Accounting 2010: Sample assessment instrument and student

advertisement

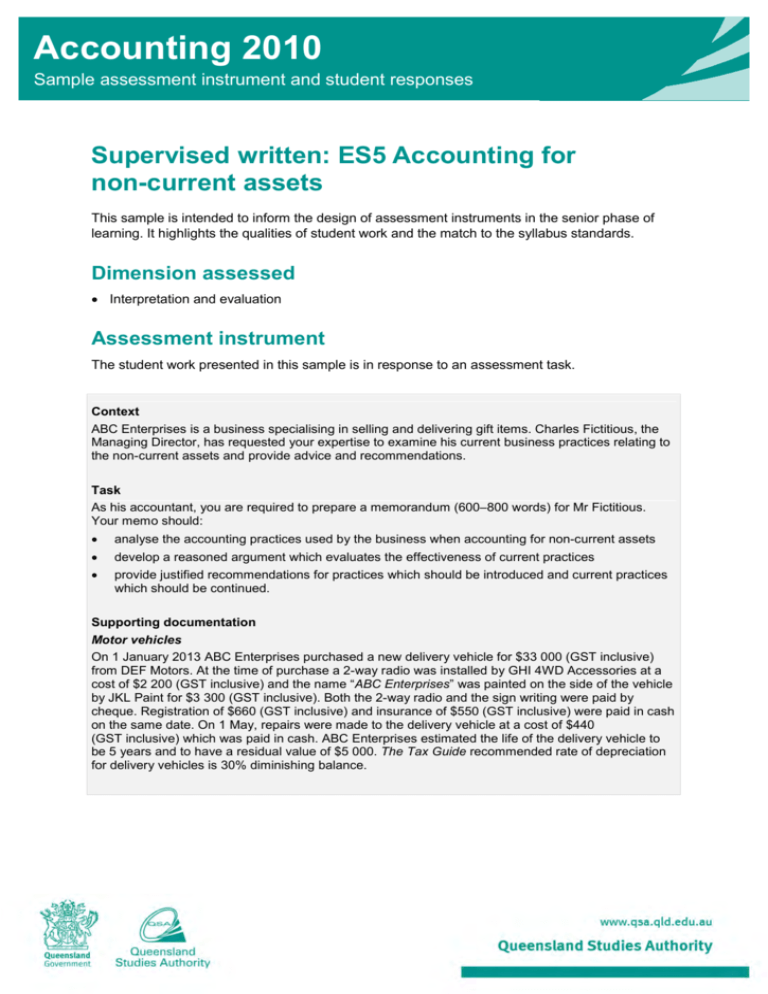

Accounting 2010 Sample assessment instrument and student responses Supervised written: ES5 Accounting for non-current assets This sample is intended to inform the design of assessment instruments in the senior phase of learning. It highlights the qualities of student work and the match to the syllabus standards. Dimension assessed • Interpretation and evaluation Assessment instrument The student work presented in this sample is in response to an assessment task. Context ABC Enterprises is a business specialising in selling and delivering gift items. Charles Fictitious, the Managing Director, has requested your expertise to examine his current business practices relating to the non-current assets and provide advice and recommendations. Task As his accountant, you are required to prepare a memorandum (600–800 words) for Mr Fictitious. Your memo should: • analyse the accounting practices used by the business when accounting for non-current assets • develop a reasoned argument which evaluates the effectiveness of current practices • provide justified recommendations for practices which should be introduced and current practices which should be continued. Supporting documentation Motor vehicles On 1 January 2013 ABC Enterprises purchased a new delivery vehicle for $33 000 (GST inclusive) from DEF Motors. At the time of purchase a 2-way radio was installed by GHI 4WD Accessories at a cost of $2 200 (GST inclusive) and the name “ABC Enterprises” was painted on the side of the vehicle by JKL Paint for $3 300 (GST inclusive). Both the 2-way radio and the sign writing were paid by cheque. Registration of $660 (GST inclusive) and insurance of $550 (GST inclusive) were paid in cash on the same date. On 1 May, repairs were made to the delivery vehicle at a cost of $440 (GST inclusive) which was paid in cash. ABC Enterprises estimated the life of the delivery vehicle to be 5 years and to have a residual value of $5 000. The Tax Guide recommended rate of depreciation for delivery vehicles is 30% diminishing balance. ABC Enterprises has recorded the purchase and depreciation of the asset for the year in its records as follows: General Ledger (extract) Date Particulars Dr Cr Balance 2013 Motor Vehicle Expenses Jan 01 Cash at Bank 3 000 3 000 Dr May 01 Cash at Bank 400 3 400 Dr 2 810 2 810 Dr 30 000 30 000 Dr Cash at Bank 2 000 32 000 Dr Cash at Bank 1 100 33 100 Dr Depreciation on Motor Vehicles June 30 Accumulated Depreciation Motor Vehicle Jan 01 DEF Motors: Nissan Accumulated Depreciation on Motor Vehicles June 30 Depreciation Profit and Loss 2 810 2 810 2 810 Cr 0 Non-current assets Recently the auditors conducted a stocktake of the business’s non-current assets. They found it impossible to ascertain which non-current assets should be in the business. Also when they did find items on business premises, multiple assets of a similar nature such as computers and office furniture were often indistinguishable. Buildings The business’s buildings were purchased five years ago when the business was first established at a cost of $100 000. A real estate agent recently conducted a valuation of this building and, as at 30 June 2013, found the building is now worth $200 000. Mr Fictitious would like to show the current valuation of the building in the balance sheet as he believes this is a more accurate representation of its true worth. Depreciation Mr Fictitious would like more details about the figure that has been allocated for depreciation this financial year as he is unsure how this figure was calculated. 2 | Accounting 2010: Sample student assessment and responses Non-current assets Instrument-specific standards matrix Student responses have been matched to instrument-specific standards. Those that best describe the student work in this sample are highlighted below. For more information about the syllabus dimensions and standards descriptors, see www.qsa.qld.edu.au/11034-assessment.html. Interpretation and evaluation Standard A Standard C The student work has the following characteristics: The student work has the following characteristics: • thorough and effective analysis and interpretation of relevant accounting information relating to non-current assets • analysis of accounting information relating to noncurrent assets • development of logical and convincing arguments to thoroughly justify valid recommendations relating to non-current assets • development of reasoned arguments to justify recommendations relating to non-current assets • effective communication of accounting information using appropriate modes for a variety of purposes. • clear communication of accounting information using appropriate modes for a variety of purposes. Note: Colour highlights have been used in the table to emphasise the qualities that discriminate between the standards. Queensland Studies Authority March 2014 | 3 Student response — Standard A The annotations show the match to the instrument-specific standards. Comments Memo To: Effective communication of accounting information for a purpose demonstrated through: • clarity of expression and logical exposition • understanding of technical terms • use of correct spelling, punctuation and grammar. Mr Fictitious (ABC Enterprises) From: Student name Date: 3/11/2013 Re: Accounting for Non-Current Assets After a recent investigation of your business, a number of concerns were raised about the current procedures in place to account for non-current assets. These issues can be addressed if the recommendations outlined in the following memo are followed. Non-current assets Non-current assets are long term economic resources which are not expected to be turned over for cash within one financial year. There are three types of non-current assets: property, plant and equipment, intangibles and investments. They are important to the business as they help it to grow and earn revenue. The appropriate controls must be used over non-current assets. Thorough and effective analysis and interpretation of accounting information Logical and convincing argument to thoroughly justify valid recommendations Thorough and effective analysis and interpretation of accounting information 4 | The analysis of the business suggests that you are having difficulties distinguishing between assets and locating them. As the business has invested significant amounts of money on these assets they must be able to be located quickly and that we can identify individual assets so that we can ensure they are working to maximum efficiency. A property, plant and equipment register (PPE) can assist with these issues. The PPE register is the most important control over non-current assets. This is a comprehensive record of all the business’s assets which details the location, ID number, cost, capital and revenue expenditure, disposal and depreciation details. Maintaining information regarding non-current assets in a PPE Register will ensure assets can be located quickly and are easily distinguishable. In addition it was also noted that you would like to show the buildings at the current valuation of $200 000 in the Statement of Financial position rather than recording them at their original cost of $100 000. The Historical Cost assumption in use in most accounting systems, requires you to use the historical cost or purchase price. This provides a stable measuring unit assumption. However a note within the Statement of Financial Position can detail the current valuation of the building ($200 000) for future reference. Accounting 2010: Sample student assessment and responses Non-current assets Comments Capital and Revenue Expenditure There are two main ways in which expenses which relate to the business’s assets can be classified; either capital expenditure or revenue expenditure. It is essential that the correct classifications are used for each expense as this can impact the figures within Statement of comprehensive income and can significantly affect depreciation rates. Thorough and effective analysis and interpretation of accounting information Logical and convincing argument to thoroughly justify valid recommendations Upon analyzing your business’s accounting records it was found that some of your expenses are classified incorrectly. Currently, the paint job on the side of the vehicle is classified as a revenue expenditure, however as it helps to promote the business it should be considered a capital expense. Capital expenditure is any expense which increases the life or value of the asset for more than one accounting period. Examples include large outlays of cash which improve the asset, or expenses which are paid to bring the assets into a location or condition ready for use. Revenue expenditure however are costs incurred for the maintenance and upkeep of an asset. For example, expenditures which will be used up within one accounting period (insurance, registration) or small expenses used to improve the asset. The registration and insurance paid on 1st January 2013 (adding up to $1100) is also incorrectly classified as a capital expenditure as both expenses will be used up within one financial year and are paid to upkeep the asset. Therefore capital expenditures should be recorded in your books at $35 000 (cost of vehicle, 2-way radio & paint job), whilst revenue expenditure should be at $1500 (registration, insurance and repairs). If a capital expenditure is incorrectly recorded as a revenue expenditure the business’s profits will be understated (because expenses are overstated), and an understatement of the asset. This will also impact on future profit because the asset is not recorded at its full amount resulting in smaller amounts of depreciation being written off in future periods. Depreciation Depreciation is a decline in the future economic benefit of a depreciable asset through wear and tear and obsolescence. There are two ways of depreciating an asset; straight line and diminishing balance method. Thorough and effective analysis and interpretation of accounting information It is apparent from your accounting records ($2 810) that the incorrect depreciation method, straight line, has been used for the delivery vehicle. The straight line method of depreciation suits assets which depreciate evenly over its lifetime, such as furniture. Each accounting period is allocated a uniform cost less any residual value. Diminishing balance method however is when a uniform rate of depreciation is applied each period to the cost of the asset reduced by any accumulated depreciation. It best suits those assets which give most of its service potential early in its life. As a delivery vehicle would give most of its service potential when first purchased, the diminishing balance method would have been more appropriate. Queensland Studies Authority March 2014 | 5 Comments Logical and convincing argument to thoroughly justify valid recommendations Using The Tax Guide which recommends delivery vehicles be depreciated at a rate of 30% using diminishing balance method, the depreciation expense should be $5250. It is essential that the correct depreciation method is used for each non-current asset as it can significantly impact the figures in both the Statement of financial position and the Statement of comprehensive income. In summary the following recommendations should be considered: 6 | • Introducing a property, plant and equipment register to record the details of all non-current assets to ensure they can be located and individually identified • Recording the value of the building at its historical cost in your accounting records, but including a note to the report detailing the building’s current valuation. • Ensuring expenditures relating to non-current assets are classified correctly as either revenue expenditure or capital expenditure to ensure accuracy of figures in financial reports. • Follow ‘The Tax Guide’ recommendation to use the diminishing balance method of depreciation, at a rate of 30%, when depreciating delivery vehicles — in recognition of the service potential provided in each vehicle’s early life. Accounting 2010: Sample student assessment and responses Non-current assets Student response — Standard C Comments Memo To: ABC Enterprises From: Student name Date: 3/11/2013 Re: Non-Current Assets While investigating ABC Enterprises there have been many incorrect accounting procedures. After evaluating and interpreting, many recommendations have been suggested. Non-current asset are the economic resources that will not be used up or converted into cash within an accounting period. These assets are required as they will help the business make profits. Analysis of accounting information In this business there is an incorrect practice as the business can’t ascertain what non-current assets should be in the business and that office furniture and computers are indistinguishable. This is poor practice as the business can’t identify if anything is stolen. Reasoned argument to justify recommendations To improve on this practice the business should label all assets and keep a record of all that have been serviced. The Property, plant and equipment register provides a comprehensive record of all details associated with the business’s assets, for example original cost, location, ID number and depreciation, etc. The Historical cost assumption relates to non-current assets. This is the original cost plus any capital expenditures. For example the building was purchased 5 years ago at a value of $100 000 but now is valued by a real estate at $200 000. This would be shown in the balance sheet and increase the value of the business. Analysis of accounting information Capital expenditure is any non-current asset that will increase the value of the business for more than one accounting period. Examples of capital expenditure are any significant cost to move the asset to location and in condition ready for use, such as freight or installation, or significant costs that increase the value of the asset, such as an air conditioner for a motor vehicle, or costs that will increase the life potential of the asset, such as a new motor. ABC Enterprises uses incorrect accounting procedures for classifying capital and revenue expenditure. Registration of $600 and Insurance of $500 were classified as capital expenditure but these expenses are revenue expenditure as these costs maintain the asset but do not add value or extend its useful life. Queensland Studies Authority March 2014 | 7 Comments Reasoned argument to justify recommendations Analysis of accounting information Revenue expenditure is any expense made on the asset that will maintain but not extend its useful life. In this business the repairs made to the delivery van for $400 and registration and insurance of $1 100 should be revenue expenditure. The painted sign on the vehicle should be capital expenditure as this increases the value of the asset by advertising the business and this should result in increased profit. Depreciation is the allocation of the cost towards the asset. There are two types of depreciation, straight line method and diminishing balance. The straight line is the original cost plus any capital expenditure less any residual value over the estimated life of the asset, for example, furniture. Whereas diminishing balance is the percentage of the original cost less any accumulated depreciation. This means that the asset is at its peak worth at the start and depreciates more each accounting period, which would suit machinery and delivery vehicles. Therefore an incorrect practice was used when the business used the straight line method for the delivery van. The business should use diminishing balance by getting the original cost of $35 000 find the 30 per cent less any accumulated depreciation. As this asset has only been in the business, you would divide the total amount by 12 and times by 6 so that only 6 months is recorded. This will affect the Statement of financial position. Recommendations for ABC Enterprises are that property, plant and equipment registers be installed, labelling and showing a record of all non-current assets. Also, capital and revenue expenditure should be applied properly so that the correct amounts are in Statement of financial position and the right depreciation method of diminishing balance is used. Acknowledgments The QSA acknowledges the contribution of Pimlico State High School in the preparation of this document. 8 | Accounting 2010: Sample student assessment and responses Non-current assets