DEPARTMENT OF FINANCE, INSURANCE, AND

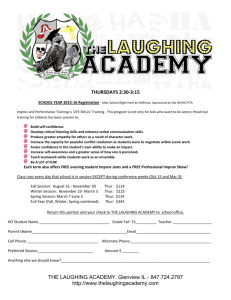

advertisement

DEPARTMENT OF FINANCE, INSURANCE, AND LAW COLLEGE OF BUSINESS ILLINOIS STATE UNIVERSITY Fall 2005 College of Business Mission The College of Business provides a student-centered learning environment to develop the business skills and appreciation for continuous learning necessary to succeed in a dynamic global economy. Our high quality programs develop ethical, knowledgeable, and technologically competent business professionals. We strive to do this to further the University mission of providing a premier educational experience to undergraduates and to students in select graduate programs. Academic Integrity Students enrolled in College of Business classes are expected to maintain high standards of ethical conduct within the classroom and when completing assignments, projects, and/or exams. Plagiarism and other forms of academic dishonesty such as cheating will not be tolerated. Students are expected to provide appropriate citations for non-original writing even if the original work is paraphrased. Penalties for plagiarism and other forms of academic dishonesty may be severe. Professional Standards All students in this course are expected to be familiar with the "College of Business Standards of Professional Behavior and Ethical Conduct." (refer to http://www.cob.ilstu.edu/professionalstandards) Please note that only bottled water may be consumed in the classroom wing of the College of Business Building and that all cell phones and other electronic devices should be turned off and stored away during classes, unless permission is otherwise granted by the instructor. COURSE INFORMATION Course Number & Title: FIL 242 Investments Prerequisite: C or better in FIL 240 and Location: TTh 9:35-10-50am, COBB 22H (in computer lab) Credit Hours: 3 Time INSTRUCTOR INFORMATION Instructor: Edgar Norton, Ph.D., CFA Phone: 438-2827 e-mail: eanorto@ilstu.edu Office: 424 COBB Office Hours: Monday through Thursday 8:30-9:30am or by appointment RESOURCES/MATERIALS Textbook: Frank K. Reilly and Edgar A. Norton Investments, 7th edition, South-western College Publishing, 2006; website: reilly.swlearning.com (includes downloadable course materials) COURSE DESCRIPTION: A survey of the field of investments, including the investment environment, risk management methods, investment and portfolio management concepts and tools. COURSE COMPETENCIES: • Understand investment vehicles, principles and concepts; • Explain influences on risk and return, both ex-ante and ex-post; • Become familiar with the market environment in which securities are traded; • Knowledgeable of the basic of investment analysis and portfolio theory and the role of derivative securities; • Describe the concept of market efficiency and its implications for investment analysis and portfolio management; • Learn to use investment-oriented software. COURSE REQUIREMENTS Projects Three projects requiring some quantitative skills and/or analysis will be assigned during the semester. Tentative due dates are: Thursday September 8, Thursday October 20, Thursday December 1. Assignments/Homework Homework assignments will be periodically collected and checked. No late homework will be accepted. You must be in class to turn in your homework. Exams Three exams, Thursday September 22, Thursday October 27, and during Finals week (Monday December 12 at 10am). Though not cumulative on purpose, the content of the course does build on itself, both in theory and application. I expect them to be mainly short answer/essay and problems. Participation Parts of the class will be “hands on” using the technology in the classroom. You can’t learn if you aren’t here. GRADING POLICIES: Projects: 150 points (50 points each) Homework: 100 points (total) Exams: 300 points possible (100 points each) Total points: 550; grades will be assigned on the basis of the percentage of total points earned: At least 90.0%: A; 80.0-89.9%: B; 70-79.9%: C; 60-69.9%: D; less than 60.0%: F ADDITIONAL INFORMATION: Course updates and other communications will be posted on the U drive in the appropriate folder or emailed to the class. It is your responsibility to check your ISU email or have it forwarded to a preferred address. No make-up exams are given unless the absence is valid (e.g., personal illness) and documented. Notification, when feasible, should occur before the exam via email or phone contact. Make-up exams may be more difficult than the regular exams. No extra credit assignments will be given unless they are offered to all students. Your singular need for additional points does not create a need for extra credit assignments for all. If discovered, instances of plagiarism (if you don’t know what it is, look it up) and cheating will be dealt with severely and can result in automatic course failure. The instructor will determine the appropriate consequences. Homework: can be done individually or in “study groups” but work turned in should represent your effort, not copying someone else’s work. See above. I will email the final course grade to you, if you desire, but you must give me written permission (via email is acceptable) to do so. I will not post grades outside my office door. ACCOMMODATION FOR STUDENTS WITH DISABILITIES Any student in need of a special accommodation should contact the staff in the Office of Disability Concerns at 438-5853 (voice) or 438-8620 (TDD). COURSE CALENDAR TOPIC WEEK MO. DATE 1 August Tues. 23 Thur. 25 Tues. 30 Course introduction Ch. 1 The Investment Setting Ch. 2 Return and Risk Basics Sept. Thur. 1 Tues. 6 Ch. 2, continued Ch. 3 Selecting Investments in a Global Market Thur. 8 Project #1 due date Ibbotson hands-on practice Ch. 6 Organization and Functioning of Securities Markets Ch. 7 Securities Market Indexes Ch. 7, continued Test #1, Chapters 1-3, 6, 7 Ch. 4 Mutual Funds and other Managed Investments 2 3 4 Tues. 13 Thur. 15 Tues. 20 Thur. 22 Tues. 27 5 6 Thur. 29 Tues. 4 Thur. 6 Ch. 5 Investment Policy Statements and Asset Allocation Issues Ch. 5, continued Ch. 8 Introduction to Portfolio Management 8 Tues. 11 Thurs. 13 Ch. 8, continued Ch. 9, An Introduction to Asset Pricing Models 9 Tues. 18 Ch. 10, Efficient Capital Markets Thur. 20 Tues. 25 Project #2 due date Ch. 11 Introduction to Valuation Ch. 13 Economic and Industry Analysis Thur. 27 Tues. 1 Test #2, Chapters 4, 5, 8-11, 13 Ch. 14 Analysis of Financial Statements 12 Thurs. 3 Tues. 8 Thurs. 10 Ch. 15 Company Analysis and Stock Valuation Ch. 15, continued Ch. 16 Technical Analysis 13 Tues. 15 Ch. 12 Analysis of Fixed Income Securities Thur. 17 Tues. 22 Thur. 24 Tues. 29 Ch. 12, continued THANKSGIVING BREAK THANKSGIVING BREAK Ch. 17, Introduction to Derivative Instruments 7 Oct. 10 11 Nov. 14 15 Project #3 due date Ch. 17, continued 16 Tues. 6 Ch. 18 Derivatives: Analysis and Valuation Thur. 8 Ch. 18, continued FINAL EXAM: December 12, 10am; Test 3 covers all material from Test #2 Dec. Thur. 1 PRELIMINARY ASSIGNMENT Prob.# 1, 2; Web# 1, 2, 3 Prob.# 1-6, 8, 9, 11 Web #2 Prob.# 2, 3, 6, 8, 9, 10 Spreadsheet #4, 5 Prob.# 1, 2, 3 Spreadsheet #1 Prob.# 1, 2, 6 Prob.# 4, 6, 7 Web #1 Spreadsheet #4 Prob.# 5 Spreadsheet # 6 Prob. # 3, 4, 5 Ibbotson exercises Question # 15 Prob. 1, 2, 3, 13 Web #3 Prob.# 1, 2 Web #2, 3 Prob.#3, 5-12 Prob.# 2, 3, 14, 15 Web #5 Prob.# 1, 2, 3 Web #1 Prob.# 1-5 Web #2 (S&P 500, WAG, MSFT) Question # 6, 7 Prob.# 1, 2, 3, 5, 7a Spreadsheet #4 Prob.# 1-9, 14-16 Web# 1, 3 Prob.# 1-5, 8 Prob.#1-4, 6, 9, 12, 14, 21, 23