Providing Comprehensive, Integrated Social Services to

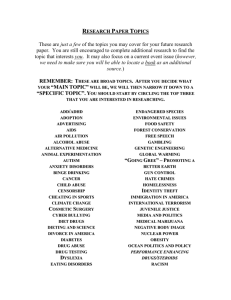

advertisement