Costa Rica in the Aerospace Global Value Chain

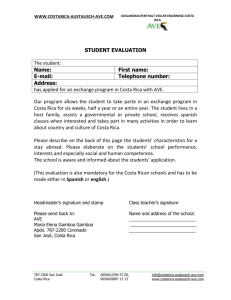

advertisement