NAVSUP P-727 Navy Cash SOP

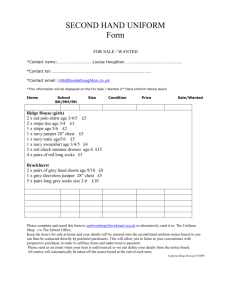

advertisement