McDonald's Corporation NYSE: MCD

advertisement

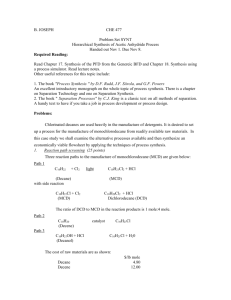

McDonald’s Corporation NYSE: MCD Student Investment Fund Stock Report Recommendation: Long‐Term Buy Sector: Consumer Discretionary Sub‐Sector: Fast Food Restaurant HIGHLIGHTS MCD is a consistent value creator, as shown by its ability to deliver year-over-year increasing NOPAT and FCF without growing its stock price above fundamentals. MCD penetrated the coffee industry with the introduction of the McCafé in 2008. MCD’s lower cost, premium coffee competes with Starbucks and is projected to generate $1 billion in total net sales each year. MCD has an established and expanding presence in high growth, emerging markets. BUSINESS SUMMARY MCD is currently recognized as the world’s largest revenuegenerating fast food restaurant, earning over $22 billion in sales during 2009. Compared to its major competitors, MCD leads the industry with 57% market share. Also in 2009, MCD earned almost 65% of its total sales in international markets. Operating 32,500 locations in 117 countries allows MCD to leverage brand equity with population growth to increase revenues worldwide. Analysts: Heather Gelsinger, Dentin Chapman, Brandon Holle, David Packard Market Cap: $75.85 billion Dividend Yield: 3.17% P/E Ratio: 15.82 Current Price: $68.01 12‐month target price: $87.73 Beta: 0.65 INVESTMENT THESIS Concerns of a sluggish economy in 2010 led us to MCD – the Student Investment Fund favors large-cap, low beta, defensive stocks that pay above-average dividends. MCD has superior financial stability and has provided shareholders with substantial return on investment — including a current dividend yield of 3.17%, the highest in their industry. MCD vigorously grows its fundamental value drivers (Dividends, NOPAT and Free Cash Flow) year-over-year. During the past 10 years of economic decline and uncertainty, MCD's stock price has appreciated 150%. Consumer Discretionary is the top performing sector since the end of January, outperforming the S&P 500 by roughly 10% 10-YEAR RETURNS McDonald’s Corporation NYSE: MCD Macroeconomic Thesis Plan to Win Consumer spending remains weak, unemployment is hovering around 10%, and real disposable income is decreasing. MCD excels under these conditions by providing high value at a low cost to consumers. In addition, the company's Plan to Win initiatives have positioned it for further increases in market share when the economy improves. MCD is deploying a multi‐billion dollar reimaging budget featuring menu innovations, space redesign and service enhancements to further upgrade its exemplary global brand. This year, MCD plans to spend $1.2 billion solely on reimaging. Moreover, MCD plans to reimage over 85% of its locations by the end of 2011. MCD has increased menu innovation by adding a premium coffee line, the McCafé , and by catering to consumers who prefer healthier options such as salads, yogurt parfaits and chicken products. MCD has increased service enhancement by offering free WiFi, offering food delivery at certain locations, and staying open 24 hours a day in others. These initiatives have already contributed to year‐over‐year revenue growth of 10.5% and global same‐store sales growth of 4.2%, and are expected to fuel above‐average growth for a considerable period of time. International Exposure MCD has diversified its locations by operating over 32,500 restaurants in 117 countries, which decreases the company’s exposure to the intensely competitive fast food industry in the United States. Also, MCD serves an average of 60 million consumers each day. This per‐day figure has increased by $14 million (30%) since 2001 and $2 million over the past year. McDonald’s Corporation NYSE: MCD MCD currently divides its revenues into four segments: the United States, Europe, the APMEA (Asia, Pacific, Middle East, and Africa segment), and other countries (i.e. Canada and Latin America and corporate sales). Almost 65% of MCD sales are derived internationally. MCD focuses both on penetrating emerging markets and expanding in developed markets. 2009 Sales By Segment The graph to the right shows MCD’s established presence in both developed and fast growing emerging markets along with the population growth rates.. The blue shaded zones represent MCD's concerted effort to enter emerging markets, where population is growing faster relative to developed markets. MCD expects to build 1,000 restaurants among all of its regional segments during 2010. This strategic move will increase revenue by approximately 2%. We view MCD's efforts to exploit opportunities in these particular markets as a strong positive catalyst, as these areas provide the largest international growth opportunities. Additionally, when an emerging market begins to industrialize, consumers begin to mirror Westerners: they want to purchase Western‐style products in general, and specifically consume more animal protein. These demographics will benefit MCD and its shareholders as it continues to expand its international presence. McDonald’s Corporation NYSE: MCD Industry Presence Invading Starbucks Territory MCD introduced the McCafé in 2008 and increased its premium coffee product line to include frappes, iced coffees, mochas, and lattes in 2009. Offering premium coffee products for an average of $2 cheaper is advantageous for MCD — they can more easily serve a price sensitive consumer who is focused on value. Additionally, Starbucks currently operates in only 50 countries, compared to MCD's operations in 117 countries. Not only does MCD have an advantage over Starbucks through its appeal to price sensitive consumers, but Starbucks does not compete with MCD in 67 countries. Superior Market Share 2009 Market Share The fast food industry generated about $160 billion dollars in revenue in 2009. When comparing MCD to its main fast food competitors YUM, WEN and BKC, MCD holds a dominant 57% market share. McDonald’s Corporation NYSE: MCD Revenue (millions) Profit Margin Dividend Yield ROIC MCD $22,745 20% 3.2% 22% BKC $2,537 8% 1.2% 28% YUM $10,836 10% 2.0% 33% WEN $3,581 0% 1.2% ‐1% SBUX $9,775 4% 0.0% 12% Within the fast food industry, MCD has the highest revenue, more than doubling the total of its closest competitor (YUM). In addition, MCD’s lean cost structure allows for the highest profit margin in the industry. This profit margin allows the company to return more value to its shareholders through dividends, producing the highest dividend yield in the industry and a competitive ROIC. Because MCD has a much larger capital investment than its competitors, earning 22% ROIC on that larger capital base allows them to earn higher economic profits than competitors with higher ROIC but much lower capital investments. McDonald’s Corporation NYSE: MCD Model Assumptions Our valuation analysis for MCD was conducted using conservative modeling assumptions. Our discounted cash flow model estimates MCD’s intrinsic value at $87.73 per share for 2010, indicating MCD is currently undervalued, even in light of these conservative expectations for its future revenue growth and cost structure. Income Statement Inputs Revenue Growth: Despite having a solid five‐year historical growth rate of 4.4%, MCD faced revenue growth of ‐3.3% during 2009. In 2009, MCD saw the adverse affects of a weak consumer spending environment, which was exacerbated by lower disposable income during the recession. o Historical Revenue Growth o Forecasted Revenue Growth Cost of Goods Sold: MCD’s historical average COGS/Sales expense was 64.9%. For our forecast, we decreased COGS/Sales to 61.0%, which was more in line with 2008 and 2009 COGS/Sales of 63.3% and 61.3% respectively. Selling, General & Administrative Expenses: MCD’s historical average SG&A/Sales expense was 10.5%. For our forecast, we decreased SG&A/Sales to 10.0%, which was more in line with 2008 and 2009 SG&A/Sales of 10.0% and 9.8% respectively. Share Growth: In September 2007, MCD announced its plan for a $10 billion share repurchasing program with no specific expiration date. Therefore, we continued MCD’s share growth at −3.0% throughout our forecast which was in line with MCD’s five‐year historical average share growth of −3.5%. Diluted Share Growth: As with share growth, we decreased MCD’s diluted share growth at the same rate of −3.0% which was in line with MCD’s five year historical growth rate of −3.4%. Dividend Growth: MCD has a forecasted dividend yield of 3.17%. Our valuation model grows the dividend payments appropriately to maintain a 3.17% dividend yield throughout the forecast period. McDonald’s Corporation NYSE: MCD Balance Sheet Inputs: Cash: MCD’s five‐year historical average Cash/Sales of 11.6% has been on a downtrend over the past three years. In 2007, 2008 and 2009 MCD had Cash/Sales of 8.7%, 8.8%, and 7.9% respectively. Our forecast repeats the current trend with forecasted Cash/Sales of 8.5%. Weighted Average Cost of Capital Assumptions: A WACC of 7.1% was calculated using Short‐term debt cost of 1.58% Long‐term debt cost of 6.10% Cost of Equity: Cost of Equity of 7.50% was calculated using the following inputs o Risk‐free rate of 4.25% o Market risk premium of 5.00% o Beta of 0.65: Conducting a regression analysis of MCD’s historical returns compared to the market since 2005 yielded a beta of 0.53. To maintain conservatism in our model and allow for reversion to the mean, we increased the beta estimate to 0.65. Long‐term Horizon Value Growth Rate We applied a long‐term horizon growth rate of 3% for MCD to maintain a conservative outlook for the company’s long‐term prospects. A long‐term horizon growth rate of 3% fits with the outlook for US GDP growth. McDonald’s Corporation NYSE: MCD Financial Analysis In the pursuit of a lean cost structure, MCD has franchised 80% of its restaurants (the remaining 20% are operated by the MCD Corporation). This is illustrated through high profitability, strong value creation, and a wide ROIC‐to‐WACC spread. ROA and ROE ROA Historical Average 11.3% Forecasted Average 13.1% ROE 23.1% 23.8% MCD maintains stable level of returns on assets and equity throughout the forecast. The forecasted ROA average is below the 2008 and 2009 ROA values of 15.2% and 15.1% respectively. The forecasted ROE is well below MCD’s 2008 and 2009 return on equity of 32.2% and 32.4% respectively. The reason for the forecasted downtrend in ROE is that the company generates excessive amounts of cash and uses it to pay down long term debt in the forecast. This decreases the equity multiplier throughout the duration of the forecast EPS and DPS growth EPS Historical Average 15.27% Forecasted Average 7.38% DPS 25.07% 6.31% MCD has paid a dividend for 34 consecutive years, increasing it every year to its current value of $0.55 per quarter ($2.20/yr). Even when compressed to lower rates for the forecast, MCD manages to grow both earnings per share and dividends per share at sustainable levels through 2019. McDonald’s Corporation NYSE: MCD Value Creation Metrics NOPAT and Free Cash Flow (millions) NOPAT FCF Historical Average $3,542 Forecasted Average $5,460 $4,309 $3,920 Over the past five years, MCD has generated large positive free cash flow. Our forecast has MCD’s free cash flow growing at an average annual growth rate of 4.25%. Historically, MCD has grown its NOPAT at an average rate of 11.33%. Following a slight reduction in NOPAT in 2010, we forecast NOPAT to grow at an average yearly growth rate of 3.94%. Economic Value Added In 2009, MCD’s EVA was $3.24. Our forecast tightens EVA to $2.80 billion and $2.91 billion in 2010 and 2011, respectively. This decrease is due to our conservative modeling assumptions. Market Value Added In 2009, MCD’s MVA was $76.84 billion. For 2010, this metric grew to $79.16 billion. MCD’s MVA is projected to continue its growth at a yearly rate of 2.8% through 2019. McDonald’s Corporation NYSE: MCD Value Spread: ROIC to WACC ROIC Historical average return on invested capital was 16.4% for MCD. In 2009, MCD generated their highest return on capital at 21.8%. For the forecast, ROIC was squeezed to an average 19.4% through 2019. WACC Weighted‐average cost of capital was calculated at 7.1%. As described above, the risk‐free rate, beta, and market risk premium were increased to maintain conservatism. Value Spread (ROIC to WACC) MCD’s historical average value spread was 9.3%. In 2009, MCD value spread was at its peak of 14.7%. MCD forecasted value spread averages 12.3%. Even with a conservative valuation model, MCD displays considerable potential to further increase its value creation beyond our forecasted ROIC‐WACC spread measure. McDonald’s Corporation NYSE: MCD Financial Stability Altman Z‐Score Test for Bankruptcy Historically, MCD scored an average of 5.20, which is well above the safe zone. MCD also scored in the same zone for the forecast with an average Altman Z‐Score of 6.77. Piotroski’s Financial Fitness Scorecard Historically, MCD scored an average of 9 out of 11. MCD’s average score for the forecasted years was also 9 out of 11, which suggests continued financial stability through 2019. Other Analyst Recommendations Both Argus and Ned Davis recommend MCD as a “Long‐Term Buy” while Standard and Poor’s recommends a hold with a three‐star rating (out of five). Argus Long‐term Buy Ned Davis Long‐term Buy Standard and Poor’s 3‐star rating McDonald’s Corporation NYSE: MCD Recommendation Summary Due to MCD’s strong dividend, stable balance sheet, and consistent ability to create shareholder value, we rate MCD as an attractive buy and hold stock for the Student Investment Fund. The purchase of MCD stock would ensure a 3.17% dividend yield for the Student Investment Fund. MCD is in the process of implementing its Plan to Win, which will focus on upgrading the current brand through reimaging, menu innovation, and service enhancement. MCD has plans to reimage 2,000 locations, 1,000 in Europe, 600 in APMEA and 400 in the U.S. in 2010. MCD also has plans to open more than 1,000 new restaurants in 2010, adding almost 2% to top line revenue. MCD offers a low correlation coefficient to the stocks held in the fund. Excluding the VTI, MCD does not have a correlation coefficient over .49 with any stock held in the fund. MCD stock has returned over 150% to shareholders in the past 10 years. With a continued ability to grow their net operating profit after tax and free cash flow on a year‐by‐year basis, MCD market price has never been able to catch up to the intrinsic value of the firm. Our forecast represents MCD performance in a less than ideal environment. MCD should meet and likely surpass our conservative modeling assumptions making our discounted cash flow price a conservative estimate. MCD Financial Analysis, Page 1 of 8 A B C D E 1 2 3 Enter Firm Ticker MCD 4 values in millions 5 Historical Income Statements 6 Enter first financial statement year in cell B6 7 8 Total revenue Cost of goods sold 9 Gross profit F G H I J K L M Forecasting Percentages 2005 2006 2007 2008 2009 2005 19,117 12,940 20,895 13,963 22,787 14,881 23,522 14,883 22,745 13,953 6,177 6,932 7,905 8,639 8,792 2,118 0 2,296 0 2,367 0 2,356 0 2,234 0 Revenue Growth COGS % of Sales SG&A % of Sales R&D % of Sales 2006 2007 2008 2009 Average 67.7% 9.3% 66.8% 9.1% 65.3% 3.2% 63.3% -3.3% 61.3% 4.4% 64.9% 11.1% 0.0% 11.0% 0.0% 10.4% 0.0% 10.0% 0.0% 9.8% 0.0% 10.5% 0.0% 10 11 SG&A expense Research & Development 12 Depreciation/Amortization 0 0 0 0 0 D&A % of Sales 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 13 Interest expense (income), operating 0 0 0 0 0 Inc. Exp. Oper. 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 14 Non-recurring expenses 128 280 1,775 Exp. Non-rec 0.7% 1.3% 7.8% -0.2% -0.5% 1.8% 15 Other operating expenses 0 0 0 0 0 Other exp. 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 3,984 4,433 3,879 6,443 6,841 0 0 0 0 0 0 32 0 (29) 0 (20) 0 (12) 0 (27) 16 Operating Income 17 Interest income (expense), non-operating 18 19 Gain (loss) on sale of assets Other income, net 20 21 Income before tax Income tax N Forecasted income statement items are based on 5 years of historical average ratios unless a value is entered in the manual cell, in which case the manual entry overrides the historical average. The idea is to consider whether the historical average is truly representative of what the firm can achieve in the future. (49) (116) 3,660 4,154 3,572 6,158 1,082 1,288 1,237 1,845 1,936 Int. inc. non-oper. 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Gain (loss) asset sales Other income, net 0.0% 0.2% 0.0% -0.1% 0.0% -0.1% 0.0% -0.1% 0.0% -0.1% 0.0% 0.0% 29.6% 31.0% 34.6% 30.0% 29.8% 31.0% Manual 61.0% 10.0% 6,487 Tax rate 22 Income after tax 2,578 2,866 2,335 4,313 4,551 23 Minority interest 0 0 0 0 0 Minority interest 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 24 25 Equity in affiliates U.S. GAAP adjustment 0 0 0 0 0 0 0 0 0 0 Equity in affiliates U.S. GAAP adjust. 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 2,578 2,866 2,335 4,313 4,551 25 678 60 0 0 2,602 3,544 2,395 4,313 4,551 Share growth -2.1% -3.7% -5.2% -3.1% -3.5% -3.0% Diluted share growth -1.8% -3.2% -5.4% -3.4% -3.4% -3.0% 26 27 Net income before extraordinary items Extraordinary items, total 28 Net income 29 Total adjustments to net income 30 Basic weighted average shares 31 Basic EPS excluding extraordinary items 32 Basic EPS including extraordinary items 33 Diluted weighted average shares 34 0 0 0 0 0 1,260 1,234 1,188 1,127 1,092 2.05 2.32 1.96 3.83 4.17 2.06 2.87 2.02 3.83 4.17 1,274 1,252 1,212 1,146 1,107 Diluted EPS excluding extraordinary items 2.02 2.29 1.93 3.76 4.11 35 Diluted EPS including extraordinary items 2.04 2.83 1.98 3.76 4.11 36 Dividends per share -- common stock 0.67 1.00 1.50 1.63 2.05 37 Gross dividends -- common stock 842 1,217 1,766 1,823 2,236 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Retained earnings 1,760 2,328 630 2,490 2,316 Data Source: Thomson/Reuters Extrordinary items Adjustments to NI Dividend growth 44.5% 45.1% 3.3% 22.6% 27.6% MCD Financial Analysis, Page 2 of 8 O P Q R S T U V W X Y Z 31.45% 3.29% 5.52% 2.51% 5.52% 3.02% 2.06% 3.29% 5.58% 3.59% 3.50% 4.00% 4.50% 6.00% 5.00% 5.00% 4.50% 4.00% 3.50% 3.00% 1 2 3 Dividend Growth (Yield set @ 3.17%) 4 Year-by-year revenue growth Forecasted Income Statements -- 10 Years 5 6 year 7 8 Total revenue Cost of goods sold 9 Gross profit 2010E 2011E 23,541 14,360 2012E 24,482 14,934 2013E 2014E 2015E 2016E 2017E 2018E 2019E 25,584 15,606 27,119 16,543 28,475 17,370 29,899 18,238 31,244 19,059 32,494 19,821 33,631 20,515 34,640 21,131 9,181 9,548 9,978 10,576 11,105 11,661 12,185 12,673 13,116 13,510 10 11 SG&A expense Research & Development 2,354 0 2,448 0 2,558 0 2,712 0 2,848 0 2,990 0 3,124 0 3,249 0 3,363 0 3,464 0 12 Depreciation/Amortization 0 0 0 0 0 0 0 0 0 0 13 Interest expense (income), operating 0 0 0 0 0 0 0 0 0 0 14 Non-recurring expenses 428 445 465 493 517 543 568 590 611 629 15 16 Other operating expenses Operating Income 17 Interest income (expense), non-operating 18 19 Gain (loss) on sale of assets Other income, net 20 21 Income before tax Income tax 0 0 0 0 0 0 0 0 0 0 6,399 6,655 6,955 7,372 7,741 8,128 8,493 8,833 9,142 9,416 (614) (607) (607) (624) (625) (620) (598) (562) (516) (456) 0 (11) 0 (11) 0 (11) 0 (12) 0 (13) 0 (13) 0 (14) 0 (15) 0 (15) 0 (15) 5,774 6,037 6,336 6,736 7,103 7,494 7,881 8,257 8,611 1,790 1,872 1,964 2,088 2,202 2,323 2,443 2,560 2,670 8,945 2,773 22 Income after tax 3,984 4,166 4,372 4,647 4,901 5,171 5,438 5,697 5,942 6,172 23 Minority interest 0 0 0 0 0 0 0 0 0 0 24 25 Equity in affiliates U.S. GAAP adjustment 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 3,984 4,166 4,372 4,647 4,901 5,171 5,438 5,697 5,942 6,172 0 0 0 0 0 0 0 0 0 0 3,984 4,166 4,372 4,647 4,901 5,171 5,438 5,697 5,942 6,172 26 27 Net income before extraordinary items Extraordinary items, total 28 Net income 29 Total adjustments to net income 30 Basic weighted average shares 31 32 33 Diluted weighted average shares 34 0 0 0 0 0 0 0 0 0 0 1,059 1,028 997 967 938 910 882 856 830 805 Basic EPS excluding extraordinary items 3.76 4.05 4.39 4.81 5.23 5.68 6.16 6.66 7.16 7.66 Basic EPS including extraordinary items 3.76 4.05 4.39 4.81 5.23 5.68 6.16 6.66 7.16 7.66 1,074 1,042 1,011 980 951 922 895 868 842 817 Diluted EPS excluding extraordinary items 3.71 4.00 4.33 4.74 5.15 5.61 6.08 6.56 7.06 7.56 35 Diluted EPS including extraordinary items 3.71 4.00 4.33 4.74 5.15 5.61 6.08 6.56 7.06 7.56 36 Dividends per share -- common stock 2.77 2.95 3.21 3.40 3.69 3.92 4.13 4.40 4.78 5.11 37 Gross dividends -- common stock 2,939 3,035 3,203 3,283 3,464 3,569 3,643 3,763 3,973 4,115 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Retained earnings 1,045 1,130 1,169 1,364 1,436 1,602 1,795 1,934 1,969 2,057 MCD Financial Analysis, Page 3 of 8 AA AB AC AD AE 1 2 3 Enter Firm Ticker MCD 4 values in millions 5 Historical Balance Sheets 6 year 7 8 Assets Cash & equivalents 9 Short term investments 10 11 AF AG AH AI AJ AK AL AM 2005 Forecasting Percentages 2006 2007 2008 2009 2005 2007 2008 2009 Average 2,128 1,981 2,063 1,796 22.3% 10.2% 8.7% 8.8% 7.9% 11.6% 0 0 0 0 0 ST Invest. % of Sales 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Receivables, total Inventory, total 794 144 806 112 1,054 125 931 112 1,060 106 Receivables % Sales Inventory % of Sales 4.2% 0.8% 3.9% 0.5% 4.6% 0.5% 4.0% 0.5% 4.7% 0.5% 4.3% 0.6% 12 Prepaid expenses 640 319 422 412 454 Pre. Exp. % of Sales 3.3% 1.5% 1.8% 1.7% 2.0% 2.1% 13 Other current assets, total 380 1,826 0 0 0 Other CA % of Sales 2.0% 8.7% 0.0% 0.0% 0.0% 2.1% 6,219 5,192 3,582 3,518 3,416 19,573 19,438 20,985 20,255 21,532 Net PPE % of Sales 102.4% 93.0% 92.1% 86.1% 94.7% 93.7% 1,924 2,074 2,301 2,237 2,425 Goodwill % of Sales 10.1% 9.9% 10.1% 9.5% 10.7% 10.1% 0 0 0 0 0 Intangibles % of Sales 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% LT Invest. % of Sales Notes Rec. % of Sales 5.4% 0.0% 5.0% 0.0% 5.1% 0.0% 5.2% 0.0% 5.3% 0.0% 5.2% 0.0% Total Current Assets 15 Property, plant and equipment (net) 16 Goodwill 17 Intangibles 18 19 Long term investments Notes receivable -- long term 1,035 0 1,035 0 1,156 0 1,222 0 1,213 0 20 Other long term assets, total 1,237 1,235 1,367 1,230 1,639 21 Other assets, total 0 0 0 0 0 29,989 28,975 29,392 28,462 30,225 624 0 620 0 636 0 22 23 Total assets Accounts payable Payable/accrued 678 0 669 0 26 Accrued expenses 1,317 1,460 1,635 1,633 1,855 27 Notes payable/short term debt 544 0 1,127 0 0 28 Current portion of LT debt/Capital leases 659 18 865 32 18 29 Other current liabilities 911 806 248 253 480 30 Total Current Liabilities 4,108 2,952 4,499 2,538 2,989 31 Long term debt, total 8,934 8,390 7,310 10,186 10,560 32 Deferred income tax 949 1,076 961 945 1,279 33 Minority interest 0 0 0 0 0 34 Other liabilities, total 852 1,098 1,343 1,410 1,363 14,843 13,516 14,112 15,079 16,191 Total Liabilities 36 Preferred stock (redeemable) 37 Preferred stock (unredeemable) 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Other LT ass. % Sales 6.5% 5.9% 6.0% 5.2% 7.2% 6.2% Other assets % Sales 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Acc. Payable % Sales Pay/accured % Sales 3.5% 0.0% 3.2% 0.0% 2.7% 0.0% 2.6% 0.0% 2.8% 0.0% 3.0% 0.0% Liabilities and Shareholders' Equity 24 25 35 Cash % of Sales 2006 4,261 14 Common stock Additonal paid-in capital Retained earnings (accumluated deficit) Treasury stock -- common ESOP Debt Guarantee Other equity, total Total Shareholders' Equity Total Liabilities and Shareholders' Equity Diluted weighted average shares Total preferred shares outstanding AN Forecasted balance sheet items are based on 5 years of historical average ratios unless a value is entered in the manual cell, in which case the manual entry overrides the historical average. The idea is to consider whether the historical average is truly representative of what the firm can achieve in the future. 0 17 2,720 23,516 (10,374) 0 (733) 15,146 29,989 1,263 0 0 17 3,445 25,846 (13,552) 0 (297) 15,458 28,975 1,204 0 0 17 4,227 26,462 (16,762) (38) 1,375 15,280 29,392 1,165 0 0 17 4,600 28,954 (20,289) (98) 199 13,383 28,462 1,115 0 Acc. Exp. % of Sales 6.9% 7.0% 7.2% 6.9% 8.2% 7.2% Notes payable % Sales 2.8% 0.0% 4.9% 0.0% 0.0% 1.6% Curr. debt % of Sales 3.4% 0.1% 3.8% 0.1% 0.1% 1.5% Other curr liab % Sales 4.8% 3.9% 1.1% 1.1% 2.1% 2.6% Def. inc. tax % Sales 5.0% 5.2% 4.2% 4.0% 5.6% 4.8% Min. Int. % of Sales 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Other liab. % of Sales 4.5% 5.3% 5.9% 6.0% 6.0% 5.5% LT debt % of Sales 0 17 4,854 31,271 (22,855) (135) 882 14,034 30,225 1,077 0 The model uses the more conservative diluted common shares number for total shares outstanding. Diluted share growth Preferred share growth -4.7% -3.2% -4.3% -3.5% -3.9% Manual 8.5% MCD Financial Analysis, Page 4 of 8 AO 1 2 3 AP AQ AR AS AT AU AV AW AX AY AZ Model maintains a fixed ratio of ST debt/sales. LT debt is adjusted for shortfalls/surpluses of AFN. Every time something changes that affects the forecasts, set row 49 4 5 Forecasted Balance Sheets -- 10 Years 6 year 7 8 Assets Cash & equivalents 9 Short term investments 10 11 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2,001 2,081 2,175 2,305 2,420 2,541 2,656 2,762 2,859 0 0 0 0 0 0 0 0 0 0 Receivables, total Inventory, total 1,001 131 1,041 136 1,088 142 1,153 151 1,211 159 1,271 166 1,328 174 1,381 181 1,430 187 1,473 193 12 Prepaid expenses 493 513 536 568 596 626 654 680 704 725 13 Other current assets, total 505 525 549 582 611 641 670 697 722 743 4,131 4,296 4,489 4,759 4,996 5,246 5,482 5,702 5,901 6,078 22,047 22,929 23,961 25,399 26,668 28,002 29,262 30,432 31,498 32,443 2,367 2,461 2,572 2,726 2,863 3,006 3,141 3,267 3,381 3,482 0 0 0 0 0 0 0 0 0 0 14 Total Current Assets 2,944 15 Property, plant and equipment (net) 16 Goodwill 17 Intangibles 18 19 Long term investments Notes receivable -- long term 1,223 0 1,272 0 1,329 0 1,409 0 1,479 0 1,553 0 1,623 0 1,688 0 1,747 0 1,800 0 20 Other long term assets, total 1,451 1,509 1,577 1,671 1,755 1,843 1,926 2,003 2,073 2,135 21 Other assets, total 0 0 0 0 0 0 0 0 0 0 31,218 32,467 33,928 35,964 37,762 39,650 41,434 43,091 44,600 45,938 22 23 Total assets Liabilities and Shareholders' Equity 24 25 Accounts payable Payable/accrued 702 0 731 0 763 0 809 0 850 0 892 0 932 0 970 0 1,004 0 1,034 0 26 Accrued expenses 1,702 1,770 1,850 1,960 2,058 2,161 2,259 2,349 2,431 2,504 27 Notes payable/short term debt 367 381 399 423 444 466 487 506 524 540 28 Current portion of LT debt/Capital leases 355 369 386 409 429 451 471 490 507 522 29 Other current liabilities 30 Total Current Liabilities 31 Long term debt, total 9,978 32 Deferred income tax 1,129 33 Minority interest 34 Other liabilities, total 35 631 660 699 734 771 806 838 867 893 3,882 4,057 4,300 4,515 4,741 4,954 5,153 5,333 5,493 9,850 9,854 10,124 10,131 10,044 9,682 9,077 8,319 7,336 1,174 1,227 1,300 1,365 1,434 1,498 1,558 1,612 1,661 0 0 0 0 0 0 0 0 0 0 1,299 1,351 1,412 1,496 1,571 1,650 1,724 1,793 1,856 1,911 16,139 16,257 16,549 17,221 17,582 17,869 17,858 17,581 17,120 16,401 36 Preferred stock (redeemable) 0 0 0 0 0 0 0 0 0 0 37 Preferred stock (unredeemable) 0 0 0 0 0 0 0 0 0 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Total Liabilities 607 3,733 Common stock Additonal paid-in capital Retained earnings (accumluated deficit) Treasury stock -- common ESOP Debt Guarantee Other equity, total Total Shareholders' Equity Total Liabilities and Shareholders' Equity Total common shares (diluted) Total preferred shares outstanding AFN (interactive with 3 items below) Adjustment to LT Debt (iterate or use Goal Seek Issue Common Stock to Fund AFN Set Balance Sheet Cash Lower to Fund AFN 17 4,854 32,316 (22,855) (135) 882 15,079 31,218 1,035 17 4,854 33,447 (22,855) (135) 882 16,210 32,467 994 0.0 (582.0) 0.0 (128.1) 17 4,854 34,616 (22,855) (135) 882 17,379 33,928 955 0.0 3.9 17 4,854 35,980 (22,855) (135) 882 18,743 35,964 918 0.0 269.7 17 4,854 37,416 (22,855) (135) 882 20,179 37,762 882 0.0 6.9 0 17 4,854 39,018 (22,855) (135) 882 21,781 39,650 847 17 4,854 40,813 (22,855) (135) 882 23,576 41,434 814 17 4,854 42,747 (22,855) (135) 882 25,510 43,091 782 17 4,854 44,716 (22,855) (135) 882 27,480 44,600 752 17 4,854 46,773 (22,855) (135) 882 29,536 45,938 722 0.0 (86.2) 0.0 (362.9) 0.0 (604.2) 0.0 (758.5) 0.0 (982.7) MCD Financial Analysis, Page 5 of 8 BA 1 Enter Firm Ticker 2 3 BB MCD BC BD BE BF BG BH BI BJ 2007 2008 2009 2010E 2011E 2012E values in millions Historical Ratios and Valuation Model 2005 4 2006 BK BL BM BN BO BP 2017E 2018E 2019E Forecasted Ratios and Valuation Model -- 10 Years 2013E 2014E 2015E 2016E 5 Liquidity 6 Current 1.51 1.76 0.80 1.39 1.14 1.11 1.11 1.11 1.11 1.11 1.11 1.11 1.11 1.11 1.11 7 8 Quick Net Working Capital to Total Assets 1.48 0.07 1.72 0.08 0.77 (0.03) 1.34 0.03 1.11 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 1.07 0.01 15.16 132.48 14.08 185.90 14.45 210.96 17.02 214.17 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 15.52 179.63 9 Asset Management 10 11 Days Sales Outstanding Inventory Turnover 12 Fixed Assets Turnover 0.98 1.07 1.09 1.16 1.06 1.07 1.07 1.07 1.07 1.07 1.07 1.07 1.07 1.07 1.07 13 Total Assets Turnover 0.64 0.72 0.78 0.83 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 16.88 181.86 14 Debt Management 15 Long-Term Debt to Equity 59.0% 54.3% 47.8% 76.1% 75.2% 66.2% 60.8% 56.7% 54.0% 50.2% 46.1% 41.1% 35.6% 30.3% 24.8% 16 Total Debt to Total Assets 31.6% 29.0% 28.7% 35.8% 34.9% 33.1% 31.5% 30.2% 29.3% 28.0% 26.5% 24.5% 22.2% 19.8% 17.1% 17 Times Interest Earned N/A N/A N/A N/A N/A 10.4 11.0 11.4 11.8 12.4 13.1 14.2 15.7 17.7 20.6 18 Profitability 19 Gross Profit Margin 32.3% 33.2% 34.7% 36.7% 38.7% 39.0% 39.0% 39.0% 39.0% 39.0% 39.0% 39.0% 39.0% 39.0% 39.0% 20 Operating Profit Margin 20.8% 21.2% 17.0% 27.4% 30.1% 27.2% 27.2% 27.2% 27.2% 27.2% 27.2% 27.2% 27.2% 27.2% 27.2% 21 Net After-Tax Profit Margin 13.5% 13.7% 10.2% 18.3% 20.0% 16.9% 17.0% 17.1% 17.1% 17.2% 17.3% 17.4% 17.5% 17.7% 17.8% 22 Total Assets Turnover 0.64 0.72 0.78 0.83 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 23 Return on Assets 8.6% 9.9% 7.9% 15.2% 15.1% 12.8% 12.8% 12.9% 12.9% 13.0% 13.0% 13.1% 13.2% 13.3% 13.4% 24 25 Equity Multiplier Return on Equity 1.98 17.0% 1.87 18.5% 1.92 15.3% 2.13 32.2% 2.15 32.4% 2.07 26.4% 2.00 25.7% 1.95 25.2% 1.92 24.8% 1.87 24.3% 1.82 23.7% 1.76 23.1% 1.69 22.3% 1.62 21.6% 1.56 20.9% 26 27 EPS (using diluted shares, excluding extraordinary items 2.02 2.29 1.93 3.76 4.11 3.71 4.00 4.33 4.74 5.15 5.61 6.08 6.56 7.06 7.56 28 DPS (dividends per share) 0.66 0.97 1.46 1.59 2.02 2.77 2.95 3.21 3.40 3.69 3.92 4.13 4.40 4.78 5.11 3.52 3.39 3.53 3.69 5.63 6.19 6.76 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Free Cash Flow per Share 4.38 0.83 4.62 Valuation Metrics Trend Analysis (NOPAT, EVA, MVA, FCF and Capital in millions) 2005 2006 2007 2008 NOPAT (net operating profit after tax) 2,806 3,058 2,536 4,513 ROIC (return on invested capital) 12.3% 15.0% 11.6% 21.4% EVA (economic value added) 1,189 1,613 982 3,015 FCF (free cash flow) N/A 5,480 1,006 5,291 Weighted Average Cost of Capital 7.1% 7.1% 7.1% 7.1% Net Operating Working Capital (NOWC) 3,204 918 901 853 Operating Long Term Assets 19,573 19,438 20,985 20,255 Total Operating Capital 22,778 20,356 21,886 21,107 Valuation (in millions where appropriate) -- through year 2019E Long-term Horizon Value Growth Rate (user-supplied) PV of Forecasted FCF, discounted at 7.10% $88,661 $89,475 Value of Non-Operating Assets $4,261 $2,128 Total Intrinsic Value of the Firm $92,922 $91,603 Intrinsic Market Value of the Equity $83,444 $83,213 Per Share Intrinsic Value of the Firm $65.49 $66.48 MVA (market value added) $68,298 $67,755 Weighted Average Cost of Capital Calculations Item Value Percent ST Debt (from most recent balance sheet) 0 0.00% LT Debt (from most recent balance sheet) 10,560 12.22% 87.78% MV Equity (look up stock's mkt. cap and enter in cell BB53 75,845 Weighted Average Cost of Capital NOPAT per Share EVA per Share MVA per Share 2.20 0.93 2.44 1.29 $94,819 $1,981 $96,801 $88,364 $72.92 $73,084 $96,258 $2,063 $98,322 $88,136 $76.91 $74,753 2009 4,799 21.8% 3,238 3,903 7.1% 472 21,532 22,003 2010E 2009 3.00% $99,187 $1,796 $100,983 $90,423 $81.65 $76,389 2010E Cost Weighted Cost 1.58% 0.00% 6.10% 0.51% 7.50% 6.58% 7.10% 2.09 0.81 3.94 2.63 4.33 2.92 68.98 2011E 2012E 4,415 4,592 4,799 19.4% 19.4% 19.4% 2,799 2,911 3,042 3,643 3,681 3,733 7.1% 7.1% 7.1% 729 758 792 22,047 22,776 22,929 23,687 23,961 24,753 2011E 2012E $102,584 $106,185 $109,989 $2,001 $2,081 $2,175 $104,585 $108,266 $112,163 $94,240 $98,034 $101,911 $87.73 $94.09 $100.83 $79,161 $81,824 $84,532 Capital Asset Pricing Model Risk Free Rate 4.25% Beta 0.65 Market Risk Prem. 5.00% Cost of Equity 7.50% 4.11 2.61 73.69 4.41 2.79 78.53 4.75 3.01 83.64 3.67 4.24 4.59 5.09 Forecasted Valuation Metrics -- 10 Years 2013E 2014E 2015E 2016E 5,086 5,341 5,608 5,860 19.4% 19.4% 19.4% 19.4% 3,224 3,385 3,555 3,715 3,601 4,029 4,230 4,558 7.1% 7.1% 7.1% 7.1% 839 881 925 967 25,399 26,668 28,002 29,262 26,238 27,550 28,927 30,229 2017E 2018E 2019E 6,095 6,308 6,497 19.4% 19.4% 19.4% 3,863 3,998 4,118 4,885 5,208 5,521 7.1% 7.1% 7.1% 1,006 1,041 1,072 30,432 31,438 31,498 32,538 32,443 33,515 2013E 2014E 2015E 2016E $114,194 $2,305 $116,499 $105,953 $108.07 $87,210 $118,271 $2,420 $120,691 $110,117 $115.80 $89,937 $122,435 $2,541 $124,976 $114,466 $124.09 $92,685 $126,566 $130,664 $134,731 $138,773 $2,656 $2,762 $2,859 $2,944 $129,222 $133,426 $137,590 $141,718 $119,054 $123,843 $128,747 $133,842 $133.06 $142.69 $152.93 $163.90 $95,478 $98,332 $101,267 $104,305 5.19 3.29 88.96 5.62 3.56 94.58 6.08 3.85 100.48 6.55 4.15 106.71 2017E 7.02 4.45 113.30 2018E 7.49 4.75 120.29 2019E 7.96 5.04 127.73 MCD Financial Analysis, Page 6 of 8 BQ BR BS BT BU BV BW BX BY BZ CA CB CC CD CE CF CG 1 2 3 4 5 6 7 8 9 In this section we are going to examine historical and forecasted ratios (or "multiples") typically used to value stocks ‐‐ P/CF, Enterprise Value/EBITDA, etc. We first want to compare the historical trends in these ratios to the trends in their forecasted values. If our forecasted multiples are systematically increasing or decreasing our forecasts may be too optimistic or pessimistic, and our forecast assumptions may have to be adjusted. Second, we want to compare our discounted cash flow valuation estimates with those derived from the various multiples. Once again, if there is a large discrepancy between our DCF valuation estimate of the company's stock and the range of values obtained from the various multiples, we may want to adjust our forecast assumptions. 1. You will need to look up the company's year‐end stock prices and enter them in the first 5 (historical) years of the "per share value" category. 2. Use the estimated DCF price per share in the forecasted period (link to your forecasted prices in cells BG47‐BP47. 3. Market capitalization will be calculated as basic weighted shares x historical year‐end prices and then forecasted basic weighted shares x DCF forecasted prices. 4. As with previous calculations, historical multiples use actual historical values and forecasted multiples use forecasted values. 10 11 12 14 Per share value (hist. & DCF est.) 15 Market capitalization 16 EBITDA 2005 $33.72 $42,501 $3,684 Enterprise Value $47,718 13 17 18 19 Inputs Multiples Price/Sales Historical Ratios and Valuation 2006 2007 2008 $44.33 $58.91 $62.19 $54,703 $70,003 $70,063 $4,833 $3,632 $6,158 2009 $62.44 $68,197 $6,487 2010E $87.73 $92,947 $6,389 2011E $94.09 $96,688 $6,644 2012E $100.83 $100,512 $6,943 Forecasted Ratios and Valuation 2013E 2014E 2015E 2016E $108.07 $115.80 $124.09 $133.06 $104,499 $108,605 $112,895 $117,420 $7,360 $7,728 $8,114 $8,479 2017E $142.69 $122,143 $8,819 2018E $152.93 $126,980 $9,127 2019E $163.90 $132,005 $9,401 $60,965 $76,961 $101,291 $104,839 $108,590 $112,740 $128,965 $132,964 $136,936 $76,458 $78,186 $116,759 $120,864 $124,932 2.22 2.62 3.07 2.98 3.00 3.95 3.95 3.93 3.85 3.81 3.78 3.76 3.76 3.78 3.81 11.54 11.32 19.27 11.38 10.51 14.55 14.55 14.48 14.20 14.05 13.91 13.85 13.85 13.91 14.04 20 Price/EBITDA 21 Price/Free Cash Flow N/A 10.20 72.25 13.97 18.02 25.51 26.27 26.93 29.02 26.96 26.69 25.76 25.00 24.38 23.91 22 Enterprise Value/EBITDA 12.95 12.62 21.05 12.70 11.86 15.85 15.78 15.64 15.32 15.11 14.90 14.73 14.62 14.57 14.57 23 Price/Earnings 16.67 19.36 30.57 16.52 15.19 23.65 23.53 23.31 22.80 22.47 22.14 21.89 21.74 21.67 21.69 24 25 Free Cash Flow Yield Dividend Yield 1.96% 9.9% 2.19% 1.4% 2.47% 7.4% 2.56% 5.6% 3.23% 3.9% 3.16% 3.8% 3.14% 3.7% 3.19% 3.4% 3.14% 3.7% 3.19% 3.7% 3.16% 3.8% 3.10% 3.9% 3.08% 4.0% 3.13% 4.1% 3.12% 2010E $60.88 $77.21 $98.37 $85.84 $73.95 $60.88 $98.37 $87.73 2011E $65.27 $82.78 $102.47 $92.04 $79.71 $65.27 $102.47 $94.09 2018E $110.98 $140.74 $179.43 $156.48 $140.71 $110.98 $179.43 $152.93 2019E $117.84 $149.45 $196.11 $166.16 $150.68 $117.84 $196.11 $163.90 26 27 Historical Override Average w/Manual 2.78 12.80 28.61 14.24 19.66 Low Price High Price DCF Price Valuation Estimates Based On: 28 Price/Sales 29 Price/EBITDA 30 Price/Free Cash Flow 31 Enterprise Value/EBITDA 32 Price/Earnings 33 34 35 Forecasted Stock Prices Based on Historical Multiples -- 10 Years 2012E $70.32 $89.18 $107.13 $99.16 $86.24 $70.32 $107.13 $100.83 2013E $76.85 $97.46 $106.56 $108.36 $94.51 $76.85 $108.36 $108.07 2014E $83.18 $105.49 $122.90 $117.29 $102.75 $83.18 $122.90 $115.80 2015E $90.04 $114.20 $133.03 $126.97 $111.76 $90.04 $133.03 $124.09 2016E $97.01 $123.02 $147.78 $136.78 $121.17 $97.01 $147.78 $133.06 2017E $104.01 $131.90 $163.28 $146.65 $130.87 $104.01 $163.28 $142.69 36 37 Forecasted Per Share Stock Values Price/Sales and Enterprise Value/EBITDA vs. Price 24 $160 20 $140 16 $120 $100 12 $80 8 $60 4 $40 $20 0 Price/Sales Enterprise Value/EBITDA Historical or DCF Price Forecasted Value Per Share $180 Historical or DCF Price P/S and Ent. Value/EBITDA 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 $210 $195 $180 $165 $150 $135 $120 $105 $90 $75 $60 $45 $30 $15 $0 Low Price DCF Price High Price CH MCD Financial Analysis, Page 7 of 8 CI CJ CK CL CM CN CO CP CQ CR CS CT CU CV CW CX CY CZ DA 1 2 3 Price/Earnings Ratio and Dividend Yield 9 10 11 12 30 4.0% 25 20 3.0% 15 2.0% 10 1.0% 5 0 13 EPS and DPS 7 8 5.0% Dividend Yield 6 Price/Earnings Ratio 5 Earnings and Dividends Per Share 35 4 0.0% $8.00 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00 14 15 16 Price/Earnings Ratio 17 Earnings Per Share Dividend Yield Dividends Per Share 18 19 Gross, Operating and Net Profit Margins 20 23 24 25 26 27 28 Gross Margin 22 29 30 Return on Assets, Equity and Invested Capital 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 35% ROA, ROE and ROIC 21 30% 25% 20% 15% 10% 5% 0% 31 32 33 Gross Margin 34 Operating Margin Net Margin Return on Assets Return on Equity Return on Invested Capital 35 36 37 NOPAT and Free Cash Flow (millions) $4,000 $100,000 $3,500 $80,000 $3,000 $60,000 $2,500 Economic Value Added Market Value Added Market Value Added $120,000 NOPAT and Free Cash Flow Economic Value Added & Market Value Added (millions) $4,500 Economic Value Added 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 $7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $0 NOPAT Free Cash Flow DB MCD Financial Analysis, Page 8 of 8 DC DD DE DF DG DH DI DJ DK 1 2 3 Piotroski Financial Fitness Score (max = 11) 4 5 7 8 9 10 11 Piotroski Score 6 12 13 11 10 9 8 7 6 5 4 3 2 1 0 14 15 16 Piotroski Score 17 18 19 Altman Probability of Bankruptcy Z‐Score 20 21 22 24 25 26 27 28 29 30 31 Altman Z‐Score 23 12 11 10 9 8 7 6 5 4 3 2 1 0 Z >2.9 = Safe, 1.23 < Z < 2.9 = Grey Area, Z < 1.23 = Distress 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 Altman Z‐Score DL DM DN DO DP DQ DR DS DT DU DV