2 Applications

advertisement

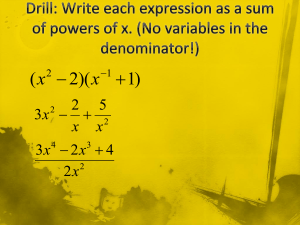

2 Applications 2.1 Graphical Analysis of Cubic Cost Function [see example H-L-M-R-S p.213 and 219.] You are given the following information: T C is total cost, T R is total revenue, ¼ are profits, x is output, 20 is fixed cost. T C(x) = 0:1x3 ¡ 3x2 + 50x + 20; T R(x) = 30x and ¼(x) = ¡0:1x3 + 3x2 ¡ 20x ¡ 20: where lines are dashed (- - -), continuous (—) and dotted (. . .) respectively. 9 1000 800 600 400 200 0 5 10 15 20 25 x -200 Graph of T C (- - -), T R (—–), and ¼ (. . .). 10 Calculate, marginal costs, averave variable costs and marginal revenues. MC(x) = :3x2 ¡ 6x + 50; AV C(x) = 0:1x2 ¡ 3x + 50 and MR = 30: where lines are dashed (- - -), continuous (—) and dotted (. . .) respectively. Find the minimum of average variable cost function. AV C = 0:1x2 ¡ 3x + 50 Candidate(s) for extrema: f27: 5g ; at ffx = 15:0gg 11 40 30 20 10 0 5 10 15 x 20 25 30 Graph of MC (- - -), AV C (—) and MR (. . .). 12 2.2 Algebraic analysis of the cubic cost function the maximum is obtained imposing the equilibrium condition (first order necessary condition) p = MC 30 = :3x2 ¡ 6x + 50 solving ¡:3x2 + 6x ¡ 20 = 0, roots: 4: 226 5 : the former is a local minimum, 15: 774 profits are negative (check graph first and second derivative later) the other is a local maximum, and profits are positive. total profits at the maximum are ¡0:1(15:8)3+3(15:8)2¡20(15:8)¡20 = 18: 489 if fixed costs are equal to 20, then there are positive profits. if fixed costs are equal to 40, then ¡0:1(15:8)3+3(15:8)2¡20(15:8)¡40 = ¡1: 511 2 i.e., there are some losses. 13 total revenue 30 £ 15:8 = 474:0 total variable costs 0:1(15:8)3 ¡ 3(15:8)2 + 50(15:8) = 435: 51 operating surplus= total revenue-total variable costs: 474:0 ¡ 435: 51 = 38: 49 these are used to cover fixed costs 38: 49 ¡ 40 = ¡1: 51 if operating surplus is negative, it is better to close and just pay the fixed costs, otherwise both fixed and variable costs are to be repaid. average variable costs at the maximum are 0:1(15:8)2 ¡ 3(15:8) + 50 = 27: 564 these are lower than the price, that is equal to 30:in this case it is better to stay in the market, at least in the short run, because p > AV C(x): when the AVC is at the minimum level of 15, then MC = AV C . 14 MC = :3(15)2 ¡ 6(15) + 50 = 27: 5 AV C = :1(15)2 ¡ 3(15) + 50 = 27: 5 In what follows we use second derivatives. Take the profit function ¼(x) = ¡0:1x3 + 3x2 ¡ 20x ¡ 20 and differentiate to get ¼0(x) = ¡: 3x2 + 6x ¡ 20: This expression has two solutions, 4:2 and 15:8. second order condition ¼ 00(x) = ¡:6x + 6, so ¼00(4:2) = ¡:6(4:2) + 6 = 3:48 > 0 and ¼ 00(15:8) = ¡:6(15:8) + 6 = ¡3:48 < 0: then we conclude the first is a local minimum and the second is a local maximum, as the visual inspection of the graph showed. 15