BEST BUY VALUATION

advertisement

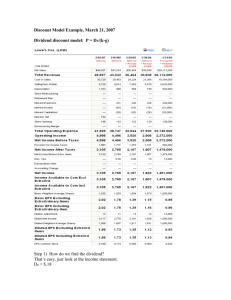

BEST BUY VALUATION David Enriquez Chris Gonsalves Rohit Kapai Patrick Nigro Two-Stage Dividend Discount/ P/E Model Assumptions • Payout ratio = 17% • Short-term dividend growth rate= 17% • Cost of equity = 12% • Beta = 1.4 • P/E ratio at t(5) = 10.01 Model Analysis Supplemental Information Best Buy is one of the country’s largest specialty retailers of consumer electronics, personal computers, and appliances. The company’s Domestic segment operates in the United States as Best Buy (consumer electronics), Best Buy Mobile (cell phones and accessories), Geek Squad (product repair, support, and installation), Magnolia Audio Video (high-end audio/video products), Napster (digital music), Pacific Sales (high-end home improvements), and Speakeasy (broadband, voice, data, information services to small businesses). The International segment operates in Canada as Best Buy, Best Buy Mobile, Future Shop, and Geek Squad; in Europe as The Carphone Warehouse, The Phone House and Geek Squad; in China as Best Buy, Geek Squad, and Five Star; in Mexico as Best Buy and Geek Squad. In Fiscal Year 2009 the company recorded revenue in excess of $45 billion with just over $1 billion in net income. Best Buy has a strong market presence that it continuously reinforces with key acquisitions. Best Buy has been able to differentiate itself by offering services such as First, our analysts found the company’s Beta by using the historical four- year monthly stock return of Best Buy as compared to the S&P 500’s returns. We then used the federal government’s 10-year T-bill yield as the risk-free rate and adjusted the returns of the equities for that. The resulting graph of these points and slope of the trend line determined Best Buy’s beta. Using CAPM with a market risk premium of 8%, we were then able to determine that Best Buy’s cost of equity should be 11.94%, which we rounded up to 12%. Once cost of equity was calculated, the next step was to plug the annual dividend rate of $0.56 per share, the share price of $28.82 as of 2/2/2009, the average short-term growth rate of 17%, and the required rate of 12% into our 5-year DDM model. The 17% shortterm dividend growth rate was calculated by averaging the dividend growth rate of the previous four years. Although the growth was at 19%, we chose 17% to be conservative. To get the terminal value after year 5 we used a P/E valuation using the trailing P/E ratio of 10.01 and the implied EPS at year 5, which we used under the assumption that Best Buy will maintain their three-year average payout rate for dividends of 17%. The summation of present values for these two valuations gave us a value of $44.34 per share. So, with this Best Buy is largely undervalued in the market right now at $28.82. The two-stage DDM/ P/E ratio valuation was the best method to use for Best Buy because the company pays a consistent dividend that has a stable payout ratio. Unfortunately, we do not believe that the dividend growth rate will remain at 17% past five years. After five years, the P/E ratio valuation was used because it takes into account the market’s expectation of growth of the company, which is safer to use than our estimated long-term growth rate. As a result, we felt that combining the DDM and P/E ratio valuations would give us the most accurate intrinsic value of Best Buy. installation of home theater equipment and other electronics. Its “Geek Squad” unit, offering computer repair and support services, has been successful and is now available in all U.S. stores as well as seven stand-alone stores. One of Best Buy’s biggest weaknesses is its lack of supplier diversity. The company’s 20 largest suppliers account for half of the merchandise purchased. Some of these top suppliers have also started to integrate vertically and open their own stores. Competition amongst electronic specialty retailers has led to the demise of three former powerhouses of the industry in the last few years: Tweeter Home Entertainment Group, CompUSA, and Circuit City. Aside from traditional competitors such as Radioshack and hhgregg, the industry has faced considerable pressure from large discount retailers Wal-Mart and Costco Wholesale, both of which have expanded their selection of consumer electronics and continue to offer less expensive products. Amazon.com has also become a strong competitor as its online sales of electronics continue to thrive. Globally, the computer and electronic retail sector had a compound annual growth rate (CAGR) of 6.3% for the period 2004-2008. That figure is forecasted to drop to 4.5% over 20082013. Two-Stage Discounted Cash Flow Model Assumptions • Cost of Equity = 12% (using CAPM) • Market Value of Equity = $11.989B • Pretax Cost of Debt = 8% • WACC = 11.4% • 5 year short-term growth = 8%; Long-term growth = 3% Model Analysis Cost of Equity was determined using CAPM, which gave a required return of 12%. Next, the Market Value of Equity was determined as of February 2009, which came out to $11.989B. We used 02/2009 because that is the date of the most recent 10K. Using the Book Value of Debt from the same time frame, WACC came out to be 11.4%. Best Buy has experienced an average growth in sales over the past four years of 13%. By comparing the calculated Free Cash Flow to Equity to Sales for the previous four years, FCFE was consistently around 4% of Sales. It is our belief that Best Buy cannot grow sales at 13% for the next five years, so we used a more reasonable 8% growth rate. Based on projected sales, we grew out FCFE at 4% of sales. Once FCFE was forecasted for 5 years, the Terminal Value needed to be determined using the perpetuity growth rate of 3%. Terminal Value was found taking the FCFE for year 6 and dividing it by the difference of WACC and the perpetuity growth rate. After discounting the five-year FCFE forecast and the Terminal Value forecast, we arrived at an intrinsic value of Best Buy at $60.21. The reason our company used a DCF model is because Best Buy showed consistent, positive Free Cash Flows. FCFE was used because Best Buy has a stable capital structure with consistent debt. FCFE also showed consistent growth for the past four years when compared to Net Sales, so we felt it was appropriate to grow this and use it as our indicator of intrinsic value. The outer five years was grown at an 8% rate because we wanted to be conservative with our growth. Knowing that even 8% was unsustainable, we decided to use a two-stage, so that we could grow the Terminal Value at a more reasonable rate, which we assumed to be fair at 3%. ACCOUNTING PRINCIPLES OVERVIEW Best Buy's accounting policies are not significantly different from its competitors. Revenue is recognized when the sales price is fixed or determinable, collectability is reasonably assured and the customer takes possession of the merchandise or the service is provided. Revenue is recognized for store sales when the customer receives and pays for merchandise. For online sales, revenue is recognized at the time the customer receives the product. The company sells service contracts as well as extended warranties that have terms that range from 3 months to 5 years. In instances where the company is deemed to be the obligor on the contract, service revenue is recognized in revenue ratably over the term of the service contract. In instances where the company sells service contracts or extended warranties on behalf of an unrelated third party, where it is not deemed to be the obligor, commissions are recognized in revenue at the time of sale. Inventory is recorded at the lower of cost using either the average cost or first-in first-out method or market. Property and equipment are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. When property is fully depreciated, retired, or disposed of, the cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in the income statement. The company owns 22 distribution centers, of which 3.2 million square feet are owned and 7.0 million square feet are leased. Almost all stores are leased. Out of 1,200 stores, the company owns 24 store locations and operates 34 stores for which they own the building and the land is leased. SUMMARY In conclusion, our firm believes that Best Buy is currently undervalued. Using the two-stage Dividend Discount model and the two-stage Discounted Cash Flow model, we calculated intrinsic prices of the company that are higher than what it was being traded at as of February 2009. EGKN CONSULTING Accounting 672 Miami, FL 33156 www.EGKN.com