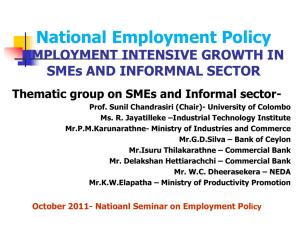

Practical Ideas to Connect Small and Medium Business with the

advertisement