Ten Sound Money Management Principles

advertisement

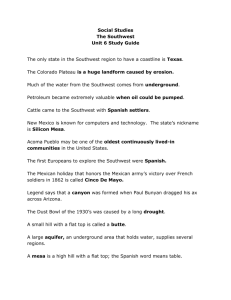

Money Management Principles n Are timeless and time-tested n Apply to everyone n Work well in up & down economies n Help people grow wealthy over time n Need to be taught in school Personal Finance Southwest High 1 1. Go For The Goal n n n n Goals provide a “why” for saving Use goals to develop action plans Break goals into benchmarks Make your goals SMART – Specific – Measurable – Attainable – Realistic – Time-Related Personal Finance Southwest High 2 Invest in your Human Capital n Get a solid education – For career satisfaction – For better health – For higher lifetime earnings n It’s OK to borrow for education – There is an opportunity cost to taking too long to earn degree – Student loans are better than credit cards Personal Finance Southwest High 3 2. Time Is Your Friend n n n n Time: a young person’s biggest asset Compound interest is awesome For every decade that savings is delayed, the required investment triples Example: $500,000 at 65; 10% yield – Age 25: $ 79 per month – Age 35: $ 219 per month – Age 45: $ 653 per month – Age 55: $ 2,141 per month Personal Finance Southwest High 4 More About Time n Time diversification reduces investment volatility n The Rule of 72 – 72/interest rate = doubling period – 72/doubling period = interest rate n Advantage calulators Personal Finance Southwest High 5 3. Live Below Your Means n Spend less than you earn n Create a spending plan – Income = Fixed Exp (including savings) + Flexible Exp + 1/12 of Occasional Expense n Distinguish needs from wants n “Step-down principle” Automate savings so money isn’t spent Southwest High 6 Personal Finance n 4. Establish Emergency Fund n Aka contingency fund – Online savings accounts • • • • No minimum FDIC insured 4.5% (varies) Linked to checking account – HSBC – Emigrant – ING & many others Personal Finance Southwest High 7 Pay Yourself First: Automate Your Savings n Tax-deferred employer plans – Get full 401(k) match from employer n n n n Employer credit unions Savings bond purchase plans Mutual fund Automatic Investment Plan Direct stock purchase plans Personal Finance Southwest High 8 Minnesota Saves n n n n n n Build wealth, not debt Saver Strategies Get out of debt Earned income tax credit Free income tax preparation Individual Development Accounts Personal Finance Southwest High 9 5. Buy Insurance According to “The Large Loss Principle” n n n Magnitude- not frequency- of losses Increase deductible to save $ Spend premium dollars on large potential losses: – Liability – Disability – Destruction of home – Large medical expenses Personal Finance Southwest High – Loss of household earner’s income 10 6. Repay Debt Quickly and Borrow For Less Consumer debt ratio < 15% of net pay n Consumer debt + housing < 50% of net n High debt makes other problems worse n Negotiate lower interest rates n Always pay more than the minimum n Avoid “perma-debt” n Pay promptly to avoid late fees Southwest High 11 Personal Finance n Family Life Center PowerPay analysis n 7. Earned Income Tax Credit n Refundable tax credit for workers Personal Finance Southwest High 12 8. Vita tax prep n n Provided by USU accounting students in Business building- starts Feb. AVOID instant tax refunds – High cost loans (similar to payday loans) n n Auto deposit Split your refund – Save a portion, pay debt, spend Personal Finance Southwest High 13 9. Buying House/Vehicle n Don’t buy more house than you can afford (Subprime mortgage meltdown) – Don’t’ trust mortgage broker n n Don’t buy before you are really ready for the financial commitment Buy new cars every 8-10 years or buy “new used” Personal Finance Southwest High 14 Check Your Financial Health n n Take the Financial Fitness Quiz Least common practices – Not having a will – No written financial goals – No written budget – No net worth calculation Personal Finance Southwest High 15 Financial Education Resources n Investing For Your Future – Home study course – http://www.investing.rutgers.edu/ n Money 2000 & Beyond – http://www.rce.rutgers.edu/money2000 n RU-FIT financial independence training – http://www.rce.rutgers.edu/ru-fit/ n USU Extension – http://extension.usu.edu/ Personal Finance Southwest High 16 Spend Less, Enjoy the Holidays More n n n n http://extension.usu.edu/htm/news/articl eID=2361 Start a UESP account for your kids Spend time with important people Avoid gift cards – High fees, money can’t be saved n Pay cash! Avoid debt. Personal Finance Southwest High 17 Personal Finance Magazines n Kiplinger’s Personal Finance Magazine – Kiplingers.com n Money Magazine – Money.com – Money 101 on-line financial mgmt course • http://money.cnn.com/pf/101/ • 23 lessons Personal Finance Southwest High 18 The Financial Checkup by Alena Johnson Personal Finance Southwest High 19 Financial Planning for Women http://www.usu.edu/fpw n For women of all ages & knowledge Personal Finance Southwest High 20 Avoid Common Mistakes of Young Adults n n n n n n n Buying a house before you are ready Buying too much house Putting too much $ into vehicles Keeping a balance on your credit cards Waiting to invest for retirement until… Not considering the cost of kids Spending too much on eating out Personal Finance Southwest High 21 Closing Thought “If it is to be, it is up to me” Comments? Questions? Experiences? Personal Finance Southwest High 22