be a A. Paymaster B. Payee C. Banker D. Creditor ANSWER: B 44. The rate at which RBI discounts approved bill of exchange is A. . Bank rate B. Interest rate C. Exchange rate D. Discount rate 1/21/2016 3:28 PM 8 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... ANSWER: D 45. The lien is defined in A. the Sale of Goods Act B. the Transfer of property Act C. the Indian Contract Act D. the Companies Act ANSWER: A 46. The apex institution in agricultural finance is A. NABARD B. EXIM Bank C. Reserve Bank of India D. IDBI ANSWER: A 47. Who is primarily liable on a promissory note? A. Holder B. Maker C. Drawee D. . Endorser ANSWER: B 48. How many parties are mainly involved in Promissory Note? A. One B. Five C. Two D. Three ANSWER: C 49. In a bill of exchange, drawee is the person A. who draws the bill B. on whom the bill is drawn C. to whom the payment of the bill is to be made D. to whom the payment of the bill is not to be made ANSWER: B 50. . ------------ is a dead cheque A. Post dated cheque B. Stale cheque C. Ante dated cheque D. Pre dated cheque ANSWER: B 51. Name the person to whom the amount of the cheque is payable? A. Drawer B. Payee C. Drawee 1/21/2016 3:28 PM 9 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... D. Acceptor ANSWER: C 52. Discounting of bills of exchange is A. Clean advance B. Secured advance C. Neither clean advance nor secured advance D. Unsecured advance ANSWER: C 53. Expand NEFT A. National Electronic Fund Transfer B. Neutral Electronic Fund Transfer C. Nominal Electronic Fund Transfer D. Natural Electronic Fund Transfer ANSWER: A 54. Which section of Negotiable Instruments Act 1881, defines endorsement A. Section 10 B. Section 15 C. Section 18 D. . Section 20 ANSWER: B 55. ------ is an endorsement in which the endorser merely signs his name on the book of the instrument without mentioning the name of the person to whom the instrument is endorsed A. Blank Endorsement B. Restrictive Endorsement C. Qualified Endorsement D. San Frais Endorsement ANSWER: A 56. Blank endorsement is otherwise called as A. Full Endorsement B. Qualified Endorsement C. General Endorsement D. Special Endorsement ANSWER: C 57. What does the term "PIN" stands for A. People Identification Number B. Personal Instruction Number C. Personal Identification Number D. Personal Information Number ANSWER: C 58. The ATM installed at bank premises is called as -------- ATM A. . Off-site 1/21/2016 3:28 PM 10 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... B. Branch C. None of the above D. On-site ANSWER: D 59. KYC means A. Know Your Card B. Know Your Cost C. Know Your Customer D. Know Your Creditor ANSWER: C 60. The first bank in India to be given an ISO certificate A. Canara Bank B. SBI C. Central Bank of India D. Indian Bank ANSWER: A 61. RTGS means A. Real Towards Gross Settlement B. Real Turn Gross Settlement C. Real Technique Gross Settlement D. Real Time Gross Settlement ANSWER: D 62. In which system computers are based on the centralized processing concept? A. Multi-user computer networking B. Stand alone computer networking C. Processing computer system D. Frame computer system ANSWER: A 63. . Core banking is a __________ branch computerization model A. centralized B. decentralized C. unified D. ATM ANSWER: B 64. objective of computerization in India is to A. make the work life more meaningful B. replace men with machines C. control the manpower D. control the economy ANSWER: B 65. ATMs are primarily used for performing the __________ functions 1/21/2016 3:28 PM 11 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... A. Infrastructure B. Computer based C. Banking D. Hospitalized ANSWER: C 66. Expand ECS A. Electronic Clearing System B. Electronic Centered System C. Electronic Cross Systems D. Electronic Conversion Systems ANSWER: A 67. EFT is introduced by A. IRDA B. RBI C. SEBI D. NSE ANSWER: B 68. . ________ is a technology that allows you to access your bank account from a mobile device A. Home Banking B. Mobile Banking C. Internet Banking D. Television Banking ANSWER: B 69. . ____ is the result of combining technology and traditional bank services through websites that customers use to access their bank accounts A. Home Banking B. Mobile Banking C. Internet Banking D. Television Banking ANSWER: C 70. A ______ is the market for short term bills which are generally of 3 months duration A. Bill market B. Money market C. Credit market D. Open market ANSWER: A 71. A Garnishee order is an order issued by A. Income tax officer B. Official liquidator C. Court D. . RBI ANSWER: C 1/21/2016 3:28 PM 12 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 72. If the endorser signs his name only, the endorsement is said to be A. Blank Endorsement B. Conditional Endorsement C. Restricted Endorsement D. Full Endorsement ANSWER: D 73. The paying banker who makes cash payment of a cross cheque at the counter shall be liable for the loss of A. Drawer of the cheque B. True owner of the cheque C. Collecting banker D. the First endorser ANSWER: B 74. Who can cancel the crossing on a cheque? A. Payee B. Paying banker C. Endorser D. Drawer ANSWER: D 75. A negotiable instrument drawn or make in India is called_______ instrument A. Inland B. Foreign C. Time D. . Clean ANSWER: A 76. Drawing of two parallel transverse lines on the face of the cheque is called A. Special crossing B. General Crossing C. Upper Crossing D. Lower Crossing ANSWER: B 77. Addition of the name of a banker across the face of a cheque is called as A. General crossing B. Special crossing C. Upper Crossing D. Lower Crossing ANSWER: B 78. The following one is a negotiable instrument, negotiable by usage or custom A. Bill of Exchange B. Accommodation Bill C. Promissory Note 1/21/2016 3:28 PM 13 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... D. Share warrant ANSWER: D 79. The most important feature of a negotiable instrument is A. Free transfer B. Transfer free from defects C. Right to sue D. a & b ANSWER: D 80. The safest form of crossing is A. General crossing B. Special crossing C. Double crossing D. Account payee crossing ANSWER: D 81. A Cheque which is not crossed is called A. . Uncrossed cheque B. Open cheque C. Order cheque D. Bearer cheque ANSWER: D 82. An order cheque can be converted into a bearer cheque by means of A. Sans recourse endorsement B. Special endorsement C. Blank endorsement D. Sans frais endorsement ANSWER: C 83. Endorsement signifies that the A. Endorser has a good title B. Endroser's signature is genuine C. . Previous endorsements are genuine D. All of the above ANSWER: D 84. In which year, Electronic Fund Transfer (EFT) was launched in India? A. 1994 B. 1995 C. 1999 D. 2000 ANSWER: B 85. Maximum limit on the amount of individual transactions permitted for fund transfer per transaction is A. Rs. 1 Lakh B. Rs. 2 Lakhs 1/21/2016 3:28 PM 14 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... C. Rs. 5 Lakhs D. Rs. 10 Lakhs ANSWER: C 86. In which year, SWIFT was established? A. April 1973 B. July 1973 C. May 1973 D. October 1973 ANSWER: C 87. . --------- allows worldwide financial institutions to exchange standardized messages relating to international financial transaction A. NEFT B. SWIFT C. ECS D. EPS ANSWER: B 88. To done banking through WAP (Wireless Application Protocol) enabled mobile phone, customer should get which type of connection? A. Telephone B. Internet C. Television D. Electrical ANSWER: B 89. When the banking operations are carried out through electronic means, it take the form of A. E-banking B. M-banking C. T-Banking D. None of the above ANSWER: A 90. . --------- credit refers to a series of electronic payment instructions that are generated to replace proper instruments A. Electronic Payment System B. Electronic Clearing Service C. Electronic Data Interchange D. None of the above ANSWER: B 91. . ----- has been introduced for the purpose of networking of banks A. Generic Architecture B. Core Banking C. Centralized Fund Management Systems D. INFINET ANSWER: A 1/21/2016 3:28 PM 15 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 92. To facilitate the growth in government securities market and for smoother trading, RBI introduced a ---------- which provides for screen based trading of government securities A. Security Settlement System B. Negotiated Dealing System C. . Security Marketing System D. Security Safety System ANSWER: B 93. Banking transaction that takes placed in a virtual ambience on the website of a banking company is termed as A. Internet Banking B. Telephone Banking C. Mobile Banking D. Modern Banking ANSWER: A 94. All banks having operations in India and intending to offer Internet Banking services to the public must obtain an approval for the same from A. Government of India B. Central Bank C. Reserve Bank of India D. All of the above ANSWER: C 95. Telephone Banking has found a high level of acceptability especially among ----------- level of people A. Professional B. Salaried C. Retired D. Business ANSWER: A 96. --------- are workstations that act as a nucleaus of the functioning of the telephone banking system operated through fully computer-integrated telephone system A. Telephone centre B. Enquiry centre C. Computer centre D. Call centre ANSWER: D 97. The ATM pin is ---------- digit code number used for authenticiating and authroizing the use of the ATM facility by a customer A. Four B. Five C. Three D. Six ANSWER: A 1/21/2016 3:28 PM 16 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 98. ------- is a technique under which effective customer authorization takes place on the basis of the biological attributes of a bonafide person A. Manometrics B. Bonametrics C. Miometrics D. Biometrics ANSWER: D 99. What is the major function performed by the ATM's worldwide A. Passboook update facility B. Cash withdrawal C. Mini-statement facility D. Funds transfer facility ANSWER: B 100. . ------ ATMs are a boost to smaller banks who cannot afford opening the ATMs in many places as possible A. Lobby B. Off-site C. International D. Shared ANSWER: D 101. In which year and date, Reserve Bank of India was established? A. May 1, 1935 B. April 1, 1935 C. . October 1, 1935 D. December 1, 1935 ANSWER: B 102. A convenient way of making a purchase or paying for a service without holding cash is called as A. Electronic Payment System B. Electronic Clearing Service C. National Electronic Fund Transfer D. Electronic Fund Transfer ANSWER: A 103. . ---- constitutes the foremost element of an electronic payment system A. Banker B. Customer C. Merchant D. Shopping mall ANSWER: B 104. An electronic payment device that involves the use of networking services where by the e-customer issues digital cheques to e-merchant malls to settle transactions carried over the internet A. Electronic cash B. e-purse 1/21/2016 3:28 PM 17 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... C. Digital cheques D. Electronic card ANSWER: C 105. Electronic cash is also called as A. Hot money B. Digital money C. Instant money D. Easy money ANSWER: B 106. A wallet-sized smart card, embedded with programmable chip which storeds e-money to be used in a virtual trading environment for making payment is called A. Electronic card B. Digital card C. Electronic purse D. Electronic cash ANSWER: C 107. Use of personal computers at home for conducting their banking operation with their banks is called A. Mobile Banking B. Anywhere Banking C. Internet Banking D. Home Banking ANSWER: D 108. is popularly known as Plastic cards or Plastic money A. Smart cards B. Electronic cards C. Credit cards D. Debit cards ANSWER: C 109. Credit cards first emerged in 1920s A. India B. China C. USA D. UK ANSWER: C 110. Which of the first subsidiary bank of State Bank of India to do whole computerization of all its branches? A. State Bank of Patiala B. State Bank of Hyderabad C. State Bank of Saurashtra D. State Bank of Travancore ANSWER: A 1/21/2016 3:28 PM 18 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 111. In which year, MICR system for cheque was implemented in India? A. 1987 B. 1996 C. 1990 D. 1993 ANSWER: A 112. Which is the first bank to introduce Credit card in India? A. Bank of India B. Global Trust Bank C. IndusInd Bank D. Central Bank of India ANSWER: D 113. Which is the first bank to launch Debit card in India? A. Standard Chartered Bank B. Citi Bank C. . ABN Amro Bank D. American Express Bank ANSWER: B 114. Which was the first Joint Stock Bank established by an Indian establishment? A. Bank of Bombay B. Oudh Commercial Bank C. Bank of Hindustan D. Hindustan Commercial Bank ANSWER: C 115. Which is the first change in banking sector of India after independence? A. Nationalization of Banks B. Social control on Banks C. Establishment of SBI D. Establishment of RBI ANSWER: B 116. When were the banks nationalized in our country? A. On 1st July 1965 B. On 19th July 1969 C. . On 15th April 1980 and 19th July 1969 D. On 16th April 1980 and 1st July 1965 ANSWER: C 117. What are the major change in banking sector of India after nationalization of Banks? A. Expansion of bank branches B. Cut throat competition in Banking sector C. Introduction of Banking Regulation Act D. Establishment of RBI ANSWER: A 1/21/2016 3:28 PM 19 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... 118. The following one is absolutely essential for a special crossing A. Two parallel transverse lines B. Words "And company? C. Words "Not negotiable" D. Name of a banker ANSWER: D 119. The reasonable period allowed in India for the presentation of a cheque is A. 1 year B. 3 months C. 9 months D. depending upon custom ANSWER: B 120. If cheque is crossed an account payee, this is direction of, to A. . Payee, paying banker B. Payee, collecting bank C. Drawer, paying bank D. Drawer, collecting bank ANSWER: D 121. Which of the following is not the form of E-banking? A. Internet Banking B. Direct Deposit in Bank C. Electronic cheque conversion D. Mobile banking ANSWER: B 122. The electronic funds transfer using a two-way communications system is referred to as a A. Pay or cheque B. Wire transfer C. Depository transfer cheque D. Payable through draft ANSWER: B 123. Interest payable on savings bank accounts is? A. Regulated by State Governments B. De-regulated by RBI C. Regulated by RBI D. Regulated by Finance Minister ANSWER: B 124. The usual deposit accounts of banks are A. Current accounts, electricity accounts and insurance premium accounts B. Current accounts, post office savings, bank accounts and term deposit accounts C. Loan accounts, savings bank accounts and term deposit accounts D. Current accounts, savings bank accounts and term deposit accounts 1/21/2016 3:28 PM 20 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... ANSWER: D 125. Fixed deposits and recurring deposits are? A. Repayable after an agreed period B. Repayable on demand C. Not repayable D. Repayable on demand or after an agreed period as per bank's choice ANSWER: A 126. Accounts are allowed to be operated by cheques in respect of? A. Both savings bank accounts and fixed deposit accounts B. Both Savings bank accounts and current accounts C. Both savings bank accounts and loan accounts D. Other savings bank accounts and cash accounts only ANSWER: B 127. Which of the following is correct statement? A. No interest is paid on current deposit accounts B. Interest is paid on current accounts at the same rate as term deposit accounts C. The rate of interest on current accounts and savings accounts are the same D. No interest is paid on any deposit by the bank ANSWER: A 128. When a bank returns a cheque unpaid, it is called? A. Payment of the cheque B. Drawing of the cheque C. . Dishonour of the cheque D. Taking of the cheque ANSWER: C 129. Largest shareholder (in percentage shareholding) of a Nationalized bank is ? A. RBI B. NABARD C. Government of India D. . LIC ANSWER: C 130. An institution whose principle business is accepting deposits and forwarding loans is called A. Mutual Fund Business B. Company C. . Bank D. Ombudsman ANSWER: C 131. Which of the following term do not represent any part of Banking technology? A. NEFT B. RTGS C. ITC 1/21/2016 3:28 PM 21 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... D. EPS ANSWER: C 132. The chief activities of bank do not include A. Providing loans B. . Accepting deposits C. Providing lockers D. . Selling real estate properties ANSWER: D 133. The MICR cheque details given. Pick the wrong statement A. MICR means Magnetic Ink Character B. MICR introduced to increase the standards of the cheques C. MICR issued by bank D. In the MICR portion, the customer allowed to write in it ANSWER: D 134. Which electronic fund transfer system run on the basis of "Deferred Net Settlement" A. NEFT B. RTGS C. . SMS D. BIFSC ANSWER: A 135. In both cases of RTGS and NEFT, the service charges are decided by A. Customer B. IMF C. . Banker D. Transferee ANSWER: C 136. was not nationalized in 1969 A. Punjab National Bank B. Oriental Bank of Commerce C. CBank of Baroda D. Union Bank of India ANSWER: B 137. Which of the following is not the name of the bank functioning in India? A. Central Bank of India B. UCO Bank C. Aegon Religare D. Dena Bank ANSWER: C 138. RBI is known as lender of last resort because A. It has to meet the credit need of citizen to whom no one else willing to lend B. Bank lend to go to RBI as a last resort 1/21/2016 3:28 PM 22 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... C. It comes to help banks in times of crisis D. All of the above ANSWER: C 139. Cheque is payable on A. Demand B. Usage C. Fixed future date D. After sight ANSWER: A 140. Garnishee order is issued by a A. Police officer B. Revenue Officer C. CID D. Court of law ANSWER: D 141. Electronic purse may have following number of storage space A. Only one B. Two C. Several D. No storage space ANSWER: C 142. The click and portal model facilitates are A. Traditional banking B. Paperless banking C. C. Virtual banking D. b and c ANSWER: D 143. Electronic payment system is an ? A. Software B. Hardware C. Application D. Package ANSWER: C 144. What are the major change in banking sector of India after nationalization of Banks? A. Expansion of bank branches B. Cut throat competition in Banking sector C. Introduction of Banking Regulation Act D. Establishment of RBI ANSWER: A 145. What is the number of nationalized banks in India? A. 20 1/21/2016 3:28 PM 23 of 23 http://172.16.2.20/printqp.php?heading=I-B.COM [2015-2018], SEME... B. 28 C. 27 D. 19 ANSWER: D 146. Which committee has recommended introduction of Smart card? A. Rangarajan Committee B. Saraf Committee C. Nayak Committee D. Pannirselvam Committee ANSWER: B 147. A card is used to obtain cash, goods or services automatically debiting the payments to the card holders bank account instantly upto the credit balance which exists in the customers bank account A. Credit B. Gold C. Debit D. Business ANSWER: C 148. are workstations that act as a nucleaus of the functioning of the telephone banking system operated through fully computer-integrated telephone system A. Telephone centre B. Enquiry centre C. Computer centre D. Call centre ANSWER: D 149. is the most favoured technology for secure Internet banking service A. Public Key Instructions B. Public Key Information C. Public Key Infrastructure D. People Key Infrastructure ANSWER: C 150. When the banking operations are carried out through electronic means, it take the form of A. E-banking B. M-banking C. T-Banking D. None of the above ANSWER: A Staff Name Senthilkumar.L. 1/21/2016 3:28 PM